3-Jun-08 PRELIMINARY RESULTS Regular Tax AMT

advertisement

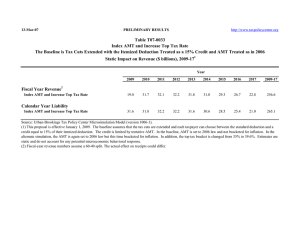

3-Jun-08 http://www.taxpolicycenter.org PRELIMINARY RESULTS T08-0099 Income Subject to Tax and Effective Marginal Tax Rates in the Regular Income Tax and the AMT Among AMT Taxpayers, Current Law 1 2007 Cash Income Class (thousands of 2008$) 2 Less than 30 30-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Regular Tax AMT Average Adjustments and Preferences4 0.0 99.5 90.0 88.9 95.2 69.4 9.9 13.6 63.4 100.0 0.5 10.0 11.2 4.8 30.6 90.1 86.5 36.6 983,913 38,071 34,408 33,483 35,423 33,337 47,691 193,232 43,439 Percent With More Income Subject to Tax In3 Percent With a Higher Marginal Tax Rate In 5 Regular Tax AMT 0.0 0.1 0.0 4.5 4.4 22.0 64.1 61.4 26.1 100.0 99.7 100.0 95.4 89.6 77.1 34.6 34.1 71.9 Average Effective Marginal Tax Rate (percent)6 Before AMT -3.9 0.0 17.1 20.9 25.2 31.1 31.2 27.4 29.6 After AMT 17.0 14.5 26.0 27.6 29.2 33.6 29.5 27.1 31.8 2008 Cash Income Class (thousands of 2008$) 2 Less than 30 30-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Regular Tax AMT Average Adjustments and Preferences4 99.2 93.4 97.1 99.0 98.2 54.3 8.6 8.2 87.1 0.8 6.6 2.9 1.0 1.8 45.7 91.4 91.8 12.9 25,951 14,332 18,007 18,803 20,866 27,855 49,324 193,659 23,635 Percent With More Income Subject to Tax In3 Percent With a Higher Marginal Tax Rate In 5 Regular Tax AMT 0.0 0.7 4.5 1.3 7.6 15.8 70.1 60.6 9.6 100.0 96.6 93.3 95.9 89.9 83.8 28.5 35.3 88.3 Average Effective Marginal Tax Rate (percent)6 Before AMT 9.8 15.6 18.8 18.9 26.0 29.8 31.3 27.9 24.8 After AMT 26.0 23.9 25.0 25.9 28.6 33.2 28.8 27.6 28.6 2010 Cash Income Class (thousands of 2008$) 2 Less than 30 30-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Regular Tax AMT Average Adjustments and Preferences4 99.6 95.6 97.0 99.0 97.4 47.7 9.0 6.5 86.4 0.4 4.4 3.0 1.0 2.6 52.3 91.1 93.6 13.6 20,786 15,535 18,465 18,323 20,916 29,549 54,131 202,171 23,738 Percent With More Income Subject to Tax In3 Percent With a Higher Marginal Tax Rate In 5 Regular Tax AMT 0.0 0.0 4.0 1.3 7.4 13.0 66.7 52.8 8.4 100.0 98.4 93.4 94.8 90.7 86.0 27.6 34.3 89.2 Average Effective Marginal Tax Rate (percent)6 Before AMT 14.1 16.0 18.2 18.6 25.1 28.7 31.0 27.9 23.7 After AMT 24.3 25.7 24.6 25.6 28.1 32.7 28.7 27.6 28.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). (1) AMT taxpayers include those with AMT liability from Form 6251, with lost credits, and with reduced deductions. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. Includes both filing and nonfiling units. Tax units that are dependents of other taxpayers are excluded from the analysis. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Income subject to tax for the regular income tax is taxable income; for the AMT it is AMTI net of the AMT exemption. (4) Amounts are in nominal dollars to facilitate comparison with AMT exemption amounts. For 2007, the AMT exemption is $66,250 for married couples filing jointly and surviving spouses; $44,350 for unmarried individuals other than surviving spouses; and $33,125 for married individuals filing separately. For 2010, the exemption amounts are $45,000, $33,750, and $22,500 respectively. (5) The marginal tax rate for each return is calculated by adding $1,000 to wages, recomputing income tax net of refundable credits, and dividing the resulting change in tax liability by 1,000. (6) Marginal tax rates represent a simple average across individuals.