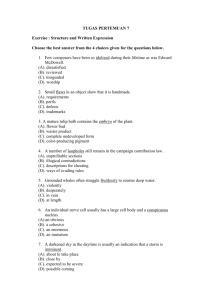

Tugas Mandiri Pertemuan 1 Soal- soal Current Liabilities and Payroll 1

advertisement

Tugas Mandiri Pertemuan 1 Soal- soal Current Liabilities and Payroll 1 Petunjuk Pengerjaan Tugas Mandiri Soal Tugas Mandiri (TM) dikerjakan secara berkelompok, di tulis tangan pada kertas double folio dengan rapi.Kelompok terdiri atas maksimal 3 orang anggota. Dikumpulkan pada awal kuliah minggu/pertemuan berikutnya. Jawaban Soal TM yang sama, oleh mahasiswa secara perorangan (individual) harus di “up load” pada forum diskusi di binusmaya (LMS), pada kolom tugas. Up load haryus sudah dilakukan paling lambat 7 hari setelah pertemuan yang dimaksudkan. Bila anda mengerjakan salah satunya saja atau tidak keduanya maka anda dianggap tidak mengumpulkan TM pada pertemuan yang dimaksudkan. 2 SOAL TUGAS MANDIRI E 11-4 Boone Company sells automatic can openers under a 75-day warranty for defective merchandise. Based on past experience. Boone estimates that 3% of the units sold will become defective during the warranty period. Management estimates that the average cost of replacing or repairing a defective unit is $15. The units sold and units defective that occurred during the last 2 months of 2005 are as follows. Units Defective Month Units Sold Prior to December 31 November December 30,000 32,000 600 400 Instructions a. Determine the estimated warranty liability at Desember 31 for the units sold in November and December, b. Prepare the journal entries to record the estimated liability for warranties and the costs incurred in honoring 1,000 warranty claims. (Assume actual costs of $15,000.) c. Give the entry to record the honoring of 500 warranty contracts in January at an average cost of $15. 3 SOAL TUGAS MANDIRI E 11-8 Betty Williams’ regular hourly wage rate is $14,00, and she receives a wage of 1½ times the regular hourly rate for work in excess of 40 hours. During a March weekly pay period Betty worked 42 hours. Her gross earnings prior to the current week were $6,000. Betty is married and claims three withholding allowances. Her only voluntary deduction is for group hospitalizatio n insurance at $15,00 per week. Instructions a. Compute the following amounts for Betty’s wages for the current week. (1) Gross earnings. (2) FICA taxes. (Assume an 8% rate on maximum of $87,000,) (3) Federal income taxes withheld. (Use the withholding table 1 below.) (4) State income taxes withheld. (Assume a 2.0% rate.) (5) Net pay. b. Record Betty’s pay, assuming she is an office computer operator. 4 Table 1 If the wages are___ But less At least than 0 1 And the number of withholding allowances claimed is____ 2 3 4 5 6 7 8 The amount of income tax to be witheld is ________ 9 10 490 500 510 520 530 500 510 520 530 540 56 57 59 60 62 48 49 51 52 54 40 42 43 45 46 32 34 35 37 38 24 26 27 29 30 17 18 20 21 23 9 10 12 13 15 1 3 4 6 7 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 540 550 560 570 580 550 560 570 580 590 63 65 66 68 69 55 57 58 60 61 48 49 51 52 54 40 41 43 44 46 32 33 35 36 38 24 26 27 29 30 16 18 19 21 22 9 10 12 13 15 1 2 4 5 7 0 0 0 0 0 0 0 0 0 0 590 600 610 620 630 600 610 620 630 640 71 72 74 75 77 63 64 66 67 69 55 57 58 60 61 47 49 50 52 53 39 41 42 44 45 32 33 35 36 38 24 25 27 28 30 16 18 19 21 22 8 10 11 13 14 1 2 4 5 7 0 0 0 0 0 640 650 660 670 680 650 660 670 680 690 78 80 81 83 84 70 72 73 75 76 63 64 66 67 69 55 56 58 59 61 47 48 50 51 53 39 41 42 44 45 31 33 34 36 37 24 25 27 28 30 16 17 19 20 22 8 10 11 13 14 0 2 3 5 6 5 SOAL TUGAS MANDIRI P 11-1A On Jamuary 1, 2005, the ledger of Shumway Software Company contains the following liability accounts. Accounts Payable $42,500 Sales Taxes Payable 5,800 Unesrned Service Revenue 15,000 During January the following selected transactions occurred. Jan. 1 Borrowed $15,000 in cash from Amsretdam Bank on a 4-month, 8%, $15,000 note. 5 12 14 20 25 Sold merchandise for cash totaling $10,400, which includes 4% sales taxes. provided services for customers who had advance payments of $9,000. (Credit Service Revenue.) Paid state treasurer’s departement for sales taxes collected in December 2004, $5,800. Sold 700 units of a new product on credit at $52 per unit, plus 4% sales taxes. This new product is subject to a 1-year warranty. Sold merchandise for cash totaling $12,480, which includes 4% sales taxes. Instructions a. Journalize the January transactions. b. Journalize the adjusting antries at January 31 for (1) the outstanding notes payable, and (2) estimated warranty lianility, assuming warranty costs are expected to equal 5% of sales of the nwe product. c. Prepare the current liabilities section of balance sheet at January 31, 2005. Assume no change in accounts payable. 6