Secretary Clinton's Tax Proposals Baseline: Current Law

advertisement

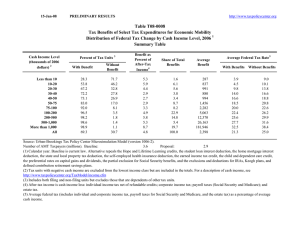

3-Mar-16 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T16-0040 Secretary Clinton's Tax Proposals Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2017 ¹ Summary Table Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) 14,725 25,414 22,395 16,134 13,207 24,054 16,257 27,725 10,572 1,332 727 173,829 Percent of Total 8.5 14.6 12.9 9.3 7.6 13.8 9.4 16.0 6.1 0.8 0.4 100.0 Percent Change in After-Tax Income 3 0.0 0.0 0.0 -0.1 -0.1 -0.1 -0.1 -0.2 -0.5 -1.5 -5.5 -0.9 Share of Total Federal Tax Change 0.0 0.1 0.2 0.2 0.3 1.0 1.5 4.6 9.8 8.9 73.2 100.0 Average Federal Tax Change ($) 1 5 9 16 24 45 106 189 1,060 7,646 115,135 657 Average Federal Tax Rate 4 Change (% Points) 0.0 0.0 0.0 0.0 0.1 0.1 0.1 0.1 0.4 1.1 3.7 0.7 Under the Proposal 7.7 3.4 5.3 8.4 11.1 13.5 15.9 18.7 23.1 28.7 37.2 20.5 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-4). Number of AMT Taxpayers (millions). Baseline: 4.5 Proposal: 4.5 (1) Calendar year. Baseline is current law (including provisions in the Protecting Americans from Tax Hikes Act of 2015 and the Consolidated Appropriations Act of 2016). Proposal includes individual, corporate, and estate tax provisions in Secretary Clinton's tax plan. For details, see TPC's "An Analysis of Hillary Clinton's Tax Plan." For a description of current law, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (4) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income. 3-Mar-16 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T16-0040 Secretary Clinton's Tax Proposals Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2017 ¹ Detail Table Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent Change in After-Tax Income 3 0.0 0.0 0.0 -0.1 -0.1 -0.1 -0.1 -0.2 -0.5 -1.5 -5.5 -0.9 Share of Total Federal Tax Change 0.0 0.1 0.2 0.2 0.3 1.0 1.5 4.6 9.8 8.9 73.2 100.0 Average Federal Tax Change Dollars Percent 1 5 9 16 24 45 106 189 1,060 7,646 115,135 657 0.3 1.0 0.7 0.5 0.5 0.5 0.7 0.7 1.6 3.9 10.9 3.7 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 -0.1 -0.1 -0.2 -0.2 -0.7 -0.5 0.0 1.7 0.0 Under the Proposal 0.2 0.4 1.0 1.5 2.1 6.5 7.3 23.4 22.4 8.4 26.5 100.0 Average Federal Tax Rate 4 Change (% Points) 0.0 0.0 0.0 0.0 0.1 0.1 0.1 0.1 0.4 1.1 3.7 0.7 Under the Proposal 7.7 3.4 5.3 8.4 11.1 13.5 15.9 18.7 23.1 28.7 37.2 20.5 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2017 ¹ Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) 14,725 25,414 22,395 16,134 13,207 24,054 16,257 27,725 10,572 1,332 727 173,829 Percent of Total 8.5 14.6 12.9 9.3 7.6 13.8 9.4 16.0 6.1 0.8 0.4 100.0 Pre-Tax Income Average (dollars) 5,917 15,736 25,818 36,366 46,824 64,427 90,606 144,813 294,461 702,881 3,152,612 89,870 Percent of Total 0.6 2.6 3.7 3.8 4.0 9.9 9.4 25.7 19.9 6.0 14.7 100.0 Federal Tax Burden Average (dollars) 453 523 1,352 3,049 5,164 8,640 14,338 26,822 66,953 194,197 1,056,303 17,793 Percent of Total 0.2 0.4 1.0 1.6 2.2 6.7 7.5 24.0 22.9 8.4 24.8 100.0 After-Tax Income 3 Average (dollars) 5,464 15,212 24,466 33,318 41,660 55,787 76,268 117,990 227,508 508,684 2,096,310 72,078 Percent of Total 0.6 3.1 4.4 4.3 4.4 10.7 9.9 26.1 19.2 5.4 12.2 100.0 Average Federal Tax Rate 4 7.7 3.3 5.2 8.4 11.0 13.4 15.8 18.5 22.7 27.6 33.5 19.8 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-4). Number of AMT Taxpayers (millions). Baseline: 4.5 Proposal: 4.5 (1) Calendar year. Baseline is current law (including provisions in the Protecting Americans from Tax Hikes Act of 2015 and the Consolidated Appropriations Act of 2016). Proposal includes individual, corporate, and estate tax provisions in Secretary Clinton's tax plan. For details, see TPC's "An Analysis of Hillary Clinton's Tax Plan." For a description of current law, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (4) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income. 3-Mar-16 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T16-0040 Secretary Clinton's Tax Proposals Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2017 ¹ Detail Table - Single Tax Units Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent Change in After-Tax 3 Income 0.0 0.0 -0.1 -0.1 -0.1 -0.1 -0.3 -0.5 -2.1 -3.7 -8.2 -0.8 Share of Total Federal Tax Change 0.1 0.5 0.6 0.8 0.9 2.8 4.5 10.1 16.6 7.6 55.2 100.0 Average Federal Tax Change Dollars Percent 1 6 11 21 31 66 212 514 4,494 18,088 170,612 304 0.2 0.7 0.5 0.5 0.5 0.6 1.2 1.8 6.1 8.2 14.5 3.7 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.1 -0.2 -0.2 -0.5 -0.3 -0.4 0.2 0.2 1.5 0.0 Under the Proposal 1.0 2.6 4.4 5.3 6.5 16.1 13.5 21.0 10.3 3.6 15.5 100.0 Average Federal Tax Rate 4 Change (% Points) 0.0 0.0 0.0 0.1 0.1 0.1 0.2 0.4 1.6 2.5 5.3 0.7 Under the Proposal 9.5 6.4 8.7 11.6 14.0 16.9 20.0 21.9 27.6 33.4 41.4 18.6 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2017 ¹ Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) 12,785 19,497 14,747 9,363 7,416 11,160 5,639 5,264 984 112 86 87,711 Percent of Total 14.6 22.2 16.8 10.7 8.5 12.7 6.4 6.0 1.1 0.1 0.1 100.0 Pre-Tax Income Average (dollars) 5,870 15,598 25,680 36,329 46,854 63,889 89,647 136,164 283,971 714,264 3,250,534 45,893 Percent of Total 1.9 7.6 9.4 8.5 8.6 17.7 12.6 17.8 6.9 2.0 7.0 100.0 Federal Tax Burden Average (dollars) 555 985 2,233 4,204 6,517 10,719 17,680 29,343 73,965 220,166 1,173,652 8,225 Percent of Total 1.0 2.7 4.6 5.5 6.7 16.6 13.8 21.4 10.1 3.4 14.1 100.0 After-Tax Income 3 Average (dollars) 5,316 14,613 23,447 32,125 40,337 53,170 71,967 106,820 210,006 494,098 2,076,882 37,668 Percent of Total 2.1 8.6 10.5 9.1 9.1 18.0 12.3 17.0 6.3 1.7 5.4 100.0 Average Federal Tax Rate 4 9.5 6.3 8.7 11.6 13.9 16.8 19.7 21.6 26.1 30.8 36.1 17.9 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-4). (1) Calendar year. Baseline is current law (including provisions in the Protecting Americans from Tax Hikes Act of 2015 and the Consolidated Appropriations Act of 2016). Proposal includes individual, corporate, and estate tax provisions in Secretary Clinton's tax plan. For details, see TPC's "An Analysis of Hillary Clinton's Tax Plan." For a description of current law, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (4) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income. 3-Mar-16 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T16-0040 Secretary Clinton's Tax Proposals Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2017 ¹ Detail Table - Married Tax Units Filing Jointly Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent Change in After-Tax 3 Income 0.0 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.1 -0.3 -1.3 -5.0 -1.0 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.1 0.3 0.5 2.7 8.1 9.8 78.5 100.0 Average Federal Tax Change Dollars Percent 1 2 5 10 17 30 51 106 696 6,620 103,041 1,369 0.7 2.7 2.9 0.8 0.6 0.5 0.4 0.4 1.1 3.5 10.1 3.7 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.8 -0.7 0.0 1.8 0.0 Under the Proposal 0.0 0.0 0.0 0.2 0.4 2.2 4.4 23.6 27.8 10.5 30.7 100.0 Average Federal Tax Rate 4 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.1 0.1 0.1 0.2 0.9 3.4 0.8 Under the Proposal 2.3 0.5 0.7 3.4 6.5 9.7 13.3 17.7 22.6 28.2 36.5 22.3 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2017 ¹ Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) 832 1,854 2,841 2,893 2,807 7,746 7,990 19,969 9,257 1,180 610 58,490 Percent of Total 1.4 3.2 4.9 5.0 4.8 13.2 13.7 34.1 15.8 2.0 1.0 100.0 Pre-Tax Income Average (dollars) 5,193 16,319 26,207 36,583 46,968 65,408 91,464 148,093 295,938 701,505 3,073,296 170,228 Percent of Total 0.0 0.3 0.8 1.1 1.3 5.1 7.3 29.7 27.5 8.3 18.8 100.0 Federal Tax Burden Average (dollars) 118 81 178 1,244 3,035 6,330 12,118 26,171 66,147 191,330 1,017,245 36,656 Percent of Total 0.0 0.0 0.0 0.2 0.4 2.3 4.5 24.4 28.6 10.5 28.9 100.0 After-Tax Income 3 Average (dollars) 5,075 16,238 26,030 35,339 43,933 59,077 79,346 121,923 229,792 510,175 2,056,051 133,573 Percent of Total 0.1 0.4 1.0 1.3 1.6 5.9 8.1 31.2 27.2 7.7 16.1 100.0 Average Federal Tax Rate 4 2.3 0.5 0.7 3.4 6.5 9.7 13.3 17.7 22.4 27.3 33.1 21.5 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-4). (1) Calendar year. Baseline is current law (including provisions in the Protecting Americans from Tax Hikes Act of 2015 and the Consolidated Appropriations Act of 2016). Proposal includes individual, corporate, and estate tax provisions in Secretary Clinton's tax plan. For details, see TPC's "An Analysis of Hillary Clinton's Tax Plan." For a description of current law, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (4) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income. 3-Mar-16 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T16-0040 Secretary Clinton's Tax Proposals Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2017 ¹ Detail Table - Head of Household Tax Units Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent Change in After-Tax 3 Income 0.0 0.0 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.4 -1.5 -5.7 -0.3 Share of Total Federal Tax Change 0.0 0.1 0.7 1.0 1.1 3.1 3.0 10.1 6.3 6.0 68.5 100.0 Average Federal Tax Change Dollars Percent 1 1 5 9 14 22 41 158 766 7,706 148,739 131 -0.2 -0.1 -0.5 0.8 0.4 0.3 0.3 0.6 1.2 3.8 11.3 2.0 Share of Federal Taxes Change (% Points) 0.0 0.1 0.1 0.0 -0.1 -0.3 -0.3 -0.5 -0.1 0.1 1.1 0.0 Under the Proposal -0.4 -4.0 -2.7 2.6 5.5 19.6 19.0 33.1 10.8 3.3 13.3 100.0 Average Federal Tax Rate 4 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.1 0.3 1.1 3.8 0.2 Under the Proposal -9.6 -10.8 -3.9 3.3 7.1 11.1 14.9 19.1 23.8 30.1 37.0 11.9 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2017 ¹ Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) 959 3,766 4,453 3,539 2,688 4,524 2,310 2,074 265 25 15 24,670 Percent of Total 3.9 15.3 18.1 14.3 10.9 18.3 9.4 8.4 1.1 0.1 0.1 100.0 Pre-Tax Income Average (dollars) 7,168 16,157 26,009 36,280 46,602 64,033 89,869 136,176 279,960 702,819 3,944,145 55,431 Percent of Total 0.5 4.5 8.5 9.4 9.2 21.2 15.2 20.7 5.4 1.3 4.3 100.0 Federal Tax Burden Average (dollars) -686 -1,753 -1,009 1,191 3,312 7,057 13,343 25,889 65,797 203,742 1,311,786 6,485 Percent of Total -0.4 -4.1 -2.8 2.6 5.6 20.0 19.3 33.6 10.9 3.2 12.2 100.0 After-Tax Income 3 Average (dollars) 7,854 17,909 27,018 35,089 43,290 56,976 76,526 110,287 214,163 499,077 2,632,359 48,946 Percent of Total 0.6 5.6 10.0 10.3 9.6 21.4 14.6 19.0 4.7 1.0 3.2 100.0 Average Federal Tax Rate 4 -9.6 -10.9 -3.9 3.3 7.1 11.0 14.9 19.0 23.5 29.0 33.3 11.7 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-4). (1) Calendar year. Baseline is current law (including provisions in the Protecting Americans from Tax Hikes Act of 2015 and the Consolidated Appropriations Act of 2016). Proposal includes individual, corporate, and estate tax provisions in Secretary Clinton's tax plan. For details, see TPC's "An Analysis of Hillary Clinton's Tax Plan." For a description of current law, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (4) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income. 3-Mar-16 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T16-0040 Secretary Clinton's Tax Proposals Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2017 ¹ Detail Table - Tax Units with Children Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent Change in After-Tax Income 3 0.0 0.0 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.3 -1.3 -4.7 -0.9 Share of Total Federal Tax Change 0.0 0.0 0.1 0.1 0.1 0.4 0.5 2.1 8.5 10.5 77.8 100.0 Average Federal Tax Change Dollars Percent 1 1 5 9 14 22 38 78 703 6,506 95,258 890 -0.2 -0.1 -0.4 1.4 0.5 0.3 0.3 0.3 1.1 3.4 9.3 3.5 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 -0.1 -0.2 -0.7 -0.7 0.0 1.6 0.0 Under the Proposal -0.1 -0.7 -0.5 0.2 0.8 3.6 5.0 23.1 27.3 10.7 30.4 100.0 Average Federal Tax Rate 4 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.2 0.9 3.1 0.7 Under the Proposal -11.4 -11.9 -4.9 1.8 6.2 10.5 13.9 17.8 22.7 28.5 36.4 20.8 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2017 ¹ Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) Percent of Total 1,271 4,584 5,580 4,445 3,574 7,111 5,269 11,874 5,419 723 367 50,501 2.5 9.1 11.1 8.8 7.1 14.1 10.4 23.5 10.7 1.4 0.7 100.0 Pre-Tax Income Average (dollars) 6,855 16,139 26,059 36,361 46,663 64,555 91,156 147,810 299,242 699,507 3,062,567 128,300 Percent of Total 0.1 1.1 2.2 2.5 2.6 7.1 7.4 27.1 25.0 7.8 17.4 100.0 Federal Tax Burden Average (dollars) -785 -1,923 -1,284 658 2,878 6,745 12,664 26,157 67,147 192,825 1,019,907 25,774 Percent of Total -0.1 -0.7 -0.6 0.2 0.8 3.7 5.1 23.9 28.0 10.7 28.8 100.0 After-Tax Income 3 Average (dollars) 7,640 18,062 27,343 35,703 43,785 57,810 78,492 121,653 232,094 506,682 2,042,660 102,526 Percent of Total 0.2 1.6 3.0 3.1 3.0 7.9 8.0 27.9 24.3 7.1 14.5 100.0 Average Federal Tax Rate 4 -11.5 -11.9 -4.9 1.8 6.2 10.5 13.9 17.7 22.4 27.6 33.3 20.1 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-4). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law (including provisions in the Protecting Americans from Tax Hikes Act of 2015 and the Consolidated Appropriations Act of 2016). Proposal includes individual, corporate, and estate tax provisions in Secretary Clinton's tax plan. For details, see TPC's "An Analysis of Hillary Clinton's Tax Plan." For a description of current law, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (4) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income. 3-Mar-16 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T16-0040 Secretary Clinton's Tax Proposals Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2017 ¹ Detail Table - Elderly Tax Units Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent Change in After-Tax Income 3 0.0 -0.1 -0.1 -0.1 -0.1 -0.2 -0.4 -0.5 -1.3 -2.5 -7.5 -1.5 Share of Total Federal Tax Change 0.0 0.2 0.2 0.3 0.4 1.5 2.8 7.1 11.4 7.0 68.8 100.0 Average Federal Tax Change Dollars Percent 2 10 14 27 44 101 285 553 2,987 13,105 172,378 973 2.0 4.8 2.3 1.9 1.7 2.0 2.7 2.4 4.6 6.6 14.4 7.4 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 -0.1 -0.1 -0.3 -0.3 -1.0 -0.5 -0.1 2.3 0.0 Under the Proposal 0.0 0.3 0.7 1.1 1.5 5.2 7.3 20.5 17.8 7.8 37.3 100.0 Average Federal Tax Rate 4 Change (% Points) 0.0 0.1 0.1 0.1 0.1 0.2 0.3 0.4 1.0 1.8 4.9 1.2 Under the Proposal 1.9 1.4 2.4 3.9 5.6 8.2 12.0 16.5 23.5 29.5 39.1 18.2 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2017 ¹ Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) Percent of Total 1,946 7,750 6,978 4,466 3,470 5,983 4,083 5,294 1,578 220 165 42,388 4.6 18.3 16.5 10.5 8.2 14.1 9.6 12.5 3.7 0.5 0.4 100.0 Pre-Tax Income Average (dollars) 5,627 16,033 25,695 36,372 46,835 64,169 90,217 141,269 290,351 721,627 3,498,419 78,386 Percent of Total 0.3 3.7 5.4 4.9 4.9 11.6 11.1 22.5 13.8 4.8 17.3 100.0 Federal Tax Burden Average (dollars) 104 221 608 1,385 2,564 5,172 10,520 22,788 65,147 199,727 1,195,876 13,251 Percent of Total 0.0 0.3 0.8 1.1 1.6 5.5 7.7 21.5 18.3 7.8 35.0 100.0 After-Tax Income 3 Average (dollars) 5,523 15,812 25,087 34,987 44,271 58,997 79,697 118,481 225,205 521,900 2,302,543 65,135 Percent of Total 0.4 4.4 6.3 5.7 5.6 12.8 11.8 22.7 12.9 4.2 13.7 100.0 Average Federal Tax Rate 4 1.8 1.4 2.4 3.8 5.5 8.1 11.7 16.1 22.4 27.7 34.2 16.9 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-4). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law (including provisions in the Protecting Americans from Tax Hikes Act of 2015 and the Consolidated Appropriations Act of 2016). Proposal includes individual, corporate, and estate tax provisions in Secretary Clinton's tax plan. For details, see TPC's "An Analysis of Hillary Clinton's Tax Plan." For a description of current law, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (4) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income.