Model Paper

advertisement

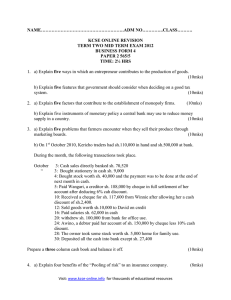

Model Paper Section A 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Give the meaning of accounting. What are drawings? Expand GAAP. What is journalizing? Mention any two features of Cash Book. What is an error of principles? State any two parties of a bill of exchange. What is closing stock? What is a statement of affairs? State any two elements of computer system. Section B 1. Brielfy explain accounting conventions. 2. Classify the following accounts under English system Furniture A/C Cash A/C Rajesh A/C Interest A/C International Traders A/C Traveling expenses A/C Motor Vehicles A/C Drawings A/C Stock A/C Wages A/c 3. Prepare a Personal account of Inchara from the following transactions: January 10 01 Credit Balance of Inchara Rs. 12000 05 Bought goods from Inchara Rs. 8000 09 Returned goods to Inchara Rs. 800 15 Sold goods to Inchara Rs. 6400 30 Paid to Inchara Rs. 9000 4. Enter the following in the purchase book for the month of March 2013 March 2013 01 Purchased goods from Rajesh Rs. 16000 06 Bought goods from Suresh Rs. 10000 less 5% trade discount 18 Purchased from Mahesh on account Rs. 8000 24 Bought Xerox from Kamalesh Rs. 15000 5. From the following information prepare analytical petty cash book under imprest system. July 2013 01 Balance of Cash Rs. 600 01 Cheque received from main cashier Rs. 1400 under imprest system. 06 Paid for cartage Rs. 300 08 Paid for postage Rs. 150 12 Wages paid Rs. 225 18 Paid for printing charges Rs. 275 22 Paid to telephone expenses Rs. 220 30 Paid to Impana on account Rs. 280 6. Prepare a trial balance from the following ledge balances as on 31 st December 2013 Cash A/c Purchase A/C Wages A/c Sales A/C Bank loan A/c Rs.90000 Rs. 125000 Rs. 30000 Rs. 140000 Rs. 40000 Furniture A/c Salary A/C Adverisement A/c Capital A/c Rs. 45000 Rs. 28000 Rs. 12000 Rs. 150000 7. Write any five advantages of computerized accounting. Section C 1. Journalize the following transactions in the books of Pavan for the month ofv February 2013 1 2 5 8 10 11 13 17 18 21 23 26 28 30 Commenced Business Opened a Bank a/c Purchased furniture by Cheque Bought goods for cash from Roopa Traders Bought from Pampa traders Cash Sales Sold goods to Krupa traders Rent Paid Paid trade expenses by Cheque Received cheque from Krupa traders Goods returned to Pampa traders Paid to Pampa traders Paid salary Received loan 2. Prepare cash book from the following transactions and balance the same: Sept 2013 Rs. 200000 Rs. 90000 Rs. 25000 Rs. 50000 Rs. 60000 Rs. 55000 Rs. 15000 Rs. 6000 Rs. 3000 Rs. 10000 Rs. 2000 Rs. 40000 Rs. 10000 Rs. 15000 the 3 column 1 3 4 5 9 11 13 15 18 20 24 Balance cash Rs. 12000 and Bank Rs. 15000 Paid to bank Rs. 8000 Purchased goods for cash Rs. 2000 Received cheque from Dharmendra Rs. 25000 and allowed him discount of Rs. 1000 Cash sales Rs. 14000 Paid to Amitab Rs. 125000 and received discount of Rs. 500 Received from Salman Rs. 7000 Deposited Dharmendra's cheque into bank Received rent Rs. 6000 Withdrew for office use from bank Rs. 9000 Paid salary by cheque Rs. 5000 3. Prepare bank reconciliation statement as 31 st Dec 2013 from the following information pass book of Shobha showed overdraft Rs. 15000 a) Cheque Rs. 6000 issued but not presented for payment b) Cheque paid into bank but not credited before 31/12/13 Rs. 4000 c) Wrong debt in passbook Rs. 800 d) Customer directly deposted Rs. 5000 but not entered in cash book. e) Dividend on shares collected by the bank credited only in the passbook Rs. 2000 f) Cheque paid to the bank was dishonored Rs. 1000 4. Record the following information in the proper subsidiary books in August 2010 1 2 4 6 9 11 15 17 21 23 25 26 27 29 Purchased from Radha Rs. 6000 Bought 20 articles @ Rs. 500 each from Vedha Sold goods to Kumudha Rs. 4500 Sold goods to Sudha Rs. 15000 Returned goods to Vedha Rs. 500 Cash Sales Rs. 3000 to Megha Bought from Sudha Rs. 20000 at 10% trade account Bought goods from Dinesh Rs. 25000 Goods returned by Kumudha Rs. 500 Returned to Sudha Rs. 3000 Bought from Roopesh Rs. 10000 Credit sales to Ramesh Rs. 9000 Purchased type writer machine from XYZ Co Rs. 30000 Sent debit note on Dinesh Rs. 1000 5. On 1st June 2013 Fathima sold goods to Mahima for Rs. 15000 on the same day. Mahima accepted a bill drew on her for 3 months. On 4th July 2013 Fathima endorsed the bill to Reema on the same day Reema discounted the bill for Rs. 14000. With her banker, on the due date the bill was honored. Pass journal entries in the books of Fathima, Mahima and Reema. 6. From the following Trial Balance and additional information, prepare trading and profit and loss account for the year ending 31st December 2013 and Balance Sheet as on that date: Trial Balance as on 31st December 2013 Sl No 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Particulars Purchase and Sales a/c Bank A/c Wages a/c Debtors and Creditors Cash A/c Legal Expenses A/c Building A/c Machinery a/c Commission A/c Office Expenses a/c Opening Stock A/c Cartage A/C Factory Expenses A/c Office Furniture A/c Investment A/c Drawing a/c Capital A/c L/F Debit Amt 160000 22000 68000 140000 2000 8000 240000 120000 14000 6000 90000 6000 17000 10000 37000 10000 950000 Credit Amt 400000 110000 12000 428000 950000 Additional information: a) b) c) d) Closing stock – Rs. 100000 Outstanding Wages – Rs. 2000 Provide for bad debts @ 5% on debtors Depreciate machinery and building at 5% each 7. Arjun Kumar kept his book under incomplete system. Prepare statement of profit and loss for the year ending 31st March 2013 and prepare revised statement of affairs as of that date. Cash Bank OD Stock Creditors Debtors Bills Payable Bills Receivable Buildings Furniture Machinery April 1 2012 100000 35000 90000 65000 80000 30000 50000 200000 60000 50000 March 31 2013 160000 25000 100000 55000 90000 40000 70000 200000 60000 50000 Adjustments a) b) c) d) e) Write off Rs. 10000 as bad debts Appreciate buildings at 10% Salary due Rs. 5000 and wages due Rs. 2000 Depreciate machinery by 5% pa and furniture by Rs. 10000 Prepaid rent Rs. 3000 During the year Arjun withdrew Rs. 10000 for personal use and introduced additional capital of Rs. 30000 Section D 1. Draw a diagram showing accounting cycle 2. Prepare a specimen of bill of exchange. 3. Prepare a Trading a/c with five imaginary figures.