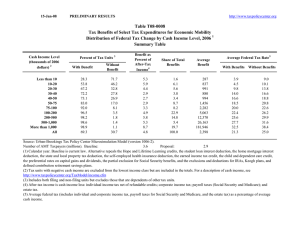

28-Jul-15 PRELIMINARY RESULTS Less than 10 10-20

advertisement

28-Jul-15 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T15-0106 Tax Benefit of Certain Retirement Savings Incentives (Cash-flow Approach) Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2015 ¹ Detail Table Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units3 With Benefit * 1.7 6.9 16.7 24.3 38.7 49.8 63.1 77.9 84.1 78.9 29.9 Without Benefit 100.0 98.3 93.2 83.3 75.7 61.3 50.2 36.9 22.1 15.9 21.2 70.1 Benefit as a Percent of AfterTax Income 4 0.0 0.0 0.0 0.0 -0.2 -0.2 -0.5 0.4 2.9 4.4 0.5 0.9 Share of Total Benefit 0.0 -0.2 -0.1 -0.2 -1.1 -3.1 -6.1 11.4 64.7 28.0 6.8 100.0 Average Benefit Dollars -2 -6 -5 -13 -81 -127 -378 418 6,336 21,239 9,827 570 Share of Federal Taxes Percent of Federal Taxes -0.4 -1.4 -0.4 -0.4 -1.6 -1.6 -2.7 1.6 9.7 11.2 1.0 3.4 With Provision 0.2 0.4 0.9 1.7 2.4 6.9 7.6 24.5 22.8 8.6 24.0 100.0 Average Federal Tax Rate6 Without Provision With Provision Without Provision 0.2 0.4 0.8 1.6 2.3 6.6 7.1 24.1 24.2 9.2 23.4 100.0 6.7 2.9 4.7 8.4 11.0 13.3 15.9 18.9 23.0 28.1 34.1 19.8 6.7 2.9 4.6 8.3 10.8 13.1 15.5 19.2 25.3 31.2 34.5 20.5 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2015 1 Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) 14,727 26,248 20,958 16,159 13,672 24,036 15,591 26,693 9,954 1,284 673 171,259 Pre-Tax Income Federal Tax Burden Percent of Total Average (dollars) Percent of Total Average (dollars) 8.6 15.3 12.2 9.4 8.0 14.0 9.1 15.6 5.8 0.8 0.4 100.0 5,642 14,969 24,710 34,754 44,867 61,486 86,698 138,229 282,645 674,624 2,963,371 83,723 0.6 2.7 3.6 3.9 4.3 10.3 9.4 25.7 19.6 6.0 13.9 100.0 379 441 1,149 2,911 4,926 8,148 13,818 26,055 65,087 189,422 1,011,094 16,582 Percent of Total 0.2 0.4 0.9 1.7 2.4 6.9 7.6 24.5 22.8 8.6 24.0 100.0 After-Tax Income 5 Average (dollars) Percent of Total Average Federal Tax Rate 6 5,264 14,529 23,562 31,844 39,942 53,338 72,879 112,174 217,558 485,202 1,952,276 67,140 0.7 3.3 4.3 4.5 4.8 11.2 9.9 26.0 18.8 5.4 11.4 100.0 6.7 2.9 4.7 8.4 11.0 13.3 15.9 18.9 23.0 28.1 34.1 19.8 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-1). Number of AMT Taxpayers (millions). Baseline: 4.1 Proposal: 4.9 * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal would (a) repeal the tax deferral of contributions to retirement accounts, accruals in IRAs, Keogh, and both defined contribution and defined benefit retirement plans; (b) repeal the saver's credit; (c) repeal exemption of income accrued within accounts; and (d) repeal tax on withdrawals from accounts as well as the early withdrawal penalty. Baseline federal tax burden differs from standard TPC tables in that tax incentives for retirement are treated on a cash flow rather than present value basis. For a description of TPC's current law baseline, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income. 28-Jul-15 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T15-0106 Tax Benefit of Certain Retirement Savings Incentives (Cash-flow Approach) Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2015 ¹ Detail Table - Single Tax Units Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Benefit 3 Without Benefit * 2.0 7.8 19.5 26.2 44.2 57.1 62.9 73.0 74.0 66.9 19.8 100.0 98.0 92.2 80.5 73.8 55.8 42.9 37.2 27.0 26.0 33.1 80.2 Benefit as a Percent of AfterTax Income 4 Share of Total Benefit 0.0 0.0 0.0 -0.1 -0.5 -0.6 0.0 0.9 1.7 0.7 -1.0 0.1 -1.0 -5.3 -5.2 -20.0 -87.7 -170.6 1.6 269.3 185.3 22.0 -88.1 100.0 Average Benefit Dollars Share of Federal Taxes Percent of Federal Taxes -1 -5 -7 -37 -207 -277 5 921 3,373 3,460 -19,258 20 -0.3 -0.5 -0.3 -0.9 -3.2 -2.7 0.0 3.2 4.7 1.6 -1.7 0.3 With Provision 0.9 2.6 4.2 5.9 7.1 16.7 13.1 22.0 10.2 3.5 13.5 100.0 6 Average Federal Tax Rate Without Provision With Provision 0.9 2.5 4.1 5.9 6.9 16.2 13.1 22.7 10.7 3.5 13.2 100.0 8.4 5.7 8.4 12.1 14.4 17.1 20.0 22.0 26.4 30.8 36.8 18.1 Without Provision 8.4 5.7 8.4 12.0 13.9 16.6 20.0 22.7 27.7 31.3 36.2 18.1 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2015 ¹ Tax Units Pre-Tax Income Federal Tax Burden Expanded Cash Income Level (thousands of 2 2015 dollars) Number (thousands) Percent of Total Average (dollars) Percent of Total Average (dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All 12,823 20,274 13,499 9,553 7,482 10,875 5,173 5,169 971 112 81 86,656 14.8 23.4 15.6 11.0 8.6 12.6 6.0 6.0 1.1 0.1 0.1 100.0 5,607 14,829 24,612 34,693 44,799 60,830 85,880 130,821 269,658 683,749 3,056,287 43,186 1.9 8.0 8.9 8.9 9.0 17.7 11.9 18.1 7.0 2.1 6.6 100.0 470 849 2,078 4,196 6,429 10,388 17,157 28,800 71,273 210,749 1,126,040 7,797 Percent of Total 0.9 2.6 4.2 5.9 7.1 16.7 13.1 22.0 10.2 3.5 13.5 100.0 5 Average (dollars) Percent of Total Average Federal Tax 6 Rate 5,137 13,980 22,534 30,497 38,369 50,442 68,723 102,022 198,385 473,000 1,930,247 35,389 2.2 9.2 9.9 9.5 9.4 17.9 11.6 17.2 6.3 1.7 5.1 100.0 8.4 5.7 8.4 12.1 14.4 17.1 20.0 22.0 26.4 30.8 36.8 18.1 After-Tax Income Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-1). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal would (a) repeal the tax deferral of contributions to retirement accounts, accruals in IRAs, Keogh, and both defined contribution and defined benefit retirement plans; (b) repeal the saver's credit; (c) repeal exemption of income accrued within accounts; and (d) repeal tax on withdrawals from accounts as well as the early withdrawal penalty. Baseline federal tax burden differs from standard TPC tables in that tax incentives for retirement are treated on a cash flow rather than present value basis. For a description of TPC's current law baseline, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income. 28-Jul-15 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T15-0106 Tax Benefit of Certain Retirement Savings Incentives (Cash-flow Approach) Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2015 ¹ Detail Table - Married Tax Units Filing Jointly Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Benefit 3 Without Benefit 0.0 0.6 2.8 7.7 16.0 28.6 43.4 63.2 78.8 85.3 80.9 46.7 100.0 99.4 97.2 92.3 84.0 71.4 56.6 36.8 21.2 14.7 19.1 53.3 Benefit as a Percent of AfterTax Income 4 Share of Total Benefit -0.1 -0.1 0.0 0.0 0.0 -0.3 -1.1 0.2 3.1 4.8 0.8 1.3 0.0 0.0 0.0 0.0 0.1 -1.6 -7.3 3.8 66.0 29.9 9.2 100.0 Average Benefit Dollars -3 -10 -6 -7 15 -171 -813 175 6,789 23,553 14,541 1,537 Share of Federal Taxes Percent of Federal Taxes -3.0 -13.6 -7.2 -0.7 0.6 -2.9 -6.9 0.7 10.6 12.6 1.5 4.5 With Provision 0.0 0.0 0.0 0.2 0.4 2.4 4.8 24.9 28.4 10.8 27.9 100.0 6 Average Federal Tax Rate Without Provision With Provision 0.0 0.0 0.0 0.2 0.4 2.3 4.3 24.0 30.0 11.6 27.1 100.0 2.1 0.5 0.4 2.9 6.2 9.5 13.5 18.0 22.6 27.8 33.7 21.6 Without Provision 2.1 0.4 0.3 2.9 6.2 9.2 12.5 18.1 25.0 31.3 34.2 22.5 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2015 ¹ Tax Units Pre-Tax Income Expanded Cash Income Level (thousands of 2 2015 dollars) Number (thousands) Percent of Total Average (dollars) Percent of Total Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All 839 1,960 2,937 2,955 3,032 8,113 8,040 19,326 8,681 1,133 565 58,086 1.4 3.4 5.1 5.1 5.2 14.0 13.8 33.3 14.9 2.0 1.0 100.0 4,948 15,596 24,999 34,975 45,080 62,635 87,457 141,066 284,339 673,359 2,888,972 157,102 0.1 0.3 0.8 1.1 1.5 5.6 7.7 29.9 27.1 8.4 17.9 100.0 Federal Tax Burden Average (dollars) 105 75 89 1,021 2,789 5,917 11,775 25,322 64,275 186,897 973,043 33,862 Percent of Total 0.0 0.0 0.0 0.2 0.4 2.4 4.8 24.9 28.4 10.8 27.9 100.0 5 Average (dollars) Percent of Total Average Federal Tax 6 Rate 4,843 15,521 24,910 33,954 42,291 56,718 75,682 115,744 220,064 486,462 1,915,929 123,240 0.1 0.4 1.0 1.4 1.8 6.4 8.5 31.3 26.7 7.7 15.1 100.0 2.1 0.5 0.4 2.9 6.2 9.5 13.5 18.0 22.6 27.8 33.7 21.6 After-Tax Income Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-1). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal would (a) repeal the tax deferral of contributions to retirement accounts, accruals in IRAs, Keogh, and both defined contribution and defined benefit retirement plans; (b) repeal the saver's credit; (c) repeal exemption of income accrued within accounts; and (d) repeal tax on withdrawals from accounts as well as the early withdrawal penalty. Baseline federal tax burden differs from standard TPC tables in that tax incentives for retirement are treated on a cash flow rather than present value basis. For a description of TPC's current law baseline, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income. 28-Jul-15 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T15-0106 Tax Benefit of Certain Retirement Savings Incentives (Cash-flow Approach) Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2015 ¹ Detail Table - Head of Household Tax Units Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Benefit 3 Without Benefit 0.0 0.2 6.1 17.3 29.1 45.2 57.5 63.6 66.5 79.1 78.7 26.3 100.0 99.8 93.9 82.7 70.9 54.8 42.5 36.4 33.5 20.9 21.3 73.7 Benefit as a Percent of AfterTax Income 4 Share of Total Benefit -0.1 -0.1 0.0 0.2 0.4 0.7 0.6 1.4 1.1 0.9 0.2 0.6 -0.1 -0.4 0.3 3.6 7.4 26.1 12.9 39.6 8.2 1.5 0.9 100.0 Average Benefit Dollars Share of Federal Taxes Percent of Federal Taxes -4 -8 5 74 174 389 416 1,463 2,324 4,509 4,285 283 0.6 0.5 -0.4 12.7 6.0 6.1 3.2 5.8 3.6 2.3 0.3 4.9 With Provision -0.5 -4.7 -4.0 1.4 6.1 21.1 19.7 33.6 11.3 3.2 12.6 100.0 6 Average Federal Tax Rate Without Provision With Provision Without Provision -0.5 -4.5 -3.8 1.5 6.2 21.3 19.3 33.9 11.2 3.2 12.0 100.0 -10.6 -11.0 -5.2 1.7 6.5 10.5 15.0 19.4 24.2 29.1 34.1 11.1 -10.7 -11.0 -5.2 1.9 6.9 11.1 15.5 20.5 25.1 29.8 34.2 11.6 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2015 ¹ Tax Units Pre-Tax Income Federal Tax Burden Expanded Cash Income Level (thousands of 2 2015 dollars) Number (thousands) Percent of Total Average (dollars) Percent of Total Average (dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All 919 3,727 4,182 3,290 2,840 4,482 2,069 1,806 235 22 14 23,633 3.9 15.8 17.7 13.9 12.0 19.0 8.8 7.6 1.0 0.1 0.1 100.0 6,748 15,392 24,808 34,738 44,828 61,026 85,747 129,990 270,186 681,258 3,700,469 51,742 0.5 4.7 8.5 9.4 10.4 22.4 14.5 19.2 5.2 1.2 4.1 100.0 -716 -1,691 -1,300 581 2,923 6,376 12,860 25,209 65,393 198,427 1,261,437 5,728 Percent of Total -0.5 -4.7 -4.0 1.4 6.1 21.1 19.7 33.6 11.3 3.2 12.6 100.0 5 Average (dollars) Percent of Total Average Federal Tax 6 Rate 7,464 17,082 26,108 34,157 41,905 54,650 72,888 104,781 204,793 482,832 2,439,032 46,014 0.6 5.9 10.0 10.3 10.9 22.5 13.9 17.4 4.4 1.0 3.0 100.0 -10.6 -11.0 -5.2 1.7 6.5 10.5 15.0 19.4 24.2 29.1 34.1 11.1 After-Tax Income Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-1). * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal would (a) repeal the tax deferral of contributions to retirement accounts, accruals in IRAs, Keogh, and both defined contribution and defined benefit retirement plans; (b) repeal the saver's credit; (c) repeal exemption of income accrued within accounts; and (d) repeal tax on withdrawals from accounts as well as the early withdrawal penalty. Baseline federal tax burden differs from standard TPC tables in that tax incentives for retirement are treated on a cash flow rather than present value basis. For a description of TPC's current law baseline, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income. 28-Jul-15 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T15-0106 Tax Benefit of Certain Retirement Savings Incentives (Cash-flow Approach) Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2015 ¹ Detail Table - Tax Units with Children Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Benefit 3 Without Benefit 0.0 0.2 4.8 15.1 26.7 42.1 57.8 73.9 86.3 91.7 91.1 43.8 100.0 99.8 95.2 84.9 73.3 57.9 42.2 26.1 13.7 8.3 9.0 56.2 Benefit as a Percent of AfterTax Income -0.1 -0.1 0.0 0.2 0.4 0.6 0.5 1.7 4.2 5.3 1.6 2.2 4 Share of Total Benefit Average Benefit Dollars 0.0 -0.1 0.0 0.2 0.6 2.2 2.0 21.3 46.5 17.2 10.2 100.0 Share of Federal Taxes Percent of Federal Taxes -5 -10 0 57 156 306 382 1,930 9,301 25,601 30,551 2,059 0.7 0.6 0.0 36.8 6.6 5.2 3.2 7.7 14.3 13.6 3.1 8.7 With Provision -0.1 -0.7 -0.7 0.1 0.8 3.7 5.4 24.0 28.2 10.9 28.2 100.0 6 Average Federal Tax Rate Without Provision With Provision Without Provision -0.1 -0.7 -0.6 0.1 0.7 3.6 5.2 23.8 29.7 11.4 26.8 100.0 -11.8 -11.7 -6.0 0.4 5.3 9.6 13.9 17.9 22.7 28.0 33.9 19.9 -11.9 -11.8 -6.0 0.6 5.7 10.1 14.4 19.2 26.0 31.8 34.9 21.7 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2015 ¹ Tax Units Pre-Tax Income Expanded Cash Income Level (thousands of 2 2015 dollars) Number (thousands) Percent of Total Average (dollars) Percent of Total Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All 1,201 4,695 5,453 4,328 3,781 7,344 5,290 11,313 5,128 690 341 49,840 2.4 9.4 10.9 8.7 7.6 14.7 10.6 22.7 10.3 1.4 0.7 100.0 6,477 15,357 24,859 34,799 44,841 61,661 87,129 140,758 286,805 669,834 2,897,339 119,143 0.1 1.2 2.3 2.5 2.9 7.6 7.8 26.8 24.8 7.8 16.6 100.0 Federal Tax Burden Average (dollars) -766 -1,800 -1,481 154 2,378 5,936 12,138 25,139 65,152 187,644 980,743 23,760 Percent of Total -0.1 -0.7 -0.7 0.1 0.8 3.7 5.4 24.0 28.2 10.9 28.2 100.0 5 Average (dollars) Percent of Total Average Federal Tax 6 Rate 7,243 17,157 26,340 34,645 42,462 55,725 74,990 115,620 221,654 482,190 1,916,595 95,383 0.2 1.7 3.0 3.2 3.4 8.6 8.3 27.5 23.9 7.0 13.7 100.0 -11.8 -11.7 -6.0 0.4 5.3 9.6 13.9 17.9 22.7 28.0 33.9 19.9 After-Tax Income Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-1). * Less than 0.05 Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal would (a) repeal the tax deferral of contributions to retirement accounts, accruals in IRAs, Keogh, and both defined contribution and defined benefit retirement plans; (b) repeal the saver's credit; (c) repeal exemption of income accrued within accounts; and (d) repeal tax on withdrawals from accounts as well as the early withdrawal penalty. Baseline federal tax burden differs from standard TPC tables in that tax incentives for retirement are treated on a cash flow rather than present value basis. For a description of TPC's current law baseline, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income. 28-Jul-15 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T15-0106 Tax Benefit of Certain Retirement Savings Incentives (Cash-flow Approach) Baseline: Current Law Distribution of Federal Tax Change by Expanded Cash Income Level, 2015 ¹ Detail Table - Elderly Tax Units Expanded Cash Income Level (thousands of 2015 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Benefit 3 Without Benefit 0.0 * 0.9 3.8 6.3 13.0 19.9 23.3 43.4 60.4 56.0 9.8 100.0 100.0 99.1 96.2 93.7 87.0 80.1 76.7 56.6 39.6 44.0 90.2 Benefit as a Percent of AfterTax Income 0.0 -0.1 -0.2 -0.6 -1.6 -2.6 -4.3 -5.6 -3.6 1.1 -1.7 -2.9 4 Share of Total Benefit 0.0 0.1 0.4 1.1 3.1 11.8 17.1 44.7 16.0 -1.6 7.3 100.0 Average Benefit Dollars 0 -7 -42 -199 -674 -1,475 -3,250 -6,334 -7,790 5,262 -34,133 -1,777 Share of Federal Taxes Percent of Federal Taxes -0.4 -2.8 -6.4 -13.7 -26.1 -29.3 -31.8 -28.3 -12.2 2.7 -3.1 -14.0 With Provision 0.1 0.4 0.8 1.2 1.7 5.6 7.5 22.1 18.4 8.5 33.4 100.0 Average Federal Tax Rate6 Without Provision With Provision 0.1 0.4 0.9 1.2 1.4 4.6 6.0 18.4 18.8 10.1 37.7 100.0 2.1 1.6 2.7 4.2 5.8 8.2 11.9 16.6 22.8 28.3 35.0 17.2 Without Provision 2.1 1.5 2.6 3.6 4.3 5.8 8.1 11.9 20.1 29.0 33.9 14.8 Baseline Distribution of Income and Federal Taxes by Expanded Cash Income Level, 2015 ¹ Expanded Cash Income Level (thousands of 2 2015 dollars) Number (thousands) Percent of Total Average (dollars) Percent of Total Average (dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All 1,990 7,796 6,134 4,079 3,280 5,702 3,732 5,020 1,456 218 152 40,001 5.0 19.5 15.3 10.2 8.2 14.3 9.3 12.6 3.6 0.5 0.4 100.0 5,666 15,198 24,525 34,834 44,907 61,521 86,294 134,991 281,044 701,136 3,187,567 73,992 0.4 4.0 5.1 4.8 5.0 11.9 10.9 22.9 13.8 5.2 16.4 100.0 120 241 668 1,452 2,588 5,025 10,238 22,391 64,135 198,117 1,115,275 12,713 Tax Units Pre-Tax Income Federal Tax Burden Percent of Total 0.1 0.4 0.8 1.2 1.7 5.6 7.5 22.1 18.4 8.5 33.4 100.0 5 Average (dollars) Percent of Total Average Federal Tax 6 Rate 5,546 14,956 23,857 33,381 42,319 56,496 76,056 112,600 216,910 503,018 2,072,292 61,279 0.5 4.8 6.0 5.6 5.7 13.1 11.6 23.1 12.9 4.5 12.9 100.0 2.1 1.6 2.7 4.2 5.8 8.2 11.9 16.6 22.8 28.3 35.0 17.2 After-Tax Income Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0515-1). * Less than 0.05 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal would (a) repeal the tax deferral of contributions to retirement accounts, accruals in IRAs, Keogh, and both defined contribution and defined benefit retirement plans; (b) repeal the saver's credit; (c) repeal exemption of income accrued within accounts; and (d) repeal tax on withdrawals from accounts as well as the early withdrawal penalty. Baseline federal tax burden differs from standard TPC tables in that tax incentives for retirement are treated on a cash flow rather than present value basis. For a description of TPC's current law baseline, see http://www.taxpolicycenter.org/taxtopics/Baseline-Definitions.cfm (2) Includes both filing and non-filing units but excludes those that are dependents of other tax units. Tax units with negative adjusted gross income are excluded from their respective income class but are included in the totals. For a description of expanded cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes tax units with a change in federal tax burden of $10 or more in absolute value. (4) After-tax income is expanded cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); estate tax; and excise taxes. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, the estate tax, and excise taxes) as a percentage of average expanded cash income.