8/8/2009 Evolution of Taxation in the Purpose is threefold

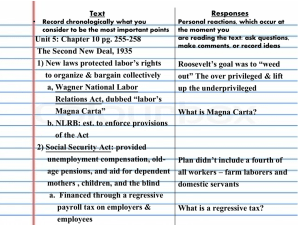

advertisement

8/8/2009 Purpose is threefold Evolution of Taxation in the constitution American lawmakers have always worked to balance three goals in the process of creating taxes – to build revenue, to influence people’s spending habits, and to be fair to all taxpayers. Lesson 2 1781-1789 The writers of the Articles of Confederation did not support a strong federal government. Only state governments had the power to tax, and they had to turn over tax revenues to the federal government. The Constitution gave the federal government new, stronger powers to tax citizens directly. Taxes were in the form of tariffs and excise taxes. These types of taxes were unfair because people with lower incomes had to pay a higher percentage of their income than did people with higher incomes This type of tax is a regressive tax. 1862-1872 During the Civil War, the federal government required more revenue than tariffs and excise taxes could provide. A tax on income was established during the civil War and was abolished after the war. 1 8/8/2009 1913-Present The Whiskey Tax Because of industrialization and modernization, many people gained huge fortunes that were not taxed. A tax on income was intended to make the system of taxation more equal. The ratification of the Sixteenth Amendment in 1913 gave Congress the right to collect income taxes. Now, people with higher incomes paid more taxes than those with lower incomes. This form of taxation is known as a progressive tax. In 1791, congress placed an excise tax on the sale of whiskey. The tax was a direct tax on the people who made and sold whiskey. Farmers in western Pennsylvania felt threatened by the tax, and many refused to pay it. To them, whiskey was not an industry but a currency because they traded it just like it was money. In 1794 hundreds of farmers staged the Whiskey Rebellion to protest the tax. This rebellion was the first test of the federal governments power to tax. The president sent troops to face the citizens and made a point that the Constitution is the law of the land and must be obeyed. The Tariff of 1832 Social Security Act of 1935 By 1832, revenue tariffs accounted for 89 percent of government income. After the War of 1812, Americans bought large amounts of textiles from the British because they were cheaper than American made goods. To protect the infant American industries. By 1935, the Great Depression had been going on for six years. Millions were unemployed, and few jobs were available. As part of President Franklin D. Roosevelt’s New Deal, the federal government created jobs for the unemployed. However, the elderly could not work, and many were living in poverty. Frances Perkins, the first female presidential Cabinet member, was charged with developing an “old-age” insurance program. The result was the Social Security Act of 1935, designed to provide elderly retired workers with pensions. At first, Social Security deductions were considered “contributions,” not taxes. The program appeared to be self-funded because only those who contributed would receive credits toward retirement benefits. However, far too many people needed help, so the program was expanded to include the families and survivors of retired and disabled workers, the unemployed, and federal workers. 2 8/8/2009 Wealth Tax of 1935 Victory Tax 1942 During the Great Depression, President Franklin D. Roosevelt’s New Deal programs put millions of jobless Americans back to work and stabilized the economy. Social Security programs provided pensions to those who could not work. However, the government needed new taxes to pay for these programs. The Revenue Act of 1935 put a new progressive tax, the Wealth Tax, in place. Those making more than $5 million a year were taxed up to 75 percent. Unlike their Civil War grandparents, the wealthy were not happy to pay income taxes during crisis times. Loopholes in the tax code were used. The federal government aggressively prosecuted tax evaders. The Revenue Act of 1937 cracked down on tax evasion by revising tax laws and regulations. In 1939 only about five percent of American workers paid income tax. The United States’ entrance into World War II changed that figure. The demands of war production put almost every American back to work, but the expense of the war still exceeded tax-generated revenue. President Roosevelt’s proposed Revenue Act of 1942 introduced the broadest and most progressive tax in American history, the Victory Tax. Now, about 75 percent of American workers would pay income taxes. Because so many citizens paid the tax, it was considered a mass tax. To ease workers’ burden of paying a large sum once a year, and to create a regular flow of revenue into the U.S. Treasury, the government required employers to withhold money from employees’ paychecks. Additional taxes were put in place in 1943. By war’s end in 1945, about 90 percent of American workers submitted income tax forms, and 60 percent paid taxes on their income. The federal government covered more than half its expenses with new income tax revenue. 3