2015 ABSTRACT OF RATABLES ATLANTIC COUNTY for

advertisement

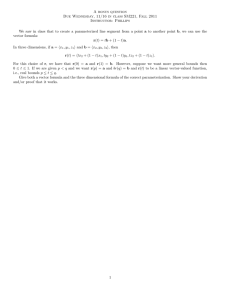

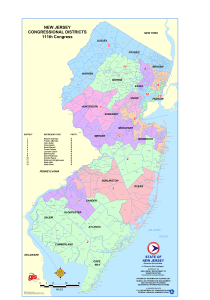

ABSTRACT OF RATABLES for ATLANTIC COUNTY 2015 Atlantic County Board of Taxation 5909 Main Street Mays Landing, New Jersey 08330 (609) 645-5820 www.aclink.org/taxation Theresa Pre ndergast, President Dennis Le vinson, County Executive Gerald D e lRo sso, Co unty Administrator William J. Polistina, Commissioner John Collette Jr. , Commissioner Greg Sykora, Commissioner Debra A. Lafferty, Commissioner Margaret M. Schott, County Tax Administrator At lantic County Board of Taxation 2015 Abstract of Ratables Column 1 Column 5 Column 4 Column 2 Column 3 Taxable Value Total Taxable Value (A) (B) Taxable Value of Partial Net Taxable Taxable Improvements Value of of Land and Exemptions & Value of Land & (Includes Partial Communication Improvements Improvements Abatements Exemptions & (Col. 2-3) (Col.lA+lB) I (Assessed Val.) Eouinment Abatements) Land 863,731 713 ,462,200 397,837,800 713,462200 0 315 ,624400 7,027,85 1 7,342,926,555 60,200 7,342,866,355 3,175,022,605 4 167,903,950 0 3,23 1,377,000 3,23 1,377,000 2054.9 10, 100 1,176,466 900 0 1,094,3 15 297,515,500 297,515 ,500 198,776600 0 98738,900 887,624 649,657,000 432,343 100 650,176,800 519,800 217,833700 34,215700 34,2 15,700 0 10,314,700 23901 000 0 0 225,081,400 148394 100 225,252,700 17 1,300 76,858,600 8,586,762 4 065,629,600 I 263 380,800 2,802,248,800 4,065 629600 0 385,5 12 104 105,500 154, 129,600 154,129,600 50024 100 0 290,0 14 108, 158899 108, 158,899 24,962,390 83 196509 0 5,670,946 2704859200 2,704,859,200 813 180,800 1,89 1,678,400 0 6,518,08 1 2,085,370 686 1,526,650 800 2 087 ,28 1,486 1,9 10,800 560 630,686 3,977,331 980,093,600 1,355,472,000 222,000 1,355,250,000 375378400 986,052,200 0 407,932,400 578119800 986052200 0 101,746 I 804,758400 1,34 1,789, I 00 462,969300 I 804758400 0 635,737 1,330943000 3 559,97 1 600 0 3 559,97 1 600 2,229,028 600 579,672 206,926,600 292,437,500 0 292,437500 85,510,900 1, 193,961 933,543,460 933,543 ,460 323 ,376.460 610 167000 0 11 ,042,623 884,366,600 3 17000 884,049,600 265,742 700 618623900 276,306 77,856,400 22,30 I ,900 55554500 77,856400 0 I 178 ,038 ,500 0 685 ,127900 1, 178,038,500 0 492 910,600 1,862,937 684,380850 2,399,17 1 450 2,399,171 ,450 1,714790600 0 467 ,642 101 ,824,500 161 ,029700 161,029,700 59,205 ,200 0 - . .. : Taxin2 District 01: Absecon City 02: Atlantic C ity 03: Brigantine City 04: Buena Bora 05: Buena Vista Twp 06: Corbin City 07: Egg Harbor City 08: Egg Harbor Twp 09: Estell Manor 10: Fo lsom Boro II: Galloway Twp 12: Hamilton Twp· 13 : Hammonton Town"· 14: Linwood C ity 15: Longpol1 Bora 16: Margate C ity 17: Mullica Twp 18: NOlt hfield City 19: Pleasantville City 20: Port Republic C ity 21: Somers Po int 22: Ventnor City 23: Weymouth Twp"" " Reassessed •• Revalued 15,979,448,641 19,268,234,409 35,247,683,050 3,201,100 35,244 ,481 ,950 51,462,791 Column 6 Net Taxable Value (Col. 4+5) 7 14,325,931 7,349,894206 3,23 1,377,000 298,609 815 650,544624 34,215 700 225,081 400 4,074 ,216,362 154,515 I 12 108,448913 2,7 10,530,146 2,091 ,888 767 1,359,227 33 1 986,052,200 1,804 860 146 3,560,607,337 293,017 172 93473742 1 895092,223 78,132,706 1,178,038.500 2.401 034,387 161 ,497 342 35,295,944,741 p"Op 1 Atlantic Coun ty Board of Taxation 2015 Abstr"act of Ratab les Column 7 , 0" Dist.# 01: Absecon City 02: Atlantic City 03 : Bri gantine City ,04 : Buena Boro 05: Buena Vista Twp ,06: Corbin City 107: Egg Harbor City '08: Egg Harbor Twp ,09: Estell Manor : 10: Folsom Boro II 1: Galloway Twp 12: Hamilton Tw~* 13: Hammonton Town" 14: Linwood City 11 5: Longport Bol'O , 16: Margate Ci ty 17: Mullica Twp 18: No rth tield City 19: Pleasantville City 20: Port Republi c City 2 1: Somers Point 22: Ventnor City 23: Weymouth Twp** • Reassessed •• Revalued General Tax Rate Per S100 3. 135 3.422 1.773 2.75 1 2.32 1 2.6 11 4.276 2.963 2.365 3.051 3.042 2.878 2.486 3.225 0.907 1.488 4.197 3.065 3.827 3.705 2.794 2. 166 2.267 Column 8 Column 9 True Value (A) (B) County UEZ Equalization Abatement Ratio Expired 92.83% 0 100.05% 0 92.25% 0 11 2.00% 0 107.79% 0 66.62% 0 106.49% 0 98.16% 0 94.34% 0 64.23% 0 90.50% 0 95.02% 0 101.31% 0 98.94% 0 95.49% 0 91.39% 0 6 1. 56% 0 97.30% 0 113.42% 0 58.54% 0 101.01% 0 104.04% 0 99.77% 0 ° Column 10 Equalization (A) (B) Class II Railroads Amounts Deducted 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 ° -30,387,677 -45,032,13 5 -11 ,371,830 -9297,887 -99,096,374 -8,763,473 -90, I 08,980 -294,058,357 Column 11 Net Valuation I for County Tax Apportionment Amounts (Col.6-9A+9B Added -lOA+IOB 56,236,374 770562,305 49,508,40 1 7 399 402,607 273 , 179,522 3 504,556,522 268,222, 138 605,5 12,489 17,261,202 5 1 476,902 213,709,570 92,007690 4 166,224,052 164,116,482 9,601,370 61,473,682 169,922,595 2,998,555,857 28802571 I 115 ,017,327 2,206,906,094 1,349,929,444 I 1,890,758 997,942,958 1,890,862,662 86,002,5 16 339,573,088 3,900, 180,425 183 ,955 , 117 476,972,289 28,966,6 14 963704.035 795,995,849 55,415,072 133,547,778 1,169,275,027 2,310 925 407 754,9 19 162252,261 1,668,869,363 36,670,755,747 PMP? Atlantic Cou nty Board of Taxation 2015 Abstract of Rat abIes Column 12A , , , Dist.# 01 : Absecon City 02: At lantic City 03: Brigantine City 04: Buena Boro 05 : Buena Vi sta Twp 06: Corb in City 07: Egg Harbor City 08: Egg Harbor Twp 09: Estell Manor 10: Fo lso m Boro I I: Ga lloway Twp 12: Hamilton Twp' 13: Hammonton Town " 14: Linwood City 15: Longport Bol'O 16: Margate City 17: Mull ica Twp 18: Northfi eld City 19: Pleasantville City 20: Port Republic City 21: Somers Point 22: Ventnor City 23: Weymouth Twp" • Reassessed Revalued .* I T otal County Taxes Apportioned 3,512,7 15 .63 33,73 1,207.72 15 976,009. 18 I 222 727.98 27603 13.04 234,664.63 974,224.85 18,992,312.80 748 147.86 774,615.82 13,669,334.66 10 060488.9 1 6153,84 1.45 4 549,262.0 I 8619,760.89 17,779,5 15 .86 2, 174 ,3 44.63 4,393 ,179.11 3,628,657.98 608 ,796.15 5330,303.12 10,534675.44 739,649.54 167,168,7 49.26 II IV III Adjustments Resultinl( from: (B) (A) M unicipal Net Co unty Appeals+Corrections Eq ualization T able Appea ls County Budget Dedu ct Add Deduct Add Taxes State Und erp ay Overpav Overpav Apportioned Aid Un derl!av 3,498,448.83 14,266.80 0 0 0 0 0 28,206,242.42 0 0 5,524,965.30 0 40,0 12 .9 1 0 15,935,996.27 0 0 0 7,866.26 1,2 14,861.72 0 0 0 0 15,923.84 2,744,389.20 0 0 0 0 0 0 0.00 0 234664.63 0 97 1,254.52 2970.33 0 0 0 0 178 ,752.89 0 0 0 18,8 13,559.91 0 1, 168.94 746,978.90 0 0 0 0 774,4 16.88 0 198.94 0 0 0 124,695.26 0 0 0 13,544,639.40 0 11 0,247.68 9,950241.23 0 0 0 0 13,098.67 6, 140742.78 0 0 0 0 71 1.82 40 0 0 0 4,508 550.19 0 61 363.90 0 8,558,396.99 0 0 0 25, 146.15 0 0 0 17,754,369.71 0 2,57 1.94 2, 17 1,772.69 0 0 0 0 49,507.26 4,343,671.85 0 0 0 0 0 0 55 ,489.37 3,573,168.61 0 0 608230.85 0 0 565.30 0 0 63,422.62 5,266,880.50 0 0 0 0 189 346.84 10,345,328.60 0 0 0 0 739, 199.74 0 0 449.80 0 0 0 0 6,522,74 2.82 o J 60,646,006.44 0 V Net County Taxes Apportioned Less State Aid (Col. 12 AIII-12AIV-County BPP Adjustment 3,498,448.83 28,206,242.42 15 ,935,996.27 1,2 14,861.72 2,744,389.20 234,664.63 97 1,254.52 18813,559.91 746,978 .92 774,416.88 13 544,639.40 9,950,241 .23 6,140,742.78 4,508,550.19 8,558,396.99 17,754,369.71 2, 171 ,772.69 4,343,671.85 3,573 ,168.61 608,230.85 5,266,880.50 10,345,328.60 739,199.74 160,646,006.44 P'CTP 1 Atla ntic COlillty Board of Taxation 2015 Abstract of Ra ta bles Column 128 County Library Taxes Apportioned 0.00 0.00 1, 195,34 1.57 9 1 485.78 206 529.48 17 557.85 72,892.51 1,42 1,024.53 55,977.20 57,957.56 1,022,753.79 752,736.2 1 460,436.80 0.00 644939.45 0.00 162,686.72 0.00 27 1 499.95 45 550.76 398818.81 788,215.34 55 341.35 (A) County Library Less: County Less: 2015 Library Health Service Credit for 2014 Tax Due 2014 Tax Taxes Overpayment Apportioned Appeals 0.00 0.00 0.00 164,35 1. 58 0.00 0.00 0.00 0.00 3,786.44 155,888 .97 1,035,666.17 747,479.33 784.39 12,463.69 78,237.70 57,208 .52 1,493. 17 29,9 10.20 175, 126.11 129, 148.46 2 433. 14 0.00 15124.71 10,979.40 61,400. 14 293.54 I I 198. 83 45,5 81.65 17,801.73 20~424.01 1,197,798.79 888,604.97 11 5.25 7,680.74 48, 181.21 35004.05 19.43 49,275. 10 36242.43 8,663.03 12,486.7 1 133,983.95 876,283. 13 639,555 .53 10, 182.89 107,554.89 634,998.43 470,706 .26 I 255.65 62, 12 1.66 397,059.49 287923.55 0.00 0.00 0.00 212849. 11 6,000.79 90898.63 548,040.03 403,298 .03 0.00 0.00 0.00 831,86 1.1 0 252.98 23001.74 139432.00 101 732.39 0.00 0.00 0.00 205 546.37 5,395.76 44417.20 22 1,686.99 169,776.24 55.77 6,061.58 39,433.4 1 28 484.12 5,925.00 55,380.82 337,5 12.99 249,392. 16 18670.87 110,454.03 659090.44 492,892.3 1 44.29 7,462.89 47,834.17 34,606.44 Dist.# 0 1: Absecon City 02: Atlantic City 03: Brigantine Ci ty 04: Buena Boro 05 : Bue na Vista Twp 06: Co rbin City 07: Egg H arbor City 08: Egg H arbo r Twp 09: Estell Manor 10: Folsom Boro II: Gall oway Twp 12: Hamil ton Twp* 13: Ham monton Town ** 14: Li nwood City 15: Longpo rt Boro 16: Marga te City 17: Mulli ca Twp 18: Northfield City 19: Pleasantvi ll e City 20: Port Republ ic City 2 1: Somers Point 22: Ventnor City 23: Weymouth Twp" • Reassessed 7,721 ,745.65 84,564.65 ** Reval ued 1,075,000.00 6,562,181.00 (8) (C) County Health Service Less: County Less: 2015 Health Credit for Open Space 2014 Service Tax 2014 Tax Taxes Overpayment Due Appeals Apportioned 83 639.50 1,109.64 79,602.44 10,864. 88 0.00 0.00 0.00 52,992.47 2,736.06 328,2 10.84 4 16,532.43 49740.39 605. 10 26,241 .22 30,362.20 3 758.49 62,973.36 65,075.15 1,099.95 8,470.76 0.00 5, 122.76 5,856.64 738.53 230.64 23,578. 18 2 1,772.83 3 024.1 z! 11,943.58 432,502.64 444, 158.75 56,881.57 90.55 18,742.35 16, 171. 15 2,338.09 ' 15.66 18,239.28 17,987.49 2,435.24 8,086.65 282,091.70 349,377. 18 41 005.05 6,676.62 226,447.58 237582.06 29,978.19 827.55 130,791.83 156,304. 17 19166.70 3, 101.76 100,286.56 109,460.79 13,804.95 4,602.71 191,379.26 2073 16.06 26,248.11 383,216. 11 446778.84 1,866.1 5 55,607.78 199.31 48,428. 19 53, 104.89 6,808.53 3756.77 88,628.52 113161.08 13,151.55 93,5 16.60 7 1,928. 14 4,331 .50 10,686.16 43.94 12,762. 14 15,678.04 1,908.37 4 146.87 116,599.57 128645.72 15,847.90 14,551.39 232,551.49 245,789.43 30,606 .08 34.60 15,713.58 18,858.26 2,321.57 6,243,224.00 70,05 7.00 2,915,055.00 3,258,112.00 458,385.48 p"Op 4 Atlantic County Board of T axation 2015 Abstra ct of Ratablcs Column 12C Column 12C (continued) Local Taxes to be Raised for Local Taxes to be Raised for I • (i) District School Purr oses (ii) Local Municipal Purposes (B) (C) (B) (C) (A) (A) Regional, Municipal Municipal District Municipal School Consolidated Local Budget Open Space Library IfAdj usted for BPP' & Joint School I(adjusted for BPP) Budget School Budget Dist.# 01: Absecon City 11 ,205,966.00 7,332,356.76 0 0 0 257073.3 1 02: Atlantic City 9 1,060,723.00 128,4 10 646.00 0 0 3,755,692.00 15,888, 11 4.00 03 : Brigantine Ci ty 969,425.50 22,97 1 223.65 0 0 0 04: Buena Bol'O 2,787,676.90 0 4,096,842 .00 0 0 05 : Buena Vi sta Tvrp 9535068 .00 2563960.52 0 0 0 0 5 10,842.00 06: Corbin City 0 125 865.00 0 0 0 07: Egg Harbo r City 3,097 713.00 1 2655 13.00 0 4,202,979.00 0 0 08: Egg Harbo r TW]J 77 ,749 ,630.00 2 1,611 ,347.00 814,843.00 0 0 0 2,373,649.00 462,916.08 09: Estell Manor 0 0 0 0 1,816,288.00 10: Folsom Boro 0 0 647,594.20 0 0 1 I: Ga ll oway Twp 0 18,262,570.67 3 1.407,242.00 17,928, 159 .00 0 0 12: Hamilton Twp* 17,495,685 .9 1 20, I 16,473 .00 11 ,708,972.00 0 0 0 13: Hamm onton Town" 8,474,137.95 18,590,006.00 0 0 0 0 14: Linwood City I I 446,971.00 422,528.00 8,557408.00 0 340,075.00 6395889 .00 1,0 14 769.00 15: Longport Boro 599 1 26 1.42 0 0 0 0 16: Margate City I 523,738.00 2 1 383 737.42 105 11 ,408.00 0 0 1,286,251 .00 17: Mulli ca Twp 3 887 596.00 2,538,2 13.00 3,498398.57 0 0 0 18: Northfi eld Ci ty 9,997,726.00 5,863,390.00 0 7,990 185.32 324,191.00 0 19: Pleasantville City 9, 130,185.00 2 1,235,92 1.00 0 0 0 0 20: Port Republic City 1,705,464.00 507,910.00 15 ,627.00 0 0 0 2 1: Somers Point 9,752,324.00 7,012,939 .00 10,385,257.00 0 0 0 22 : Ventnor City 17,819,977.00 2 1,448 268.00 1 4 12948 .00 0 0 0 23 : Weymouth Twp** 2, 196,296.00 0 0 640060.0 1 16,149.00 0 * Reassessed 351 ,279,362.00 66,344,985.00 4,328,639.50 336,987,366.38 846,619.00 5,963,282.31 .. Reva lued '----- ° ° Column 12D Total Levy on which Tax Rate is Computed 22,389,458.89 25 1,486,295.68 57,273 ,220.90 8,213, 128.50 15,094,682.86 893,091.5 1 9,624,180.79 120,717,964.34 3,653 .011.42 3,308.031.99 82,429,849.78 60,190,790.3 4 33 779,500.29 31 797,788.67 16,356,635.11 52,963 ,756.79 12,295,777.97 28649,233.54 34,253,303.17 2,894,351.38 32,909,478.98 51 ,995 ,229. 81 3,660,797. 02 936,829,559.73 - P ~O f' C; Atlan tic Co un ty Boa rd of Taxation 2015 Abstract of Ratabl es , Column 13 Real Property Exempt F rom Taxation (A) Dist.# 01 : Abseco n City 02 : At lantic Ci ty 03: Bri gantine City 0 4 : Buena Bol'O 05: Buena Vista Twp 06 : Corbi n City 07: Egg Harbor City 0 8 : Egg Harbor Twp 09: Estell Manor 10: Fo lsom Boro I 1: Galloway Twp 12: Ham ilton Twp ' 13: Hammonton To wn 14: Lin wood City 15: Longport Bora 16: Margate City 17: Mulli ca Twp 18: N0I1hfield City 19: Pleasantv ill e City 20: Po rt Republic City 2 1: So mers Poi nt 22 : Ventnor City 23: Weymouth Twp" • Reassessed ** Revalued Public School 16,660 100 426,397,200 32,868700 6,559,700 20,77 1, 100 0 36,8 18 500 172,988,500 4,72 1,400 1,738, 100 414737,497 13202 1,300 64 871 500 43 816,200 0 17,235,400 3,958,300 6, 142,170 54,768,400 1, 177,600 26,560,600 15,808900 3,931 200 1,504,552,367 (C) (B) (D) (E) (F) Public Church and Property Charitable 30,494 ,900 10,004,900 2,137,380,600 2 15,927,900 166,286,200 6, 198,600 5,369,800 5,367,200 15,490,700 4,021 ,700 1,279,600 193 ,900 23,300,000 8,295,200 324,49 1,800 72,308,900 22,355,600 1,053,300 2,989,400 1 099900 83716000 74,537,300 126,8 11 ,600 11 022005 42628,752 24, 17661 1 11 ,984700 22,782,800 48,088,100 8792,800 11 8 309,800 29,406,200 14,570,900 2.468 ,200 82,965,400 22, 12 1,400 26,681,800 34,533,800 4,369,600 760,700 38,611,800 15,958,800 28,052,980 11,469 190 2994,900 947,800 Cemeteries and Gravevards 0 0 0 274,800 355,700 53,600 157,000 12,012,200 49200 0 505,200 472 1 300 674 200 244,700 0 0 222, 100 5.000 10,3 72,800 146,500 79400 0 0 Other Exempts 7,679,600 2, 180 115,700 12294,700 2773 4,600 15443,700 5064,975 13,497,9 19 50 42 1 300 2469500 54 1 200 229,369, 100 166868,60 1 19,552,500 4,440,200 556,700 5,774,400 3,2 13,600 3,576,000 83,756000 487200 259525 .086 12,3 84,880 I 303600 74,64 7,218 3,359,222,332 583,451 ,706 29,873,700 3,106,071,061 Other School 12,870,800 o 0 2,2 14 800 18,395700 700 1,533700 0 0 0 15530600 1,9 18,600 5 180,3 18 426,200 0 780,000 0 798,000 0 0 14,997,800 0 0 JG) Total Amount of Exempts 13A+B+C+D+E+F 77,710300 4,959,82 1 400 1 2 17,648200 : 47,520900 ! 74,478,600 ! 6,592,775 ' 83,602 319 632222,700 30,649,000 6,368600 818395 ,697 443 ,3 63,406 157,083 ,88 1 83,694,800 57,437,600 171,505,800 24,433, I 00 11 5,607970 2 10,11 2,800 694 1,600 355,733 486 67 7 15,950 9,177,500 8,657,818,384 P ~OP h Atlantic County Board of Tax ation 2015 Abstract of Ratables , Dist.# 0 1: Absecon City 02 : Atlantic C ity 03: Brigantine City 04: Buena Boro OS: Buena Vista Twp 06: Corbi n City 07: Egg Harbor City 08: Egg Harbor Twp 09: Estell Manor 10: Folsom Boro 11: Gal loway Twp 12: Hami lton Twp' 13: Hammo nton Town" 14: Linwood Ci ty 15: Longport Boro 16: Margate City 17: Mullica Twp 18: NOl1hfi el d City 19: Pleasantvi lie City 20: Port Republic City 2 1: Somers Point 22 : Ventnor City 23: Weymou th Twp" * Reassessed *. Revalued Column 14 Column 15 Deductions Allowed Amount of Miscellaneous Revenues to Support Local Budget (A) (B) (A) (B) (D) (Cl Total of Miscellaneous Senior Citizen, Miscellaneous Veterans Surplus Revenues Receipts from Revenues and Widows Disabled and Revenue Anticipated Delinquent Tax iCCol.14A+B+Cl Surviving_Spouse 363,000.00 1,457,075.43 440,000.00 15 ,250.00 2,260,075.43 92,500.00 o 127,778,776.00 2,500,000.00 130,278,776.00 52,250.00 101 ,250.00 19,750.00 1,593,000.00 3,807,890.31 500,000.00 5,900,890.31 111,750.00 200,000.00 1,017,372.37 170,000.00 1,387,372.37 18,500.00 34,500.00 29,250.00 52,500 .00 405000.00 1,34 1,250.3 8 35,000.00 1.78 1 250.38 1,000.00 5,750.00 486769.00 134450.00 57,000.00 678,219.00 1,349,097.00 17,550.00 14,250.00 213,000.00 1,579,647.00 34000.00 300,000.00 16,390,935.00 210,000.00 16,900,935.00 75,500.00 265,000.00 150000.00 444,784.79 100,000.00 694,784.79 6000.00 17,250.00 16,750.00 310,000.00 291 377.49 100,000.00 70 1,377.49 5,250.00 3,929 664.00 5,097, 175. 10 20,000.00 57,500.00 285,500.00 9,046,839.1 2,220 000 .00 4,790364.27 500000.00 7510364.27 44250.00 151 000.00 56,750.00 1,250,000 .00 2,455 958.54 70000.00 3,775,958.54 113 ,000.00 3,487619.00 200,000.00 385 000.00 4,072,619.00 70,500.00 9,500.00 695000.00 1 287 889.73 200000.00 2 182889.73 2250.00 15750 .00 3,4 15,200.00 3,46 1,841.96 570,000.00 7,447,04 1.96 10,250.00 82,250.00 2 1,250.00 634,000 .00 928,279.43 425,000.00 I 987,279.43 54,000.00 24,750.00 1,660,000.00 2,799,452.5 1 365,000.00 4,824,452.51 100,500.00 I 635 3 11.00 6,473, 142.00 73,25 1.00 8, 18 1,704.00 50,000.00 56,000.00 170,000.00 422,489.00 58,000.00 650,489.00 3,000.00 14,250.00 3,523,598 .00 675,000.00 1,050,000.00 5,248,598.00 87,000.00 24,500.00 24,000.00 2,000,000.00 3,36 1,123.00 1,600,000.00 6,96 1, 123 .00 78,750.00 2,750.00 13,000.00 157,000.00 5 11 ,766.56 668,766.56 ° 22,684,625.00 192,966,026.87 ° 9,07 0,801.00 224,72 1,452.87 567,750.00 1,852,750.00 Pepp 7 Atlantic Co un ty Board of Taxation 2015 Abstract or Ratables , , Dist.# 0 1: Absecon Ci ty 02: Atlan tic City 03 : Briganti ne City 04: Buena BarD 05: Bue na V ista Twp 06: Corbi n Ci ty 07: Egg Harbor Ci ty 08: Egg Harbor Twp 09: Este ll Manor 10: Fo lsom Bora I I: Gall oway Twp 12: Hamilton Twp' 13: Hammonton Town" 14: Linwood C ity 15: Longport Bora 16: Margate C ity 17: Mulli ca Twp 18: North field City 19: Pleasantvi lie Ci ty 20: Port Republi c City 2 1: Somers Po int 22: Ventn or C ity 23: Weymouth Twp" • Reassessed •• Reval ued Addendum IAI to th e Abstract of Ratablcs: Assessed Valu e of Partial Exemptio ns & A batements (Column 3) -4-5-6-7-8-9-1-2-3- Polluti on C ontrol 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Fire Suppress ion 0 0 0 0 0 0 0 0 0 0 0 1,9 10800 0 0 0 0 0 0 0 Fallout Sh elter 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1,91 0,800 0 0 M ultiFamily Water/Sewer R enewable UEZ Hom e Class 4 Facility E nergy Abatement Im pr ovem ent Dwelline Abatement 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 P~ oe R Atlantic County Board of Taxation 2015 Abstract of Ratables . -, -10- Dist.# 01: Absecon City 02: Atlantic Ci ty 03: Brigantine City 04 : Buena Boro 05 : Buena Vista Twp 06 : Corbin C ity 07: Egg Harbor City 08: Egg Harbor Twp 09: Estell Manor 10: Fo lsom Boro 11 : Gall oway Twp 12: Hamilton Twp' 13: Hammonton Town" 14: Lin wood C ity 15: Longport Boro 16: Margate City 17: Mullica Twp 18: Northfi eld City 19: Pleasantv ill e City 20: Port Republic City 21 : Somers Point 22 : Venlnor City 23: Weymouth Twp" , Reassessed " Revalued Addendum 'A' (continued): Assessed Value of Partial Exemr tions & Abatements (Column 3) -12-13-14-15-11-16- Dwelling Abatement Dwelling Exemption 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 171 ,300 0 0 0 0 0 0 0 0 0 0 0 14,200 0 0 0 0 0 185,500 New Dwelling New Dwelling Commercialf Conversion Conversion MultiDwelling MultiDwelling Industrial Abatement Exemption Exemption Abatement Exemption 0 0 0 0 0 13,900 46,300 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 519,800 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 222,000 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 302,800 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 13,900 46,300 0 0 1,044,600 -17- Total Value 60,200 - 519,800 171,300 - 1,910,800 222,000 317,000 3,201 ,100 P,oe C) Atlantic County Board orTaxation 20 15 Abst ract of Ratab les Addendum 'C' REAP Distribution Summary -1-2-3- Addendum 'B' State Aid Adustment for BPP -1-2-3- Dist.# 01 : Absecon City 02: Atlan ti c City 03: Briganti ne City 04: Buena Bol'o 05: Buena Vi sta Twp 06: Corbi n City 07: Egg Harbor City 08: Egg Harbor Twp 09: Estell Manor 10: Folso m Boro II : Ga ll oway Twp 12: Hamilton Twp' 13: Hammonton Town** 14: Linwood City 15: Longpolt Bol'O 16: Marga te Ci ty 17: Mu ll ica Twp 18: NOlth fie ld City 19: Pleasantvill e City 20: Port Republic City 21: Somers Point 22: Ventnor City 23: Weymouth Twp" • Reassessed •• Revalued County Budget School Budget Municipal Budget BPP Aid BPP Aid BPP Aid 0 0 0 0 0 0 0 0 0 0 0 0 0 12,425.00 0 0 12,626.00 0 0 0 a a 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 77,212.00 0 a a 0 0 0 102,263.00 Property Assessments Tax Rate Credit Amount of REAP Aid 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 a 0' 0 0' 0 0 0' 0 0, O. 0 0 0' 0' 0 0 0 0 0 0 0 0 °i0 , i, i P,op In Atlantic Cou nty Board of Taxation 2015 A bstr act of Ratables , Addendum - Equalized Value Based on In Lieu of Taxes (CoI10B) -1-2-3-4-5- Taxing District aI: Absecon Ci ty a2: Atl antic C ity a3: Bri gantin e C ity a4: Buena Bora a5: Buena Vista Twp a6: Corbin City a7: Egg Harbor City a8 : Egg Harbor Twp a9: Este ll Manor I a: Fo lsom Bora II : Ga ll oway Twp 12: Ham ilton Twp' 13: Hammon ton Town" 14 : Linwood City 15: Lo ngport Boro 16: Margate C ity 17: Mu lli ca Twp 18: No rthfield City 19: P leasantvi lle Ci ty 2a: Port Republi c City 21 : So mers Point 22 : Vent nor City 23: Weymouth Tvl'p" • Reassessed ., Revalued C. 12 PL 1977 In Lieu of Tax NJHousing Finance Agency a a a a a a a a a a a a a a a a a 0 0 a a a a a a a a a a a a a a a a a a a a 0 a 0 a Urban Renewal Other a a a a a a a a a a a a a a a a a a 0 0 0 0 0 0 0 a a a 0 Total a a a a a a a a a a a a a a a a 0 a a 0 a a a a a a a a a a a a a a a a a a 0 0 0 0 0 0 0 0 0 0 P~OP II Atlantic Co un ty Boa rd of Taxatio n 2015 Abstract of Ratab les ,, Breakdown of General Tax Rate o' , " " , " Taxine; District '0 I: Abseco n City 02: Atla ntic City 03: Bri gantine City '04: Buena Boro OS: Buena Vista Two 06: Corbin City 07: Egg Harbo r City 08: Egg Harbor Twp 09: Este ll Manor 10: Fo lso m Boro II: Gal loway Twp 12: Ham il ton Twp' 13: Hammonton Town" 14: Linwood City 15: Lon gpo rt Boro 16: Margate City 17: Mu lli ca Twp 18: Northfield City 19: Pleasantvill e City 20: Port Republ ic City 2 1: Som e rs Point 22: Ventnor City 23: Weymouth Twp" , Reassessed •• Reva lued Health County Library Service Tax Tax Tax 0,0 11 0.490 0384 0,033 0,0 13 0.493 0,0 11 0.407 0,027 0,010 0,027 0.422 0,018 0,686 0,045 0,027 0.009 0.432 0,0 11 0,030 0.462 0,484 0,03 1 0,0 13 0,016 0,045 0.715 0,0 14 0,500 0,033 0.Q31 0,475 0,0 12 0,451 0,030 0,0 12 0,458 0,0 12 0,474 0,03 1 0.0 12 0,498 0.0 13 0,74 1 0,048 0,0 19 0,0 13 0,465 0,399 0.025 0.009 0,778 0,02 1 0,050 0,447 0,030 0,0 12 0,430 0,029 0,0 11 0,0 12 0,458 0,030 Municipal County Open District Regional Local Municipal Open Municipal General Effective Space School School School Purpose Library Space Tax Tax Tax Tax Tax Tax Tax Tax Tax Rate Rate 0,002 1.569 0,036 3,135 1.027 3378 0,00 1 1,239 0,05 1 3.422 L747 JA22 0,491 0,03 1 0,710 0,002 1.773 1.925 0,002 0,933 L37 1 2,75 1 2.458 1,466 0,002 0394 2,32 1 2,156 0,002 1.493 2,61 1 3,924 0367 0,002 0,563 1,867 4,019 L376 4.276 0,002 0,530 2,963 0,020 1.908 3.022 0,002 1.536 0.299 2365 2.510 0,003 0,597 3,051 4,755 1.675 0,662 0,673 3,042 0002 U58 3364 0,837 0,002 0,962 0,559 3,031 2878 0,624 0,002 1,367 2.486 2.456 1,1 60 0,648 0.Q35 0,002 0,043 0,867 3,225 3.263 0,002 0,057 0,952 : 033 1 0,907 0,043 0,037 1,488 0,002 0,295 0.600 1,63 1 0,003 1,327 1,193 4,197 6,823 0.866 0,002 0.Q35 1.069 0,627 0,854 3,153 3.065 0,002 1.020 2372 3.827 3,378 0,003 2,1 82 0,02 1 0,650 nos 6336 0,002 0.827 0.595 0,88 1 2,770 2.794 0,002 0.742 0.059 0.893 2.166 2085 0,002 1,359 0,009 0397 2.267 2.274 - - - p"Op 1) Atlantic County Board of Taxation 2015 Abstract of Ratables SPECIAL TAXING DISTRICTS , Taxing District 04: Buena Bora 04: Buena Boro 05: Buena Vi sta Twp 05: Buena Vi sta Twp 05: Buena Vista Twp 05: Buena Vista Twp 05 : Buena Vista Twp 23 : Weymouth Twp** Special Taxing District Fire District: FOI Fire District: F02 Fire Di stri ct: FOI Fire District: F02 Fire District: F03 Fire District: F04 Fire Di strict: FOI Fire Di strict: FOI Number Special District of Ratables Ratable Value Budget Amount Rate. 920 143,762,500 126,075.00 0.088 936 154,847,315 272,578 .00 0.177 181 ,25 6, 100 I 079 186,075 .00 0.103 759 149,181 ,200 331,925.00 0.223 2526 144,662,900 194,743.00 0.135 627 72,94 1,000 68,722.00 0.095 670 101,615,800 196,757.00 0.194 161,497,342 98,864.00 0.062 980 Poop II Atlantic Co un ty Board of Taxatioll 2015 Abstract of Rat abies 40,455,714.12 Total Amount of Miscellaneous Revenues for the SUppOlt of the County Budget (Incl udes smplus revenues appropriated) Rate per $ 100 to be applied to Column 11 for apportionment of County Taxes Net COllnty Taxes APPoliioned (Co lumn 12 A iii) Adjustments to County Taxes Apportioned (Net Overpaymnets are added to the Net Taxes Apportioned) (Net Underpayments are deducted from the Net Taxes Apportioned) 0.45586399 160,646,006.44 6,522,742.82 Rate per $100 to be applied to Column I 1 for apportio nm ent of Library Taxes Rate per $J 00 to be applied to Column 11 for apportionment of Health Taxes Rate per $100 to be appl ied to Column 11 for appo rtiolUllent of Open Space Taxes 0.02935976 0.01137006 0.00125000 Co unty Percentage Level of Taxable Value of Real Propeliy is 100% ATLANTIC C OUNTY Bol , ATJON Theresa.Pre n~er~esiGient _. t(C//~ ~ - William7i'stina ~rR;, hI 6Jidi: Q ' 1m Collette J r. I Attest: M Jt'l24~ /)".A-,...- . . v,zl 5if [h ereby celiify this to be a true copy of the Abstract of Rat abies and Exemptions for the County of Atl antic, State of New Jel'S.ey for the year 2015 as filed with me by the Atlantic County Board of Taxation. Bonnie Lindaw, Co unty Treasurer P"oe. 14