The Effects of Exposure to Better Neighborhoods on Children:

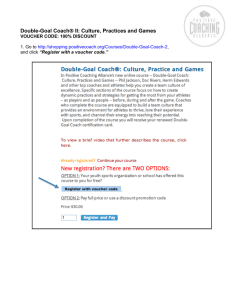

advertisement