NONRESIDENT ALIEN TAXATION TABLE OF CONTENTS TAXATION/RECONCILIATIONS

advertisement

TAXATION/RECONCILIATIONS

NRA TABLE OF CONTENTS

NONRESIDENT ALIEN TAXATION

TABLE OF CONTENTS

SECTION

1.

TABLE OF CONTENTS

2.

OVERVIEW

3.

WORK AUTHORIZATION VERIFICATION

A. EMPLOYEES

1.

Form I-9 Employment Eligibility Verification

2.

Changes Since 11/91

3.

Receipt Rule

4.

Information Verification

5.

Work Authorization

B. INDEPENDENT CONTRACTORS

1.

Employee or Independent Contractor

2.

Forms for Eligibility Verification

C. VISAS

1.

Immigrant Visa

2.. Non-Immigrant Visa

3.

Visa Types and Working Privileges

4.

Visa Waiver Program (VWP)

5.

United States-Canada Free Trade Agreement

6.

North American Free-Trade Agreement (NAFTA)

D. FOREIGN CORPORATIONS

4. TAX RESIDENCY RULES

A. GREEN CARD TEST

B. SUBSTANTIAL PRESENCE TEST

C. DUAL RESIDENCY STATUS

D. TAX TREATY IMPACT

REVISED: JANUARY 2005

SECTION 1

PAGE 1 OF 6

TAXATION/RECONCILIATIONS

NRA TABLE OF CONTENTS

E. CLAIMING RESIDENT STATUS

5.

INCOME SUBJECT TO WITHHOLDING

A. SOURCE OF INCOME

1.

Personal Service Income

2.

Scholarship and Fellowship Grants (non-service)

3.

Royalties

4.

Prizes, Awards, and Other Grants

B. TYPE OF INCOME

1.

Dependent Compensation

2.

Independent Compensation

3.

Scholarship or Fellowship Grant

4.

Royalties

5.

Prize or Award

C. EFFECTIVELY CONNECTED INCOME

D. WITHHOLDING ON SPECIFIC INCOME

1.

Scholarship and Fellowship Grants (Income Code 15)

2.

Industrial Royalties – Patents, Trademarks, etc. (Income Code 11)

3.

Other Royalties – Copyright, Recording, Publishing (Income Dode 12)

4.

Independent Personal Services (Income Code 16)

5.

Dependent Personal Services (Income Code 17)

6.

Pay for Teaching (Income Code 18)

7.

Pay During Studying and Training (Income Code 19)

8.

Prizes, Awards, and Other Grants (Income Code 50)

6. REDUCED OR EXEMPT INCOME

A. FOREIGN SOURCE INCOME EXCLUSION

B. QUALIFIED SCHOLARSHIP EXCLUSION (IRC SECTION 117)

C. COMPENSATION INCOME EXCLUSIONS

1.

IRC Section 125 – Cafeteria Plan Exclusion

REVISED: JANUARY 2005

SECTION 1

PAGE 2 OF 6

TAXATION/RECONCILIATIONS

NRA TABLE OF CONTENTS

2.

IRC Section 872(b)(3) – Foreign Employee Exclusion

3.

Per Diem Payments Made Under USAID Contracts

4.

Reimbursement of Travel and Living Expenses

D.

U.S. CITIZENS AND RESIDENT ALIENS WORKING ABROAD

E.

U.S. CITIZENS WORKING IN U.S. POSSESSIONS

F. CITIZENS OF U.S. POSSESSIONS AND TERRITORIES

1.

American Samoa

2.

Guam

3.

Northern Mariana Islands

4.

Puerto Rico

5.

Virgin Islands

G. NONRESIDENT ALIENS PERFORMING SERVICES OUTSIDE THE U.S.

H. EXEMPTION UNDER A TAX TREATY

7.

1.

Form W-9 – Request for Taxpayer Identification Number

2.

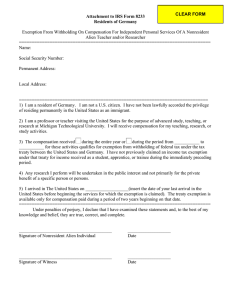

Form 8233 – Exemption From Withholding on Compensation…

3.

Form W-8BEN – Certificate of Foreign Status of Beneficial Owner…

WITHHOLDING TAX RATES

A. WAGES PAID TO EMPLOYEES – GRADUATED WITHHOLDING

1.

Special Instructions for Form W-4

2.

Special Rules for Residents of Certain Countries

B. STUDENTS/FELLOWS RECEIVING COMPENSATION

C. SCHOLARSHIP AND FELLOWSHIP GRANTS – REDUCED WITHHOLING

D. INDEPENDENT CONTRACTORS

E. ROYALTIES

F. PRIZES, AWARDS, OR OTHER GRANTS

8.

TAXPAYER IDENTIFICATION NUMBERS

A. SOCIAL SECURITY NUMBER

B. INDIVIDUAL TAXPAYER IDENTIFICATION NUMBER

C. EMPLOYER ASSIGNED IDENTIFICATION NUMBER (TEMPORARY)

REVISED: JANUARY 2005

SECTION 1

PAGE 3 OF 6

TAXATION/RECONCILIATIONS

9.

NRA TABLE OF CONTENTS

TAX TREATY BENEFITS

A. ELIGIBILITY FOR TREATY BENEFITS

1.

Residency

2.

Primary Purpose

3.

Type of Income

4.

Length of Stay

5.

Other Specific Qualifications

B. EMPLOYEE COMPENSATION

1.

Income Code 17 – Dependent Personal Services

2.

Income Code 19 – Students and Trainees

3.

Income Code 18 – Teachers and Researchers

C. SCHOLARSHIP AND FELLOWSHIP RECIPIENTS (Income Code 15)

D. INDEPENDENT CONTRACTORS (Income Code 16)

E. OTHER TAX TREATY ISSUES

1.

U.S - U.S.S.R. Tax Treaty Applications

2. U.S. - U.S.S.R. Exemption for Students

3.

Students and Researchers – Kazakhstan, Russia and Ukraine Tax Treaties

4.

India Tax Treaty Student Provisions

5.

Hungary, Barbados, and Jamaica – Special Provisions

F. FORMS REQUIRED FOR INCOME TREATY EXEMPTION

1.

Form W-9 – Request for Taxpayer Identification Number and Certification

2. Form 8233 – Exemption From Withholding on Compensation…

3. Form W-8BEN – Certificate of Foreign Status of Beneficial Owner…

G. INDIVIDUALS WITHOUT SSN OR ITIN

H. TECHNICAL EXPLANATIONS

10. FICA TAX EXEMPTIONS

A. IRC 3121(b)(19) – F, J, M, AND Q VISA STATUS EXEMPTION

B. IRC 3121(b)(10) – STUDENT FICA EXEMPTION

REVISED: JANUARY 2005

SECTION 1

PAGE 4 OF 6

TAXATION/RECONCILIATIONS

NRA TABLE OF CONTENTS

1.

School, College, or University

2.

Student Status Standard – General Rule

C. APPLICATION OF TAX TREATIES TO FICA WITHHOLDING

D.

SOCIAL SECURITY “TOTALIZATION” AGREEMENTS

E.

NONRESIDENT ALIEN FICA REFUND REQUESTS

11. FEDERAL TAX REPORTING

12. PAYMENTS FROM LOCAL FUNDS

13. TAX PAID BY EMPLOYER

14. NRA PAYMENT PROCESSING PROCEDURES

A. EMPLOYEES

B.

1.

Canada, Mexico, and U.S. Nationals

2.

India

3.

Japan and Korea

INDEPENDENT CONTRACTORS

1.

Foreign Source Payments Object Codes and Documentation

2.

Payments Exempt Under a Tax Treaty Object Codes and Documentation

3. Taxable Payments Object Codes and Documentation

C. SCHOLARSHIP AND FELLOWSHIP GRANTS

1.

Cash Payments – F001 Payroll Requisition File

2.

Cash Payments – Per Diem Under The Mutual Security Act of 1954

3.

Cash Payments – Paid Through the Voucher Audit System

4.

Non-Cash Payments

D. ROYALTY PAYMENTS

E.

PRIZES AND AWARDS

15. VIEW PAYROLL SYSTEM – EMPLOYEE EXCLUDED INFORMATION

16. TAX TREATY ARTICLES

A. TAX TREATY OVERVIEW

REVISED: JANUARY 2005

SECTION 1

PAGE 5 OF 6

TAXATION/RECONCILIATIONS

NRA TABLE OF CONTENTS

B. RESEARCHING TAX TREATIES

1. IRS Publication 901, U.S. Tax Treaties

2. IRS - Income Tax Treaties

3. Other Links – Treaty Information

17. RESOURCES

A. TELEPHONE CONTACTS

B.

LINKS

C.

FORMS AND PUBLICATIONS

D.

GLOSSARY

REVISED: JANUARY 2005

SECTION 1

PAGE 6 OF 6

TAXATION RECONCILIATION

NRA OVERVIEW

OVERVIEW

This overview is to provide a quick and basic guideline for handling nonresident alien payments in a

step-by-step format. The information in this overview is not all inclusive of every detail involved in the

process; however, the NRA Handbook is divided into sections that offer more extensive details on

processing payments to nonresident aliens. Please refer to the Table of Contents to locate sections that

contain more in depth information on each subject if further clarification and explanation is needed.

Also note that Immigration tax laws are subject to change, so it is important to refer to other sources,

such as those listed in the Resource section of this handbook, to stay informed to ensure proper

processing and compliance.

This overview will provide the steps for determining, verification of work authorization, residency

status, type of payment being made, source of income, whether or not the payment is subject to

withholding tax, as well as FICA tax, and lastly tax reporting.

A. Step One – Verification of Work Authorization

1. It is prohibited by federal law to knowingly hire or continue employing any foreign national that

is not authorized to work in the U.S. The Immigration Reform and Control Act is the authority

that requires employers verify not only employment eligibility, but also the identity, of all

employees hired to work in the U.S. This is accomplished by requiring employers complete a

Form I-9, Employment Eligibility Verification.

a. I-9’s are not filed with the U.S. Government.

b. I-9’s are to be retained by the employers for 3 years after date of hire, or 1 year after

termination, which ever is later.

2. Citizens and nationals of the U.S. have to prove to the employers that they have work eligibility.

3. Form I-9 is not required to be completed for independent contractors, but proof of work

authorization is required. Independent contractors also need to furnish their correct taxpayer

identification number. Forms that should be completed include:

a. DFS-A3-53, State of Florida, Chief Financial Officer, Taxpayer Identification Number

Request

b. IRS Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States

Tax Withholding\

c. Foreign National Information Form

4. References

a. U.S. Citizenship and Immigration Services: http://uscis.gov/graphics/howdoi/EEV.htm

b. Social Security Administration: http://www.ssa.gov/employer/hiring.htm

c. NRA Handbook Section 3, Verification of Work Authorization

d. Handbook for Employers by USCIS Booklet M-274

e. USCIS Office of Business Liaison, whose purpose is to:

i.

Educate U.S. public on immigration related employment, investment, and school

issues.

ii.

Provide information of the employment eligibility verification process

iii. Provide information on opportunities available to employers to hire and/or

sponsor foreign workers in accordance with U.S. Government

iv.

Internet web address:

http://uscis.gov/graphics/services/employerinfo/oblhome.htm

FEBRUARY 2006

SECTION 2

PAGE 1 of 10

TAXATION RECONCILIATION

NRA OVERVIEW

B. Step Two – Determination of Tax Status

1. It is important to note that the definition of nonresident alien for tax purposes differ from that for

immigration purposes. The special rules to determine whether or not an individual is a

nonresident alien for tax purposes are included in SECTION 4 of this handbook.

a. Alien: An individual who is not a U.S. national or U.S. citizen.

b. U.S. National: An individual who owes his sole allegiance to the U.S., including all U.S.

citizens, and including some individuals who are not U.S. citizens.

2.

Tax Concepts of Residency under U.S. Immigration Laws

a. Immigrants: A foreign-born person who has been approved for lawful permanent

residence in the U.S. Immigrants have permanent, unrestricted eligibility for

employment authorization.

b. Nonimmigrant: An alien who seeks temporary entry to the U.S. for a specific purpose.

A nonimmigrant status may or may not permit employment.

c. Illegal aliens: Undocumented Alien. Person present in the U.S. in violation of the

immigration laws, and subject to deportation by the DBTS (Directorate of Border and

Transportation Security).

3. Tax Concepts of Residency under U.S. Tax Laws. There are four categories of individuals.

a. U.S. Citizen: An individual born in the United States; An individual whose parent is a

U.S. citizen; A former alien who has been naturalized as an U.S. citizen; An individual

born in Puerto Rico; An individual born in Guam.

b. Permanent resident alien (immigrant): An alien admitted to the U.S. as a lawful

permanent resident. A green card holder.

c. Resident Alien: An immigrant to the U.S., or nonimmigrant who meets certain residency

requirements or makes a special election to be taxed as a resident.

d. Nonresident Alien: For federal income tax purposes, a person in considered a

nonresident if they are not a U.S. citizen and they do not meet the test to be considered a

resident alien.

4. Appropriate Forms to have completed: If an individual is not a U.S. citizen or permanent

resident alien, the withholding agency should have the individual complete a standard

information form, and submit needed documentation for verification.

a. Foreign National Information Form is available in SECTION 17 (FORMS).

b. Form I-94: Departure Record

c. DS-2019: Certificate of Eligibility for Exchange Visitor Status (formerly IAP-66)

d. and/or I-20: Certificate of Eligibility for Nonimmigrant (F-1) Student Status

5. There are two tests for determining whether a non-U.S. citizen should be treated as a U.S.

resident for tax purposes. If an individual satisfies or passes either test, he is a U.S. resident for

tax purposes; if he satisfies neither test, he is taxed as a nonresident alien.

FEBRUARY 2006

SECTION 2

PAGE 2 of 10

TAXATION RECONCILIATION

NRA OVERVIEW

a. Green Card Test: Individual will pass if he or she has been granted lawful permanent

resident status, and he or she has been issued or will receive an alien registration card by

the U.S. Citizenship and Immigration Services.

b. Substantial Presence Test: This test is a calculation of all the days an individual has been

physically present in the U.S. over a period of 3 years. To meet the substantial presence

test, and be considered a resident alien for tax purposes, and alien must at least:

i. Be physically present for 31 days in the current year, and

ii. Be physically present for 183 days during the 3-year period consisting of the

current year and 2 immediate prior years. The 183 days are calculated as follows:

All days of presence in the current year;

1/3 of days of presence in the year immediately before the current year; and

1/6 of days of presence in the year before that

c. There are certain individuals that may be exempt from the substantial presence test. The

time spent in exempt status does not count toward the 183 days in the U.S. that normally

will convert a nonresident alien into a resident alien. The two categories to be concerned

with at this time that will temporarily exempt a person from the substantial presence test

are:

i. Students: Anyone who is temporarily in the U.S. on an “F”, “J”, “M”, or “Q” visa

and substantially complies with the requirements of that visa. A person is

considered to be substantially complying if he has not engaged in activities

prohibited by the immigration law. Students are exempt from the substantial

presence test for 5 years.

ii. Teachers, Trainers, Researchers: A non-student in the U.S. on a “J”, or “Q” visa

and substantially complies with the requirements of that visa. A person is

considered to be substantially complying if he has not engaged in activities

prohibited by the immigration law. These individuals are exempt from the

substantial presence test only if they have been in the U.S. no more than 2 out of

the last 6 years.

iii. Closer Connection Exception: When an alien passes the substantial presence test,

they may still be classified as a nonresident alien for tax purposes if they can

show a closer connection to a foreign tax home than to the U.S.

iv. Dual Resident Status: When an alien is a nonresident and resident alien within the

same year, usually resulting from their status changing during their stay in the

U.S.

6. References:

a. IRS Publication 519, U.S. Tax Guide for Aliens

b. IRS Publication 678-FS, Foreign Students and Scholars Text

c. IRS Publication 15-A, Employer’s Supplemental Tax Guide

d. NRA Handbook Section 4, NRA Determination of Tax Status

FEBRUARY 2006

SECTION 2

PAGE 3 of 10

TAXATION RECONCILIATION

NRA OVERVIEW

C. Step Three – Employee, Independent Contractor, or Scholarship Payment

1. It is important to determine the classification between worker and employer. The worker may be

classified as either an employee or and independent contractor based on certain control factors

and a “common law test”. For purposes of making payments to nonresident aliens, there may be

employee payments, such as wages; scholarship, fellowship, or grant payments; or nonresident

alien independent contractor payments. All nonresident alien employees, independent

contractors, and scholarship recipients must be identified.

2. Employees: If the employer has the right to control what work will be done and how that work

will be done, then and employer-employee relationship exist and the worker is a common law

employee.

a. The aliens must be divided into two groups “Resident Aliens” and “Nonresident Aliens”

as defined by Internal Revenue Code 7701(b), or by a tax treaty.

b. For withholding tax purposes, treat resident aliens the same as U.S. citizens.

c. For withholding tax purposes, treat nonresident aliens according to the special

withholding rules that apply to nonresidents.

d. Nonresident aliens who refuse to file a proper W-4 as required by IRS regulations shall

have federal income taxes withheld at the rates pertaining to single status, zero

exemptions allowed.

e. Some nonresident aliens are eligible for exemptions from federal income tax withholding

because of tax treaties if they file IRS Form 8233 accompanied by the required

statement.

f. The Bureau of State Payrolls reports wages paid to nonresident aliens, which are exempt

under a tax treaty on forms 1042-S. Any additional wages paid to a nonresident alien

over and above the exempt amount are reported on form W-2.

3. Nonresident Alien Independent Contractor

a. Amounts paid to nonresident aliens who temporarily visit the campus for the purpose of

giving lectures, giving live performances, doing research, and performing other services,

on a short-term, contract basis, or royalties paid to nonresident aliens, are reportable on

Form 1042-S, and are subject to withholding of federal income tax at the rate of 30%.

b. Any nonresident aliens who claims that all or part of their compensation for personal

services is exempt from taxation under a tax treaty should file IRS Form 8233, which is

valid for one calendar year.

c. Any nonresident alien who claims that all or part of the royalties paid to them are exempt

from taxation because of tax treaty should file IRS Form W-8BEN.

4. Scholarship, Fellowship, and Grant Recipients

a. The payment of a qualified scholarship to a nonresident alien is not reportable and is not

taxable. However, the portion of a scholarship or fellowship paid to a nonresident alien

which does not constitute a qualified scholarship is reportable on Form 1042-S and

subject to NRA withholding. If the grant is from sources outside the United States, the

grant is neither reportable not subject to withholding

FEBRUARY 2006

SECTION 2

PAGE 4 of 10

TAXATION RECONCILIATION

NRA OVERVIEW

b. Payees who are temporarily present in the U.S. holding F-1, J-1, M-1, or Q-1 visas are

subject to withholding at 14% of the taxable portion of the grant. These individuals are

considered to be engaged in a U.S. trade or business.

c. Some nonresident aliens are eligible for exemptions from federal income tax withholding

because of tax treaties if they file IRS Form W-8BEN.

d. In general, those portions of a scholarship, fellowship, or grant that are used to pay

tuition, fees, books, supplies, or required equipment are not taxable under IRC 117 if the

recipient is a candidate for a degree. Any portion of the scholarship, fellowship, or grant

over and above the five items mentioned above is taxable. For non-degree candidates the

entire grant is taxable.

e. Stipends, tuition waivers, or other financial aid paid to or on behalf of nonresident aliens,

which require the recipient perform services in exchange for the financial aid are taxable

as wages, reportable to the IRS.

5. References:

a. IRS Publication 678-FS, Foreign Students and Scholars Text

b. Internal Revenue Code 7701(b)

c. Internal Revenue Code 117

d. Section 12, Nonresident Alien Payment Processing Procedures

e. IRS Form 8233

f. IRS Form W-8BEN

D. Step Four – Determination of the Type of Payment Being Made

1. Compensation: Any payment that is made in consideration of a past, present, or future activity.

a. Dependent: wages, salary

b. Independent – consulting fees, speaker’s fees, payments made to independent contractors,

honoraria.

2. Scholarship or Fellowship Grant

a. Scholarship defined by IRC Section 117: an amount paid or allowed to, or for the benefit

of a student, whether an undergraduate or graduate, to aid such individual in pursuing his

studies.

b. Fellowship defined by IRC Section 117: an amount paid or allowed to, or for the benefit

of, an individual to aid him in pursuit of study or research.

c. Qualified Scholarship: amount paid as a scholarship grant, but only to the extent that it is

used for either tuition and fees required for enrollment or attendance at the education

institution or fees, books, supplies and equipment required for course of instruction at the

education institution.

d. Non-Qualified Scholarship: Amounts paid as a scholarship grant for the expenses such

as room, board, travel, and clerical help – as well as equipment and other expenses not

required wither for enrollment or attendance at that educational institution.

e. General Rule: A scholarship or fellowship grant will be treated as compensatory if it is

paid in consideration of past, present, or future services.

FEBRUARY 2006

SECTION 2

PAGE 5 of 10

TAXATION RECONCILIATION

NRA OVERVIEW

E. Step Five – Determination of Source of Income Paid to the Alien

1. The general rule of income taxation is that income is taxable where the economic activity occurs.

U.S. tax law classifies all types of income as either U.S. source or foreign source.

a. To see the “TEN RULES OF U.S. TAXATION” by Paula N. Singer, Esq., or Windstar

Technologies, Inc., click on: http://www.windstartech.com/public/article/10_Rules.htm

b. Here is a chart that will assist with U.S. Sourcing Rules:

Location of Payor

Compensation

Dependent or

Independent Services

Scholarship/Fellowship

(Non-Service)

Location or Activity

Location or Activity

U.S.

Outside U.S.

U.S.

U.S. Source Income

Foreign Source Income

Outside U.S.

U.S.

U.S. Source Income

U.S. Source Income

Foreign Source Income

Foreign Source Income

Outside U.S.

Foreign Source Income

Foreign Source Income

2. U.S. tax law classifies all types of income as either U.S. source or foreign source.

a. Foreign source: Not subject to U.S. tax

b. U.S. source: Potentially subject to U.S. tax. It is only potentially subject to tax because

such income, although U.S. source, may not ultimately be taxable due to an exclusion

contained either in the Internal Revenue Code or an income tax treaty.

F. Step Six – Reduced or Exempt Income

1. Now it is time to decide if the payment is subject to tax withholding, and if so at what rate. The

general rule is that all income paid to a nonresident alien or to a third party on his or her behalf is

taxable unless otherwise excluded. There are three ways to exclude income:

a. Foreign source

b. Internal Revenue Code

c. Income Tax Treaty

2. Foreign source payments

a. All foreign source payments made to nonresident aliens are not subject to IRS

withholding and reporting requirements.

b. These payments do not have to be reviewed by BOSP.

3. Internal Revenue Code Section 117 exclusion.

a. A student who is a candidate for a degree may be able to exclude from income some or

all amount received under a qualified scholarship.

4. Description of applicable tax treaties on major income codes. Many countries have tax treaties

with the U.S. that allow their residents to earn some money while temporarily in the U.S. without

being subject to income tax on those earnings in both countries. Each type of income that an

alien can earn is identified by a numeric code. These codes assist with determining the treaty

benefit.

FEBRUARY 2006

SECTION 2

PAGE 6 of 10

TAXATION RECONCILIATION

NRA OVERVIEW

a. The codes that may be most useful are income codes 15, 16, 18, and 19

i. Income code 15: Scholarship and Fellowship Grants

Nonqualified Fellowships/Scholarships

Qualified Fellowships/Scholarships

Money received on condition that the recipient performs services such as

teaching or research. This money is treated as wages and is considered code

18 or 19 income

ii. Income code 16: Independent Contractors

Students and scholars sometimes try to make use of the treaty benefits for

independent personal service income. This is an incorrect interpretation of

the treaties. Treaties often do not permit students and scholars to earn those

types of income. The USCIS does not usually allow a student to engage in

independent personal services in the U.S.

iii. Income code 18: Compensation for Teaching and Researching

Pay of professors and teachers may be exempt form U.S income taxes for

wither 2 or 3 years if they are temporarily in the U.S. to teach or do research.

The treaty exemption for teaching or research income is counted from the

day of arrival in the U.S.

NOTE: Germany, India, Netherlands, Thailand, and the United Kingdom

have retroactive treaty clauses, stating that if the maximum years of presence

are exceeded, the entire treaty benefit is lost. This could require the teacher

to file amended returns and pay tax on past years. Therefore, a taxpayer who

expects to stay more than the limit on years of presence should avoid

claiming the treaty benefit for any years.

iv. Income code 19: Compensation During Studying and Training

Students and trainees from many countries are allowed to earn some money

tax-free in the U.S. The amounts vary from country to country.

Immigration restrictions usually bar students from working off-campus

during their first year in the U.S. Even after that year special USCIS

permission is needed to work off-campus. Majority of students earn money

from the university or college they attend.

Sometimes students earn more wages than their benefit. If that happens, the

excess must be reported on their tax return. In this case, this type of excess

earnings is reported as W-2 gross and is taxed.

b. The tax treaty limits for the income codes listed above are available in the IRS

publication 901. By using the tables provided in this publication, it is easy to research

the tax treaties for the different countries. However, if the country is not listed in the

table at all, then there are not treaty benefits for that specific country. IRS Publications

that specifically address tax treaties are:

i. IRS Publication 515: Withholding of Tax on Nonresident Aliens and Foreign

Entities

FEBRUARY 2006

SECTION 2

PAGE 7 of 10

TAXATION RECONCILIATION

ii. IRS Publication 901: U.S. Tax Treaties

iii. IRS Publication 678 – FS: Foreign Student and Scholar Text

NRA OVERVIEW

c. Forms to be completed by an NRA Independent Contractor claiming tax treaty

exemption.

i. Foreign National Information Form

ii. IRS Form 8233: Exemption from Withholding on Compensation for Independent

Personal Services of a Nonresident Alien Individual

iii. IRS Form W-8BEN: Certificate of Foreign Status of Beneficial Owner for United

States Tax Withholding

iv. Copy of the Form I-94: Arrival and Departure Record

v. Copy of contractor’s U.S. visa from passport

vi. Copy of DS-2019: Certificate of Eligibility for Exchange Visitor Status (formerly

IAP-66)

d. Forms to be completed by an NRA Fellowship/Scholarship recipients claiming tax treaty

exemption.

i. Foreign National Information Form

ii. Copy of SSN/ITIN

iii. W-8BEN: Certificate of Foreign Status of Beneficial Owner for United States Tax

Withholding

iv. Copy of the Form I-94: Arrival and Departure Record

v. Copy of scholarship recipient’s U.S. visa from passport

5. Withholding Rates when there is no exemption

a. Wages/Salaries/Tips

i. Wages are generally subject to tax withholding by the employer unless they are

claiming a tax treaty.

ii. International students and scholars can claim a personal exemption, but they cannot

normally use the standard deduction or take exemptions for dependents.

iii. India is the only country whose international students are allowed to use the standard

deduction in the U.S.

iv. Upon being hired, an employee files Form W-4 to advise the employer of the

employee’s status for withholding.

Check “Single” box even if married

Claim only 1 withholding allowance (Unless NRA is from Canada, Mexico,

Japan, South Korea, or India)

Additional withholding tax amounts for Biweekly paid employees $15.30

Additional withholding tax amounts for Monthly paid employees $33.10

b. Independent Contractors

i. Withholding taxes rate for nonresident alien independent contractor is 30%

c. Scholarship/Fellowship

i. Withholding taxes rate for NRA fellowship scholarship is 14%

FEBRUARY 2006

SECTION 2

PAGE 8 of 10

TAXATION RECONCILIATION

NRA OVERVIEW

G. Step Seven – Determination if Income is Subject to FICA taxes

1. A separate set of rules applies to determine if a nonresident alien individual is subject to FICA

taxes. Exemption from Social Security and Medicare taxes applies only to the following who are

temporarily present in the U.S. in F-1, J-1, M-1, or Q-1 nonimmigrant status:

a. Students

b. Scholars

c. Teachers

d. Researcher

e. Trainees

2. Foreign students in F-1, J-1, M-1, or Q-1 nonimmigrant status who have been in the U.S. over 5

years and foreign scholars, teachers, researchers, and trainees are considered resident aliens.

Therefore, they must pay Social Security and Medicare Taxes.

3. Non-students in J-1 or Q-1 nonimmigrant status who have been in the U.S. over 2 years are

considered resident aliens. Therefore, they must pay Social Security and Medicare taxes.

4. Spouses and dependents or alien student, scholars, trainees, teacher, or researchers, temporarily

in the U.S. are not exempt for Social Security and Medicare taxes.

5. Alien students, scholars, trainees, teachers, or researchers in F-1, J-1, M-1, or Q-1 nonimmigrant

status who change to a nonimmigrant status other than F-1, J-1, M-1, or Q-1 will become liable

to pay Social Security and Medicare taxes, in most cases, on the day they change status.

6. Teachers, trainees, and researchers in H1-B status are liable for Social Security and Medicare

taxes from the first day of the U.S. employment regardless of whether they are non-resident or

resident aliens, and whether or not their wages may be exempt form federal income tax under an

income tax treaty.

7. Refunds for nonresident alien employees that had FICA contributions erroneously withheld may

be requested from BOSP using form DFS-A3-NRA-Refund, Nonresident Alien FICA Refund

Request Form

H. Step Eight – Federal Tax Reporting

1. Forms for reporting income paid to nonresident aliens

a. 1042-S : The Bureau of State Payrolls Reports on IRS Form 1042-S, Foreign Person’s

U.S. Source Income Subject to Withholding, amounts qualified and nonqualified

fellowships, independent contractor payments and compensation paid to a nonresident

alien employee under a tax treaty exemption.

b. W-2: All other employee compensation is reported on Form W-2.

c. 1042-S and W-2: Nonresident alien individuals may receive a Form W-2 as was as Form

1042-S if they claim the benefits of a tax treaty, but their income exceeds the maximum

dollar limit or time limit of the treaty.

2. Authority that requires institutions to withhold and report income paid to nonresident aliens

a. Section 1441 of the Internal Revenue Code states that a withholding agent is required to

withhold federal income tax from all income payments made to or on behalf of

nonresident alien.

b. Treasury Regulation Sec. 1.1461-2 requires that all such payments be reported to the IRS

FEBRUARY 2006

SECTION 2

PAGE 9 of 10

TAXATION RECONCILIATION

NRA OVERVIEW

3. Nonresident Aliens Paid from Local Fund

a. Universities and agencies that pay nonresident aliens through their local funds are

responsible for withholding the required amount of tax, and reporting these transactions to

the Internal Revenue Service. The university or agency must use their own federal

identification number for this purpose.

b. Payments and reporting should be made in accordance with applicable sections of the

Internal Revenue Code, Treasury Regulations, and Immigration Law. Documentation

supporting these payments should be retained by the university and should be available to

the Department of Financial Services upon request for audit purposes.

4. Federal Income Tax Withholding Paid by Employer

a. When an agency or university elects to pay the individual’s tax liability (assuming that the

agency or university has a discretionary fund for this purpose) under U.S. tax law, the

payment constitutes addition income to that individual and the “tax on tax” problem

occurs. The fact that an agency/university may not be able to withhold tax from a

particular payment does not alleviate the agency’s/university’s responsibility to withhold

or the liability for the tax required to be withheld.

b. Example: If a university pays a nonresident alien independent contractor $1000 for giving

a lecture, it must withhold 30% of that amount, or $300. However, if the university has

discretionary funds available and elects to pay the IRS on behalf of the individual, the

amount may be “grossed up.” Then $300 withholding would constitute addition income

to the nonresident alien and is therefore subject to addition taxation. Consequently, the

university must pay addition withholding to the IRS. This “grossed-up” amount is

calculated as follows:

$1000/[1-(.30)] = $1,428.57

Total withholding remitted to the IRS would be $428.57.

Net amount is $1000.

c. Formula: Net Amount/[1-(tax rate)] = Gross amount to be paid

FEBRUARY 2006

SECTION 2

PAGE 10 of 10

TAXATION/RECONCILIATION

NRA WORK AUTHORIZATION VERIFICATION

WORK AUTHORIZATION VERIFICATION

A. EMPLOYEES

Federal law prohibits employers from knowingly hiring or continuing to employ any foreign national

not authorized to work in the United States. The 1986 Immigration Reform and Control Act made

all U.S. employers responsible for verifying the employment eligibility and identity of all employees

hired to work in the United States after November 6, 1986. To implement the law, employers are

required to complete Form I-9, Employment Eligibility Verification for all employees,

including U.S. citizens. There are civil penalties for violation of the prohibitions on hiring

unauthorized aliens. There are also criminal penalties for “patterns of practice” violations.

1. Form I-9 Employment Eligibility Verification

Form I-9, included in SECTION 17 (Forms), has two parts that must be completed. The first

part is to be completed by the employee at the time of hire and reviewed by the employer to

ensure it is completed correctly. The second part is to be completed by the employer after he/she

has reviewed and verified the employee's identity and work authorization documents.

An employer’s obligation to review Form I-9 documents is not triggered until a person has been

hired, whereupon the new employee is entitled to submit a document or combination of

documents of his choice (from List A or a combination of List B and C documents on the reverse

side of Form I-9) to verify his identity and work eligibility. The employee must complete

Section 1 by the date of hire (i.e., no later than the date on which employment starts).

2. Changes Since 11/91

The current versions of Form I-9 and the Handbook for Employers (Form M-274) are dated

11/21/91. Both documents are undergoing revision to reflect changes in U.S. immigration law

since they were issued, but the publication date has not been established. The proposed changes

and Form I-9 published in 1998 are not currently in effect.

The following changes are not reflected on the current 1991 version of Form I-9 or Form M274 since the changes occurred after 1991.

•

Form I-151 has been withdrawn from circulation and is no longer a valid List A

document.

•

Form I-766 was introduced in January 1997 as an Employment Authorization Document

(EAD). It should be recorded on the Form I-9 under List A. A previous version of the

EAD is Form I-688B, which continues to be an acceptable List A document.

•

Form I-551, the Permanent Resident Card (new version of Form I-551) was introduced in

1990 as documentation issued to lawful permanent residents of the U.S. Older versions

of Form I-551 remain valid until expiration, if any. Form I-551 should be recorded on

the Form I-9 under List A.

REVISED: FEBRUARY 2006

SECTION 3

PAGE 1 OF15

TAXATION/RECONCILIATION

NRA WORK AUTHORIZATION VERIFICATION

Effective September 30, 1997 via interim rule published at 61 Fed. Reg. 51001-51006, the

following documents were removed from the list of acceptable identity and work authorization

documents (listed on the 11/91 version of Form I-9) to comply with the Illegal Immigration

Reform and Alien Responsibility of 1996 (IIRIRA):

• Certificate of U.S. Citizenship (List A #2)

• Certificate of Naturalization (List A #3)

• Unexpired Reentry Permit (List A #8)

• Unexpired Refugee Travel Document (List A #9)

In addition, the acceptability of an unexpired foreign passport with Form I-94 indicating

unexpired work authorization (List A #4) was made more limiting. Such combination of

documents is only acceptable where the individual is employment authorized incident to status

for a specific employer.

An interim rule (8 CFR Part 274A) was published in the Federal Register on September 30,

1997, designating documents acceptable for the employment eligibility verification (Form I-9)

process. The rule, which took effect immediately, affects only the list of documents that

employees may present to establish both identity and eligibility to work ("List A") and the

"receipt rule.” The rule makes no changes to List B or List C. Its goal is to maintain the status

quo to the extent permitted under the new law until the Service has completed a more extensive

document reduction effort. Employers should continue to use the existing Form I-9 (11/21/91

version) under the interim rule. The interim rule is available at the U.S. Immigration and

Naturalization Service (USCIS) web site, http://uscis.gov/graphics/lawsregs/8cfr.htm.

The USCIS will withhold enforcement of civil penalties associated with these changes until a

final rule is in place. Employers will not be penalized if, while the interim rule is in effect, they

mistakenly accept documents that were previously acceptable but were deleted from the list

other enforcement activities will continue. Once the reduction of the number of documents to be

used to verify the USCIS finalizes work eligibility, an entire new handbook will be available.

The USCIS will be publishing its final rule on their web site as soon as it is approved.

3. Receipt Rule

The employer must personally review original document(s) that demonstrate an employee’s

identity and eligibility to work in the U.S. Only original documents (not necessarily the first

document of its kind ever issued to the employee, but an actual document issued by the issuing

authority) are satisfactory, with the single exception of a certified copy of a birth certificate.

Originally effective September 30, 1997, amended by interim rule of February 9, 1999; the rule

explaining when receipts may be used in lieu of original documents in the I-9 process (receipt

rule) now provides that:

•

If an individual’s document has been lost, stolen, or damaged, then he/she can present a

receipt for the application for a replacement document. The replacement document needs

to be presented to the employer within 90 days of hire, or in the case of reverification, the

date the employment authorization expires.

REVISED: FEBRUARY 2006

SECTION 3

PAGE 2 OF15

TAXATION/RECONCILIATION

NRA WORK AUTHORIZATION VERIFICATION

•

If the individual presents as a receipt, the arrival portion of the Form I-94 containing an

unexpired temporary I-551 stamp (indicating temporary evidence of permanent resident

status) and photograph of the individual, such document satisfies the I-9 documentation

presentation requirement until the expiration date on the Form I-94. If no expiration date

is indicated, an employer may accept the receipt for one year from the issue of the Form

I-94.

•

Form I-94 with refugee admission stamp is acceptable as a receipt for 90 days, within

which time the employee must present an unrestricted Social Security card together with

a List B identity document, or an Employment Authorization Document (EAD) Form I688B or I-766.

The receipt rule stated in the Form I-9 instructions and the Handbook for Employers (Form M274) is not the current rule. See Employer Information Bulletin 102 or 107 at

http://www.uscis.gov/index.htm.

4. Information Verification

Employers must ensure that Section 1 (Form I-9) is completed by the employee upon date of

hire (i.e., 1st day of paid work). The signature and attestation under penalty of perjury portions

of Section 1 are very important, and employers should take special care to ensure that employees

complete these in full.

•

Note: An employee’s signature and attestation of status under penalty of perjury are

particularly important. If a given employee refuses to provide his/her signature or

attestation, there is no reason for the employer to proceed to complete Section 2, and the

employer should not continue to employ the individual.

•

Note: An employee may not be able to provide a social security number if the Social

Security Administration has not yet issued the individual a social security card.

Therefore, an employer cannot require an employee to complete it. Advise the workers

that they are required to apply for a Social Security number and card. If a worker applied

for but has not yet received a SSN, you should get the following information as complete

as possible: The workers full name, address, date of birth, father’s full name, mother full

maiden name, gender, and date he or she applied for a Social Security number.

5. Work Authorization

Form I-94 is for used for most individuals that enter the country on a nonimmigrant status. A

student should have a Form I-20 Student ID in addition to the I-94 endorsed with employment

authorization by the Designated School Official for off campus employment or curricular

practical training. USCIS will issue Form I-688B (Employment Authorization Document) to all

students (F-1 and M-1) authorized for post-completion practical training periods.

Nonimmigrant exchange visitors (J-1) must have an I-94 accompanied by an unexpired DS-2019

(formerly IAP-66), specifying the sponsor and issued by the United States Information Agency

(USIA). J-1 students working outside the program indicated on the DS-2019 also need a letter

from their responsible school officer.

REVISED: FEBRUARY 2006

SECTION 3

PAGE 3 OF15

TAXATION/RECONCILIATION

NRA WORK AUTHORIZATION VERIFICATION

Information concerning employer and employee responsibilities is available at the United States

Citizenship and Immigration Services, Office of Business Liaison, telephone 1-800-357-2099;

and internet address http://www.uscis.gov/index.htm.

B. INDEPENDENT CONTRACTORS

Although independent contractors are exempt from the Form I-9 employment eligibility verification

process, a newly hired worker’s self-declaration as an independent contractor is not sufficient in

itself to waive the requirement for completing and retaining a Form I-9. The U.S. Citizenship and

Immigration Services (USCIS) interprets the guidelines for distinguishing independent contractors

from employees more strictly than does the IRS. That is, an independent contractor for federal tax

purposes may be considered an employee for employment eligibility verification purposes.

To determine whether a worker is an independent contractor or an employee under common law,

you must examine the relationship between the worker and the business. In general, someone who

performs services for you is your employee if you can control what will be done and how it will be

done.

1. Employee or Independent Contractor

Most of the problems employers have in regard to worker classification arise when determining

whether a worker is an employee or independent contractor. Because misclassification of

workers as independent contractors rather than employees has led to substantial losses for the

federal government and the failure to properly credit earnings for social security and

unemployment benefit purposes, the IRS has focused more resources on payroll tax audits for

worker misclassification.

While there is no uniform definition of an employee under all payroll laws, most workers can be

classified as either employees or independent contractors once the “common law test” has been

applied. The IRS, for example, relies on the common law test in making worker status

determinations for the purpose of federal income tax withholding and the withholding of

employment (social security, Medicare, and federal unemployment) taxes.

Right to control is the key. Under the common law test, if the employer has the right to control

what work will be done and how that work will be done, then an employer-employee

relationship exists and the worker is a common law employee. This is true regardless of whether

or not the employer actually exercises the right on a regular basis. However, if an individual is

subject to the control and direction of another only as to the results to be accomplished, and not

as to the details by which those results are accomplished, the individual would not be an

employee under the common law test. It makes no difference what the worker is called by the

employer. An “agent” or “contractor” is still an employee if the employer controls the work to

be done.

IRS looks to identify key control factors. The IRS has sought to streamline the process for

determining whether a worker is an employee or independent contractor by identifying those

REVISED: FEBRUARY 2006

SECTION 3

PAGE 4 OF15

TAXATION/RECONCILIATION

NRA WORK AUTHORIZATION VERIFICATION

factors that most clearly indicate the degree of control or independence in the relationship of the

worker and the business. Evidence of the degree of control and independence can be grouped

into three general types or categories: behavioral control, financial control, and the type of

relationship between the parties.

•

Behavioral Control.

a. Level of instructions the business gives the worker.

b. Level of training provided to the worker.

•

Financial Control.

a. Whether worker has un-reimbursed business expenses.

b. Whether the worker has a substantial investment in the work.

c. Whether the worker’s services are available to the public.

d. How the worker is paid.

e. Whether the worker can realize a profit or incur a loss.

Relationship

a. Type of (see Section 17 – Resources).

b. Whether employee-type benefits are provided.

c. The term of the relationship.

d. Whether the worker’s services are in important aspect of the business’s regular

operations.

•

IRS Publication 15-A, Employer's Supplemental Tax Guide contains useful information to use

in making a determination of whether the worker is an employee or an independent contractor.

An employer can get a definitive ruling from the IRS as to a newly hired worker’s status as an

employee or independent contractor by completing Form SS-8, Determination of Worker Status

for Purposes of Federal Employment Taxes and Income Tax Withholding. Call 1-800-829-3676

to order a copy of the form or go to the IRS Web site at www.irs.gov.

2. Forms for Eligibility Verification

Independent Contractors must complete the following forms:

•

U.S. citizens and resident aliens must complete Form DFS-A3-53 (Substitute for IRS

Form W-9), request for taxpayer identification number.

•

Nonresident aliens should complete IRS Form 8233 and Foreign National Information

Form (see SECTION 17 – RESOURCES).

These forms will assist in determining the tax residency status of the independent contractor and

provide their taxpayer identification number. The IRS requires all independent contractors

receiving compensation to furnish their correct taxpayer identification number. For additional

information on Taxpayer Identification Numbers refer to SECTION 8 of this manual, or IRC

Section 3406, IRS Reg. Section 301.6109-1.

C. VISAS

The U.S. Department of State is responsible for the issuance of U.S. passports and immigrant visas

REVISED: FEBRUARY 2006

SECTION 3

PAGE 5 OF15

TAXATION/RECONCILIATION

NRA WORK AUTHORIZATION VERIFICATION

to the United States. There are basically two types of visas for foreign nationals seeking admission

to the U.S. – immigrant visas and nonimmigrant visas. Individuals who wish to become lawful

permanent residents of the U.S. seek immigrant visas; those who are in the country for a more

temporary reasons seek nonimmigrant visas. This section will provide a brief explanation of most of

the different types of visas an employer should be familiar with. The type of visa that an employee

or independent contractor holds determines the types of payment remuneration that an individual

may receive. Certain visas are not eligible to receive any type of payments.

1. Immigrant Visas

Immigrant visas, or “green cards” are issued to foreign nationals entering the U.S. as lawful

permanent residents or who become lawful permanent residents. An immigrant visa is an I-551

Permanent Resident Card, formerly called the Alien Registration Receipt Card or Resident Alien

Card. Forms I-551 with these earlier names are valid until their expiration date. When presented

by a newly hired employee, it proves both identity and authorization to work under the

Immigration Reform and Control Act.

Note. Old green cards (Form I-151) are no longer valid proof of immigrant status, identity, and

employment eligibility. Lawful permanent resident aliens should have Form I-551, which has

the bearer’s photograph, signature, and fingerprint.

Foreign nationals holding green cards - those foreign nationals admitted under immigrant visas are classified as resident aliens for U.S. taxation purposes. However, foreign nationals admitted

under nonimmigrant visas are not necessarily nonresident aliens for tax purposes. Nonimmigrants will be considered resident aliens if they satisfy the "substantial presence test." See

SECTION 4 – TAX RESIDENCY.

2. Non-Immigrant Visas

A non-immigrant visa authorizes foreign nationals to proceed to the United States; where, if

admitted, are issued a Form I-94 indicating the length of the period they are authorized to remain

in the United States. Non-immigrant or temporary visas are issued to foreign nationals who wish

to enter the U.S. for a specific purpose and will not be in the country indefinitely. They may,

however qualify as resident aliens under the substantial presence test, so employers should not

assume they are nonresident aliens for tax purposes.

3. Visa Types and Working Privileges

The green card granted to a foreign national entering the United States with an immigrant visa

conveys to its holder full civil rights to work in the United States. However, foreign nationals

entering the United States with nonimmigrant visas, if granted any working privileges at all, may

work within the United States only under the specific conditions set for the visa they hold.

Beginning July 16, 2004, holders of C, E, H, I, L, O, and P visas must renew through the U.S.

consulate office in their home countries. The State Department will no longer process renewals

of temporary business visas.

Some of the common types of nonimmigrant visas that give holders limited privileges to work

REVISED: FEBRUARY 2006

SECTION 3

PAGE 6 OF15

TAXATION/RECONCILIATION

NRA WORK AUTHORIZATION VERIFICATION

within the United States are shown below. For additional information, see USCIS website

www.uscis.gov/graphics/services/employerinfo/eibulletin.htm.

B-1 Visitor for Business

Individual in the United States for a short time to engage in business activities such as

negotiating contracts for overseas employees, consulting with business associates, attending

professional conferences, or conducting independent research.

Not permitted to be employed in the United States. Academic institutions are permitted to pay

an individual admitted in B-1 status “an honorarium payment and associated incidental expenses

for a usual academic activity or activities (lasting no more than 9 days at a single institution), as

defined by the Secretary of Education, if such payment is offered by an institution or

organization described in subsection (p)(1) and is made for services conducted for the benefit of

that institution or entity and if the alien has not accepted such payment or expenses from more

then 5 institutions or organizations in the previous six-month period.” Must present a valid visa

and Form I-95, Record of Arrival and Departure, as verification of status.

B-2 Visitor for Tourism

May also be issued visas as “prospective students” if they show an intention to switch to

student/exchange visitor status: “prospective student” noted on visa.

Not permitted to be employed in the United States. Effective October 21, 1998, any individual

admitted in B-2 status “may accept an honorarium payment and associated incidental expenses

for a usual academic activity or activities (lasting no more than 9 days at a single institution), as

defined by the Secretary of Education, if such payment is offered by an institution or

organization described in subsection (p)(1) and is made for services conducted for the benefit of

that institution or entity and if the alien has not accepted such payment or expenses from more

then 5 institutions or organizations in the previous six-month period.” Must present a valid visa

and Form I-95, Record of Arrival and Departure, as verification of status.

F-1 Foreign Academic Student (except Border Commuters from Canada or Mexico

Individuals in the United States in a full course of academic study in an accredited educational

program. May include elementary school, high school, college/university, conservatory, or

language training. (Students enrolled in vocational training are given M-1 visas.)

a. May be employed on the campus of the school they are authorized to attend for a maximum

of 20 hours per week while classes are in session. The school authorizes part-time oncampus employment, prior USCIS approval not needed. During school vacations students

may work for a maximum of 40 hours per week, if eligible and intending to enroll for the

next term.

b. While enrolled, visa holders in circumstances of “economic hardship” may work off campus

is so recommended by DSO on Form I-20 and approved by USCIS. In such cases, EAD is

required.

c. May participate in employment directly related to field of study. This employment may take

the form of: Curricular Practical Training (requires DSO approval on Form I-20ID, EAD

not required, employment is employer specific; Optional Practical Training (employment

during or after completion of studies, total employment period may not exceed 12 months,

DSO recommendation and USCIS approval needed, EAD required.

REVISED: FEBRUARY 2006

SECTION 3

PAGE 7 OF15

TAXATION/RECONCILIATION

NRA WORK AUTHORIZATION VERIFICATION

F-1/F-3 Border Commuter Academic Students from Canada and Mexico

Must apply for employment authorization for curricular practical training or post-completion

optional practical training.

F-2 Dependent of F-1 Visa Holder

Not permitted to work in the U.S. under any circumstances.

H-1B Temporary Professional Worker in a Specialty Occupation

Individuals in the U.S. to perform professional services for a sponsoring employer in a specific

position for a fixed period of time. Employment authorization is granted for an initial period of

up to 3 years. Extensions for and additional 3 years are possible. Maximum is 6 years.

Employment permitted only with the sponsoring institution that obtained USCIS approval for the

visa classification. Prohibited from receiving payments from other organizations. Individuals

may receive USCIS approval to work in H-1B status for more than one employer. Each

employer must petition USCIS and receive approval for the employment. INS Form I-797A

authorizes employment. EAD not required.

H-1C Registered Nurse Serving in Underserved Area

Employment authorized only for sponsoring employer.

H-3 Trainee

Individuals in the U.S. for a temporary period to participate in a training program provided by a

specific employer. May be employed by petitioning employer for a specified period of time, as

approved by the USCIS. INS Form I-797A authorizes employment. EAD not required.

H-4 Dependent of H Visa Holder

Not eligible for employment.

J-1 Exchange Visitor (Student)

Individuals in the U.S. as exchange visitors for the primary purpose of studying at an academic

institution under the auspices of the United States Information Agency (USIA) and a designated

program sponsor.

J-1 students may work 20 hours per week on campus or off campus in limited circumstances.

Employment does not require additional permission from USCIS or an EAD. Eligible for up to

18 months of academic training following completion of their program (36 months for

postdoctoral training).

J-1 Exchange Visitor (short term scholar, professor, researcher, or specialist)

Individuals in the U.S. as visiting researchers, professors, short-term scholars, or specialists

under the auspices of the United States Information Agency (USIA) and a designated program

sponsor.

May be employed only by the designated program sponsor or appropriate designee, and within

the guidelines of the program approved by USIA for the period of validity as stated on the IAP66. Under limited circumstances, may receive compensation from other institutions provided

prior written authorization form the Responsible Officer of their designated program has been

REVISED: FEBRUARY 2006

SECTION 3

PAGE 8 OF15

TAXATION/RECONCILIATION

NRA WORK AUTHORIZATION VERIFICATION

secured. J-1 professors and researchers may give occasional talks at institutions other than the

program sponsor and for those talks, receive honoraria.

J-2 Dependent of J-1 Visa Holder

Eligible to apply to USCIS for work authorization. With EAD issued by USCIS, may work for

any employer. Employer must re-verify employment authorization by the expiration date on the

EAD.

O-1 Alien with Extraordinary Ability in sciences, arts, education, business, or athletics

Employment authorized only with sponsoring employer or through sponsoring agency. INS

Form I-797A authorizes employment. EAD not required.

O-2 Aliens accompanying/assisting O-1 Visa Holder

Employment authorized only with sponsoring employer or through sponsoring agency. INS

Form I-797A authorizes employment. EAD not required.

Q-1 Participant in an International Cultural Exchange Program

Individuals in the U.S. as participants in an international cultural exchange visitor program

approved by the Attorney General to provide practical training, employment, and the sharing of

the history, culture, and traditions of the foreign national’s country (“Disney Visa”).

May be employed and compensated only by the petitioning employer or agency through whom

the status was obtained. INS Form I-797A authorizes employment. EAD not required.

TN-1 Canadian Holder of Trade NAFTA Visa, working in occupation listed in NAFTA

May be employed and compensated only by the sponsoring employer through whom the status

was obtained in activity in accordance with the provisions of the treaty. Canadians require only

an I-94 card as employment authorization.

TN-2 Mexican Holder of Trade NAFTA Visa, working in occupation listed in NAFTA

May be employed and compensated only by the sponsoring employer through whom the status

was obtained in activity in accordance with the provisions of the treaty. Mexicans require INS

Form I-797A; EAD is not required.

VWT Visa Waiver for Business

VWT Visa Waiver for Tourism

Visitors to U.S. who are nationals of countries on the Visa Waiver list may visit U.S. for 90 days

for business or pleasure/tourism.

No employment authorization: VWB/VWT visitors may not receive compensation for services

performed in the U.S. except for honoraria from academic institutions for certain academic

activities. (Individuals entering the U.S. under a visa waiver project should be treated as if they

had entered with a temporary visitor visa, either B-1 or B-2 according to the nature of the visit.

4. Visa Waiver Program (VWP)

Aliens from certain countries may travel to the U.S. without visas under the VWP, presenting

only their unexpired foreign passports and proof, such as a roundtrip ticket, of intention to depart

from the U.S. within 90 days. For admission purposes, most foreign passports must be valid for

REVISED: FEBRUARY 2006

SECTION 3

PAGE 9 OF15

TAXATION/RECONCILIATION

NRA WORK AUTHORIZATION VERIFICATION

at least six months beyond the authorized period of stay. Visa waiver travelers are issued green

Forms I-94 marked WB (Waiver-Business) or WT (Waiver –Tourist), which correspond to B-1

and B-2 classification, respectively. Although travel without a visa represents a convenience, it

has several limitations of which the traveler must be aware.

Currently, 27 countries participate in the Visa Waiver Program, as shown below.

Andorra

Australia

Austria

Belgium

Brunei

Denmark

Finland

France

Germany

Iceland

Ireland

Italy

Japan

Lichtenstein

Luxembourg

Monaco

The Netherlands

New Zealand

Norway

Portugal

San Marino

Singapore

Slovenia

Spain

Sweden

Switzerland

United Kingdom

To obtain the latest list of countries see U.S. Department of State, web site

http://travel.state.gov.

5. United States-Canada Free Trade Agreement

Public Law 100-449 (Act of 9/28/88) established a special reciprocal trading relationship

between the United States and Canada. It provided two new classes of nonimmigrant admission

to Canadian citizen businesspersons and their spouses and unmarried minor children for

temporary visitors to the United States. Entry is facilitated for visitors seeking classification as

visitors for business, treaty traders or investors, intra-company transferees, or other business

people engaging in activities at a professional level. Such visitors are not required to obtain

nonimmigrant visas, prior petitions, labor certifications, or prior approval; but must satisfy the

inspecting officer they are seeking entry to engage in activities at a professional level and that

they are so qualified. The North American Free Trade Agreement (NAFTA) as of 1/1/94

superseded the United States-Canada Free Trade Agreement. See North American Free-Trade

Agreement below.

6. North American Free-Trade Agreement (NAFTA)

The 1994 North American Free Trade Agreement (Public Law 103-182, Act of 12/8/93)

supersedes the United States-Canada Free-Trade Agreement (FTA) as of 1/1/94. NAFTA

continues the special, reciprocal trading relationship between the United States and Canada and

establishes a similar relationship with Mexico.

NAFTA facilitates travel to and employment in the United States of certain Canadian and

Mexican workers. NAFTA created a new visa category “TN” for eligible Canadian and Mexican

professional workers and also affected terms of admission of Canadians’ admissions to the U.S.

under other nonimmigrant classifications.

REVISED: FEBRUARY 2006

SECTION 3

PAGE 10 OF15

TAXATION/RECONCILIATION

NRA WORK AUTHORIZATION VERIFICATION

A TN position must require services of a NAFTA professional whose profession is noted in U.S.

Citizenship and Immigration Services (USCIS), Employer Information Bulletin 11, December 2,

2003, Appendix 1603.D.1. See: http://uscis.gov/graphics/services/employerinfo/EIB11.pdf.

The employee must possess the credentials required as well as proof of qualifying citizenship.

TN status allows unlimited multiple entries to the U.S. for the period of service required by the

U.S. employer (includes foreign employers), up to a maximum of one year, extendible

indefinitely so long as the temporary purposes of the employment continues.

Self-Employment in the U.S. is Not Permitted

TN: Members of Appendix 1603.D.1 professions who are self-employed outside the U.S. may

pursue business relationships from outside the U.S. (e.g., contracts for services) with U.S. based

companies and obtain TN status to engage in these prearranged activities in the U.S. However,

under TN classification an alien is not permitted to come to the United States to engage in selfemployment in the United States, nor to render services to a corporation or other entity in which

he/she is a controlling owner or shareholder.

Other NAFTA Admissions Categories

Canada and Mexico nationals may also seek admission as B-1 (business visitor), E-1 (treaty

trader), E-2 (treaty investor), or L-1 (intra-company transferee) non-immigrants under NAFTA.

TN Processing and Admissions Procedure

Canadians may apply for TN-1 classification directly at a U.S. Class “A” port-of-entry, at a

U.S. airport handling international traffic, or at a U.S. pre-flight/pre-clearance station in Canada.

A Canadian citizen who enters the U.S. more than twice per year in B, E, L, or TN status may be

eligible for automated border inspections via the INSpass program.

Documentation must include:

• Proof of Canadian citizenship,

• $50 filing fee,

• Proof of required Appendix 1603.D credentials; and

• Letter from U.S. employer (or a sending employer in Canada) describing nature and

duration of professional employment and salary/wages in the U.S. The employer letter

should include a job description including professional activities and duties, duration of

TN alien’s services in the U.S., requirements for position to be filled (training, license,

experience, etc.), alien’s credentials, and salary/benefits.

Canadian citizens are visa exempt and do not need consular visas to travel or apply for admission

to the U.S. TN-1 applicants at land ports-of-entry must also pay a modest Form I-94 fee.

TN-2 non-immigrants from Mexico must be approved beneficiaries of Form I-129 petitions

filed by prospective U.S. employers and approved by the Department of Homeland Security,

U.S. Citizenship and Immigration Services’ Nebraska Service Center. Documentation must

include:

•

•

•

Proof of Mexican citizenship,

$130 filing fee,

Proof of the purpose for entry, and proof of participation in a permitted NAFTA

REVISED: FEBRUARY 2006

SECTION 3

PAGE 11 OF15

TAXATION/RECONCILIATION

NRA WORK AUTHORIZATION VERIFICATION

professional activity.

Mexicans applying for admission to the U.S. under TN-2 classification must file the necessary

paperwork with a Department of State Consulate in Mexico in order to receive a TN visa. Visit

the Department of State website for more information on the procedures Mexican citizens must

follow in order to obtain a TN visa.

Family Members

Spouses and unmarried children under 21 of Canadian and Mexican professionals obtain TD

status. They can be included on the application of the TN principal (no separate filing fees) and

admitted for the same duration of stay. TD non-immigrants may study in the U.S. under this

classification, but are not authorized for employment. Canadian dependents’ eligibility may be

adjudicated at a U.S. port-of-entry. Although Mexican family members are automatically

included in TN petitions filed at the Nebraska Service Center, they must file separate application

for TD visas at U.S. consulates. Note: Dependents are not required to be Canadian or Mexican

citizens.

Additional information about verification of work authorization may be obtained at

http://www.uscis.gov/index.htm.

D. FOREIGN CORPORATIONS

This section is authored by An Issue Specialist, IRS Foreign Payments Branch, Washington, DC.

"The matter of withholding taxes on payments to foreign corporations is not quite as simple as it

might seem. Basically, four questions have to be answered about the income you are paying to a

foreign corporation: (1) does U.S. law consider this income to be foreign--sourced, (2) does U.S. law

consider this income to be effectively connected with a U.S. trade or business, (3) is the foreign

corporation a personal holding company under U.S. law, and (4) is there any tax treaty provision

which applies to this payment?

The income of a foreign corporation that is effectively connected with a U.S. trade or business is

subject to U.S. tax at the same rates applicable to U.S. taxpayers. This income should be reported on

a U.S. income tax return form 1120F for foreign corporations. This income is not usually reportable

to IRS by a withholding agent and is not subject to withholding if the foreign corporation gives to

the withholding agent form 4224 Exemption From Withholding of Tax on Income Effectively

Connected With the Conduct of a Trade or Business in the United States. (Please note that form

4224 is being replaced during 1999 by the new form W-8ECI).

Income that is effectively connected with a U.S. trade or business is often connected with the fact

that the foreign corporation has a "fixed base" or "permanent establishment" in the USA. That is, it

has some sort of permanent office, factory, base of operations, etc. in the USA from which it

generates its U.S. income. Income of a foreign corporation that is not effectively connected with a

U.S. trade or business is classified as "Fixed, Determinable, Annual, or Periodical" (called FDAP for

short). FDAP income that is considered to be U.S.-- sourced income is subject to 30% withholding,

or withholding at a lower tax treaty rate, and is reportable on forms 1042 and 1042-S. However,

FDAP income that is not U.S. -- sourced income is not reportable by the U.S. withholding agent, and

is not subject to any withholding tax. The sourcing rules about payments made to foreign entities

REVISED: FEBRUARY 2006

SECTION 3

PAGE 12 OF15

TAXATION/RECONCILIATION

NRA WORK AUTHORIZATION VERIFICATION

are found in sections 861- 865 of the Internal Revenue Code; and you will find a brief summary of

them on page 7 of the 1998 edition of IRS Publication 515 Withholding of Tax on Nonresident

Aliens and Foreign Corporations.

Payments made to a foreign corporation to purchase personal property items which are produced

outside of the USA by a foreign corporation which has no fixed base or permanent establishment in

the USA are usually considered to be foreign--sourced income of the foreign corporation and are not

subject to U.S. reporting or withholding.

Payments made to a foreign corporation in exchange for the personal services of nonresident alien

individuals performed outside of the U.S. are considered to be foreign--sourced income, and are not

reportable to the IRS and are not subject to U.S. withholding tax.

On the other hand, payments to a foreign corporation in exchange for personal services performed in

the USA by either U.S. citizens or aliens is considered to be U.S.-- sourced income and is usually

subject to withholding. The type of withholding will depend on the employment relationship

between the workers and the U.S. payer or the foreign corporation.

If the U.S. payer or the foreign corporation is considered to be an "employer" under U.S. law, then

such employer will have to file forms 941, W-2, etc. and withhold U.S. taxes at the graduated rates

on the wages paid to the employees. (Please consult Revenue Ruling 92-106). If no employment

relationship exists between the workers and the U.S. payer or the foreign corporation, then the

payments are probably in the nature of self-employment income paid to independent contractors

(independent personal services), and will be reported on forms 1042 and 1042-S if paid to

nonresident aliens, and will be subject to 30% withholding, or withholding at a lower tax treaty rate.

If the payment to the foreign corporation consists partially of remuneration for personal services

performed in the USA and partially of payment for personal property items purchased from overseas

or of some other kind of income which is foreign-sourced, then the U.S. payer will have to

determine what percentage of the payment to the foreign corporation is U.S.--sourced and report that

portion and withhold tax on it.

If the U.S. payer cannot determine which portion of the payment is taxable or nontaxable, then the

U.S. payer will withhold 30% on the entire payment. The reporting will usually be on forms 1042

and 1042-S (showing the foreign corporation as payee) and the withholding will usually be at 30%

or lower tax treaty rate which may apply, unless the foreign corporation can show the U.S. payer that

it has already reported the income and paid U.S. tax on it.

One further complication exists under U.S. law for payments made to foreign corporations. Some

individuals (especially foreign athletes and entertainers) form foreign corporations to act as the

recipients of their income in order to take advantage of the sometimes more favorable tax treatment

given to corporations than to individuals.

Under U.S. law a corporation 60% of whose gross income comes from contracts for the personal

services of specified individuals, and such specified individuals own at least 25% of the outstanding

stock of such corporation, is known as a "personal holding company".