Robust Stability of Monetary Policy Rules under Adaptive Learning Eric Gaus

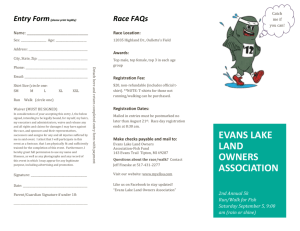

advertisement

1

Robust Stability of Monetary Policy Rules under

Adaptive Learning

Eric Gaus∗

Ursinus College

601 East Main St.

Collegville PA 19426-1000

Office Phone: (610)-409-3080

Email: egaus@ursinus.edu

Abstract

Recent research has explored how minor changes in expectation formation

can change the stability properties of a model (Duffy and Xiao 2007, Evans

and Honkapohja 2009). This paper builds on this research by examining an

economy subject to a variety of monetary policy rules under an endogenous

learning algorithm proposed by Marcet and Nicolini (2003). The results indicate

that operational versions of optimal discretionary rules are not “robustly stable”

as in Evans and Honkapohja (2009). In addition commitment rules are not robust

to minor changes in expectational structure and parameter values.

JEL Codes: E52, D83

∗ Acknowledgements:

Many thanks to Srikanth Ramamurthy, George Evans, Jeremy Piger, Shankha

Chakraborty, the associate editor, and two anonymous referees for their helpful suggestions and comments.

All remaining errors are my own.

2

1

Introduction

In addressing important open questions in monetary policy, inflation and expectations,

Bernanke (2007) states that many of the interesting issues in modern monetary theory

require a framework that incorporates learning on the part of agents. Adaptive learning

relaxes the rational expectations assumption by allowing agents to use econometrics to

forecast the economic variables of interest. As new data arrives, agents “learn” about the

data process by updating their forecast equations. Agents might apply a decreasing weight

(referred to as a gain) to new information if they believe the economic structure is fixed.

Alternatively, agents might apply a constant weight to the new data to account for frequent

structural change. Regardless of the weighting scheme, the ability of the agents to learn the

rational expectations solution can be reduced to a stability condition, described below.

In an early paper, Howitt (1992) showed that an interest rate pegging regime does not

result in agents learning the rational expectations solution. More recently, Evans and

Honkpohja (2003 and 2006) provide an overview of various monetary policy rules and their

stability under learning. As pointed out by Duffy and Xiao (2007), these results hold only if

policy makers do not consider the interest rate in their loss function. Rules with so-called

interest rate stabilization are stable under the so-called decreasing gain learning, but Evans

and Honkapohja (2009) contend that Duffy and Xiao’s rules do not result in stability for

constant gain learning.

This paper investigates a variety of monetary policy rules under various learning

algorithms with a particular focus on a hybrid of decreasing and constant gain learning

presented by Marcet and Nicolini (2003), which may be appropriate if agents believe they

face occasional structural breaks. By using this hybrid gain this paper can address how

demonstratively Duffy and Xiao (2007) and Evans and Honkapohja (2009) differ from each

other. Under the same conditions as Evans and Honkapohja (2009), using a hybrid gain

3

does not overturn the results in their paper, implying a stronger result.

Duffy and Xiao (2007) derive two optimal interest rate rules - one under discretion,

which can be characterized as a Taylor rule

it = θx xt + θπ πt ,

(1)

and the other under commitment, which is similar, but incorporates lagged values,

it = θπ πt + θx (xt − xt−1 ) + θi1 it−1 − θi2 it−2 .

(2)

Evans and Honkapohja (2009) assume that agents do not have access to contemporaneous

endogenous variables (the output gap, x, and inflation, π) and therefore examine an

operational version of (1),

it = θx xte + θπ πte ,

(3)

∗ x and π e = E ∗ π , where the star indicates that expectations need not be

where xte = Et−1

t

t

t−1 t

rational. This paper adds to the literature by examining these three rules plus an operational

version of (2) of the form,

it = θπ πte + θx (xte − xt−1 ) + θi1 it−1 − θi2 it−2 ,

(4)

and deriving an expectations based rule of the flavor of Evans and Honkapohja (2006),

e

e

it = θx1 xt−1 + θx2 xt+1

+ θπ πt+1

+ θi1 it−1 + θi2 it−2 + θu ut + θg gt .

where ut and gt are exogenous AR(1) processes. The following equations govern these

processes:

ut = ρut−1 + ũt , and gt = µgt−1 + g̃t ,

(5)

4

where g̃t ∼ iid(0, σg2 ), ũt ∼ iid(0, σu2 ), and 0 < |µ|, |ρ| < 1. A critical difference between

Evans and Honkapohja’s analysis and Duffy and Xiao is the distinction between optimal

and operational rules. The assumption of operational behavior drives the instability results

in Evans and Honkapohja (2009), which may result because of a violation in optimality.1

The paper unfolds as follows. The next section describes the basic modeling

framework, learning, the stability concept in learning, and introduces the hybrid learning

algorithm. Section 3 explores the optimal discretionary policy (1) and also the operational

version (3) under all three types of learning. That section also provides description of the

dynamics associated with the hybrid learning algorithm. The fourth section examines Duffy

and Xiao’s optimal rule with commitment (2), the operational version (4) and an

expectations based rule (5). The last section concludes.

2

Methodology

Basic Model

The following New Kyensian (NK) model, presented in section 3 of Evans and Honkapohja

(2009), describes the economy,2

e

e

xt = xt+1

− ϕ(it − πt+1

) + gt ,

(6)

e

πt = β πt+1

+ λ xt + ut ,

(7)

The Euler equation for consumption generates the output equation (6), while (7) describes

the NK Phillips Curve. The model is closed by specifying an interest-rate rule.

Substituting the generic Taylor rule (1) into (6) and rearranging (6) and (7) results in

5

the following matrix form of the model.

e

yt = Myt+1

+ Pυt ,

(8)

where yt = (xt , πt )0 and υt = (gt , ut )0 and where,

M

ϕ −1

ϕ −1 +θπ λ +θx

=

λ ϕ −1

−1

ϕ +θπ λ +θx

β

1−θπ β

ϕ −1 +θπ λ +θx

λ (1−θπ β )

+ ϕ −1

+θπ λ +θx

and

ϕ −1

ϕ −1 +θπ λ +θx

P=

λ ϕ −1

−1

ϕ +θπ λ +θx

− ϕ −1 +θθπ λ +θ

π

x

λ θπ

1 + ϕ −1 +θ

λ +θ

π

.

x

Denoting F = diag{µ, ρ} and ν̃t = (g̃t , ũt )0 the corresponding process for the shocks

takes the form

υt = Fυt−1 + υ̃t .

Learning and E-stability

Under these assumptions, agents’ perceived law of motion (PLM) - the equation they

estimate - takes the form of the minimum state variable (MSV) solution,

yt = a + cυt

(9)

e = a + cFυ . Substituting these

which implies that agents expectations can be written as yt+1

t

expectations into (8) yields the actual law of motion (ALM),

yt = Ma + (McF + P)υt .

(10)

There exists a mapping of perceived coefficients to the actual coefficients, which the

6

literature refers to as the T-map. In this particular case the T-mapping is,

T (a) = Ma,

T (c) = McF + P.

The fixed point of the T-mapping is the Rational Expectations Equilibrium (REE). If all the

eigenvalues of the derivative of the T-map are less than one, then the solution is locally

expectationally stable, or E-stable. The result is local in the sense that agents expectations

will converge to the REE as long as their initial expectations are not too far away from the

REE. Evans and Honkapohja (2001) define the E-stability principle, which states that there

exists a correspondence between the E-stability of an REE and its stability under adaptive

learning.

The agents in the model do not know the structural parameters. Their expectations of

future outcomes are therefore based on estimates of a and c for the model (9). In real time,

these estimates of ϕt = (at , ct )0 are calculated by recursive least squares (RLS),

ϕ̂t = ϕ̂t−1 + γt Rt−1 ξt0 (yt − ξt0 ϕ̂t−1 ),

Rt = Rt−1 + γt (ξt ξt0 − Rt−1 ),

where ξ = (1 υ), and Rt is the moment matrix.

Adaptive learning assumes the gain, γt , is simply t −1 , which can also be referred to as

decreasing gain learning. This case corresponds to standard OLS, where the all data is

weighed equally. In contrast, setting γt = γ ∈ (0, 1] implies that the oldest data has virtually

no weight. This is called constant-gain learning and is similar to a rolling window of data.3

Proposition 1 in Evans and Honkapohja (2009) states that for constant gain learning the

eigenvalues must lie inside a circle of radius 1/γ and origin (1 − 1/γ, 0). Further, they show

that this is true for several different monetary policy rules for empirically relevant values of

7

the constant gain.

Switching Gains

Marcet and Nicolini (2003) propose a hybrid gain sequence which allows for an

endogenous switch between constant gain and decreasing gain. It is plausible that switching

between the different types of gain may vindicate the monetary policy rules examined by

Evans and Honkapohja (2009). The switch is endogenously triggered by forecast errors.

Large errors cause agents to suspect a structural break and therefore they would prefer to

use a constant-gain to remove the bias of the older data. Once forecast errors fall below a

cutoff agents switch back to a decreasing-gain. In Milani (2007b) this cutoff is determined

by the historical average of forecast errors.

Denoting the gain, γz,t , for each endogenous variable, z = {x, π}, the switching gain

takes the following form,

γz,t =

γ̄z

1

γ̄z−1 +k

if

∑ti=t−J |zi −zei |

J

if

∑ti=t−J |zi −zei |

J

≥

∑ti=t−W |zi −zei |

,

W

<

∑ti=t−W |zi −zei |

.

W

(11)

where k is the number of periods since the last switch to a decreasing-gain, J is the number

of periods for recent calculations, and W is the number of periods for historical

calculations.4 This rule sets the gain of a particular estimation equal to a constant value if

recent prediction error of that variable is greater than the historical average. If the reverse is

true, then the value of the gain declines with each subsequent period. Unfortunately, the

stability properties of this particular type of gain have not been studied. The following

section explores the stability properties of this type of gain sequence in the context of

several models.

8

3

Discretionary Monetary Policy

Optimal Policy

Duffy and Xiao (2007) suggest an optimal policy rule based on policymaker minimizing a

loss function that includes interest-rate stabilization in addition to output and inflation

stabilization. Note that like Duffy and Xiao, no zero-lower bound condition is imposed

because this particular line of literature relies on the observation by Woodford (2003) that

monetary policy makers should include the interest rate in their loss function to ensure that

the lower bound does not bind.5 Specifically policymaker minimize the following loss

function subject to (6) and (7), which are modified to account for a lack of commitment.6

∞

E0 ∑ β t [πt2 + αx xt2 + αi it2 ],

(12)

t=0

where the relative weights of interest-rate and output stabilization are αi and αx ,

respectively. Using the first order conditions of this loss function Duffy and Xiao (2007)

derive the following interest-rate rule,

it =

ϕαx

ϕλ

πt +

xt .

αi

αi

(13)

To analyze E-stability of the model closed by (13) one sets θπ = ϕλ αi−1 and

θx = ϕαx αi−1 in (8) and finds the eigenvalues of the derivative of the T-map. The derivative

of the T-map is as follows:

DTa = M,

DTc = F 0 ⊗ M.

Table 6.1 of Woodford (2003) , provides the calibrated values αx = 0.048, αi = 0.077,

9

ϕ = 1/0.157, λ = 0.024, and β = 0.99. In addition, σu = σg = 0.2 and ρ = µ = 0.8.7

Under this parameterization the model all the eigenvalues of the derivative of the T-map are

less than one. This implies that the model is locally E-stable for a decreasing-gain. The

eigenvalues also satisfy the constant gain learning local stability condition for all values of γ

between zero and one. Consequently, the switching-gain must be locally E-stable.

As noted by Evans and Honkapohja (2009) and McCallum (1999) policy rules with

contemporaneous endogenous variables are problematic. What follows is a version of Duffy

and Xiao’s rule that accounts for this problem under a few common parameterizations.

Operational Policy

Operational monetary policy rules, in the sense of McCallum (1999), assume knowledge of

contemporaneous exogenous variables, but not contemporaneous endogenous variables.8

Thus, agents form expectations over contemporaneous endogenous variables and this,

following Evans and Honkapohja (2009), changes (1) to (3).9 By substituting (3) into (6)

the model can be rewritten in matrix form as,

e

yt = M0 yte + M1 yt+1

+ Pυt ,

(14)

where yt = (xt , πt )0 and υt = (gt , ut )0 and where,

2

− ααx ϕi

M0 =

2

− αxαϕi λ

2

− ϕαiλ

ϕ

1

1 0

,

M

=

and

P

=

.

1

2 2

− ϕ αλi

λ β + ϕλ

λ 1

Substituting the appropriate expectational terms into (14) yields the ALM,

yt = (M0 + M1 )a + (M0 c + M1 cF + P)υt .

(15)

10

with the following T-map,

T (a) = (M0 + M1 )a,

T (c) = (M0 c + M1 cF + P).

Table 1 lists the eigenvalues of the derivatives of the T-map under three common

parameterizations of the New Keynesian model: Woodford (2003), Clarida, Gali and

Gertler (2000), and Jensen and McCallum (2002). The Duffy and Xiao rule is not E-stable

under the Jensen, McCallum (JM) parameterization, but is under Woodford and Clarida,

Gali, Gertler (CGG). This is likely due to the inter-temporal elasticity of substitution being

greater than one under Woodford and CGG and less than one under JM. When the model is

E-stable we see large negative numbers under Woodford and CGG. As in Evans and

Honkapohja (2009), this is the cause for the instability with large constant gains. Note that

the only one of the eigenvalues is effected when switching from contemporaneous data rule

to and operational rule.

Simulation of this gain structure requires a small burn in period to establish a history of

error terms. In order to create a seamless transition from the burn-in to learning, the burn-in

length is set to the inverse of the gain. During this period agents use the constant-gain.

Given the constant-gain value of 0.025 this implies a burn in length of 40 periods. This

ensures no discontinuity at agent’s first opportunity to switch; agents choose between

keeping the constant-gain or allowing the value of the gain to decrease. In the initialization

period agent’s expectations do not have an effect in the economy to minimize the usual

learning dynamics. Thus, the coefficients driving the simulation will be a small perturbation

away from the Rational expectations (RE) values. When the initialization period ends

agents use the switching-gain in (11).

Figures 1 and 2 depict a particular realization of the NK economy under constant-gain

learning and the contemporaneous expectations Duffy and Xiao policy rule. Evans and

11

Honkapohja (2009) report that with the Woodford parameterization the model converges to

RE if the constant-gain parameter takes values less than 0.024. They refer to the result as

not being “robustly stable,” in the sense that empirical estimates of the constant-gain are

larger that this value.10 Under the CGG parameterization the model is converges to RE if

the constant-gain parameter takes values less than 0.059, an implied window size of 17

periods, which is an improvement but does not cover the entire plausible range.

Discussion of Switching Gain Stability

While the values of the constant-gain have increased (from 0.024 to 0.026 under the

Woodford parameterization), the simulations exhibit temporary deviations from the REE.

Figure (3) illustrates these exotic dynamics for a particular realization of the NK economy

when agents use the switching-gain.11 For these simulations γ̄z = 0.025 for z = x, π, which

lies just outside the stable range found by Evans and Honkapohja (2009), the historical

window length, W = 35, which suggests that agents use about nine years of past data for the

historical volatility indicator, the window length for recent data, J = 4, which is the

estimated value found by Milani (2007b). Simulations do not explode for values of the

constant-gain of 0.026 or lower, which would not be considered robustly stable. The

historical average suggested by Milani partially drives this result. Should one use an

arbitrary value in the switching rule as suggested by Marcet and Nicolini (2003), then, for a

given value of the constant gain, there exists a value above which the model is explosive

and below which the model rapidly settles into a continuous decreasing-gain regime.

Unlike Marcet and Nicolini (2003) there are no underlying structural changes in this

NK model. Thus, the result is completely driven by the expectation formation behavior.

Sargent (1999) uses a model in which agents temporarily escape a self-confirming

equilibrium as well, but examines government beliefs, not beliefs of the entire economy.

Cho, Williams and Sargent (2002) examine the ordinary differential equations (ODEs) in

12

the Sargent (1999) framework and find that the “escape dynamics” include an additional

ODE relative to the mean dynamics.

Table 2 provides a comparison of the economic significance of the temporary

deviations. These examples come from two independent simulations of 15,000 periods.

After discarding the first 10,000 periods, the mean and variance of output and inflation

relative to the REE are calculated entire remaining 5,000 periods and also for a 100 period

window around the largest temporary deviation in that 5,000 period section. These

examples suggest that the exotic behavior leads to a large increase in variance relative to

RE. The top example shows that both inflation and output may be lower than under RE,

while the bottom example has both variables above RE.

Robustness of these results is not easily obtained. Changing structural parameters

changes the threshold for instability requiring more than one parameter to change in the

comparison. However, changing the parameters in the gain structure (11) does not.

Therefore Table 3 looks at different values of the rolling window. This gives a sense of the

economic impact of the deviations from rational expectations, but does not address

frequency. Table 4 displays stability results from a Monte Carlo exercise for several

different historical window lengths. These results are based on 5,000 simulations of 10,000

periods each. If the last estimated coefficients lie within 1 percent of the REE value then

that the particular simulation achieved stability.12 The two sets of calibrated parameters that

result in stability under a decreasing-gain are used. Ignoring the level effects, one can see

more sensitivity to the window size, W , under Woodford than under CGG. A potential

explanation is that under the CGG parameterization the expectational feedback loop is more

sensitive to a “bad” series of shocks.

13

4

Monetary Policy with Commitment

Evans and Honkapohja (2009) postulate that the policy rule with commitment in Duffy and

Xiao (2007) suffers from the same instability that arises under discretionary policy. As

mentioned above, Evans and Honkapohja restrict their examination of commitment to rules

where αi = 0, which leaves Duffy and Xiao’s rule undefined. This section evaluates the

stability of Duffy and Xiao’s commitment rule under all three types of gain sequences, and

compares it to the expectations based rule similar to Evans and Honkapohja (2003) and

Evans and Honkapohja (2006). It also examines the robustness of Evans and Honkapohja

(2009) result by considering alternative parameterizations.

Optimal Policy with Commitment

The first order condition that results from minimizing (12) subject to (6) and (7) under the

timeless perspective results in,

β λ πt + β αx (xt − xt−1 ) + αi λ it−1 + αi ϕ −1 (it−1 − it−2 ) − β αi ϕ −1 (it − it−1 ) = 0

Rearranging results in (2) with θπ =

ϕλ

αi ,

θx =

αx ϕ

αi ,

θi1 =

ϕλ +β +1

,

β

(16)

and θi2 = β1 . The system

under commitment can be written as,

e

yt = Myt+1

+ N0 yt−1 + N1 wt−1 + Pυt ,

(17)

where wt = (it , it−1 )0 and the appropriate matrices for M, N0 , N1 , and P. The MSV solution

provides the PLM, which also supplies the form of the RE solution.

yt = a + b0 yt−1 + b1 wt−1 + cυt .

(18)

14

Note that the law of motion governing the exogenous variables, wt , can be written as,

wt = Q0 yt + Q1 yt−1 + Q2 wt−1 .

(19)

Substituting (18) and (19) in (17) one can find the T-mapping,

T (a) = M(I + b0 + b1 Q0 )a,

T (b0 ) = M(b20 + b1 Q0 b0 + b1 Q1 ) + N0 ,

T (b1 ) = M(b0 b1 + b1 Q0 b1 + b1 Q2 ) + N1 ,

T (c) = M((b0 + b1 Q0 )c + b1 cF) + P.

Upon inspection one can see that there are multiple equilibria in this model. Using these

equations one can find derivatives of the T-mapping at a rational expectations solution,

DTa = M(I + b̄0 + b̄1 Q0 ),

DTb0 = b̄00 ⊗ M + I ⊗ M(b̄0 + b̄1 Q0 ),

DTb1 = I ⊗ M(b̄0 + b̄1 Q0 ) + (Q0 b̄1 )0 ⊗ I + Q02 ⊗ I,

DTc = I ⊗ M(b̄0 + b̄1 Q0 ) + F 0 ⊗ b̄1 ,

where a bar indicates the rational expectations coefficients found using the generalized

schur decomposition (Klein 2000).

The results are consistent with Duffy and Xiao (2007), that is, all real parts of the

eigenvalues of the derivative of the T-map lie within the unit circle. This implies that the

model is locally stable under adaptive learning. However, since there lagged endogenous

variables the model may be unstable for high values of a constant gain. Numerical

simulation shows that the optimal rule results in instability for values of 0.18 or greater and

the switching yields no improvement.

15

Operational Policy with Commitment

Drawing on the methodology of Evans and Honkapohja (2009) one can operationalize (2)

as (4), now referred to as DX, with the same values for the θ ’s as in the optimal

commitment policy, the system can be written as,

e

yt = M0 yte + M1 yt+1

+ N0 yt−1 + N1 wt−1 + Pυt ,

(20)

with the appropriate matrices for M0 , M1 , N0 , N1 , and P. The MSV solution (18) serves as

the PLM for this model as well. Using the appropriate law of motion for wt , the derivatives

of the T-map at the unique saddle path stable rational expectations solution are,

DTa = M0 + M1 (I + b̄0 + b̄1 Q0 ),

DTb0 = I ⊗ M0 + b̄00 ⊗ M1 + I ⊗ M1 (b̄0 + b̄1 Q0 ),

DTb1 = I ⊗ M0 + I ⊗ M1 (b̄0 + b̄1 Q0 ) + (Q0 b̄1 )0 ⊗ I + Q02 ⊗ I,

DTc = I ⊗ M0 + I 0 ⊗ M1 (b̄0 + b̄1 Q0 ) + F 0 ⊗ b̄1 ).

Under the Woodford parameterization I find that the model achieves stability for values

of the gain of 0.0078 or less. Using Milani’s switching gain extends this region to 0.0084,

but it does not display the transitory exotic dynamics found under a Taylor-type rule. As

predicted by Evans and Honkapohja (2009), the DX rule does not fare well under large

gains. In fact the instability is so severe that even allowing for temporary switches to a

decreasing-gain does not significantly extend the range of values that result in stability.

Expectations Based Policy with Commitment

A potential criticism of operational rules is that they are not necessarily optimal.

Generalizing the expectations based rule of Evans and Honkapohja (2009) for αi > 0 allows

16

for better comparison to the previous optimal rule with commitment. Substituting (6) and

(7) into the first order condition (16) and rearranging results in (5), now referred to as EH,

with

θx1 = − α ϕ −1 +λαx2 ϕ+α ϕ ,

i

θi1 =

x

αi (ϕλ +β +1)

,

β (αi +λ 2 ϕ 2 +αx ϕ 2 )

θx2 = θg =

θi2 =

λ 2 +αx

,

αi ϕ −1 +λ 2 ϕ+αx ϕ

αi

,

β (αi +λ 2 ϕ 2 +αx ϕ 2 )

θπ =

λ β +λ 2 ϕ+αx ϕ

,

αi ϕ −1 +λ 2 ϕ+αx ϕ

θu =

λ

.

αi ϕ −1 +λ 2 ϕ+αx ϕ

The matrix form of the model is identical to (17), where M, N0, N1, and P are redefined

appropriately. Using the MSV solution (18), and the appropriate law of motion for wt , the

derivatives of T-mapping are,

DTa = M(I − b̄1 Q0 )−1 (I + b̄0 ),

DTb0 = b̄00 ⊗ M(I − b̄1 Q0 )−1 + I ⊗ M(I − b̄1 Q0 )−1 b̄0 ,

DTb1 = −(Q0 (I − b1 Q0 )−1 (b̄0 b̄1 + b̄1 Q2 ))0 ⊗ M(I − b̄1 Q0 )−1

+ I ⊗ M(I − b̄1 Q0 )−1 b̄0 + Q02 ⊗ M(I − b̄1 Q0 )−1 ,

DTc = I ⊗ M(I − b̄1 Q0 )−1 b̄0 + F 0 ⊗ M(I − b̄1 Q0 )−1 .

The eigenvalues of the T-mapping under the Woodford parameterization for DTa are

0.0782, and 0.9169, those for DTb are 0.0350, and 0.9114, and those for DTc are 0, 0,

0.0715, and 0.7192. Much like the result in Evans and Honkapohja (2009) all the

eigenvalues lie within the unit circle. Though the EH rule satisfies the E-stability condition,

the lagged endogenous variables imply that there exists a possibility for instability for

sufficiently high values of the constant-gain. Similar to the expectations based rule when

αi = 0, the EH rule is robustly stable under the Woodford parameterization. The values of

the constant gain equal to or larger than 0.134 result in the instability of the EH rule under

interest-rate stabilization. This value is much smaller than the expectations based rule

without interest-rate stabilization found in Evans and Honkapohja (2009). Using the Milani

switching gain extends the stable range significantly. The EH rule remains stable until

17

values of 0.292 or higher.

Table 5 shows these policy rules with commitment are sensitive to different

parameterizations. The EH rule is not E-stable under CGG and JM. Fewer large negative

numbers are observed as ϕ decreases for the DX rule, however they still exist. Taken

together, these results suggest that commitment rules with interest rate stabilization perform

poorly under learning. In addition the sensitivity of the constant-gain portion of the

switching-gain to a series of “bad” shocks differs across monetary policy rules. This

sensitivity suggests that the expectational feedback loop spirals out of equilibrium faster

than the decreasing gain can reattain the REE. The expectations based rule has a larger

range, not only is “robustly stable,” but also slows down the expectational feedback loop.

5

Conclusion

Researchers have debated the merits of monetary policy rules under learning using two

types of gain structures, decreasing and constant. Finding conflicting results for many

monetary policy rules leads one to consider switching between a constant-gain and a

decreasing-gain, as proposed by Marcet and Nicolini (2003). Though the switching-gain

extended the stable region for all interest-rate rules, in most cases it did not result in robustly

stable values of the gain. The results also suggest that the results in Evans and Honkapohja

(2009) rely on the distinction between optimal and operational monetary policy rules.

The analysis above shows that switching-gains result in stability, but potentially

develop exotic dynamics. These dynamics are characterized by several episodes of very

high volatility. This indicates that monetary policy rules that appear stable may in fact hide

a potential period of substantial economic turmoil driven entirely by expectations. Marcet

and Nicolini (2003) also find deviations from the rational expectations equilibrium, but their

model has two equilibria predicated on government imposition of exchange rate rules. This

18

paper documents exotic behavior in model with a single REE. The results presented above

suggest that policymakers should be concerned with the potential that expectations, and

expectations alone, can create exotic behavior that temporarily strays from the REE.

19

Notes

1 For

more discussion of optimality under learning see Mele, Molnár and Santoro (2011).

2 See

Woodford (2003) for derivation.

3 The

window size can be found by taking the inverse of the value of the gain.

4 In

Milani (2007b) W was set to 3000 for very long simulations.

5 If the interest rate target is high enough, then negative values impose a high cost to the policy maker.

While

this is true, it is not the same as the zero lower bound condition imposed in Adam and Billi (2006). The results

below are robust to high interest rate targets. Ascari and Ropele (2009) show that high trend inflation leads

to deterioration in efficient policy and potential indeterminacy. These points raise interesting questions that

should be examined in future research.

6 All

the targets have been set to zero for convenience.

7 These

values are chosen for ease of comparison to Evans and Honkapohja (2009). The results are not

sensitive to these parameter values.

8 One

might also create an operational policy by using lagged values. In the context of adaptive learning this

would be a naive expectation.

9 Bullard and Mitra (2002) provides an excellent evaluation of data timing and expectations for a Taylor type

rule under learning.

10 Estimates

of constant-gain values range from 0.03 to 0.1, respectively, see Milani (2007a) and Branch and

Evans (2006).

11 Though

the last deviation may be in an indicator of instability, extending the simulation to 10,000 periods

can show that this deviation is temporary and the future deviations remain close to the REE. This example is

meant to show that relatively large deviations can occur later in the simulation.

12 This

method will underestimate the number of simulations that are stable.

20

References

Adam, Klaus, and Roberto M. Billi. 2006. Optimal monetary policy under commitment

with a zero bound on nominal interest rates, Journal of Money, Credit and Banking

54(3): 728–52.

Ascari, Guido, and Tiziano Ropele. 2009. Trend inflation, Taylor principle and

indeterminacy, Journal of Monetary Economics 41(8): 1557–84.

Bernanke, Benjamin. 2007. Inflation expectations and inflation forecasting. Federal

Reserve Bank Speech, July 10.

Branch, William A., and George W. Evans. 2006. ‘A simple recursive forecasting

model’, Economics Letters 91(2): 158–66.

Bullard, James, and Kaushik Mitra. 2002. Learning about monetary policy rules,

Journal of Monetary Economics 49(6): 1105–29.

Cho, In-Koo, Noah Williams and Thomas J. Sargent. 2002. Escaping Nash inflation, The

Review of Economic Studies 69(1): 1–40.

Clarida, Richard, Jordi Gali and Mark Gertler. 2000. Monetary policy rules and

macroeconomic stability: evidence and some theory, Quarterly Journal of Economics

115(1): 147–80.

Duffy, John, and Xiao, Wei. 2007. The value of interest rate stabilization policies when

agents are learning, Journal of Money, Credit and Banking 39(8): 2041–56.

Evans, George W., and Seppo Honkapohja. 2001. Learning and expectations in

macroeconomics. Princeton, NJ: Princeton University Press.

Evans, George W., and Seppo Honkapohja. 2003. Adaptive learning and monetary

policy design, Journal of Money, Credit and Banking 35(6): 1045–72.

21

Evans, George W., and Seppo Honkapohja. 2006. Monetary policy, expectations and

commitment, The Scandinavian Journal of Economics 108(1): 15–38.

Evans, George W., and Seppo Honkapohja. 2009. Robust learning stability with

operational monetary policy rules. In Monetary Policy under Uncertainty and Learning,

edited by Karl Schmidt-Hebbel and Carl Walsh. Santiago, Chile: Central Bank of Chile,

pp. 145–70.

Howitt, Peter. 1992. Interest rate control and nonconvergence to rational expectations,

Journal of Political Economy 100(4): 776–800.

Jensen, Christian, and Bennett T. McCallum. 2002. The non-optimality of proposed

monetary policy rules under timeless perspective commitment, Economics Letters

77(2): 163–8.

Klein, Paul. 2000. Using the generalized Schur form to solve a multivariate linear

rational expectations model, Journal of Economic Dynamics and Control

24(10): 1405–23.

Marcet, Albert, and Juan P. Nicolini. 2003. Recurrent hyperinflations and learning,

American Economic Review 93(5): 1476–98.

McCallum, Bennett T. 1999. Issues in the design of monetary policy rules. In Handbook

of Macroeconomics, edited by John Taylor and Michael Woodford. Amsterdam, The

Netherlands: Elsevier, pp. 1483–1530.

Mele, Antonio, Krisztina Molnár and Sergio Santoro. 2011. The suboptimality of

commitment equilibrium when agents are learning. Unpublished paper, University of

Oxford.

Milani, Fabio. 2007a. Expectations, learning and macroeconomic persistence, Journal

of Monetary Economics 54(7): 2065–82.

Milani, Fabio. 2007b. Learning and time-varying macroeconomic volatility.

Unpublished paper, University of California-Irvine.

22

Sargent, Thomas J. 1999. The conquest of American inflation. Princeton, NJ: Princeton

University Press.

Woodford, Michael. 2003. Interest and prices: foundations of a theory of monetary

policy. Princeton, NJ: Princeton University Press.

23

DTa

DTc

Table 1: Operational vs. Optimal Rules

Woodford

CGG

Jensen McCallum

Oper

Opt

Oper

Opt

Oper

Opt

-41.2973 0.0231

-25.7550 0.0360

0.9264

0.9274

0.9865 0.9865

0.9791 0.9793

1.0388

1.0383

-41.5280 0.0185

-26.0154 0.0288

0.7381

0.7419

0.7886 0.7892

0.7815 0.7834

0.8285

0.8307

Displays computed value of the eigenvalues of the derivative of the T-map under different parameterizations. Woodford (2003): αx = 0.048, αi = 0.077, ϕ = 1/0.157,

λ = 0.024, β = 0.99, σu = σg = 0.2, and ρ = µ = 0.8. Clarida et al. (2000): ϕ = 4,

and λ = 0.075. Jensen and McCallum (2002): ϕ = 0.164, and λ = 0.02. If all eigenvalues within the unit circle then the model is E-stable under constant gain learning.

Eigenvalues less than one ensure E-stability under decreasing gain learning.

24

Table 2: Examples of Temporary Deviations

Mean

Variance

x

π

x

π

5000 Periods 0.9755 0.9757

1.0996 1.0000

100 Periods 0.9843 0.9978

4.8917 1.0020

5000 Periods 1.0082 1.0133

100 Periods 1.0489 0.9955

1.1178 1.0000

6.3118 1.0003

Relative mean and variance statistics from two simulations with

Woodford calibrated values and W =35, J=4, and γ̄z =0.025.

Compares different subsamples around a temporary deviation

from rational expectations that occurs after a burn in of 10,000

periods.

25

Table 3: Sensitivity of Switching Gain Parameters

W =35, J=5, and γ̄z =0.025

Mean

x

π

5000 Periods 1.0070 1.0115

100 Periods 1.0436 .09961

Variance

x

π

1.0940 1.0002

5.2390 1.0000

W =35, J=6, and γ̄z =0.025

5000 Periods 0.9944 0.9744

100 Periods 0.7178 1.0990

4.7127 1.0002

168.67 1.0078

W =45, J=4, and γ̄z =0.025

5000 Periods 1.0185 1.0223

100 Periods 0.9938 0.9930

1.0000 1.0000

1.0000 1.0000

W =25, J=4, and γ̄z =0.025

5000 Periods 0.9902 1.0080

100 Periods 1.2012 0.9983

2.8574 1.0010

84.858 1.0004

Relative mean and variance statistics from four simulations

with Woodford calibrated values. Compares different subsamples around a temporary deviation from rational expectations

that occurs after a burn in of 10,000 periods.

26

Table 4: Switching Gain Stability Sensitivity Analysis

Woodford parameters, J=4, and γ̄z =0.025

W

15

25

35

% Converge

61.28

87.02

89.86

45

90.58

55

90.50

65

90.08

75

89.34

85

88.22

95

86.16

105

84.46

115

83.32

125

81.68

Woodford parameters, J=4, and γ̄z =0.024

W

15

25

35

% Converge

87.96

94.16

95.64

45

95.80

55

95.84

65

95.70

75

95.52

85

94.98

95

94.34

105

93.58

115

93.30

125

92.48

CGG parameters, J=4, and γ̄z =0.074

W

15

25

35

% Converge

57.54

73.86

62.26

45

49.52

55

40.26

65

30.20

75

23.08

85

15.52

95

11.36

105

8.48

115

5.74

125

4.14

Shows the percent of simulations in which the last value of the estimated parameters lie within 1 percent of the RE paramters.

The historical window is the parameter the governs the number of periods used to calculate the historical average MSFE. These

results are based on 5,000 simulations of 10,000 periods each.

27

DTa

DTb0

DTb1

DTc

Table 5: Robustness of Commitment Rules

Woodford

CGG

DX

EH

DX

EH

-27.4387

0.0030

-12.7509

0.0201

-0.0674

0.9990

-0.2815

1.0431

-26.3243

-0.0762

-11.6997

-0.1942

0.8352

-0.9185

0.3695

-0.7144

-27.4387

0

-12.7509

0

-0.0674

-0.0347

-0.2815

-0.0295

-27.6392

0.0754

-12.5596

0.2239

-27.2455 -0.0316 + 0.0085i -12.8931 -0.0373 + 0.0485i

-0.2679 -0.0316 - 0.0085i -0.0902 -0.0373 - 0.0485i

0.1257

-0.0339

-0.4237

-0.0543

-27.8832

0.0715

-13.3539

-13.3539

0.0039

0.7192

-0.1992

0.7834

JM

DX

-0.2055

-0.0324

0.5599

0.6361

-0.2055

-0.0324

0.8099

0.6368

0.0343

0.2074

-5.4861

0.1711

EH

-5.0314

0.9402

6.7124

-0.3795

0

3.3469

135.7722

-14.9013

6.8163

-0.3912

-3.3547

0.7512

Displays computed value of the eigenvalues of the derivative of the T-map under different parameterizations for

the operationalized Duffy and Xiao rule (4) and the expectations based rule (5). Woodford (2003): αx = 0.048,

αi = 0.077, ϕ = 1/0.157, λ = 0.024, β = 0.99, σu = σg = 0.2, and ρ = µ = 0.8. Clarida et al. (2000): ϕ = 4,

and λ = 0.075. Jensen and McCallum (2002): ϕ = 0.164, and λ = 0.02. If all eigenvalues within the unit

circle then the model is E-stable under constant gain learning. Eigenvalues less than one ensure E-stability

under decreasing gain learning.

28

Figure 1: Explosive behavior of the operational Taylor-type rule. Woodford

parameterization and γ = 0.04

Figure 2: Convergence to the REE under Taylor-type rule. Woodford parameterization

and γ = 0.02

Figure 3: Stability of operational Taylor-type rule with endogenously switching-gain,

γ̄z = 0.025, and Woodford parameterization.

29

Figure 1

30

Figure 2

31

Figure 3