CHAPTER 2008-111 Committee Substitute for Senate Bill No. 1790

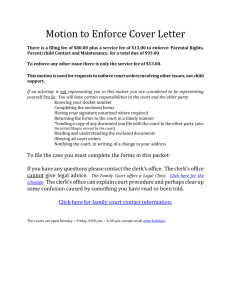

advertisement