ELMIRA COLLEGE STUDENT ACCIDENT AND STUDENT HEALTH INSURANCE PLAN

advertisement

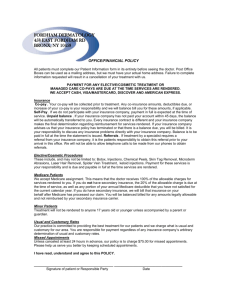

ELMIRA COLLEGE STUDENT ACCIDENT AND STUDENT HEALTH INSURANCE PLAN BENEFIT HIGHLIGHTS 2015/2016 Aggregate Maximum Benefit per Policy Year: Unlimited IN-NETWORK Deductible Amount per Covered Person per Policy Year Out-of-Pocket Maximum per Policy Year OUTPATIENT SERVICES Doctor’s Visits/Walk-in Care (limited to one visit per day and does not apply when related to surgery)Includes injections and infusion therapy when administered in the Doctor’s office. Urgent Care Hospital Emergency Room and Non-Scheduled Surgery, including operating room laboratory and x-ray examination, supplies. The co-pay is waived if admitted to the Hospital as an $250 $5,000 IN-NETWORK $25 co-pay per visit 100% of Allowable Charges OUT-OF-NETWORK $250 $5,000 OUT-OF-NETWORK $25 co-pay per visit 60% of R & C $40 co-pay per visit 80% of Allowable Charges $40 co-pay per visit 60% of R & C $150 co-pay per visit 80% of Allowable Charges $150 co-pay per visit 60% of R & C $25 co-pay per visit 80% of Allowable Charges $25 co-pay per visit 80% of Allowable Charges $25 co-pay per visit 60% of R & C $25 co-pay per visit 60% of R & C $25 co-pay per visit 80% of Allowable Charges $25 co-pay per visit 60% of R & C $25 co-pay per visit 80% of Allowable Charges $25 co-pay per visit 60% of R & C 100% of R & C Not subject to deductible and co-pays. 60% of R & C inpatient. X-Ray and Laboratory CAT Scan/MRI/PET Scans/Nuclear Medicine Diagnostic Services and Medical Procedures performed by the Doctor (other than Doctor’s visits, physiotherapy, x-rays and lab procedures). Habilitation and Rehabilitation Services Preventive Services Benefit (in accordance with the comprehensive guidelines supported by USPSTF and HRSA): Includes Preventive Services such as: • Adult Annual Physical Examinations • Adult Immunizations • Routine Gynecological Services/Well Woman Exams • Cervical Cytological Screening • Family Planning & Reproductive Health Services • Bone Mineral Density Measurements or Testing • Mammography Screenings • Well Baby and Well Child Care and Immunizations • Screening for Prostate Cancer All other Preventive Services required by USPSTF and HRSA. Chiropractic Services Allergy Testing & Treatment Alcoholism/Drug Abuse (up to 60 visits per Policy Year for a Covered Person / up to 20 visits per Policy Year for family members) (Total number of visits combined shall not exceed 60 visits) Psychiatric Conditions Biologically Based Mental Illness Mental or Nervous Disorders Outpatient Prescription Benefit Eligible Prescriptions are paid on a reimbursement basis and a claim form will need to be filed per the standard claim procedures. Benefits include medication management for chronic conditions. Outpatient Surgical Expense Outpatient Anesthesia (professional services) Day Surgery Facility/Miscellaneous $25 co-pay per visit 80% of Allowable Charges Paid the same as any other Sickness Paid the same as any other Sickness Paid the same as any other Sickness Paid the same as any other Sickness but not less than 20 days per Policy Year Co-pay per prescription or refill: Generic: $15 copay Formulary: $25 co-pay Non-Formulary: $40 co-pay Please Note: Co-pay does not apply for Generic Prescription Contraceptives as specified by the Patient Protection and Affordable Care Act (PPACA). 80% of Allowable Charges 60% of R & C 80% of Allowable Charges 60% of R & C 80% of Allowable Charges 60% of R & C $25 co-pay per visit 80% of Allowable Charges Second Surgical Opinion 80% of Allowable Charges Radiation Therapy and Chemotherapy INPATIENT SERVICES Room and Board Expense (except if intensive care unit, limited to average daily semi-private room rate) Pre-Admission Testing IN-NETWORK $25 co-pay per visit 60% of R & C 60% of R & C OUT-OF-NETWORK $150 copay per admission then $150 copay per 80% of Allowable Charges admission then 60% of R &C 80% of Allowable Charges 60% of R & C Hospital Miscellaneous 80% of Allowable Charges 60% of R & C Habilitation and Rehabilitation Services 80% of Allowable Charges 60% of R & C Surgical Expense (Doctor’s Charges) 80% of Allowable Charges 60% of R & C Assistant Surgeon 80% of Allowable Charges 60% of R & C Anesthesia (professional services) 80% of Allowable Charges 60% of R & C Doctor’s Visits (limited to one visit per day) 80% of Allowable Charges 60% of R & C Skilled Nursing Facility 80% of Allowable Charges 60% of R & C Psychiatric Conditions Biologically Based Mental Illness Mental or Nervous Disorders Paid the same as any other Sickness Paid the same as any other Sickness Alcoholism/Drug Abuse (Detox up to 7 days per Policy Year/Rehab up to 30 days per Policy Year) IN-NETWORK OTHER SERVICES Specialist’s, Consultant’s Fees Expense Pediatric Services, including oral and vision care Dental Treatment for Injury Ambulance Maternity, Complications of Pregnancy & Newborn Care Durable Medical Equipment and Braces; Prosthetic Appliances and Devices Home Health Care: Up to 40 visits per Policy Year. Four hours of home health aide service shall be considered as one home care visit. OUT-OF-NETWORK $25 co-pay per visit $25 co-pay per visit 80% of Allowable Charges 60% of R & C $25 co-pay per visit $25 co-pay per visit 80% of Allowable Charges 60% of R & C 80% of Actual Charge 80% of R & C Paid the same as any other Sickness 80% of Allowable Charges 60% of R & C 80% of Allowable Charges 60% of R & C 80% of Allowable Charges 60% of R & C Hospice Care $50,000 Maximum Benefit Medical Evacuation $50,000 Maximum Benefit Repatriation of Remains Additional Coverage Required by the State of New York: Pre-Hospital Medical Emergency Services; Diabetic Equipment; Supplies and Self-Management Education; Autism Spectrum Disorders; Contraceptive Services; Breast Reconstruction; Breast Cancer Treatment; Clinical Trials Expense; Cancer Second Opinion; Enteral Formulas up to $2,500 per Policy Year; End of Life Care; Hearing Aids Expense; Off Label Cancer Drugs; and any other applicable coverage required by the State of New York. Please see the Policy on file with the Policyholder for details. *PREMIUM RATES: Fall Term Winter-Summer Term 8/1/15-12/31/15 1/1/16-7/31/16 $900 $ 900 *Rates include administrative fees. This document provides only a brief description of the coverage available. The Policy contains reductions, limitations, exclusions and termination provisions. Full details of the coverage are contained in each Policy. If there are any conflicts between this document and the Policy, the Policy shall govern.