SAN BERNARDINO COMMUNITY COLLEGE DISTRICT

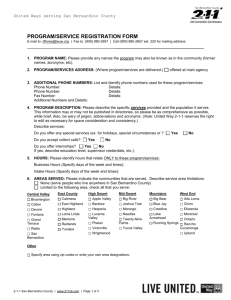

advertisement