Macroeconomics Unit Test

advertisement

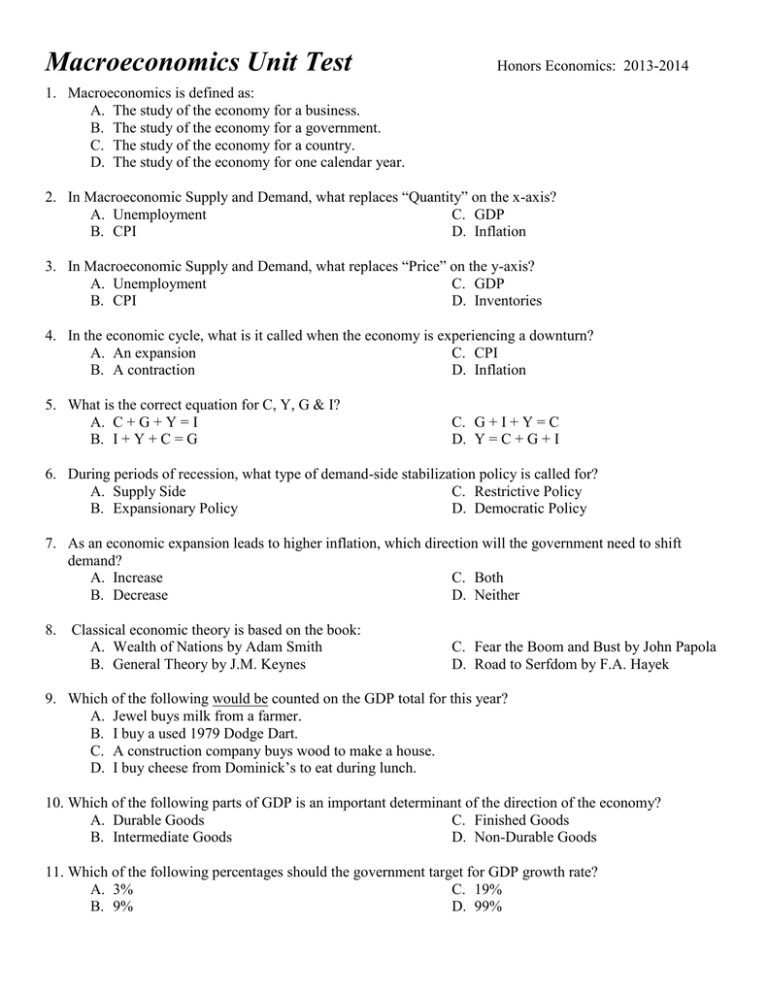

Macroeconomics Unit Test Honors Economics: 2013-2014 1. Macroeconomics is defined as: A. The study of the economy for a business. B. The study of the economy for a government. C. The study of the economy for a country. D. The study of the economy for one calendar year. 2. In Macroeconomic Supply and Demand, what replaces “Quantity” on the x-axis? A. Unemployment C. GDP B. CPI D. Inflation 3. In Macroeconomic Supply and Demand, what replaces “Price” on the y-axis? A. Unemployment C. GDP B. CPI D. Inventories 4. In the economic cycle, what is it called when the economy is experiencing a downturn? A. An expansion C. CPI B. A contraction D. Inflation 5. What is the correct equation for C, Y, G & I? A. C + G + Y = I B. I + Y + C = G C. G + I + Y = C D. Y = C + G + I 6. During periods of recession, what type of demand-side stabilization policy is called for? A. Supply Side C. Restrictive Policy B. Expansionary Policy D. Democratic Policy 7. As an economic expansion leads to higher inflation, which direction will the government need to shift demand? A. Increase C. Both B. Decrease D. Neither 8. Classical economic theory is based on the book: A. Wealth of Nations by Adam Smith B. General Theory by J.M. Keynes C. Fear the Boom and Bust by John Papola D. Road to Serfdom by F.A. Hayek 9. Which of the following would be counted on the GDP total for this year? A. Jewel buys milk from a farmer. B. I buy a used 1979 Dodge Dart. C. A construction company buys wood to make a house. D. I buy cheese from Dominick’s to eat during lunch. 10. Which of the following parts of GDP is an important determinant of the direction of the economy? A. Durable Goods C. Finished Goods B. Intermediate Goods D. Non-Durable Goods 11. Which of the following percentages should the government target for GDP growth rate? A. 3% C. 19% B. 9% D. 99% 12. Which of the following does rising inflation generally hurt? A. The average American B. Upper-class Americans C. Banks lending money. D. People looking for home loans. 13. Which of the following is the correct order of lowest to highest inflation types? A. Creeping-Moderate-Walking-RunningC. Creeping-Moderate-Walking-GallopingGalloping-Hyperinflation Running- Hyperinflation B. Creeping-Moderate-Walking-RunningD. Moderate- Creeping -Walking-RunningHyperinflation-Galloping Galloping-Hyperinflation 14. Inflation that rises past income causes a loss in all of the following EXCEPT: A. Real Income C. Purchasing Power B. Take Home Salary D. The value of money 15. Which of the following percentages should the government target for our inflation rate? A. 0% C. 6% B. 2% D. 10% 16. Which type of unemployment is a person who gets replaced on the assembly line by a robot? A. Frictional C. Cyclical B. Structural D. Full Employment 17. Which type of unemployment is a person who goes back to school for re-education? A. Frictional C. Cyclical B. Structural D. Full Employment 18. Which type of unemployment is a person who is laid off during a recession? A. Frictional C. Cyclical B. Structural D. Full Employment 19. According to most economists, which types of unemployment are beneficial for the health of the economy? A. Frictional & Structural C. Cyclical & Frictional B. Structural & Cyclical D. Full Employment 20. Which of the following percentages should the government target for our unemployment rate? A. 0% C. 10% B. 5% D. 15% 21. Of the following types of taxes, which is the only one a lottery winner won’t pay? A. State Income Tax C. Capital Gains Tax B. Federal Income Tax D. Gift Tax 22. A type of tax that rises with income level. A. Regressive B. Progressive C. Direct D. Income 23. Which pair below is INCORRECT? A. Income Tax – Progressive B. Payroll Tax – Regressive C. Sales Tax – Proportional D. Sin Tax – Regressive 24. The amount of each additional dollar a consumer receives which they will spend. A. Potential GDP C. Multiplier B. Consumption D. Marginal Propensity to Consume 25. If there is a MPC of .50, what is the Multiplier? A. .50 B. 2 C. 10 D. 50 26. If the American public receives a tax cut, what determines how much of it they will spend? A. Whether they perceive the cut as permanent or temporary. B. What they need to buy. C. How much money they get. D. The inflation rate. 27. Full Employment is defined by economists as being closest to which percentage? A. 80 % C. 95 % B. 90 % D. 100 % 28. Potential GDP A. Total GDP that the economy is capable of producing. B. Total value of goods and services produced in the domestic economy in a year. C. Total GDP that the economy is capable of producing at Full Employment. D. Total GDP that the economy is capable of producing at 100 % employment. 29. Can the economy produce more than its Potential GDP? A. Yes B. No C. It depends. D. Not sure, was it on the study guide? 30. What is the biggest determinant of consumer spending for the economy as a whole? A. Rate of Interest C. Income B. Wealth D. Inflation Rate 31. What is the biggest determinant of investment spending for the economy as a whole? A. Potential GDP C. Marginal propensity to consume B. Multiplier D. Confidence of business 32. What is the biggest determinant of government spending for the economy as a whole? A. Inflation Rate C. Business Confidence B. Marginal Propensity to Consume D. Our elected representatives. 33. Currently our economy is closest to which of these unemployment numbers? A. 2 % C. 6 % B. 4 % D. 8 % 34. Currently our economy is closest to which of these inflation numbers? A. 2 % C. 7 % B. 4 % D. 10 % 35. Currently our economy is closest to which of these Real GDP growth figures? A. 2 % C. 8 % B. 5 % D. 10% 36. When a liberal (Democrat) tries expansionary policy, what generally do they do? A. Increase G C. Increase Taxes B. Decrease G D. Decrease Taxes 37. When a conservative (Republican) tries restrictive policy, what generally do they do? A. Increase G C. Increase Taxes B. Decrease G D. Decrease Taxes 38. Which of the following Economic Indicators decreases when the economy is improving? A. Inventories C. Stock Prices B. Consumer Confidence D. Retail Sales 39. Which of the following Economic Indicators would be most useful in predicting a recession is about to begin? A. Manufacturing Labor Hours C. Industrial Production B. New Durable Good Orders D. Unemployment 40. An example of expansionary fiscal policy would be A. Cutting taxes. B. Cutting Government spending C. Cutting production of consumer goods D. Cutting prices of consumer goods. 41. In contrast with classical economics, Keynesian economics: A. Reduces the role of government. B. Relies more heavily on the laws of supply and demand. C. Believes strongly in Laissez Faire philosophy. D. More strongly emphasizes the role of the government in the economy. 42. All of the following are characteristics of classical economics EXCEPT A. A free market economy. B. A significant role for government in the running of the economy. C. The law of supply and demand. D. The idea of achieving market equilibrium. 43. Which of these statements is a fundamental part of Keynesian economics? A. The federal government should have a balanced budget every year to protect economic growth. B. The government should reduce taxes to promote economic growth by increasing aggregate supply. C. The government can use deficit spending to increase aggregate demand and pull the economy out of recession. D. The economy will only reach equilibrium and prosperity through the self-regulation of the free market. 44. Which of these statements is a fundamental part of supply-side economics? A. The federal government should have a balanced budget every year to protect economic growth. B. The economy will only reach equilibrium and prosperity through the self-regulation of the free market. C. The government can use deficit spending to increase aggregate demand and pull the economy out of recession. D. The government should reduce taxes and regulations to promote economic growth by increasing aggregate supply. 45. How did the Great Depression relate to the school of classical economics? A. The end of the Great Depression in the 1940s confirmed many of the theories of classical economics. B. Crises like the Great Depression were predicted by Adam Smith. C. The Great Depression appeared to disprove the classical theory that demand and supply could return to a healthy equilibrium through market forces alone. D. The issues of the Great Depression had no connection to classical economics. Who Said it? A. John Maynard Keynes B. Friedrich Von Hayek C. Neither 46. Savings is destruction, that’s the paradox of thrift, don’t keep money in your pocket or that growth will never lift. 47. Your so-called “stimulus” will make things even worse. It’s just more of the same, more incentives perverse. 48. Don’t look for a cure from the hair of the dog. 49. Read my lips, no new taxes. 50. In the long run…..we’re all dead. 51. We need more government spending, now its stimulus season. 52. Persistent unemployment, the result of sticky wages. Waiting for recovery? Seriously? That’s outrageous! 53. You provide them with cover to sell us a free lunch, then all we are left with is debt, and a bunch. 54. The place you should study isn’t the bust. It’s the boom that should make you feel leery, that’s the thrust. 55. Prepared to get schooled in my Austrian perspective. 56. C, I, G, all together gets to Y. 57. In the long run, my friend, it’s your theory that’s dead. 58. The monetary and the fiscal, they’re equally correct. Public works, digging ditches, war has the same effect. 59. Blame low interest rates….. 60. No…..it’s the animal spirits. Short Answer Question 10 points possible – answer on blank, separate shhet. Explain the role of the government in the U.S. Economy from 9/11 to present. Cite specific examples and events that occurred and the impact of each. Identify them, in your opinion, as positive or negative. Lastly, cite the belief systems of Keynes and Hayek and which one you agree with. Use the events you listed above as support for your opinion of Keynes or Hayek.