What is Macroeconomics? “Aggregation,” “Aggregated Demand”

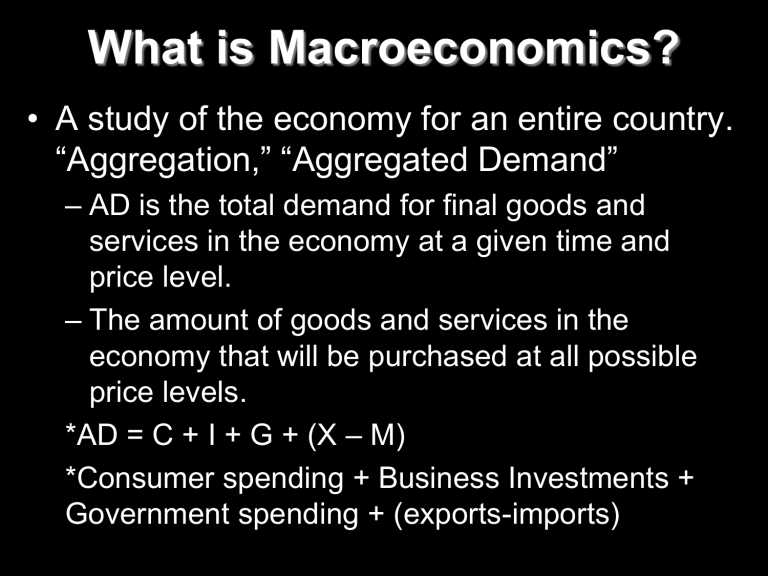

What is Macroeconomics?

• A study of the economy for an entire country.

“Aggregation,” “Aggregated Demand”

– AD is the total demand for final goods and services in the economy at a given time and price level.

– The amount of goods and services in the economy that will be purchased at all possible price levels.

*AD = C + I + G + (X – M)

*Consumer spending + Business Investments +

Government spending + (exports-imports)

Supply and Demand for Macro

• Shifts in Demand and effects?

P

• Shifts in Supply and effects?

P

Q

A History of GDP Growth

A History of Inflation

Government goals

• Price stability

– Measure: Inflation / CPI

• Full Employment

– Measure: Unemployment %

• Economic Growth

– Measure: GDP

Stabilization Policy

• Demand Side Policy

– If there is a recession…..gov’t will increase demand. How?

– 1) Decrease interest rates

– 2) Decrease Taxes

– 3) Government Expenditures

• Causing…

• Inflation. Spending goes up and producers can charge high prices.

Stabilization Policy

– If there is inflation…..gov. will decrease demand.

– How?

– Raise taxes or interest rates, cut gov’t spending

• Causing…higher unemployment and a recession.

• Unemployment OR Inflation will result when the government tries to control demand.

• Keynesian economics suggest that increasing government spending and decreasing tax rates will stimulate aggregate demand.

Stabilization Policy

• Supply Side Policy

– If there is a recession…..gov. will increase supply.

– If there is inflation…..gov. will increase supply.

• But……unemployment AND inflation will result when the supply decreases.

Supply Side Economics

• Supply Side Policies are government attempts to increase productivity

• Shifts Aggregate Supply (AS) to the…??

– Right

– Causing an increase of decrease in prices?

Supply Side website

Macroeconomic Supply &

Demand

Price

CPI

GDP

Quantity

AD

Aggregate Supply Graphs

Economy is at full employment, full potential. Similar to the PPF

(productions possibility frontier).

Like the PPF shifts outward with growth in the labor supply, improvements in technology, and the addition of new productive resources such as capital, so does the AS curve.

Inflation

Facts about GDP

• Definition of GDP

• Formula for GDP

• The Numbers

• Nominal vs. Real GDP

• Terms

– Final Goods vs. Intermediate Goods

– Durable vs. Non-Durable Goods

• GDP is not intended to measure the well-being of our economy. Why not?

Fiscal Policy

• Using government spending and revenue collection to influence the economy.

Types of Fiscal Policy

• Expansionary Policy

– To increase the output of the economy.

• Restrictive / Contractionary Policy

– To decrease the output of the economy.

• The Politics of Fiscal Policy

• The Problems with Fiscal Policy

Fiscal Policy History

• Classical Economics

– Laissez Faire from Adam Smith

– Allow the free market to fix itself.

– “In the long run, the economy will be selfsustaining.”

Fiscal Policy History

• Keynesian Economics

– Problems with Classical Theory?

– “In the long run, we are all dead.”

– Proposed a new role for Government

Supply Side Economics

• Reagan’s Version

– Supply side vs. Trickle Down

• Clinton

– Investment Tax Credit

• How do we change the supply curve?

• What are problems with supply side theory?

Sample Problem

• Current Economic Conditions:

– Unemployment Rate 7.5% (13% underemployed)

– GDP Growth Rate 2%

– Inflation Rate 1%

• What’s the problem?

• What’s the general solution?

• How would a Classical economist fix it? A

Keynesian? A Supply-sider?

• Three Types of Unemployment

– Frictional: moving between jobs.

• Leaving Motorola to work at Apple

– Structural: shift in demand

• Typewriters replaced by computers. Typewriter factories shut down, workers???

– Cyclical: unemployment rate moves in opposite direction of GDP growth rate. So when GDP growth is small (or negative) unemployment is high.

Facts about Inflation

• Definition of Inflation

• The CPI

• The Numbers

• Who does inflation hurt?

– The average person?

– Those who lend money?

– Those who borrow money?

– The government?

Facts about Inflation

• Effects of Inflation

– Purchasing Power

– Interest Rates

• Creeping vs. Galloping

Facts about Unemployment

• Numbers

• Definition of Unemployment

• Three Categories of People

• 1. Employed

• 2. Unemployed but expected to return.

• 3. Not in the Labor Force