Financial Statements and Report of Independent Certified Public Accountants

advertisement

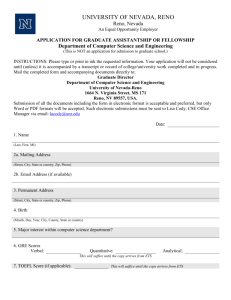

Financial Statements and Report of Independent Certified Public Accountants University of Nevada, Reno Foundation June 30, 2009 Contents Page Report of Independent Certified Public Accountants 3 Management’s Discussion and Analysis 5 Basic Financial Statements Balance Sheet 11 Statement of Support and Revenue, Expenses and Changes in Fund Net Assets 12 Statement of Cash Flows 13 Notes to Financial Statements 15 Supplemental Information Unrestricted Fund – Alumni and University Program Expenses 25 Unrestricted Fund – Administrative and Fundraising Expenses 26 Audit Tax Advisory Report of Independent Certified Public Accountants Board of Trustees University of Nevada, Reno Foundation Grant Thornton LLP 100 W Liberty Street, Suite 770 Reno, NV 89501-1965 T 775.786.1520 F 775.786.7091 www.GrantThornton.com We have audited the accompanying balance sheet of the University of Nevada, Reno Foundation (the “Foundation”) as of June 30, 2009, and the related statements of support and revenue, expenses and changes in fund net assets, and cash flows for the year then ended. These basic financial statements are the responsibility of the Foundation’s management. Our responsibility is to express an opinion on these basic financial statements based on our audit. The prior year summarized comparative information has been derived from the Foundation’s 2008 financial statements, and in our report dated September 9, 2008, we expressed an unqualified opinion on the respective basic financial statements. We conducted our audit in accordance with auditing standards generally accepted in the United States of America as established by the Auditing Standards Board of the American Institute of Certified Public Accountants. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion. In our opinion, the basic financial statements referred to above present fairly, in all material respects, the financial position of the University of Nevada, Reno Foundation as of June 30, 2009, and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America. The Management’s Discussion and Analysis on pages 5 through 9 is not a required part of the basic financial statements but is supplemental information required by accounting principles generally accepted in the United States of America. We have applied certain limited procedures, which consisted principally of inquiries of management regarding the methods of measurement and presentation of the required supplemental information. However, we did not audit the information and express no opinion on it. Our audit was conducted for the purpose of forming an opinion on the financial statements that comprise the Foundation’s basic financial statements. The accompanying supplementary information listed in the table of contents is presented for purposes of additional analysis and is not a required part of the basic financial statements. The supplemental information has been subjected to the auditing procedures applied in the audit of the basic financial statements and, in our opinion, are fairly stated in all material respects in relation to the basic financial statements taken as a whole. Reno, Nevada September 15, 2009 Grant Thornton LLP U.S. member firm of Grant Thornton International Ltd MANAGEMENT’S DISCUSSION AND ANALYSIS University of Nevada, Reno Foundation MANAGEMENT’S DISCUSSION AND ANALYSIS For the year ended June 30, 2009 This section of the University of Nevada, Reno Foundation’s (“the Foundation”) annual financial report presents our discussion and analysis of the financial performance of the Foundation for the fiscal year ended June 30, 2009. This discussion and analysis has been prepared by management along with the accompanying financial statements and footnotes and should be read in conjunction with the accompanying financial statements and footnotes. Reporting Entity The University of Nevada, Reno Foundation is a nonprofit corporation whose mission is to facilitate the solicitation and management of gift revenues and endowments on behalf of the University of Nevada (University). The Foundation was established by the Nevada System of Higher Education (“NSHE”), who is the sole owner of the Foundation. Additionally, the appointment to the Foundation Board of Trustees is the responsibility of the NSHE. As such, the Foundation is considered to be a component of both the University and NSHE. Transactions with the University relate primarily to the disbursement of gift funds to the University and receipt of support from the University to fund administrative expenses of the Foundation. Financial Statements The basic financial statements of the Foundation are the Balance Sheet; Statement of Support and Revenue, Expenses and Changes in Fund Net Assets; and the Statement of Cash Flows. The Balance Sheet presents the financial position of the Foundation as of June 30, 2009. The Statement of Support and Revenue, Expenses and Changes in Fund Net Assets summarizes the Foundation’s financial activity for the year ended June 30, 2009. The Statement of Cash Flows reflects the effects on cash that result from the Foundation’s operating activities, investing activities, and capital and non-capital financing activities for the year ended June 30, 2009. The following schedules are prepared from the Foundation’s basic financial statements. Balance Sheet This statement is presented with three major categories; assets, liabilities and fund net assets. The assets are classified between current and non-current. The current assets include cash and cash equivalents, investments, accounts receivable, prepaid expenses and deposits, accrued interest receivable and the current portion of pledges, and current portion of notes receivable. The non-current assets include investments, pledges receivable, net of allowance for doubtful accounts, notes receivable, real property held for investment, residual interests in irrevocable trusts, other assets and equipment, less accumulated depreciation. Liabilities are also classified between current and non-current. Current liabilities include the amount due to the University and accounts payable. Non-current liabilities consist of unearned revenue. Total assets decreased by $19.4 million during the year ended June 30, 2009. This change in total assets is due primarily to an $18.9 million decrease in the investments, a $6.2 million decrease in cash, and a $5.1 million increase in pledge receivables. 5 University of Nevada, Reno Foundation MANAGEMENT’S DISCUSSION AND ANALYSIS - CONTINUED For the year ended June 30, 2009 Balance Sheet – Continued Gross pledges receivable increased by $5.8 million as a result of fundraising activities in connection with the construction of the new Medical Education Building. This was off-set by a $0.7 million allowance for uncollectable pledges that was recorded in the current year due to the current economic climate. Notes receivable increased by $1.0 million due to a loan to the University of Nevada for construction of the Davidson Math and Science Center. Current liabilities increased by $0.8 million which was largely due to amounts owed to the University at the end of the year. Fund net assets decreased by $19.9 million for the year ended June 30, 2009. The following is a comparison of the balance sheet at June 30, 2009 and 2008. Balance Sheet 2009 2008 $112,014,023 17,160,638 $138,620,359 9,936,124 Total assets $129,174,661 $148,556,483 Liabilities Current liabilities Non-current liabilities $ 3,851,614 2,418,832 $ 3,040,289 2,668,543 6,270,446 5,708,832 Fund net assets Invested in capital assets Unrestricted Restricted – expendable Endowment – nonexpendable 17,768 8,202,345 37,488,599 77,195,503 21,283 7,598,024 35,605,611 99,622,733 Total fund net assets 122,904,215 142,847,651 $129,174,661 $148,556,483 Assets Current assets Non-current assets Total liabilities Total liabilities and fund net assets 6 University of Nevada, Reno Foundation MANAGEMENT’S DISCUSSION AND ANALYSIS - CONTINUED For the year ended June 30, 2009 Fund Net Assets Total fund net assets were $122.9 million at June 30, 2009, of which $8.2 million is available for the unrestricted purposes of the Foundation. Included in unrestricted net assets are Quasi Endowment and other designated funds of $5.3 million. The Quasi Endowment is a board directed endowment which the board has set aside for designated purposes; it is not a donor designated endowment. Financial Analysis of Fund Net Assets 2009 Invested in capital assets Unrestricted Undesignated Quasi Endowment and other Restricted - expendable Endowment - nonexpendable $ Total fund net assets 17,768 2008 $ 21,283 2,899,976 5,302,369 37,488,599 77,195,503 2,357,390 5,240,634 35,605,611 99,622,733 $122,904,215 $142,847,651 Statement of Support and Revenue, Expenses and Changes in Fund Net Assets This statement reflects the results of the Foundation’s operations on fund net assets for the year ended June 30, 2009. The statement is broken down into three categories: Operating Support and Revenue, Operating Expenses and Investment Income (Loss). Operating support and revenue include donor contributions, university support and special events and other income. These revenues decreased from the prior year by $14.7 million. Donor contributions decreased by $14.6 million when compared to the prior year. This decrease is due primarily to extensive fundraising activities and donor contributions in connection with the construction of the Davidson Math and Science Center in the prior year. University support increased by 9% due to having vacant positions filled and special events and other income decreased by 28% due to a decrease in souvenir sales and event revenue in the schools and colleges. Investment income (loss) decreased by $23.9 million. The net decrease in the fair market value of the investments for the year was $29.9 million. As a result, the fair market value of the investments at June 30, 2009 was less than the cost by $12.3 million. Operating expenses consist of alumni programs, capital projects, university programs, university scholarships, and administrative and fundraising expenses and decreased by $16.2 million for the year ended June 30, 2009 when compared to prior year. Capital projects accounted for $15.4 million of the decrease in operating expenses. Expenses for alumni programs, administrative and fundraising decreased slightly, while scholarships increased slightly over the previous year. 7 University of Nevada, Reno Foundation MANAGEMENT’S DISCUSSION AND ANALYSIS - CONTINUED For the year ended June 30, 2009 Statement of Support and Revenue, Expenses and Changes in Fund Net Assets - Continued The following is a comparison of the results of operations for the years ended June 30: Results of Operations 2009 2008 $17,358,635 2,213,239 758,714 $31,965,934 2,036,867 1,058,606 6,190,141 2,083,011 26,520,729 37,144,418 Investment income Interest and dividend income Realized gain on sale, net Unrealized loss Management fees Redemption and consultation fees 2,143,717 2,043,378 (29,915,724) 2,372,243 (222,735) 3,770,832 6,229,952 (10,129,479) 678,128 (190,995) Investment income (loss) (23,579,121) 358,438 2,941,608 37,502,856 294,188 6,627,705 10,317,085 2,453,849 1,594,233 1,597,984 374,464 22,035,410 11,013,857 2,414,086 1,512,895 1,730,210 22,885,044 39,080,922 $(19,943,436) ($1,578,066) Revenues Donor contributions University support Special events and other income Additional to permanent and term endowments Total non-investment revenue Total revenues Expenses Alumni programs Capital projects University programs University scholarships Administrative Fundraising Total expenses Net change in fund net assets 8 University of Nevada, Reno Foundation MANAGEMENT’S DISCUSSION AND ANALYSIS - CONTINUED For the year ended June 30, 2009 Economic Factors The Foundation’s primary sources of revenue are donor contributions, university support and investment income. Comparing fiscal years ended June 30, 2009 to June 30, 2008, donor contributions decreased by 46%. The majority of this decrease was due to the fundraising activities and donor contributions for the new Davidson Math and Science building in the previous year. Investment income declined during the current year due primarily to a decrease in market value of the Foundation’s investments from June 30, 2008 to June 30, 2009 in the amount of $29.9 million. Additionally, the Foundation sold off investments to transfer construction funds to the university. As stated in last year’s audited financial statements, the economic condition has had a negative impact on our donor contributions and endowments as well as our investment income for the year ended June 30, 2009. Based on existing economic conditions, the Board of Trustees has prepared the next fiscal year’s budget based upon conservative estimates of revenues in addition to reducing expenses. Requests for Information This report is designed to provide a general overview of the University of Nevada, Reno Foundation’s finances for all interested parties. For additional information or questions concerning the information contained in this report, please call (775) 784-1587. 9 BASIC FINANCIAL STATEMENTS University of Nevada, Reno Foundation BALANCE SHEET June 30, 2009 (With comparative totals as of June 30, 2008) ASSETS Total 2008 Total 3,314,217 73,335,838 5,355 398,000 2,405 77,055,815 $ 14,660,908 94,073,506 520,852 31,407 38,872 2,514,716 173,762 112,014,023 $ 20,869,987 114,343,299 655,684 8,415 8,452 2,556,106 178,416 138,620,359 1,878,256 10,899,623 1,000,000 377,234 402,265 213,602 110,035 2,365 2,028,405 45,900 1,878,256 11,009,658 1,002,365 380,734 2,430,670 441,187 471,030 5,865,296 4,489 408,240 2,781,561 384,225 17,768 202,953 14,770,980 2,186,705 17,768 17,160,638 21,283 9,936,124 $ 8,488,985 $ 41,443,156 $ 79,242,520 $ 129,174,661 $ 148,556,483 $ 124,595 20,477 145,072 $ 3,660,084 27,846 3,687,930 $ $ $ 123,800 268,872 266,627 3,954,557 2,028,405 2,047,017 2,418,832 6,270,446 2,668,543 5,708,832 17,768 8,202,345 8,220,113 37,488,599 37,488,599 77,195,503 77,195,503 17,768 8,202,345 37,488,599 77,195,503 122,904,215 21,283 7,598,024 35,605,611 99,622,733 142,847,651 $ 8,488,985 $ 41,443,156 $ 79,242,520 $ 129,174,661 $ 148,556,483 Unrestricted Restricted $ 4,261,385 3,418,718 369,648 31,407 33,517 171,357 8,286,032 $ 7,085,306 17,318,950 151,204 2,116,716 26,672,176 3,500 181,685 2009 Endowment CURRENT ASSETS Cash and cash equivalents Investments Accounts receivable Prepaid expenses and deposits Accrued interest receivable Current portion of pledges receivable, net Current portion of notes receivable Total current assets $ NON-CURRENT ASSETS Investments Pledges receivable, net Notes receivable Real property, held for investment Residual interest-irrevocable trusts Other Equipment, at cost, less accumulated depreciation of $12,923 Total non-current assets Total assets LIABILITIES AND FUND NET ASSETS CURRENT LIABILITIES Due to University of Nevada Accounts payable Total current liabilities 18,612 18,612 3,784,679 66,935 3,851,614 3,015,469 24,820 3,040,289 NON-CURRENT LIABILITIES Unearned revenue Total liabilities FUND NET ASSETS Investment in capital assets Unrestricted Restricted - expendable Restricted - nonexpendable Total fund net assets Total liabilities and fund net assets The accompanying notes are an integral part of this statement. 11 University of Nevada, Reno Foundation STATEMENT OF SUPPORT AND REVENUE, EXPENSES AND CHANGES IN FUND NET ASSETS Year ended June 30, 2009 (With comparative totals for the year ended June 30, 2008) Unrestricted Operating support and revenue Donor contributions University support Special events and other income 2008 Total - $ 17,358,635 2,213,239 758,714 $ 31,965,934 2,036,867 1,058,606 $ 17,018,492 579,272 2,732,824 17,597,764 - 20,330,588 35,061,407 294,188 66,090 - 6,627,705 10,250,995 2,453,849 - 294,188 6,627,705 10,317,085 2,453,849 374,464 22,035,410 11,013,857 2,414,086 360,278 19,332,549 - 19,692,827 35,837,817 1,594,233 1,597,984 - - 1,594,233 1,597,984 1,512,895 1,730,210 Total administrative and fundraising expenses 3,192,217 - - 3,192,217 3,243,105 Total operating expenses 3,552,495 19,332,549 - 22,885,044 39,080,922 (819,671) (1,734,785) - (2,554,456) (4,019,515) 1,421,809 (685,221) (24,315,709) (23,579,121) 358,438 - - 6,190,141 6,190,141 2,083,011 17,227 (18,559) 4,471,634 (168,640) (4,488,861) 187,199 - - (1,332) 4,302,994 (4,301,662) - - 600,806 1,882,988 (22,427,230) (19,943,436) (1,578,066) 7,619,307 35,605,611 99,622,733 142,847,651 144,425,717 $ 8,220,113 $ 37,488,599 $ 77,195,503 $ 122,904,215 $ 142,847,651 Operating expenses Program expenses Alumni programs Capital projects University programs University scholarships Total program expenses Administrative and fundraising expenses Administrative Fundraising OPERATING INCOME (LOSS) Investment income (loss) Additions to permanent and term endowments Transfers between funds Distribution of expendable endowment Other Total transfers between funds NET CHANGE IN FUND NET ASSETS Fund net assets at beginning of year Fund net assets at end of year The accompanying notes are an integral part of this statement. 12 $ Total 340,143 2,213,239 179,442 Total operating support and revenue $ 2009 Endowment Restricted University of Nevada, Reno Foundation STATEMENT OF CASH FLOWS For the year ended June 30, 2009 (With comparative totals for the year ended June 30, 2008) Unrestricted Cash flows from operating activities: Donor contributions University support Special events and other income Cash paid to University Cash paid to employees for services Cash paid to suppliers 2008 Total - $ 12,176,595 2,186,895 758,714 (18,654,211) (2,526,453) (640,095) $ 27,762,036 1,864,793 1,059,100 (34,614,729) (2,422,267) (894,853) $ 11,835,646 579,272 (17,669,936) 17,470 (1,461,007) (5,237,548) - (6,698,555) (7,245,920) (1,332) 4,302,994 6,059,198 (4,301,662) 6,059,198 - 4,388,099 - (1,332) 4,302,994 1,757,536 6,059,198 4,388,099 (9,148) - - (9,148) (19,539) (9,148) - - (9,148) (19,539) 2,923,129 17,663,918 (18,063,288) 5,298 - 365,593 168,039 (2,435,969) 1,050,000 (2,050,000) 1,046,692 8,939,338 (15,174,804) 1,480 - 4,335,414 26,771,295 (35,674,061) 1,056,778 (2,050,000) 4,467,240 37,638,879 12,500 (41,313,993) 5,200 (6,250) Net cash provided by (used in) investing activities 2,529,057 (2,902,337) (5,187,294) (5,560,574) 803,576 NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS 1,057,570 (3,836,891) (3,429,758) (6,209,079) (2,073,784) 3,203,815 10,922,197 6,743,975 20,869,987 22,943,771 $ 4,261,385 $ 7,085,306 $ 3,314,217 $ 14,660,908 $ 20,869,987 Cash flows from non-capital financing activities: Additions to permanent and term endowments Transfer between funds Net cash provided by (used in) non-capital financing activities Cash flows from capital and related financing activities: Purchase of equipment Net cash used in capital and related financing activities Cash flows from investing activities: Investment income Proceeds from sale of investments Proceeds from sale of real estate Purchase of investments Payments received from notes receivable Issuance of note receivable Cash and cash equivalents, beginning Cash and cash equivalents, ending 13 $ Total 340,949 2,186,895 179,442 (984,275) (2,526,453) (657,565) Net cash used in operating activities $ 2009 Endowment Restricted University of Nevada, Reno Foundation STATEMENT OF CASH FLOWS - CONTINUED For the year ended June 30, 2009 (With comparative totals for the year ended June 30, 2008) Unrestricted Reconciliation of operating loss to net cash provided by (used in) operating activities: Operating loss Adjustments to reconcile operating loss to net cash provided by (used in) operating activities: Depreciation Gifts of stocks and bonds Changes in: Accounts receivable Accrued interest Pledges receivable Prepaid expenses and deposits Residual interest - irrevocable trust Other assets Due to University of Nevada Accounts payable Unearned revenue Net cash used in operating activities Non-cash Increase in cash surrender value of life insurance The accompanying notes are an integral part of this statement. $ Restricted 2009 Endowment 2008 Total - $ (2,554,456) $ (4,019,515) (819,671) $ (1,734,785) 12,662 (1,958) (56,046) - 12,662 (58,004) 10,023 (2,715,079) (26,344) (22,992) (640,633) 18,529 19,400 161,176 (5,014,921) (11,062) 1,409,843 17,470 (9,223) - 134,832 (5,014,921) (22,992) (11,062) 769,210 35,999 10,177 (480,211) (8,452) (1,283,984) 20,419 (99,936) 127,947 1,216,195 (4,027) (9,300) $ (1,461,007) $ (5,237,548) $ - $ (6,698,555) $ (7,245,920) $ $ $ - $ $ - 14 11,062 $ Total 11,062 10,804 University of Nevada, Reno Foundation NOTES TO FINANCIAL STATEMENTS June 30, 2009 NOTE A - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES The University of Nevada, Reno Foundation (the “Foundation”) is a nonprofit corporation. The Foundation’s mission is to serve as an innovative, flexible and efficient organization to facilitate the solicitation and management of gifts, grants, bequests and other revenues for the benefit of the University of Nevada or any organizations that are affiliated with the University of Nevada and are exempt from Federal income taxation. The Foundation is considered a component unit and will be included in the basic financial statements of the Nevada System of Higher Education. A summary of the Foundation’s significant accounting policies applied in the preparation of the accompanying financial statements follows. 1. Financial Reporting The financial statements of the Foundation have been prepared in accordance with generally accepted accounting principles (“GAAP”) as applied to governmental units. The Governmental Accounting Standards Board (“GASB”) is the accepted standard-setting body for establishing governmental accounting and financial reporting principles. GASB Statement No. 20 requires the Foundation to apply all applicable GASB pronouncements and, unless they conflict with or contradict GASB pronouncements, all Financial Accounting Standards Board (FASB) Statements and Interpretations, Accounting Principles Board Opinions, and Accounting Research Bulletins issued on or before November 30, 1989. As permitted by the Statement, the Foundation has elected not to apply FASB pronouncements issued after that date. Since the Foundation’s funds are considered to be enterprise funds for financial reporting purposes, the Foundation follows the accrual basis of accounting, wherein revenues are recorded as earned and expenses are recorded as incurred. In order to ensure observance of limitations and restrictions placed on the use of resources available to the Foundation, its accounts are maintained in accordance with the principles of fund accounting. Resources for various purposes are classified for accounting and reporting purposes into funds established according to their nature and purpose. Separate accounts are maintained for each fund. Accordingly, all financial transactions have been recorded and reported by fund group as follows: Unrestricted Fund - Represents funds that are not restricted and are available for the general operations and programs of the Foundation. Restricted Fund - Represents funds that are restricted by the donor and may only be utilized in accordance with purposes established by such donors. These funds are primarily restricted for scholarships and University programs. Endowment Fund - Represents funds that are subject to restrictions of gift instruments requiring that the principal be invested and only the income be utilized for their established purposes. Endowments are primarily restricted for scholarships and University programs. 15 University of Nevada, Reno Foundation NOTES TO FINANCIAL STATEMENTS - CONTINUED June 30, 2009 NOTE A - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES 1. - Continued Financial Reporting – Continued Because Endowment investment funds include funds derived originally from permanently restricted gifts, the management of these funds is subject to Nevada law (NRS 164.640), The Uniform Prudent Management of Institutional Funds. The Board of Trustees has a separate Investment Committee that reviews the performance and makes recommendations on the investments. The Foundation has adopted an investment policy that establishes an annual spendable objective, which is to provide funds for operating and capital expenses, and is calculated as 6% of the average market value of assets over the 12-quarter period ending on September 30 of each previous year. Earnings in excess of 6% are reinvested into the corpus. The spending objective is to be met through the use of interest, dividends, and, to the extent appropriate, accumulated capital gains and corpus. As of June 30, 2009, the Foundation has calculated the current spending objective and has distributed all expendable endowment funds accordingly. The expendable endowment is presented as a transfer between funds on the Statement of Support and Revenue, Expenses and Changes in Fund Net Assets. 2. Recognition of Support and Revenue Donations, gifts and pledges received are recognized as income when all eligibility requirements are met, provided that the promise is verifiable, the resources are measurable and the collection is probable. Pledges receivable are recorded at net present value using the appropriate discount rate. Pledges are examined on an annual basis to determine their collectiblity based upon the Foundation’s collection history; an allowance is recorded for amounts where collection is uncertain. Contributions received are recorded as unrestricted, restricted or endowed support depending on the existence and/or nature of any donor restrictions. 3. Cash and Cash Equivalents The Foundation considers all highly liquid short-term interest bearing investments purchased with an original maturity of three months or less and money market funds to be cash equivalents. Cash from all accounts are pooled for investment purposes. 4. Investments Investments in equity and debt securities with readily determinable fair values are stated at fair value. In such cases, fair value is determined based on quoted market prices. Investments in the Commonfund that do not have readily available market values are stated at fair value as reported by the Investment Manager. These investments include a diverse range of vehicles, including private equity, real estate and commodity funds. The valuation of these investments is based on the most recent value provided by the Investment Manager, usually with a June 30 “as of” date. To evaluate the overall reasonableness of the valuation carrying value, management obtains and considers the audited financial statements of such investments. Management believes this method provides a reasonable estimate of fair value. However, the recorded value may differ from the market value had a readily available market existed for such investments, and those differences could be material. Investments are stated at fair value, and realized and unrealized gains and losses are reflected in the Statement of Support and Revenue, Expenses and Changes in Fund Net Assets. The cost of securities sold is based on the average cost and/or first-in, first-out basis of all the shares of each security held at the time of sales. 16 University of Nevada, Reno Foundation NOTES TO FINANCIAL STATEMENTS - CONTINUED June 30, 2009 NOTE A - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES 5. - Continued Depreciation Depreciation is provided for in amounts sufficient to relate the cost of depreciable assets to operations over their estimated service lives on a straight-line basis. 6. Income Taxes The Foundation is a nonprofit corporation, exempt from income tax under Internal Revenue Code Section 501(c)(3), qualified for the charitable contribution deduction. Accordingly, no liability for Federal income taxes has been provided in the financial statements. 7. Donated Assets and Services Donated assets are reflected as contributions in the accompanying statements at their estimated fair market value at date of receipt. No amount for donated services has been reflected in the Foundation’s financial statements, since no objective basis is available to measure the value of such services. Nevertheless, a substantial number of volunteers have donated significant amounts of their time to the Foundation’s program services and its fundraising efforts. 8. Use of Estimates In preparing financial statements in conformity with generally accepted accounting principles, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant accounting estimates made by management include the amount of pledges receivable, the amount of expendable endowment income, and the fair value of investments. 9. Comparative Information The basic financial statements and the notes to the financial statements include certain prior-year summarized comparative information in total, but not by fund. Such information does not include sufficient detail to constitute a presentation in conformity with generally accepted accounting principles. Accordingly, such information should be read in conjunction with the Foundation’s basic financial statements for the year ended June 30, 2008 from which the summarized information was derived. 17 University of Nevada, Reno Foundation NOTES TO FINANCIAL STATEMENTS - CONTINUED June 30, 2009 NOTE B - CASH AND INVESTMENTS Cash and cash equivalents at June 30 consists of: 2009 Cash Money market funds Commonfund Certificates of deposit Treasury bills and notes 2008 $ 351,320 304,440 13,405,185 599,963 $ 1,449,445 18,361,953 130,000 928,589 $14,660,908 $20,869,987 The fair value of investments at June 30 are as follows: 2009 Equity Investments Commonfund Bond Commonfund Equity Commonfund Intermediate Commonfund Capital Partners Commonfund Realty Investors Commonfund Global Distressed Commonfund International Commodities Certificates of Deposit Law Debenture U.S. Government Securities $ 2008 390,036 22,665,815 47,559,432 2,389,938 2,063,409 4,459,365 1,498,528 4,027,402 4,895,427 1,015,125 4,987,285 $ $95,951,762 503,090 24,947,333 62,624,579 3,622,913 2,035,809 5,303,067 1,490,821 6,920,871 2,449,928 4,915,918 $114,814,329 At June 30, 2009, the Foundation investments had the following maturities: Investment Maturities (in Years) Less than 1 1–5 6 – 10 Fair Value Equity investments Open ended mutual funds Certificates of deposit U.S. Government securities $ 390,036 85,679,014 4,895,427 4,987,285 $95,951,762 18 $ 390,036 85,679,014 3,017,171 4,987,285 $94,073,506 $ 1,878,256 - $1,878,256 $ - $ -0- University of Nevada, Reno Foundation NOTES TO FINANCIAL STATEMENTS - CONTINUED June 30, 2009 NOTE B - CASH AND INVESTMENTS - Continued The Foundation’s investment policy for cash and cash equivalents is to exercise sufficient due diligence to minimize investing cash and cash equivalents in instruments that will lack liquidity. The Foundation, through its Investment Managers, may invest in high quality commercial paper, repurchase agreements, Treasury Bills, certificates of deposit, internal loans, and money market funds to provide income, liquidity for expense payments and preservation of the investment’s principal value. Commercial paper must be rated at least A1 or P-1 (by Moody’s or S&P). No more than 5% of the Fund’s total market value may be invested in the obligations of a single issuer, with the exception of the United States Government and its agencies. Investments are recorded in the following funds at June 30: 2009 Unrestricted Fund Restricted Fund Endowment Fund 2008 $ 3,418,718 19,197,206 73,335,838 $ 4,552,226 17,842,983 92,419,120 $95,951,762 $114,814,329 The cumulative net depreciation (costs in excess of fair market value) of investments at June 30 is as follows: 2009 Unrestricted Fund Restricted Fund Endowment Fund 2008 ($1,191,760) (989,369) (27,734,595) ($520,732) (368,065) (9,240,682) ($29,915,724) ($10,129,479) Investment Risk Factors There are many factors that can affect the fair value of investments. Some factors, such as credit risk and concentrations of credit risk may affect fixed income securities, which are particularly sensitive to credit risks and changes in interest rates. The Investment Committee of the Foundation has policies regarding acceptable levels of risk. The Committee meets quarterly to review the investments. Significant amounts of the investments are held with the Commonfund which also has policies regarding acceptable levels of risk. 19 University of Nevada, Reno Foundation NOTES TO FINANCIAL STATEMENTS - CONTINUED June 30, 2009 NOTE B - CASH AND INVESTMENTS - Continued Concentration of Credit Risk Concentration of credit risk is the risk of loss attributed to the magnitude of an organization’s investment in a single issuer. The Foundation restricts investment of cash and cash equivalents and investments to financial institutions with high credit standing and The Commonfund, a nonprofit membership corporation operated by and for its member colleges, universities and independent schools. The Foundation currently purchases certificates of deposit of less than two hundred fifty thousand dollars per bank or institution. Commercial paper is limited to a maximum of 10% of the total cash available. The Foundation has not experienced any losses in such accounts and believes it is not exposed to any significant credit risk on cash and cash equivalents and investments. Credit Risk Fixed income securities are subject to credit risk, which is the chance an issuer or other counterparty to an investment will not fulfill its obligations. It is the policy of the Foundation to manage its credit risk by limiting its fixed income securities to obligations of the U.S. Government, which are not considered to have credit risk, and to pooled fixed income funds with the Commonfund. The Commonfund is unrated by recognized statistical rating organizations. Interest Rate Risk Interest rate risk is the risk that changes in interest rates will adversely affect the fair value of an investment. As a means of limiting its exposure to fair value losses arising from rising interest rates, the Foundation’s current policy limits the maturities of U.S. Treasury instruments and certificates of deposit to no more than 90 days out unless the rate justifies the return and the current liquidity requirements are met. Foreign Currency Risk Foreign currency risk is the risk that changes in exchange rates will adversely affect the fair value of an investment or a deposit. Foreign investments are managed by the Commonfund who has policies in place to address foreign currency risk. Custodial Credit Risk – Deposits In the case of deposits, this is the risk that in the event of a bank failure, the Foundation’s deposits exceed FDIC limits and as a result may not be returned to the Foundation. All cash deposits are primarily on deposit with two financial institutions and several investment companies. The Foundation does not have a deposit policy for custodial credit risk. As of June 30, 2009, the Foundation’s bank balance was $13,297,600. Of this balance, $661,796 was covered by depository insurance and/or collateralized and $12,044,648 is held by the Commonfund Government Securities Fund and subject to their investment policies. The remaining $591,156 was subject to custodial credit risk and as a result was uninsured at June 30, 2009. 20 University of Nevada, Reno Foundation NOTES TO FINANCIAL STATEMENTS - CONTINUED June 30, 2009 NOTE B - CASH AND INVESTMENTS - Continued Custodial Credit Risk – Investments For an investment, this is the risk that, in the event of the failure of the counterparty, the Foundation will not be able to recover the value of its investments or collateral securities that are in the possession of an outside party. Investments consist primarily of open-end mutual funds through a single custodian. Debt and equity securities other than open-end mutual funds are uncollateralized. NOTE C - UNEARNED REVENUE Unearned revenue primarily represents assets held in irrevocable trusts of which the Foundation is the residual beneficiary. The support and revenue from these irrevocable trusts will be recognized when the Foundation receives its residual interest in the trusts. Distributions to beneficiaries of these irrevocable trusts are made based on rates set forth in the trust documents. Upon death of the income beneficiaries, the trusts will be distributed, and the Foundation will receive its residual interest in the trusts. The assets held in the irrevocable trusts are recorded at fair value. Unearned revenue at June 30 is comprised of: Residual Interest in Trust Royalties and Special Events 2009 2008 $2,295,032 123,800 $2,564,143 104,400 $2,418,832 $2,668,543 NOTE D - RELATED PARTY TRANSACTIONS The University of Nevada provided the Foundation with administrative and support services for the years ended June 30, 2009 and 2008 in the amounts of $2,213,239 and $2,036,867, respectively. The Foundation expended $19,398,639 and $35,463,353 for capital projects, programs and scholarships for the University of Nevada for the years ended June 30, 2009 and 2008, respectively. Amounts due to the University of Nevada at June 30, 2009 and 2008 are $3,784,679 and $3,015,469, respectively. The Foundation received $1,464,656 and $678,128 from the Nevada System of Higher Education during the years ended June 30, 2009 and 2008, respectively, for the management fees related to endowments held on the Foundation’s behalf. These amounts are included in investment income on the Statement of Support and Revenue, Expenses and Changes in Net Assets. 21 University of Nevada, Reno Foundation NOTES TO FINANCIAL STATEMENTS - CONTINUED June 30, 2009 NOTE E - PLEDGES RECEIVABLE Pledges receivable are recorded as revenue at the pledge date. The net present value is calculated based upon the pledge date, the Internal Revenue Service Applicable Federal Rates (AFR) and the pledge payment schedule. The AFR varies from 3.2% to 8.0% depending on the term or duration of the pledge. Pledges receivable at June 30 consist of the following: 2009 Athletics College of Liberal Arts College of Agriculture, Biotech College of Business College of Education College of Engineering College of Science Library Scholarships School of Journalism School of Medicine Other Present value discount Net pledges receivable Less: Current maturities Less: Allowance for uncollectable pledges 22 2008 $ 233,000 115,000 43,467 389,438 482,327 2,010,494 650,457 300,373 601,681 14,082,826 18,909,063 (4,674,244) 14,234,819 (2,514,716) (710,445) $ 395,595 122,071 10,252 62,025 437,500 102,681 1,983,187 1,184,580 378,810 744,107 4,063,626 5,000 9,489,434 (1,068,032) 8,421,402 (2,556,106) - $11,009,658 $5,865,296 University of Nevada, Reno Foundation NOTES TO FINANCIAL STATEMENTS - CONTINUED June 30, 2009 NOTE F - NOTES RECEIVABLE Notes receivable as of June 30 consist of the following: 2009 2008 Installment note receivable, secured by a first deed of trust, monthly payments of $1,391, including interest at 6.5%, maturing November 2009. $ 171,357 $176,655 Note receivable with the University of Nevada with the principal balance reduced by pledge payments due on the Davidson Math and Science Center, including interest at 1% in excess of the Commonfund money market rate, maturing June 30, 2016. 1,000,000 - Installment note receivable, secured by a first deed of trust, monthly payments of $190, including interest at 6.0%, maturing June 2011. Less current maturities 23 4,770 1,176,127 (173,762) 6,250 182,905 (178,416) $1,002,365 $ 4,489 SUPPLEMENTAL INFORMATION University of Nevada, Reno Foundation UNRESTRICTED FUND ALUMNI AND UNIVERSITY PROGRAM EXPENSES Year ended June 30, 2009 (With comparative totals for the year ended June 30, 2008) 2009 Alumni programs Alumni College Homecoming Membership Fund Miscellaneous Outreach Pack Tracks Senior Scholar Dinner Staff and Office Expense $ Total alumni programs University programs Faculty and Staff Enrichment Tibbitts Memorial Distinguished Teacher Award Total university programs Total alumni and university program expenses 25 6,869 59,875 44,243 16,586 100,660 16,604 29,679 19,672 2008 $ 8,536 56,145 63,630 36,923 137,002 11,201 22,751 38,276 294,188 374,464 58,590 25,802 7,500 7,500 66,090 33,302 $ 360,278 $ 407,766 University of Nevada, Reno Foundation UNRESTRICTED FUND ADMINISTRATIVE AND FUNDRAISING EXPENSES Year ended June 30, 2009 (With comparative totals for the year ended June 30, 2008) 2009 Fundraising Total 2008 Total 883,504 225,496 1,109,000 $ 1,081,683 335,770 1,417,453 $ 1,965,187 561,266 2,526,453 $ 1,899,064 523,203 2,422,267 51,460 2,400 5,282 4,109 10,799 7,015 2,956 43,301 12,980 21,222 21,718 23,602 4,050 53,681 175,769 5,631 15,220 4,332 19,706 485,233 7,706 127 6,442 43,931 1,594 19,780 72 5,726 6,528 14,730 4,048 15,145 37,288 8,140 1,299 7,975 180,531 51,460 10,106 5,409 10,551 54,730 7,015 4,550 63,081 12,980 21,294 27,444 30,130 18,780 57,729 190,914 42,919 23,360 5,631 27,681 665,764 44,383 2,217 8,654 29,591 86,939 10,023 6,432 58,692 10,005 18,364 29,618 48,863 17,384 110,747 163,396 2,496 88,378 21,231 16,178 47,247 820,838 $ 1,594,233 $ 1,597,984 $ 3,192,217 $ 3,243,105 Administrative Payroll and related expenses Salaries and wages Fringe benefits Operating Accounting fees Advertising Appreciation, gifts and sponsorships Books, periodicals and subscriptions Contract services Depreciation expense Dues and memberships Equipment maintenance expense Insurance, taxes and licenses Legal fees Meeting and hosting expense Office expense Photography Postage and freight Printing and duplicating Recruitment costs Special event and meeting supplies Telephone Training and registration fees Travel expense Total administrative and fundraising expenses $ 26