MARYLAND U N I V E R S I T Y...

advertisement

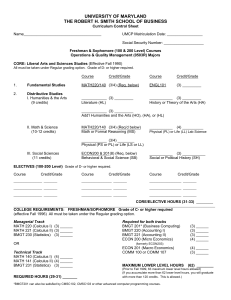

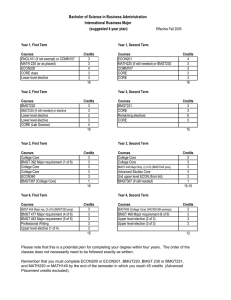

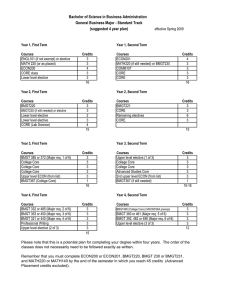

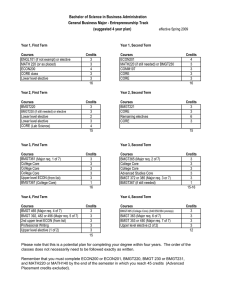

UNIVERSITY OF 1119 M a i n A d m i n i s t r a t i o n B u i l d i n g College Park, M a r y l a n d 20742-5031 301.405.5252 TEL 301.405.8195 FAX MARYLAND OFFICE OF T H E SENIOR VICE PRESIDENT AND PROVOST June 9,2015 MEMORANDUM TO: Alexander J. Triantis Dean, Robert H. Smith School of Business FROM: Elizabeth Beise Associate Provost for Academic Planning and Programs SUBJECT: Proposal to Establish a Combined Bachelor's/Master's Program in Accounting (PCC log no. 14050) At its meeting on May 1, 2015, the Senate Committee on Programs, Curricula and Courses approved the proposal to establish a combined Bachelor's/Master's Program in Accounting. A copy of the approved proposal is attached. The change is effective Fall 2015. Please ensure that the change is fully described in the Graduate and Undergraduate Catalogs and in all relevant descriptive materials, including the program's four-year plan (contact Lisa Kiely at lkiely(g),umd.edu for more information), and that all advisors are informed. MDC/ Enclosure cc: Gregory Miller, Chair, Senate PCC Committee Barbara Gill, Office of Student Financial Aid Reka Montfort, University Senate Erin Taylor, Division of Information Technology Pam Phillips, Institutional Research, Planning & Assessment Anne Turkos, University Archives Linda Yokoi, Office of the Registrar Cynthia Stevens, Office of Undergraduate Studies Alex Chen, Graduate School Joyce Russell, Robert H. Smith School of Business T H E UNIVERSITY OF MARYLAND, C O L L E G E PARK PROGRAM/CURRICULUM/UNIT PROPOSAL • Please email the rest of the proposal as an MS Word attachmentPCC to pcc-submissions^umd.edu. LOG NO. 140 go f Please submit the signed form to the Office of the Associate Provost for Academic Planning and Programs, 1119 Main Administration Building, Campus. College/School: Please also add College/School Unit Code-First 8 digits: 01202900 Unit Codes can be found at: hllps://hvpprod. iimd. edw'Hlm -/ units.htm Department/Program: Please also add Department/Program Unit Code-Last 7 digits: 1291701 Reports/ Type of Action (choose one): academic degree/award program • Curriculum change (including informal specializations) ^New • New Professional Studies award iteration • Renaming ofprogram or formal Area of Concentration • New Minor • Addition/deletion offormal Area of Concentration • Other • Suspend/delete program Italics indicate that the proposed program action must be presented to the full University Senate for cons Summary of Proposed Action: The Robert H. Smith School of Business (RHS) at the University of Maryland, College Park (UMCP) proposes the creation o f a dual Bachelor's/Master's Program in Accounting. The proposed program would enable promising students to obtain both their Bachelor's and Master's degrees from the University of Maryland College Park in five years or less. In turn, this highly attractive program should augment the historic outstanding reputation of the RHS as a center for accounting education and growing in reputation in research and attract outstanding students to both its undergraduate and graduate populations. Current and prospective students would have the opportunity to combine their accounting undergraduate degree with rigorous graduate training in accounting and taxation. The national tax office of some major accounting firms and the headquarters of the Internal Revenue Service, the Government Accountability Office, the Securities and Exchange Commission, and the Public Company Accounting Oversight Board are all in the Washington, D. C. area. Thus, the lure o f coming to the Washington, D.C., area to obtain an undergraduate major in accounting and a Master of Science in Accounting (MSA) from the highly-ranked RHS should prove compelling to many outstanding prospective students. A P P R O V A L SIGNATURES - Please print name, sign^aryi 1. Department Committee Chair 2. Department Chair Stephen Loeb Martin Loeb 3. College/School PCC Chair _Joyce Russell^~7 4. Dean Alexander Triantis 5. Dean of the Graduate School (if required) 6. Chair, Senate PCC 7. University Senate Chair (if required) 8. Senior Vice President & Provost date. Usjzfadditional lines for multi-u DRAFT UNIVERSITY OF MARYLAND COLLEGE PARK Robert H. Smith School of Business Proposal for a Dual Bachelor’s/Master’s Program in Accounting I. INTRODUCTION The Robert H. Smith School of Business (RHS) at the University of Maryland, College Park (UMCP) proposes the creation of a dual Bachelor’s/Master’s Program in Accounting. The proposed program would enable promising students to obtain both their Bachelor’s and Master’s degrees from the University of Maryland College Park in five years or less. In turn, this highly attractive program should augment the historic outstanding reputation of the RHS as a center for accounting education and growing in reputation in research and attract outstanding students to both its undergraduate and graduate populations. Current and prospective students would have the opportunity to combine their accounting undergraduate degree with rigorous graduate training in accounting and taxation. The national tax office of some major accounting firms and the headquarters of the Internal Revenue Service, the Government Accountability Office, the Securities and Exchange Commission, and the Public Company Accounting Oversight Board are all in the Washington, D. C. area. Thus, the lure of coming to the Washington, D.C., area to obtain an undergraduate major in accounting and a Master of Science in Accounting (MSA) from the highly-ranked RHS should prove compelling to many outstanding prospective students. II. COURSE OF STUDY To earn a Bachelor’s degree at UMCP, students must complete 120 credits, fulfill the University’s General Education requirements, and fulfill the requirements of a major1. (Some courses can fulfill both General Education and a major requirement.) To earn the MSA, students must complete 30 credits of graduate courses which include, depending on a student’s specialization, 22 or 16 credits of core courses, the remaining credits from accounting-related electives.2 To separately earn both degrees, students must currently earn 150 credits. Under this proposal students will need a minimum of 140 credits. Given the current design it is anticipated that students in this program will 1 2 Only Accounting majors are eligible for this program. The audit specialty has 22 credits of core and the tax and general specialties have 16 credits of core. 1 V12- Final earn a minimum of 141 credits to earn both a BS in accounting and a MSA. Due to the Maryland State Board of Accountancy’s regulation that recognizes that one graduate credit = 1.5 undergraduate credits, students receiving the MSA degree will meet the Maryland State Board of Accountancy’s 150 hour requirement if they complete this program. Students in the proposed program would complete a minimum of 140 credits, of which 120 would be earned at the undergraduate level and 20 would be at the graduate level. Students would be required to fulfill the same Bachelor’s degree requirements (including General Education and major requirements) and the same MSA degree requirements as other students. Students could count up to 10 of their credits towards both their MSA and their Bachelor’s degrees although we anticipate most students will only count 9 at this time.3 To illustrate how this program would work in practice, the courses or types of courses a student might take in the auditing and tax specialties are listed in Appendix A. The sample schedules in Appendix B show how a student in this program could possibly complete both the BS and MSA requirements in 4.5 years (or even less time if they came in with advanced placement credits). The sample schedule in Appendix B could also be planned so that students can graduate in 5 years with both the BS and MSA degrees. This proposed program would provide students with a highly effective education in liberal arts, business, and accounting. In addition to gaining the key undergraduate skills and exposure to a wide variety of disciplines required by the General Education program, students in their first four years would, through their undergraduate accounting major, immerse themselves in general business fundamentals. Students during their first four or three and one half years would take the traditional undergraduate accounting courses including three graduate courses. In the graduate/last year of the program the focus would change to learning at a graduate level in their specialty of accounting. These specialties include auditing, taxation, or a general program that the student proposes to the program’s academic director and Assistant Dean for Undergraduate Studies or their representatives. Examples of courses of studies that a student wishing to take the general specialty might follow are concentrations in management accounting, forensic accounting, or government accounting. We believe, based on past experience, that an overwhelming number of students will opt for either the 3 The College of Behavioral and Social Sciences has a dual degree with the School of Public Policy. The MPP degree is a 54-credit program so in the combined program, students take 102 undergraduate credits and 54 graduate degree level credits. Eighteen credits are double counted. The program allows students to obtain an undergraduate degree from BSOS and an MPM degree. 2 V12- Final auditing or tax specialties, which prepare students for careers in auditing or tax and are closely related to the CPA examination and in the case of the auditing specialty also for the Certified Internal Auditing examination. The program will provide opportunities for students to participate in non-credit internships at various time periods. III. ADMISSION PROCESS AND CRITERIA Students in their freshman and sophomore years would be eligible to become “affiliate members” of the program. This would allow students to declare their interest in accounting, meet other accounting-oriented students, and attend special accounting-relevant events. Students would apply for formal admission to the program as early as the end of their sophomore year. Admittance to the program would be limited to students with records suggesting a strong likelihood of excelling in graduate studies and would be determined in multiple steps. The RHS faculty and Graduate School would make an initial determination based on a student’s grades during his/her first two years (i.e., after earning at least 60 credits), SAT or ACT scores, letters of recommendations, and written statement(s). Most students admitted into the program would have a cumulative undergraduate GPA of at least 3.5, either a SAT or ACT score in the 80th percentile or higher, and a demonstrated interest in accounting. Students who were not admitted after their sophomore year could reapply for admission to the program after their junior year. Students who were initially admitted into the program at the end of their sophomore year would be reevaluated after their junior year. If the students had maintained at least a 3.5 undergraduate GPA (or if the RHS faculty felt their continuance in the program was otherwise warranted), they would be permitted to proceed with their MSA graduate courses and would be told to expect admittance into the Graduate School after completion of their BS requirements as long as they had continued to achieve at least a 3.5 undergraduate GPA. The RHS faculty and Graduate School, however, could in exceptional circumstances choose to admit students who did not meet this threshold. To be admitted formally to the Graduate School, students admitted into the program would have only to first complete their BS degree while maintaining at least the 3.5 undergraduate average. This multi-step admission process is viewed to be the best way of providing students a clear-cut opportunity of being admitted to the Graduate School after their BS studies are complete, while ensuring that students 3 V12- Final initially admitted into the program have every reason to diligently pursue their studies during their remaining undergraduate years, continue to demonstrate an ability to excel academically, and are truly prepared to succeed in their graduate studies. Students who were not admitted into the program or were not able to maintain a 3.5 undergraduate GPA would be free to apply to the regular MSA program pursuant to the usual application process without prejudice. IV. FINANCIAL IMPACT The proposed program per se is not expected to require significant additional financial resources. While we expect the program to increase the number of exceptional students applying to both the undergraduate program and to the MSA program, it is in the power of both programs to realize this gain in the form of better qualified, rather than additional, students. Given the current targets for undergraduate admissions, this would appear to be the likely outcome for the undergraduate program. The strategic plan of the Robert H. Smith School of Business does not call for an increase in the number of MSA students admitted into the program. Instead, its objective is to diversify the student body of the MSA program, and attracting more UMCP undergraduates will significantly enable achieving that objective. The Robert H. Smith School of Business will manage its admission standards to realize the benefits of this program in the form of even better students. 4 V12- Final APPENDIX A Dual Bachelor’s/MSA Course Requirements BS/MSA Course Requirements The discussion below considers only the auditing or tax specialties. Students wishing to take the general specialty should design a program in conjunction with the Academic Director of the MSA program and the Assistant Dean for Undergraduate Studies or their representatives. The program will follow the same patterns developed below for the auditing or tax specialties. We believe, based on past experience, that an overwhelming number of students will opt for either the auditing and tax specialties, which prepare students for careers in auditing and tax and are closely related to the CPA examination and in the case of the auditing specialty also for the Certified Internal Auditing examination. Accounting Major University Requirements (that are not satisfied by Smith School requirements) Academic Writing (ENG 101) 3 Natural Sciences* 7-8 Humanities* 6 Scholarship in Practice 3 Diversity Courses* 6 I-Series* 6 19 - 32 credits Smith School Lower Level Core Math (220, 130 or 140) 3-4 BMGT 110: Business Value Chain 3 BMGT 220: Principles of Accounting I 3 BMGT 221: Principles of Accounting II 3 BMGT 230 or 231: Business Statistics 3 ECON 200: Principles of Micro-Economics 4 ECON 201: Principles of Macro-Economics 4 COMM 100/107/200: Public Speaking 3 Electives (100 – 200 level) 3 - 17 30 - 43 62 total lower level credits *Overlap permitted with (I-Series, Diversity, and Distributed Studies courses, must meet minimum of 40 credits completed for University requirements. 5 V12- Final Smith School Upper Level Core BMGT 301: Intro to Info Systems BMGT 340: Business Finance BMGT 350: Marketing Principles BMGT 364: Management & Org Principles BMGT 367: Career Search Strategies in Business BMGT 380: Business Law I BMGT 495: Business Policies Upper Level Electives 3 3 3 3 1 3 3 19 credits 9@ Major Requirements BMGT 310: Intermediate Accounting I BMGT 311: Intermediate Accounting II BMGT 321: Managerial Accounting BMGT 323: Taxation of Individuals BMGT 326 Accounting Systems* BUAC 765: Bus Ethics for Accts and Auditors+ BMGT 422: Auditing Theory and Practice BUAC 780: Fin Statement Analysis for Accts and Auditors** 3 3 3 3 3 3 3 3 24 credits Upper Level Economics Requirement 3 credits Professional Writing ENGL 391, 392, 393, 394, 395, or 398 3 credits TOTAL CREDITS TOWARD BS 120 BS awarded Masters of Accounting Accounting Graduate Courses 20 additional credits–MSA awarded GRAND TOTAL 140 credits * Students in the auditing specialty should take BUAC 790 (Information Security, Audit and Control) in lieu of BMGT 326 (Accounting Systems). ** Only students in the tax specialty should take BUAC 780 (Financial Statement Analysis for Accountants and Auditors) as undergraduates. Students in the auditing specialty should take another 400- level undergraduate accounting course except for BMGT 411. @ Students in the tax specialty should take BMGT 417 (Taxation of Corporations, Partnerships and Estates) after completing BMGT 323 (Taxation of Individuals) as an upper level elective. All students in the program take BUAC 792 (Forensic Accounting/Auditing) as an upper level elective. + Replaces BMGT 411 (Ethics and Professionalism in Accounting) for all students in the program. 6 V12- Final .APPENDIX B Sample 4.5-Year Bachelor’s/Master’s Course Schedules For Selected Smith Accounting Majors: This sample curriculum sheet shows how the combined BS/MSA can be completed in 4.5 years. It does not reflect the range of options that students might have in their bachelor’s programs. Furthermore, students can take more or less than 4.5 years to finish this program depending on a number of factors such as AP credits, summer school courses, and the course load a student carries. Sample 4-Year BS/MSA Schedule with UG Major = Accounting Freshman – Fall (Cumulative Credits: 16 Total) Course Credits Requirements Met ENGL 101 3 BS – Accounting MATH 220/140/130 3 BS – Accounting ECON 200 4 BS – Accounting BMGT 110 3 BS – Accounting Lower Level Elective 3 BS – Accounting Freshman – Spring (Cumulative Credits: 32 Total) Course Credits ECON 201 4 BMGT 230 or 231 3 COMM 100/107/200 3 Natural Science Non-Lab 3 Lower Level Elective 3 Requirements Met BS – Accounting BS – Accounting BS – Accounting BS – Accounting BS – Accounting Summer: Initial Decision Whether to Admit to Dual BS/MSA Program Sophomore – Fall (Cumulative Credits: 49 Total) Course Credits BMGT 220 3 Natural Sciences Lab 4 Humanities Course/Diversity 3 Scholarship in Practice/I-Series/Diversity 3 Lower Level Elective 3 BMGT 367 1 Sophomore – Spring (Cumulative Credits: 66 Total) Course Credits BMGT 221 3 Humanities Course/I-Series 3 Lower Level Elective 3 7 V12- Final Requirements Met BS – Accounting BS – Accounting BS – Accounting BS – Distributive Studies/I-Series/Diversity BS – Accounting BS – Accounting Requirements Met BS – Accounting BS – Accounting BS – Accounting Lower Level Elective Lower Level Elective Upper Level Economics 3 2 3 BS – Accounting BS – Accounting BS – Accounting Summer: Provisional Admittance into Graduate School Junior – Fall (Cumulative Credits: 84 Total) Course Credits BMGT 310 3 BMGT 321 BMGT 301 BMGT 340 Professional Writing BMGT 323 3 3 3 3 3 Requirements Met BS – Accounting BS – Accounting BS – Accounting BS – Accounting BS – Accounting BS – Accounting Junior – Spring (Cumulative Credits: 102 Total) Course Credits BMGT 311 3 BMGT 350 3 BMGT 364 3 BUAC 792b 3 d 3 Upper Level Elective Upper Level Elective 3 Requirements Met BS – Accounting BS – Accounting BS – Accounting MSA/ BS – Accounting BS – Accounting BS – Accounting Senior– Fall Course Credits Requirements Met BMGT 422 3 BS – Accounting BMGT 380 3 BS – Accounting BMGT 495 3 BS – Accounting c 3 MSA/ BS – Accounting BUAC 790 BUAC 765 Bus, Eth for Accts & Auditors+, b 3 MSA/ BS – Accounting a, b BUAC 780 Fin. Statement Analysis 3 MSA/BS – Accounting Spring Receipt of BS, Formal Admittance to Graduate School Senior/– Spring (Cumulative Credits: 120 Total) Grad I -- Spring Auditing Specialty Course (Cumulative Credits: 10 Total) BUAC 786 Int. Audit: Conceptual & Inst. Framework BUAC 784 Bus. Comm. For Accts. & Auditorsb BUAC 782 Adv. Mgrl. Acct. & Control Systemsb 8 V12- Final Credits 3 2 3 Requirements Met MSA MSA MSA BUMO 794 Essentials of Negotiationb Non-credit Internship Grad II – Fall (Cumulative Credits: 21 Total) BUMO 796 Leadership & Human Mgmt. for Acct & Auditorsb BUAC 780 Financial Statement Analysisb BUAC 787 Inte Aud II: Int Audit Appls & Pract. Elective 2 MSA 3 3 3 2 MSA MSA MSA MSA 2 3 2 2 2 MSA MSA MSA MSA MSA 2 2 2 2 2 MSA MSA MSA MSA MSA Non-credit Internship Grad I -- Spring Tax Specialty Course (Cumulative Credits: 11 Total) BUAC 784 Bus. Comm. For Accts. & Auditorsb BUAC 782 Adv. Mgrl. Acct. & Control Systemsb BUMO 794 Essentials of Negotiationb BUAC 758 (Non-profit tax) BUAC 758_ Real Estate Tax Non-credit Internship Grad II – Fall (Cumulative Credits: 21 Total) Course BUAC 758_ Financial Planning, Estates and Trusts BUAC 758_ International Tax BUAC 758_ State and Local Tax BUAC 758_ Tax Research Elective Non-credit Internship ---------------------------------------------a Tax Specialty only take this course at this time Core course c Auditing specialty only – other specialties take BMGT 326 (Accounting Systems) d Tax Specialists – take BMGT 417 (Taxation of Corporations, Partnerships and Estates) as an upper b level elective. + Replaces BMGT 411 (Ethics and Professionalism in Accounting). 9 V12- Final Michael D Colson From: Sent: To: Subject: Mike Marcellino <mmarcellino@rhsmith.umd.edu> Tuesday, April 14, 2015 11:40 AM Michael D Colson Re: BMGT PCC Proposals for Combined BS/MS Programs Hi Mike, Thanks for passing along the times for the meeting. I'm making arrangements to join a faculty representative. As for your questions, I think they were just trying to show where the 9-10 (double counted) credits could be taken. We are not requesting that the students take more than 10 as double counted credits. For example: With accounting the courses vary based on whether the students are in the auditing track or the tax track. For each group they will take a different set of courses. If this needs to be clarified feel free to modify with additional text or let me know what you would like to add and I can make the adjustment. Thanks Mike Michael R Marcellino Assistant Dean MBA & MS Programs Masters Programs Office Robert H. Smith School of Business 2308 Van Munching Hall University of Maryland College Park, MD 20742-1815 (301) 405-0010 TEL (301) 314-9862 FAX mmarcellino@rhsmith.umd.edu http://www.rhsmith.umd.edu http://www.mbanetworth.rhsmith.umd.edu On Fri, Apr 10, 2015 at 5:44 PM, Michael D Colson <mcolson@umd.edu> wrote: Hi Mike, I wanted to let you know that I have received your proposals to create combined BS/MS programs for Accounting and Information Systems 1 Here are the files: http://www.provost.umd.edu/ProgDocs/1415/14049_BMGT_BMGT_AddCombinedBachelorMasterInformationSystems.pdf http://www.provost.umd.edu/ProgDocs/1415/14050_BMGT_BMGT_AddCombinedBachelorMasterAccounting.pdf The steps in the approval route for this proposal are as follows: 1. Graduate PCC review (at the April 20th meeting) 2. Senate PCC review (at the May 1st meeting—assuming that the Grad PCC approves) For the committee meetings, you will be contacted beforehand with a specific time (usually a 15-minute window) for the presentation and discussion of the proposal. If there is a specific contact person for this proposal, please let me know. The Grad PCC will meet from 10:30-12:00 on the 20th, and the Senate PCC committee will meet from 8:30-10:00 on May 1. Betsy and I reviewed both proposals and had some questions. It looks like in some cases you are asking to double count 12 credits? This first image is on page 20 of the PDF for the Information Systems proposal: The same seems to be the case for the Accounting proposal (this is taken from page 9 of the pdf): 2 Was this intentional? I’ll be forwarding the proposal to the Graduate School today and they will be contacting you about scheduling a time to meet on the 20th but if I need to revise the proposal I can. Please let me know if you have any questions. Thank you, Mike --Mike Colson 3