Document 14300715

advertisement

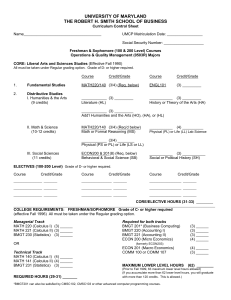

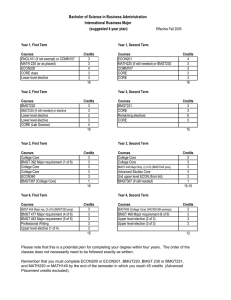

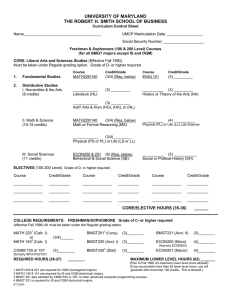

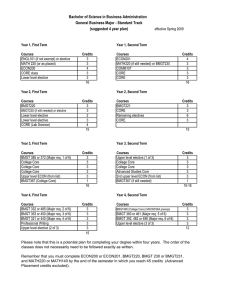

REASONS FOR PROPOSED ACTION The Accounting and Information Assurance (AIA) Department would like to make a slight modification to its Accounting major curriculum. In particular, AIA is proposing to VPAC that BMGT428A Special Topics in Accounting: Government Accounting receive a permanent course number of BMGT410. If approved by VPAC, AIA would like to list BMGT 410 as an official course option in the Accounting major. BMGT428A Government Accounting in Spring 2007 and was very popular with students. Since many Accounting majors obtain jobs in Federal or State government, this subject will continue to be attractive to our students for the foreseeable future. DESCRIPTION OF CURRICULUM CHANGE AIA is requesting that BMGT410 Government Accounting be added as an option in both the Public Accounting Track and the Management Accounting/Consulting Track. See details below. Old Requirements Required of all Accounting majors BMGT BMGT BMGT BMGT 310—Intermediate Accounting I — 3 credits 311—Intermediate Accounting II — 3 credits 321—Managerial Accounting — 3 credits 326—Accounting Systems — 3 credits Accounting majors must complete an additional 12 credits from one of the following tracks. Public Accounting Track BMGT 323—Taxation of Individuals — 3 credits BMGT 422—Auditing Theory and Practice — 3 credits BMGT 411—Ethics and Professionalism in Accounting One of the following courses: — 3 credits BMGT 417—Taxation of Corporations, Partnerships & Estates BMGT 423—Fraud Examination BMGT 424—Advanced Accounting BMGT 427—Advanced Auditing Theory and Practice BMGT 428—Special Topics in Accounting Management Accounting/Consulting Track BMGT 426—Advanced Managerial Accounting — 3 credits Three of the following courses: — 9 credits BMGT 323—Taxation of Individuals BMGT 411—Ethics and Professionalism in Accounting BMGT 417—Taxation of Corporations, Partnerships & Estates BMGT 423—Fraud Examination BMGT 424—Advanced Accounting BMGT 428—Special Topics in Accounting BMGT 305—Survey of Business Information Systems and Technology BMGT 402—Database Systems BMGT 403—Systems Analysis and Design BMGT 332—Operations Research for Management Decisions BMGT 385—Operations Management BMGT BMGT BMGT BMGT 430—Linear Statistical Models in Business 434—Introduction to Optimization Theory 440—Advanced Financial Management 446—International Finance Upper Level Economics Requirement One of the following courses: ECON 305, 306, 330 (formerly 430), 340 (formerly 440) – 3 credits Total Credits for Accounting and Economics – 27 credits New Requirements Required of all Accounting majors BMGT BMGT BMGT BMGT 310—Intermediate Accounting I — 3 credits 311—Intermediate Accounting II — 3 credits 321—Managerial Accounting — 3 credits 326—Accounting Systems — 3 credits Accounting majors must complete an additional 12 credits from one of the following tracks. Public Accounting Track BMGT 323—Taxation of Individuals — 3 credits BMGT 422—Auditing Theory and Practice — 3 credits BMGT 411—Ethics and Professionalism in Accounting — 3 credits One of the following courses: — 3 credits BMGT 410—Government Accounting (new option) BMGT 417—Taxation of Corporations, Partnerships & Estates BMGT 423—Fraud Examination BMGT 424—Advanced Accounting BMGT 427—Advanced Auditing Theory and Practice BMGT 428—Special Topics in Accounting Management Accounting/Consulting Track BMGT 426—Advanced Managerial Accounting — 3 credits Three of the following courses: — 9 credits BMGT 323—Taxation of Individuals BMGT 410—Government Accounting (new option) BMGT 411—Ethics and Professionalism in Accounting BMGT 417—Taxation of Corporations, Partnerships & Estates BMGT 423—Fraud Examination BMGT 424—Advanced Accounting BMGT 428—Special Topics in Accounting BMGT 305—Survey of Business Information Systems and Technology BMGT 402—Database Systems BMGT 403—Systems Analysis and Design BMGT 332—Operations Research for Management Decisions BMGT 385—Operations Management BMGT 430—Linear Statistical Models in Business BMGT 434—Introduction to Optimization Theory BMGT 440—Advanced Financial Management BMGT 446—International Finance Upper Level Economics Requirement One of the following courses: ECON 305, 306, 330 (formerly 430), 340 (formerly 440) – 3 credits Total Credits for Accounting and Economics – 27 credits Additional Degree Requirements of the Accounting Major At the Smith School of Business, a minimum of 120 credit hours is required to complete a Bachelor of Science degree. Besides the major requirements listed above and the specific Smith School of Business requirements listed below, a student must complete the University's CORE General Education Requirements and sufficient lower and upper level elective credit to accumulate a total of 120 credit hours. A minimum of 58 credit hours of the required 120 hours must be in 300-400 (upper) level courses. A detailed explanation including additional Smith School of Business degree requirements are listed below. Freshmen/Sophomore Smith School Requirements MATH 220 or 140 - Elem.Calculus I or Calculus I BMGT 220 & 221 - Principles of Accounting I & II BMGT 230 or 231 - Business Statistics ECON 200 & 201 - Principles of Micro & Macro Economics COMM 100, 107 or 200 - Foundations of Speech Communications, Speech Communication, or Critical Thinking and Speaking Total 3-4 cr 6 cr 3 cr 8 cr 3 cr 23-24 cr Junior/Senior Smith School Requirements BMGT 301 - Introduction to Information Systems BMGT 340 - Business Finance BMGT 350 - Marketing Principles BMGT 364 - Management and Organization BMGT 367 - Career Search Strategies and Business BMGT 380 - Business Law BMGT 495 - Business Policies Total 3 cr 3 cr 3 cr 3 cr 1 cr 3 cr 3 cr 19 cr Accounting Major Requirements (details listed previously) 24 cr Upper Level Economics Requirements (details listed previously) 3 cr University CORE General Education Requirements not fulfilled by Smith School requirements listed above. - Total Credits 28 cr Lower Level Electives Upper Level Electives Grand Total Required 16-17 cr 6 cr 120 cr Current Catalog Description Accounting, in a limited sense, is the analysis, classification, and recording of financial events and the reporting of the results of such events for an organization. In a broader sense, accounting consists of all financial systems for planning, controlling, and appraising performance of an organization. Accounting includes among its many facets: financial planning, budgeting, accounting systems, financial management controls, financial analysis of performance, financial reporting, internal and external auditing, and taxation. The accounting curriculum provides an educational foundation for careers in public accounting, management, whether in private business organizations, government or nonprofit agencies, or consulting. Two tracks are provided: The Public Accounting Track leading to the CPA (Certified Public Accounting) and the Management Accounting/Consulting Track. Updated Catalog Description No change. Typical 4 Year Plan – Public Accounting Track Year 1, First Term Courses ENGL101 (if not exempt) or elective MATH 220 (or as placed) ECON200 CORE class Lower level elective Year 1, Second Term Credits 3 3 4 3 3 16 Year 2, First Term Courses BMGT220 BMGT230 (if still needed) or elective Lower level elective Lower level elective CORE (Lab science) Credits 3 3 2 3 4 15 BMGT326 (Major Requirement 5 of 8) BMGT422 (Major Requirement 6 of 8) College Core Professional Writing Upper level elective (1 of 2) Courses BMGT221 CORE Remaining electives CORE Credits 3 3 6 3 15 Year 3, Second Term Credits 3 3 3 3 3 1 16 Year 4, First Term Courses Credits 4 3 3 3 3 16 Year 2, Second Term Year 3, First Term Courses BMGT310 (Major Requirement 1 of 8) BMGT321 (MajorRequirement 2 of 8) College Core College Core Upper level ECON (from list) BMGT367 (College Core) Courses ECON201 MATH220 (if still needed) or BMGT230 COMM107 CORE or lower level elective CORE Courses BMGT311 (310 prereq) Major Req. 3 or 8 BMGT323 (Major Requirement 4 of 8) College Core College Core Advanced Studies Core BMGT367 (if still needed) Credits 3 3 3 3 3 1 15-16 Year 4, Second Term Credits 3 3 3 3 3 15 Courses BMGT495 (College Core) (340/350/364 prereqs) BMGT411 (Major Requirement 7 of 8) Upper level elective (2 of 2) Major Requirement (8 of 8) from options Credits 3 3 3 3 12 Typical 4 Year Plan – Management Accounting/Consulting Track Year 1, First Term Courses ENGL101 (if not exempt) or elective MATH 220 (or as placed) ECON200 CORE class Lower level elective Year 1, Second Term Credits 3 3 4 3 3 16 Year 2, First Term Courses BMGT220 BMGT230 (if still needed) or elective Lower level elective BMGT201 (if not exempt) or elective CORE (Lab science) Credits 3 3 2 3 4 15 BMGT426 Accounting elective (1 of 3) Accounting elective (2 of 3) Professional Writing Upper level elective (1 of 3) Courses BMGT221 CORE Remaining electives CORE Credits 3 3 6 3 15 Year 3, Second Term Credits 3 3 3 3 3 1 16 Year 4, First Term Courses Credits 4 3 3 3 3 16 Year 2, Second Term Year 3, First Term Courses BMGT310 BMGT321 College Core College Core Upper level ECON (from list) BMGT367 (College Core) Courses ECON201 MATH220 (if still needed) or BMGT230 COMM107 CORE or lower level elective CORE Courses BMGT311 (310 prereq) BMGT326 College Core College Core Advanced Studies Core BMGT367 (if still needed) Credits 3 3 3 3 3 1 15-16 Year 4, Second Term Credits 3 3 3 3 3 15 Courses BMGT495 (College Core) (340/350/364 prereqs) Accounting elective (3 of 3) Upper level elective (2 of 3) Upper level elective (3 of 3) Credits 3 3 3 3 12 Prerequisite/Course Sequencing Structure - All Accounting majors can easily complete their degree over their junior/senior years because the longest prerequisite sequence is three semesters. Public Accounting Track, Junior/Senior Year BMGT310 (prereq: BMGT221) BMGT311 (prereq: BMGT310) BMGT321 (prereq: BMGT221) BMGT323 (prereq: BMGT221) BMGT326 (prereq: BMGT221 and (BMGT201 or 301)) BMGT410 (prereq: BMGT221) BMGT411 (prereq: BMGT 311) BMGT417 (prereq: BMGT 221) BMGT422 (prereq: BMGT221) BMGT423 (prereq: BMGT310) BMGT424 (prereq: BMGT311) BMGT427 (prereq: BMGT422) Management Accounting/Consulting Track, Junior/Senior Year BMGT310 (prereq: BMGT221) BMGT311 (prereq: BMGT310) BMGT321 (prereq: BMGT221) BMGT323 (prereq: BMGT221) BMGT326 (prereq: BMGT221 and (BMGT201 or 301)) BMGT410 (prereq: BMGT 311) BMGT411 (prereq: BMGT 311) BMGT417 (prereq: BMGT 221) BMGT422 (prereq: BMGT221) BMGT423 (prereq: BMGT310) BMGT424 (prereq: BMGT311) BMGT426 (prereq: BMGT 321) Non-Accounting options: BMGT305 BMGT402 (prereq: BMGT301, recommd: BMGT302) BMGT403 (prereq: BMGT301, recommd: BMGT302) BMGT332 (prereq: BMGT230) BMGT385 BMGT430 (prereq: BMGT230 or 231) BMGT434 (prereq: MATH220, Recommended: MATH221 or MATH141) BMGT440 (prereq: BMGT340) BMGT446 (prereq: BMGT340) Course Descriptions BMGT 220 Principles of Accounting I (3) Basic theory and techniques of contemporary financial accounting. Includes the accounting cycle and the preparation of financial statements for single owner and partnership forms of business organizations operating as service companies or merchandisers. BMGT 221 Principles of Accounting II (3) Prerequisite: BMGT220. Basic theory and techniques of accounting for managerial decision making. Involves the introduction of the corporation and manufacturing operations. Includes costvolume-profit analysis and capital budgeting. Introduces the topics of income taxation and international accounting. BMGT 305 Survey of Business Information Systems and Technology (3) For Information Systems-Business majors only. Computer Science majors will not receive credit. 53 semester hours. Introductory course for the decision and information science major. Covers the components of modern business information systems as well as the consequences of information technology on society and the environment. BMGT 310 Intermediate Accounting I (3) Prerequisite: BMGT221. Comprehensive analysis of financial accounting topics related to financial statement preparation and external reporting. BMGT 311 Intermediate Accounting II (3) Prerequisite: BMGT310. Continuation of BMGT310. BMGT 321 Managerial Accounting (3) Prerequisite: BMGT221. A study of the basic concepts of product costing and cost analysis for management planning and control. Emphasis is placed on the role of the accountant in organizational management, analysis of cost behavior, standard cost budgeting, responsibility accounting and relevant costs for decision-making. BMGT 323 Taxation of Individuals (3) Prerequisite: BMGT221. Federal taxation of individuals focusing on income, exclusions, deductions, depreciation, credits and capital transactions. Property coverage includes the tax consequences of sales and dispositions of investment and business assets. Both tax planning and compliance issues are covered. BMGT 326 Accounting Systems (3) Prerequisites: BMGT221 and (BMGT201 or 301). A study of accounting systems and computer and communications technology. BMGT 332 Operations Research For Management Decisions (3) Prerequisite: BMGT230 or BMGT231; or equivalent. Surveys the philosophy, techniques and applications of operations research to managerial decision-making. Techniques covered include: linear programming, transportation and assignment models, Markov processes and inventory and queuing models. Emphasis is placed on formulating and solving decision problems in the functional areas of management. BMGT 385 Operations Management (3) Studies the design, management and improvement of a firm’s processes and systems for creation and delivery of products and services. Includes strategic and operational views of supply chain, product development, and capacity analysis, highlighting the competitive advantages that operations management can provide the firm. BMGT 402 Database Systems (3) Prerequisite: BMGT301 or equivalent. Recommended: BMGT302. Introduction to basic concepts of database management systems. Relational databases, query languages and design will be covered. Fileprocessing techniques are examined. BMGT 403 Systems Analysis and Design (3) Prerequisite: BMGT301 or equivalent. Recommended: BMGT302. Techniques and tools applicable to the analysis and design of computer-based information systems. System life cycle, requirements analysis, logical design of databases and performance evaluation. Emphasis on case studies. Project required that involves the design, analysis and implementation of an information system. BMGT410 Government Accounting (3) Prerequisite: BMGT221. An introduction to the theory and practice of accounting and financial reporting as applied in both federal and state/local governments, with a focus on generally accepted accounting principles applicable in each. Topics include analyzing transactions; recognizing transactions in the accounting cycles; and preparing and analyzing financial statements and the overall financial reports at both the federal and state/local government levels. Various techniques are used to study government accounting and may include problem sets, case studies, computer applications, and other materials. BMGT 411 Ethics and Professionalism in Accounting (3) Prerequisite: BMGT311. For accounting majors only. 86 semester hours. Analysis and discussion of issues relating to ethics and professionalism in accounting. BMGT 417 Taxation of Corporations, Partnerships and Estates (3) Prerequisite: BMGT221. Federal taxation of corporations using the life-cycle approach-formation, operation, assessment, merger, reorganization and liquidation. Overviews of pass-through entities - partnerships and s-corporations - using the life-cycle approach, and the tax consequences of wealth transfers by individuals gift and estate taxation. Both tax planning and compliance issues are addressed. BMGT 422 Auditing Theory and Practice (3) Prerequisite: BMGT221. A study of the independent accountant’s attest function, generally accepted auditing standards, compliance and substantive tests and report forms and opinions. BMGT 423 Fraud Examination (3) Prerequisite: BMGT310. Covers fraud prevention, detection and investigation techniques. The traditional accounting areas of fraud – fraudulent financial accounting and misappropriation of assets as well as recent and historical cases of fraud will also be examined. Current fraud Topics will be discussed. BMGT 424 Advanced Accounting (3) Prerequisite: BMGT311. Advanced accounting theory applied to specialized topics and current problems. Emphasis on consolidated statements and partnership accounting. BMGT 426 Advanced Managerial Accounting (3) Prerequisite: BMGT321. Advanced cost accounting with emphasis on managerial aspects of internal record-keeping and control systems. BMGT 428 Special Topics in Accounting (3) For Accounting majors only. Repeatable to 06 credits if content differs. Selected advanced topics in Accounting. BMGT 430 Linear Statistical Models in Business (3) Prerequisite: BMGT230 or BMGT231 or permission of department. Model building involving an intensive study of the general linear stochastic model and the applications of this model to business problems. The model is derived in matrix form and this form is used to analyze both the regression and ANOVA formulations of the general linear model. BMGT 434 Introduction to Optimization (3) Prerequisite: MATH220 or MATH140; or equivalent. Recommended: MATH221 or MATH141. For BMGT majors only. Introduces concepts and techniques of operations research to model and solve business decision problems, focusing on optimization and commercially available software tools. Models include linear programming, the transportation and assignment problems, network flow models, and non-linear programming. Emphasis is placed on analyzing business scenarios and formulating associated decision models. BMGT 440 Advanced Financial Management (3) Prerequisite: BMGT340. Analysis and discussion of cases and readings relating to financial decisions of the firm. The application of finance concepts to the solution of financial problems is emphasized. BMGT 446 International Finance (3) Prerequisite: BMGT340. Financial management from the perspective of the multinational corporation. Topics covered include the organization and functions of foreign exchange and international capital markets, international capital budgeting, financing foreign trade and designing a global financing strategy. Emphasis of the course is on how to manage exchange and political risks while maximizing benefits from global opportunity sets faced by the firm.