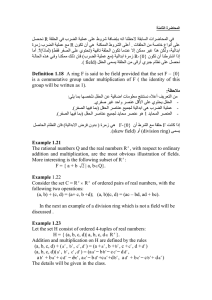

Economic Feasibility Techniques Study and Its Importance in the

advertisement