Using a VAT for Deficit Reduction November 2011

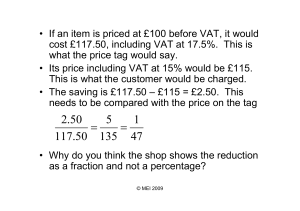

advertisement