Figure 1:Energy Consumption in US g gy p

advertisement

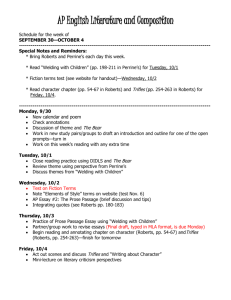

Figure 1:Energy Consumption in US g gy p 2008 Source: www.eia.gov E Roberts, Energy in US 1 Figure 2: US Liquid Demand by Sector and Fuel Source: EIA: Annual Energy Outlook 2011 E Roberts, Energy in US 2 Figure 3: Supply and Demand Distribution of US Energy E Roberts, Energy in US 3 Figure 4: Leading Global Oil Producers E Roberts, Energy in US 4 Figure 5: Leading Global Natural Gas Producers Figure 5: Leading Global Natural Gas Producers E Roberts, Energy in US 5 Figure 6:Leading Nuclear Countries E Roberts, Energy in US 6 Figure 7: History of Energy Use in US National Academy of Science 2009 E Roberts, Energy in US 7 Figure 8: US Production of Primary Energy by Fuel EIA Annual Energy Outlook 2012 E Roberts, Energy in US 8 Figure 9: US Natural Gas Supply and Demand (as as projected by the NCC in 2007 projected by the NCC in 007) NCC 2007 E Roberts, Energy in US 9 Figure 10: US Oil Production Figure 10: US Oil Production NPC 2011 Report: Prudent Development E Roberts, Energy in US 10 Figure 11: US Liquid Fuels Supply and Demand E Roberts, Energy in US EIA Annual Energy Outlook 2012 11 Figure 12: US Liquid Fuel Supply E Roberts, Energy in US 12 Figure 13: Total US Energy Consumption and Production E Roberts, Energy in US EIA Annual Energy Outlook 2012 13 Figure 14: Oil Price Fluctuations and Global Events DOE: 2011 Vehicle Technology Market Report E Roberts, Energy in US 14 Figure 15: Effect of Oil Prices on US Economy DOE: 2011 Vehicle Technology Market Report E Roberts, Energy in US 15 Figure 16: NCC Proposed Future Coal Use E Roberts, Energy in US National Coal Council Report, 2007 16 Figure 17: Use of Transport Fuels E Roberts, Energy in US 17 Figure 18: Projected Vehicle Consumption E Roberts, Energy in US 18 Figure 19: N America High Potential Oil Resources NPC 2011 Report: Prudent Development E Roberts, Energy in US 19 Figure 20: US Oil Production Potential NPC 2011 Report: Prudent Development E Roberts, Energy in US 20 Figure 21: Proven Global NG Reserves in 2008 200 yrs IEA 2008 E Roberts, Energy in US 21 Figure 22: 2007 Projected U.S. NG Imports EIA AEO 2007 E Roberts, Energy in US 22 Figure 23: LNG Capacity at U.S. Terminals Liquid Natural Gas, 2004 d l E Roberts, Energy in US 23 Figure 24: Current US Natural Gas Projections E Roberts, Energy in US AEO 2012 24 Figure 25: Estimates Of US NG Resources NPC 2011 Report: Prudent Development, from a prior 2011 MIT report E Roberts, Energy in US 25 Figure 26: US NG Flat Supply Scenario NPC 2011 Report: Prudent Development E Roberts, Energy in US 26 Figure 27: Source of US NG Flat Supply Note that after 2020 more than 50% comes from shale E Roberts, Energy in US NPC 2011 Report: Prudent Development 27 Figure 28: US NG Supply‐Growth Scenario NPC 2011 Report: Prudent Development E Roberts, Energy in US 28 Figure 29: Source of US NG Supply Growth E Roberts, Energy in US NPC 2011 Report: Prudent Development 29 Figure 30: Energy Losses in Vehicles E Roberts, Energy in US 30 Efficiency Figure 31: ICE LDV Efficiency Strategies Strategies E Roberts, Energy in US EIA Energy Conference, April 2011 f l 31 Figure 32: Alternative Transportation Fuels TTank volume for same energy k l f as 55 liters of gasoline) %of gasoline Liquid OECD report: 2002 E Roberts, Energy in US 32 Figure 33: Payback Periods for LDV’s Operating on CNG E Roberts, Energy in US 33 Figure 34:Proposed LNG Interstate Distribution Centers g p E Roberts, Energy in US 34 Figure 35: Conversion of NG to Liquid Fuels Figure 35: Conversion of NG to Liquid Fuels MIT choice for transportation 2011 E Roberts, Energy in US 35 Figure 36: ‐Projected Figure 36: Projected Methanol Cost Methanol Cost Note assumed cost of gasoline. Present day US national average cost is ~ $3.50/gallon with tax 2011 Present Henry Hub price about $3.50/MMBTU E Roberts, Energy in US 36 Figure 37: Resource Needs for Hydrogen Production (Assume: 4MMT H2 for 20 M LDV’s) Gasification Current and future BAU production and Reforming DOE Hydrogen Program Plan 2011 E Roberts, Energy in US 37 Figure 38: FreedomFUEL Initiative DOE 2002 E Roberts, Energy in US 38 Figure 39: Distributed Hydrogen Production g y g D istrib st b uted H yd ydroge oge n P ro o d uct uction o via a S tea team M et ethan a e Re eform o ing g E le c tricity y 2,0 00 B tu 20 lb C O 2 -eq uiv S tea m R e fo rm er H yd ro g en G a s 1 1 6,00 0 B tu 1 gge H2 H yd ro g e n G a s 1 16 ,0 0 0 Btu 1 gge H2 N atural G as 1 37 ,0 000 B tu E ne rg y U s e fo r D e live ry a t the F o rec o urt 7 ,,2 00 B tu W ate r-G as S hift R ea c to rs PSA P o u t/p / ro d = 300 psi W ate r (fo r s te a m ) E ne rg y L o ss e s 2 3 ,00 0 B tu C o m p res s io n, S to ra g e, & D is p e ns ing 5,000 psi gas fill E ne rg y L o s s es 7 ,200 200 B tu F igure R epresents F uture (2015) C ase. F lows in diagram represent direct energy and em issions between production and dispensing, and are not based on well-to-wheels calculations. E Roberts, Energy in US DOE Hydrogen Program Plan 2011 39 Figure 40: Cost Contributors to Distributed Hydrogen Production b d d d Cost Breakdown of Hydrogen from Di t ib t d N Distributed Natural t lG Gas ($3 ($3.10/gge) 10/ ) NG Feedstock F d t k 30% Capital Cost 44% Other Variables 8% Fixed O&M 18% E Roberts, Energy in US DOE Hydrogen Program Plan, 2011 d l 40 Figure 41: Current Estimates of Costs of Distributed Hydrogen Production Distributed Hydrogen Production Cost, gge DOE Fuel Cells update, 11/2011 DOE Fuel Cells update, 11/2011 E Roberts, Energy in US 41 Figure 42: Schematic Diagram of a Fuel Cell FuelCellHandbook7, DOE 2004 E Roberts, Energy in US 42 Figure 43: Comparison of Fuel Cell and ICE Efficiency E Roberts, Energy in US 43 Figure 44: Fuel and Application of Fuel Cells DOE Hydrogen and Fuel Cells Program Plan 2011 E Roberts, Energy in US 44 Figure 45: Fuel Cell Types Figure 45: Fuel Cell Types DOE Hydrogen and Fuel Cells Program Plan 2011 E Roberts, Energy in US 45 Figure 46: DMFC Benefits for MHE Figure 46: DMFC Benefits for MHE E Roberts, Energy in US 46 Figure 47: UTC PAFC PureCell Model 400 CHP Figure 47: UTC PAFC PureCell Model 400 CHP E Roberts, Energy in US 47 Figure 48: SECA Power Generating System E Roberts, Energy in US 48 Figure 49: SECA IGFC Projections NETL‐SECA, 2010 E Roberts, Energy in US 49 Figure 50: Wartsila 20kw methanol SOFC E Roberts, Energy in US 50 Figure 51: Plug‐in LDV Commercialization Status E Roberts, Energy in US 51 Figure 52: Charging Duration for PEV Systems Figure 52: Charging Duration for PEV Systems NPC Future Transportation Fuels, 2013 E Roberts, Energy in US 52 Figure 53: High Voltage DC Charging of a Nissan Leaf.f NPC Future Transportation Fuels, 2013 E Roberts, Energy in US 53 Figure 54: EPRI PHEV Analysis Figure 54: EPRI PHEV Analysis EPRI Report July 2007 EPRI Report July 2007 Environmental Assessment of Plug‐in Hybrid Electric Vehicles E Roberts, Energy in US 54 Figure 55: Impact of Vehicle Charging on Incremental Electric Power Capacity l l EPRI data summarized in 2012 NPC FTF report E Roberts, Energy in US 55 Figure 56: FreedomCAR Goals Figure 56: FreedomCAR E Roberts, Energy in US 56 Figure 57: Projected Transportation Fuel Cell System Costs l ll E Roberts, Energy in US 57 Figure 58: GM FCEV Skateboard Chassis NPC 2012 Report on Future Transportation Fuels NPC 2012 Report on Future Transportation Fuels E Roberts, Energy in US 58 Figure 59: Hydrogen Fuel Cell LDV’ss in the US Figure 59: Hydrogen Fuel Cell LDV in the US E Roberts, Energy in US 59 Figure 60: MIT/PEW Projections of LDV Economy PEW article on reducing transportation GHG, 7‐2012 PEW article on reducing transportation GHG, 7 2012 E Roberts, Energy in US 60 Figure 61:NPC Conclusions on LDV Fleet Portfolio in 2050 Portfolio in 2050 NPC Future Transportation Fuels, 2013 E Roberts, Energy in US 61 Figure 62:NPC Conclusion on Fuel Shares in 2050 NPC Future Transportation Fuels, 2013 E Roberts, Energy in US 62 Figure 63: Relative Global Warming Potential of Several Gases Several Gases. 100 year E Roberts, Energy in US 63 Figure 64: Carbon Dioxide Emissions of Fossil Fuels Fuel MMT/Quad Kg/GJ Anthracite (coal) Anthracite (coal) 103 1 103.1 97 6 97.6 Fuel Oil 73.1 69.2 Natural Gas 53.1 50.3 E Roberts, Energy in US 64 Figure 65: Global Anthropogenic CO2(eq) Emissions E Roberts, Energy in US 65 Figure 66: US Reference Case (BAU) CO2(eq) Emission Projections i i j i E Roberts, Energy in US 66 Figure 67:US GHG Emissions by Economic Sector Figure 67:US GHG Emissions by Economic Sector E Roberts, Energy in US 67 Figure 68: Changes in Atmospheric CO2 concentrations E Roberts, Energy in US 68 Figure 69: Global Temperature and CO2 Correlations E Roberts, Energy in US 69 Figure 70: Projected Impact Of Climate Change Figure 70: Projected Impact Of Climate Change E Roberts, Energy in US 70 Figure 71: The Scale of the Challenge E Roberts, Energy in US 71 Figure 72: Reference Case CO2 Intensity Projections j i E Roberts, Energy in US 72 Figure 73:Effect of Environmental Controls on E i i Emissions E Roberts, Energy in US 73 Figure 74:Projected Impact of the Waxman‐Markey Bill on Emissions k ill i i PEW article on reducing transportation GHG, 7‐2012 W i l d i i GHG 2012 E Roberts, Energy in US 74 Figure 75: State Renewable Portfolio Goals for Power Generation l f E Roberts, Energy in US 75 Figure 76: Growth of Non‐hydro Renewable Power Generation bl E Roberts, Energy in US 76 Figure 77: Effect of New EPA rules on Power Generation i E Roberts, Energy in US 77 Figure 78: EPRI Projections of EPA Ruling Figure 78: EPRI Projections of EPA Ruling E Roberts, Energy in US 78 Figure 79:CO2 Emissions by Plant Type E Roberts, Energy in US 79 Figure 80: GHG Emissions from Coal and NG Generators NG Generators E Roberts, Energy in US NPC 2011 Report: Prudent Development 80 Figure 81: Projected Changes in Electric Power Capacity l E Roberts, Energy in US 81 Figure 82: History of Natural Gas Price Variation E Roberts, Energy in US 82 Figure g 83: CO2 capture p p processes E Roberts, Energy in US 83 Figure 84: The Future Gen Process E Roberts, Energy in US 84 Figure 85: Possible Sequestration Paths E Roberts, Energy in US 85 Figure 86: US Geological Sinks for CO2 E Roberts, Energy in US 86 Figure 87: Projected Levelized Cost of Electricity NAS 2008 Energy Future E Roberts, Energy in US 87 Figure 88: GHG Emissions Reductions in France Following Introduction of Nuclear Power CO2 emissions fell two‐thirds as a result of French nuclear program. E Roberts, Energy in US 88 Figure 89:New Nuclear Plants Planned in the US NEI 2012 E Roberts, Energy in US 89 Figure 90: Proposed EPRI Generation Portfolios E Roberts, Energy in US 90 Figure 91: Transport GHG Emissions Figure 91: Transport GHG Emissions NPC Future Transportation Fuels, 2012 E Roberts, Energy in US 91 Figure 92: On‐road Vehicle Distribution NPC Future Transportation Fuels, 2012 l E Roberts, Energy in US 92 Figure 93: Direct CO2 Emissions from Transportation PEW article on reducing transportation GHG, 7‐2012 E Roberts, Energy in US 93 Figure 94:Direct Transport Emissions for BAU Scenario Figure 94:Direct Transport Emissions for BAU Scenario PEW article on reducing transportation GHG, 7‐2012 E Roberts, Energy in US 94 Figure 95:Direct CO2 Emissions in Transportation E Roberts, Energy in US 95 Figure 96: History of Changes to CO2 Emissions in LDV’s E Roberts, Energy in US 96 Figure 97: CAFÉ Standards 2012‐2025 E Roberts, Energy in US 97 Figure 98:Direct CO2 Target Emissions in Various Countries E Roberts, Energy in US 98 Figure 99: Petroleum Use with Power Train Design(2035) g ( ) 2025 NHTSA target Suggested 2035 target Source: ANL GREET 2010 E Roberts, Energy in US 99 Figure 100: Estimates of Bio‐fuel Production E Roberts, Energy in US 100 Figure 101: Well to Wheels GHG Emissions Source: ANL GREET 2010 E Roberts, Energy in US 101 Figure 102: WTW 2035 Vehicle Emission Projections MY 2025 EPA target Required “on‐road” 2050 target Suggested MY 2035 target Source: ANL GREET 2010 E Roberts, Energy in US 102 Figure 103: Total Predicted LDV GHG Emissions For 2050 NPC Future Transportation Fuels, 2012 NPC Future Transportation Fuels, 2012 E Roberts, Energy in US 103