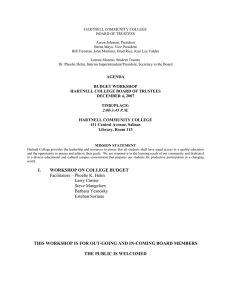

H A R

advertisement