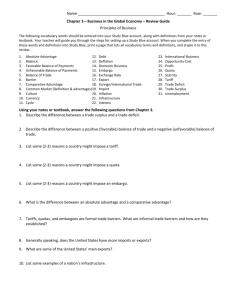

1. The basis for international trade is a) Established trade patterns

advertisement

1. The basis for international trade is 11. Which one of the following is not true? a) Established trade patterns a) An exchange rate is the price of one currency in terms of another. b) The size of gold holdings of two countries c) Absolute advantage d) Comparative advantage 2. Which of the following is not a reason for international specialization? a) Some countries have educated, trained workers, while other countries have unskilled workers b) Tastes and preferences tend to be different in different countries c) Economies of scale can allow larger, specialized producers to operate at lower average cost d) The world price of a good is determined by the world supply and demand for it 7. An import quota is a: a) tax on imports b) legal limit on the amount of a specific good that can be imported into a particular country c) tax on import quantities above the legal limit d) legal incentive for members of GATT to increase their exports of a particular good b) An exchange rate is the means by which the price of a good in one country is translated into the price to the buyer in another country. c) The exchange rate will affect the willingness of foreign buyers and sellers to trade with each other. d) The exchange rate is the price of a currency in terms of another currency for exchanges of goods and services but not for financial transactions. 12. Which of the following observations about a tariff is not true? A tariff: a) is usually an ad valorem tax b) can raise revenues for the imposing government c) usually benefits domestic producers more than consumers d) can be used to protect foreign industries 14. Intra industry trade is more likely to occur between a) rich and poor countries b) countries with high and similar income levels c) developing countries 9. A major U.S. motive for negotiating a freetrade agreement with Mexico was to a) increase immigration into the United States b) encourage Mexico's recent drive to achieve a more market-oriented economy c) keep Mexico from going Communist d) help foster the study of the Spanish language in the United States as a means to trading with all Spanish-speaking countries d) developed and developing countries 18. The characteristics of quotas and tariffs are described correctly by which of the following: a) tariffs assure a certain final price for imports, but not as surely as a quota does. b) quotas assure a certain limited quantity of imports, but not as well as a tariff does. c) quotas assure a certain final price for imports better than a tariff does. d) tariffs do not assure a certain limited quantity of imports as a quota does. 23. A depreciation of the dollar refers to a (an): a) Fall in the dollar price of foreign currency b) Increase in the dollar price of foreign currency c) Loss of foreign-exchange reserves for the U.S d) Intervention in the international money market d) $8.00 per pound 32. Starting at the point of equilibrium between the money supply and the money demand, an increase in the domestic money supply causes the value of the home currency to: a) Depreciate relative to other currencies b) Appreciate relative to other currencies c) Not change relative to other currencies d) None of the above 26. In the early 1980s, the Federal Reserve pursued a tight monetary policy. All else being equal, the impact of that policy was to __________ interest rates in the United States relative to those in Europe and cause the dollar to __________ against European currencies. a) Decrease, depreciate b) Decrease, appreciate c) Increase, depreciate 34. Under a system of floating exchange rates, which of the following policies promotes internal balance for a nation? a) Fiscal policy b) Monetary policy c) Both fiscal policy and monetary policy d) Neither fiscal policy nor monetary policy d) Increase, appreciate 35. Under a fixed exchange-rate system, an expansion in the domestic money supply leads to: 27. Under a system of floating exchange rates, the Swiss franc would depreciate in value if which of the following occurs? a) Trade-account deficit and a capital-account surplus a) Price inflation in France b) Trade-account deficit and a capital-account deficit b) An increase in U.S. real income c) A decrease in the Swiss money supply d) Falling interest rates in Switzerland 30. If wheat costs $4 per bushel in the United States and 2 pounds per bushel in Great Britain, then in the presence of purchasing-power parity the exchange rate should be: a) $.50 per pound b) $1.00 per pound c) $2.00 per pound c) Trade-account surplus and a capital-account surplus d) Trade-account surplus and a capital-account deficit 37. Under a floating exchange-rate system, an expansionary fiscal policy leads to a: a) Trade-account deficit, a capital-account surplus and appreciation of domestic currency b) Trade-account deficit, a capital-account surplus and appreciation of foreign currency c) Trade-account surplus, a capital-account surplus and depreciation of domestic currency d) Trade-account surplus, a capital-account deficit and depreciation of domestic currency 38. Under a fixed exchange-rate system, an contractionary fiscal policy leads to a: a) Trade-account deficit and a capital-account surplus b) Trade-account deficit and a capital-account deficit c) Trade-account surplus and a capital-account surplus d) Trade-account surplus and a capital-account deficit Answer 3. (d) 4. (d) 7. (b) 9. (b) 11. (d) 12. (d) 14. (b) 18. (d) 23. (b) 26. (d) 27. (d) 30. (c) 32. (a) 34. (a) 35. (b) 40. Under a fixed exchange-rate system, an expansionary fiscal policy leads to a worsening in a nation’s balance-of-payments position if the resulting: a) Trade-account deficit more than offsets the capital-account surplus b) Trade-account deficit more than offsets the capital-account deficit c) Trade-account surplus more than offsets the capital-account surplus d) Trade-account surplus more than offsets the capital-account deficit 37. (a) 38. (d) 40. (a)