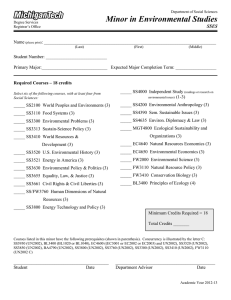

g lo ata e c

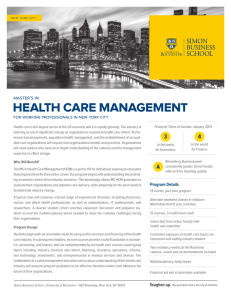

advertisement