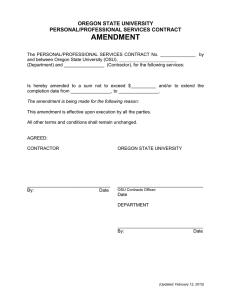

Oregon State University A member of the Oregon University System

advertisement