CFO Jeff Atwater and Broward County Sheriff Al Lamberti

advertisement

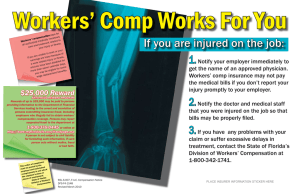

CFO Jeff Atwater and Broward County Sheriff Al Lamberti Announce More Arrests in Joint Workers’ Compensation Task Force Investigations 9/24/2012 Contact: Anna Alexopoulos (850) 413-2842 TALLAHASSEE – Florida Chief Financial Officer Jeff Atwater and Broward County Sheriff Al Lamberti announced today the additional arrests stemming from the newly formed Broward County Workers’ Compensation Fraud Joint Task Force. Barbara Macineiras, 39, owner of JC Check Cashing Store, Inc., and Akram Musa, 45, have been arrested: Macineiras for involvement in a large-scale check cashing scheme and Musa for operating as an unlicensed money transmitter. “The criminals who perpetrate this type of fraud try to be two steps ahead of the law,” CFO Atwater said. “Partnerships between law enforcement agencies such as this one help us stay ahead of the game. By sharing intelligence and resources, I know this joint task force will continue to make great strides in protecting Florida’s honest, hard-working Floridians.” “White collar crimes are becoming more common and the victims are honest citizens,” Sheriff Al Lamberti said. “In law enforcement, we know how to chase a thief down the street but making arrests in these fraud cases requires a new approach and cooperation on the local, state and federal levels.” An investigation by the Workers’ Compensation Fraud Joint Task Force revealed various shell construction companies operating an ongoing workers’ compensation premium fraud scheme and conspiring with Macineiras to file fraudulent currency transaction reports (CTR) totaling over $3.5 million with the Department of Treasury. No workers’ compensation premiums were ever collected on any of the money that passed through the shell companies. In a separate, but similar investigation, fraud detectives arrested Akram Musa, 45, for operating as an unlicensed money transmitter in Broward County. Musa was observed by detectives transporting more than $100,000 in cash and allegedly confessed that he transported the currency from Pompano Beach to Ft. Pierce for a money service business operation without having the proper licensure to do so. The investigation is ongoing and additional arrests are expected. Macineiras was booked into the Palm Beach County jail and Musa was booked into the Broward County jail. If convicted on these charges, Macineiras faces up to 5 years in prison while Musa could face up to 30 years. The Workers’ Compensation Fraud Joint Task Force was jointly created by CFO Atwater’s Division of Insurance Fraud and Sheriff Lamberti’s office in August 2011. Through combined efforts, the task force has successfully shut down 18 shell companies and identified $200 million in fraudulent transactions associated with these companies. Championed by Sen. Thrasher and Rep. Davis during the 2012 Legislative Session, reforms equipped regulators and law enforcement officials with critical tools, including the ability to make unannounced inspections and outlawing the possession of thumbprint stamps or other items used to forge payment authorization. These new provisions are helping detect workers’ compensation insurance fraud more quickly, protecting the honest players in the marketplace while ensuring those responsible for diverting more than a billion dollars from Florida’s economy are caught and held accountable. Anyone with information about these or any other incidents of suspected insurance fraud is asked to call 1-800-378-0445. Citizens who provide tips can remain anonymous. The Department of Financial Services to date has awarded almost $275,000 to more than 40 citizens as part of its Anti-Fraud Reward Program. The program rewards individuals up to $25,000 for information that directly leads to an arrest and conviction in an insurance fraud scheme. Chief Financial Officer Jeff Atwater, a statewide elected official, oversees the Department of Financial Services. CFO Atwater’s priorities include fighting financial fraud, abuse and waste in government, reducing government spending and regulatory burdens that chase away businesses, and providing transparency and accountability in spending.