Health Care Update and Changes

advertisement

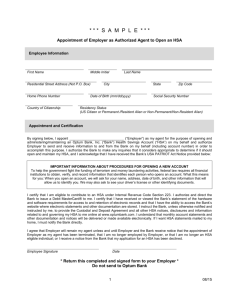

Health Care Update and Changes Gayln L Bowers Agenda Health Care Plan Updates Flexible Spending Account Update Critical Illness Plan Consumer Driven Healthcare Overview Increased Interest in Consumer Engagement • Consumerism – The movement in health care to bring about favorable utilization patterns by providing patients and other consumers with financial incentives (National Business Group on Health) • Taking the “vital signs” of consumer directed health plans with the help of Google: – Consumer Directed Health Plan –405,000 hits – Health Savings Account – 25,200,000 hits – Health Reimbursement Accounts – 343,000 hits – High Deductible Health Plan – 338,000 hits CDHP Defined • A CDHP is a health insurance arrangement with the following features: – An account funded by the employer and/or the employee that can be used to pay for eligible medical expenses (with unused amounts carried forward to subsequent plan years) – A deductible amount that the employee must satisfy after the “account” has been exhausted – An insurance plan that pays benefits (often with a coinsurance feature) after the deductible has been satisfied – Stop-loss protection that kicks in after an out-of-pocket maximum has been reached (frequently comparable to out-of-pocket maximums in traditional PPO plans) • CDHPs come in two basic types: – Health Reimbursement Account (HRA) – Health Savings Account (HSA) CDHP – Health Savings Account (HSA) • Health Savings Accounts (HSA) – HSA accounts can be funded with employer dollars and/or employee salary reduction – Account balances are fully portable – Limited plan design flexibility (Federal regs set minimum deductible, out-of-pocket limits, and maximum HSA contributions) – Employee can not have other coverage (may have a limited use FSA) HSA Basics How long have HSAs been in existence? • The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 added section 223 to the Internal Revenue Code to permit eligible individuals to establish health savings accounts (HSAs) for taxable years beginning after December 31, 2003 • There has been slower acceptance in California - HMO model is still heavily embraced with existence of Kaiser and other HMOs HSA Basics What is an HSA? • Allows members to set aside tax-free dollars to pay for qualified health care expenses* • Unused dollars roll over into the next year • Account balances earn interest tax-free* • Members own their HSA – it moves with them if they change jobs or health plans *Contributions & earned interest to an HSA are taxable income in California HSA Basics Who is Eligible? • • • • • Members must be enrolled in a high-deductible health plan (HDHP). The HDHP must have the following to be considered HSA-compatible:* – A minimum deductible of $1,200 employee only / $2,400 family – An annual out-of-pocket maximum which can not exceed $6,050 employee only / $12,100 family Members must not be enrolled in another health plan Members must not be enrolled in Medicare Members must not be claimed as a dependent by anyone Expenses for adult dependent children are not eligible beyond age 18 (if full-time school) or 23 (exception for disabled dependents) – Not consistent with Healthcare Reform dependent change *Reflects 2012 IRS requirements – subject to change in future years. HSA Basics • How Much May be Contributed? • Up to the IRS annual limits:*012 Contribution Limits – 2012 Contribution Limits • $3,100 = Employee only • $6,250 = Family • Individuals 55 or older may increase contributions by:* • 2012 = $1,000 • If members enroll mid-year and fully fund their HSA, they must remain enrolled through the following calendar year to avoid a tax penalty • *Reflects 2012 IRS requirements – subject to change in future years. HSA Basics When and How are Contributions Made? • Contributions for the current year may be made at any time (thru April 15th of the following year) • Contributions may be made in any amount (up to Federal maximum) • Contributions may be made: – Pre-tax via payroll deduction (if allowed by employer) – Post-tax check (deposit requirements will vary by vendor) • MSA, other HSA and IRA rollovers are permitted with limitations *Contributions to an HSA are taxable income in California. HSA Basics How Will this Differ from a Traditional Plan? • Higher plan deductibles - must be met prior to insurance kicking in • Prescriptions are also subject to the plan deductible • Lower premiums - annual savings could total more than the plan deductible • More paperwork than with an HMO • Funds must be deposited in an HSA before they can be used for reimbursement • HSA balance will grow if no expenses are incurred NOTE: The plan deductible is not prorated, regardless of plan effective date. HSA Advantages Member Tax Savings: • Pre-tax contributions can be made via payroll* (if allowed by employer) • Earnings are tax-free while the money remains in the members HSA* • Withdrawals for qualified health care expenses are tax free • HSA may transfer to the surviving spouse tax free • After turning 65, HSA dollars may be withdrawn for any purpose, paying only normal income taxes with no penalties *Contributions & earned interest to an HSA are taxable income in California. HSA Advantages Long-Term Savings: • Save for future medical needs – a variety of healthcare expenses including dental and vision, LTC premium and medical premium during periods of unemployment – Refer to IRS Publication 502 for complete listing • Unused balance rolls over tax-free from year to year • Variety of mutual fund investment options available once an account balance reaches the required minimum – Minimum balance requirements and fund options vary by HSA vendor • . Can serve as a “medical retirement fund” HSA Advantages Member Tax Savings: • Pre-tax contributions can be made via payroll* (if allowed by employer) • Earnings are tax-free while the money remains in the members HSA* • Withdrawals for qualified health care expenses are tax free • HSA may transfer to the surviving spouse tax free • After turning 65, HSA dollars may be withdrawn for any purpose, paying only normal income taxes with no penalties *Contributions & earned interest to an HSA are taxable income in California. HSA Advantages Ownership: • Members control how they spend the money in their HSA account – Used for eligible expenses today – Save it for the future • Members can change health care plans and keep the money in their account* • Members can change jobs and keep the money in their account* *Continued contributions are not permitted unless members are enrolled in an HSA-compatible plan Member Expenses Visiting the Doctor: • Members should notify their doctor’s office that they have changed insurance plans to a high deductible health plan • Deductible is waived for preventive care – All other expenses are subject to the plan deductible, including prescriptions • Members are not required to pay at the time of visit • Members should request that their doctor submit claims to their insurance provider first Member Expenses Paying for Services: • The insurance provider will process the claim and send the member their Explanation of Benefits (EOB) • The EOB will reflect the provider’s discounted rates with the insurance provider (the savings members receive for having insurance) • Members may pay the bill by using: – HSA debit card – HSA checkbook – Or other personal accounts, allowing their HSA balance to grow Note: Member assumes responsibility for legitimizing reimbursed expenses. Member Expenses Pharmacy: • Prescription drugs are subject to the plan deductible • Present the health care ID card at the pharmacy • Even though members will be responsible for the cost in full, most prescriptions are available in a Generic form • Members may pay their bill at the Pharmacy by using their: – HSA debit card – HSA checkbook – Or other personal accounts, allowing their HSA balance to grow Member Expenses HSA Account Fees: • HSA vendors charge setup and monthly fees • Employers have the option to cover the monthly and/or setup fee charged by HSA vendors • All transactional fees associated with the members account will automatically be deducted from their account balance, i.e. ATM fees, deposits, withdrawals Summary - Member • Members may not be enrolled in another non-HDHP medical plan or Medicare • Pay for services after the EOB has been received • Limit ATM fees – use debit card to pay for expenses • Funds are not available until deposited • The plan deductible is based on the calendar year and not prorated to the enrollment date • Members may use HSA funds to pay for eligible expenses incurred by dependents up to age 19 (if in school full-time) and 24 • HSA funds may not be used for expenses incurred by domestic partners • Members can have multiple HSA accounts, but the limits defined by the IRS will be aggregated Summary - Member • HSA contributions under a cafeteria plan may be increased, lowered or even stopped as long as it is prospective • If enrolling in an HSA in the middle of a year, members are allowed to make a full year’s contribution, provided that they remain covered by the HSA for at least the 12-month period following that year • Members with dependents must meet the family deductible before coinsurance kicks in for any insured • Prescriptions are subject to the deductible; generic option saves money • Member is responsible for legitimizing reimbursed expenses • HDHPs generate more paperwork and financial responsibility • The first year could be the most difficult since members could incur a large claim prior to funds being available Contribution Examples • EXAMPLE 1: Joe, age 45, and his children are enrolled in an HSA-compatible plan. How much can be contributed to Joe’s HSA? − ANSWER 1: $6,250 (2012 family limit) • EXAMPLE 2: Jane, age 58, wants to contribute the maximum allowable amount to her HSA. How much is she allowed to contribute? − ANSWER 2: $4,100 (2012 individual limit + catch-up) W-2 Example • Rollovers from MSAs and other HSAs are permitted. These rollover contributions are not subject to the annual contribution limits. • Rollovers from an IRA are permitted once in a lifetime, and cannot exceed the maximum contribution limits for that calendar year. Employer contributions will appear in section 12 of member’s W-2 as taxable income Qualified Expenses Examples (but not limited to): • Acupuncture • Legal fees • Ambulance • Anesthetist • Lodging / Transportation costs (relative to health care) • Birth control pills • Nursing Services • Braces • Ophthalmologist Reimbursement is not permitted for all expenses. Some examples of unqualified expenses are provided below: • Chiropractor • Orthopedic Shoes • Over the Counter Drugs • Contact Lenses • Oxygen Equipment • Contraceptive devices • Vaccines • Cosmetic Surgery • Dentures • Wheelchair • Funeral Services • Dermatologist • X-rays • Health Club Dues • Eyeglasses • Medicare Parts A & B after age 65 • Life Insurance Premiums • Guide Dog • Premium LTC and COBRA • Babysitting/Childcare • Hearing Aids/ Batteries • Insulin treatment • Lab tests • Lead paint removal For more information, see IRS Publication 502: Medical and Dental Expenses (Section 213(d)) or consult members tax advisor. Not All Expenses Qualify (without a physician’s prescription) • Teeth Bleaching PUC – HSA Design • Employee Only - $2,000.00 (PUC will deposit 50% of deductible split into $250.00 per quarter.) • Employee plus one - $4,000.00 (PUC will deposit 50% of deductible split into $500.00 per quarter.) • Preventive care must continue to be paid at 100% as required by the Patient Affordability and Protection Act. • PUC traditional medical plan will not pay until employee has met deductible. Once employee has met deductible PUC traditional plan will pay at 90% and employee at 10%. Maximum out of pocket remains for employee only $3,000.00 and employee plus one $6,000.00. Rollover Contributions • Rollovers from MSAs and other HSAs are permitted. These rollover contributions are not subject to the annual contribution limits. • Rollovers from an IRA are permitted once in a lifetime, and cannot exceed the maximum contribution limits for that calendar year. Tax Penalty • Distributions from an HSA, not used exclusively for qualified medical expenses, are includable in the members gross income and may be subject to an additional 20% penalty tax. • Distributions made for expenses that are reimbursed by another health plan are includable in members gross income, whether or not the other health plan is a high-deductible health plan. NOTE: Other tax penalties may apply depending on the scenario. Questions