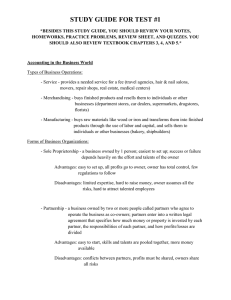

Chapter 4 Review Outline Examine to read Chapter 4 for the test.

advertisement

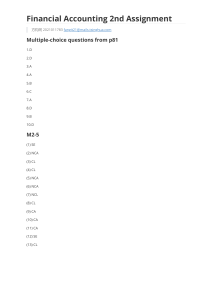

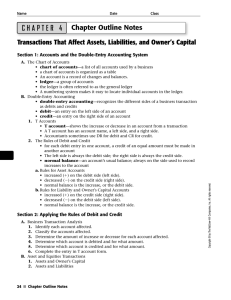

Chapter 4 Review Outline Test – Wednesday, 10/14 Examine the learning objectives below you should be able to complete all of the following. Also, be sure to read Chapter 4 for the test. Apply the rules of debit and credit to asset, liability, and owner’s equity accounts. Use T accounts to analyze a business transaction into its debit and credit parts. Identify the normal balance of accounts. Calculate account balances after recording business transactions. Analyze transactions that increase or decrease assets, liabilities, and owner’s capital and record them in T accounts. Define and use the accounting terms introduced in this chapter. Demonstrate your ability to define and apply the following terms: o Ledger o Chart of Accounts – o Double-Entry Accounting System – o T account – o Debit – o Credit – o Normal Balance – Apply your knowledge gained throughout this chapter by responding to the questions below. 1. Why is a business transaction entered in at least two accounts? 2. Would double-entry accounting be used in an electronic accounting system? 3. Why do accounts use T accounts? 4. Name the three basic parts of a T account. 5. What is the left side of a T account called? The right side? 6. State briefly the rules of debit and credit for increasing and decreasing AND the normal balance for the following: a. Asset Accounts – b. Liability Accounts – c. The Owner’s Capital Account – 7. Classify the following accounts: a. Office Equipment b. Delivery Truck c. Accounts Receivable d. Store Supplies e. Cash in Bank f. Lee Jones, Capital g. Office Supplies h. Accounts Payable 8. Explain briefly what is meant by each of the following phrases: a. A debit of $100 to Cash in Bank b. A credit balance. c. A credit of $500 to Accounts Payable. d. A debit balance. e. What are the 6 steps involved in analyzing transactions?