FLAIR Meeting Minutes

advertisement

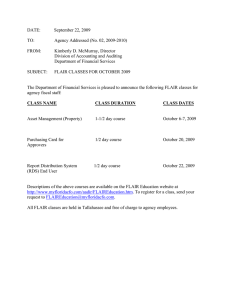

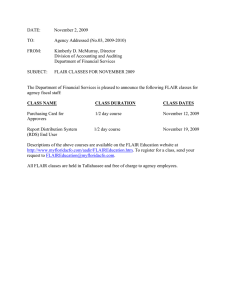

DEPARTMENT OF FINANCIAL SERVICES FLAIR Meeting Minutes Meeting Name: FLAIR User Group Date: 5/27/2010 Time: 2:30 p.m. Location: Burns Auditorium ¾ FLAIR User Group Call to Order – Mike Wolfe - Chairman ¾ Approval of the Minutes – Mike Wolfe – Chairman Minutes approved unanimously as written. http://www.myfloridacfo.com/aadir/FLAIRUserGroup/MinutesMay2009.pdf ¾ Report of the Sub-Committee – Jim Oakley – Enhancement Chairman 2009-002 Department of Environmental Protection (DEP) proposed changes to Account Code TR80 transactions. Tommy Lemacks commented that when the transactions move from the GL to property sub-system some fields do not currently have data (ORG, CAT, YEAR). This enhancement would include all fields on the GF80 so that reconciliation is easier. Enhancement passed. 2009-003 JAC requested that automated Certified Forward (CF) be the default and not the exception. Sub-committee had questions at their meeting, since JAC was unavailable to answer them, the enhancement has been tabled. 2009-04 Request to re-title TR57 as “Overpayments.” Department of State (DOS) refunds fees (not classified as tax related) that are transferred to General Revenue (GR); they are concerned the title of the TR57 “Overpayment of Taxes” is misleading. After discussion of the issues a vote was called for by the committee chairman. Enhancement passed. 2009-005 Department of Children and Families (DCF) would like the ability to schedule regular reports for a prior period. When a report is run for a prior period and a report is run for a daily report, they look exactly the same and the current date appears on both. This enhancement would allow for an “As of” date. Enhancement passed. 2010-001 Department of Revenue (DOR) is unable to upload a TR30s with a negative line item. Frank Noltee is working with DOR as it appears to be an isolated problem. This enhancement was tabled pending further research. ¾ Legislative Update – Kimberly McMurray (Christina Smith) Overview is not all inclusive of the statutory changes. SB2386 • Debit Collection Change timeframe to turn over debt to DFS from 180 to 120 days. FLAIR User Group Page 1 of 6 6/22/2010 DEPARTMENT OF FINANCIAL SERVICES FLAIR Meeting Minutes October 1 – each agency shall submit a report to Legislature and CFO: o Total of all accounts referred to collections & status. o A list of all delinquent accounts not referred to collections & reason. o A list of all accounts written off or waived. December 1 – CFO shall submit a report to Governor and Legislature: o Amount of claims referred to collections by each agency. o Number of accounts by age and amount. o Listing of agencies that failed to report known claims to the CFO. o Total amount of claims collected. • Electronic Funds Transfers Receipts: o Give Agencies rule making authority for the receipt of payments by electronic means. Payments: o Gives the CFO rule making authority for the payment of goods and services by electronic means. • Contracting: o New agency reporting requirements to the CFO for non-competitively awarded contracts. o Contract and grant agreements must include a scope of work and quantifiable deliverables. o Agencies must maintain records to support a cost analysis for noncompetitive awarded contracts. o Increase to purchasing category thresholds. o Added health services as an exemption to the competitive solicitation requirements. o New business case requirements for outsourcing projects in excess of $10 million. o New human and health service contracting coordination requirements for DCF, APD, DOH, DOEA, and DVA. New OLOs • Southwood Shared Resource Center – New OLO 7298 FY10-11 • Northwood Shared Resource Center – New OLO TBD FY11-12 GAA Impacts • Health Insurance Modifications – Spouse Program and SES/SMS ¾ 3% Federal Withholding from Vendor Payments – Molly Merry 1. Overview of 3% withholding law: a. Section 3402(t), I.R.C. (Tax Increase Prevention and Reconciliation Act of 2005. b. Became law on 5/17/2006 with an extended date by ARRA of 1/1/2012. c. Bills in Congress: HR 275 – Currently with House Committee on Ways & Means S 292 – Currently in Senate Finance Committee FLAIR User Group Page 2 of 6 6/22/2010 DEPARTMENT OF FINANCIAL SERVICES FLAIR Meeting Minutes 2. 3. 4. 5. d. Applies to all vendor payments for goods and services $10,000 or more. e. Excludes payments for: 1. Interest, 2. Purchases of real property, 3. Public assistance or other “need-based” payments, 4. Payments made to other governmental entities and taxexempt entities. f. In 2008-2009 fiscal year, the state made 166,196 expense payments over $10,000 to 19,113 vendors. Implementation Plan: a. Create an Electronic W-9 Website for vendors to submit W-9s electronically by January 1st, 2011. b. Collect valid W-9s on the approximately 250,000 vendors with requirements becoming effective in early 2012. c. Validate W-9s using the IRS TIN Matching program. d. Design and implement modifications to Central FLAIR for 3% criteria. e. Reviewing the state’s object codes. Changes may occur to the file on 7/1/2011. f. Reporting - Modify reports for DFS and agencies as required. g. Work with MFMP to simplify the W-9 process for vendors. Agency Impacts: a. Communicate with vendors - should be mentioning the 3% withholding law to vendors now http://www.myfloridacfo.com/aadir/IRS3PercentWithholding.htm. b. Go to CFO website – type in search box “IRS 3%” and click on 3percent@myfloridacfo.com for updates. c. Working on a document for vendors to be added to the website “What does the 3% withholding law mean to State of Florida vendors?” d. Object codes will become even more important! There will be formal training prior to go-live. Questions to date with responses: a. “Are we talking with other states to see how they are proceeding?” – We are, but Florida seems to be on the forefront of this. Texas and New York are also working hard on this, but many states are waiting to see if the law will be repealed. b. “Will MFMP keep procurement from happening with vendors who do not have a W-9 in place?” – We are currently having discussions with MFMP, but do not yet have a resolution. c. “Will the object code list change?” – Yes, there will be some changes, but we do not expect them to be extensive. Changes will be limited to the object code level; categories will not be affected. d. “Any thought of sending out a central transaction report?” – Maybe, but that has not yet been decided. There was an additional comment that we hope the information will be stored on the Nightly Transaction File, which is a central file. e. “Are we starting communications with vendors?” – Yes. f. “What will happen when warrants are cancelled? Will the entire 100% be returned to the agency?” – There will be a process for cancelled warrants, but that process has not been worked through at this time. g. “What will keep a business from submitting 10 invoices for $9,999.99 instead of one for the total amount?” – There is a provision in the law that requires us to monitor for that activity. FLAIR User Group Page 3 of 6 6/22/2010 DEPARTMENT OF FINANCIAL SERVICES FLAIR Meeting Minutes h. “What if an invoice for $17,000 is paid from 2 different funds and the payments are each under $10,000?” – Right now, that would not trigger the 3% withholding. For now, we will continue to do business as we always have. i. “Is there anything in the law that will require vendors to accept the 97% as payment in full?” – No. 6. There is also a provision in the Health Care Reform bill that will require the state to send 1099 forms to corporations that have received payments of $600 or more. 7. The 3% withholding regulation does apply to P-Card. DFS has appealed to the Federal government explaining that the vendor gets their money from the bank. It is not currently known how this will be implemented, but it does apply to P-Card purchases. DFS is reviewing options. 8. The Vendor Client File project was put on hold but will be reviewed to determine alternatives for using the Vendor Client File differently. ¾ W-2s On-line Project Update – Becky Rosier 1. Communication regarding the electronic W-2 availability will be forthcoming later this year. 2. Implementation is anticipated for the Calendar Year 2010. 3. Employees must OPT-IN through the Employee Information Center (EIC) beginning later this year. Employees can’t be forced to receive electronic form. 4. Employees must have a valid e-mail address in their EIC record to OPT-IN for electronic W-2 purposes. 5. Employees who OPT-IN will be able to view their W-2 early in January. This will be in pdf format and can be saved to the employee’s computer or printed by the employee. Employees who have not opted to receive their W-2 electronically will be able to view their W-2 on the web beginning Feb. 1st. 6. Annual Earnings & Benefit Statement (Old Information Statement) will only be available on the website. Corrected annual statements will no longer be generated. 7. Agency Reports will be modified to indicate if the employee received a paper or electronic W-2. 8. W-2c’s will be a second phase of the project and will continue to be printed at this time. BENEFITS TO STATE AGENCIES 1. Less W-2 handling a. Agencies will no longer need to collate the Annual Information Statement & W-2 for stuffing. b. Agencies will have less W-2 forms to distribute resulting in savings of time & mailing cost (envelopes, postage, etc). 2. Simpler Duplicate W-2 processing a. Employees can log into the Employee Information Center and print any W-2 beginning with 2010. W-2’s will remain available to the employee for 3 years on the website. b. Duplicate W-2’s can be printed from the website by the designated Agency staff immediately rather than as an overnight mainframe process. This will be a much quicker process and have less likelihood of the duplicate W-2 being lost in transit. FLAIR User Group Page 4 of 6 6/22/2010 DEPARTMENT OF FINANCIAL SERVICES FLAIR Meeting Minutes c. Agencies that do not currently have an Access Control Custodian set up (about ½ of the Agencies) for the Employee Information Center will need to get one established so Local Supervisors can be created. See Agency Addressed Memo on how to do this at: http://www.myfloridacfo.com/aadir/bosp/DFSBP%2007-05.pdf Contact Information: Becky Rosier 850-413-5431 Becky.Rosier@myfloridacfo.com ¾ Re-submission of Sampled Invoices – Cheri Greene Agencies were reminded deleted sampled invoices must be re-vouchered using the “A” bookkeeping indicator on the disbursement transaction to ensure the invoice is required to be pre-audited by the Bureau of Auditing. The return notice received from the Bureau should be attached to the new voucher schedule. Agencies that input a contract number on the disbursement transaction should continue to use the “Z” bookkeeping indicator in order to bypass Central’s Contract System. The Bureau of Auditing will work with these agencies on an alternative plan. ¾ Batch Transaction Types 21, 22, 33 – Joanne Krieberg-Wolin These transactions are now available as batch transactions. For file layouts, go to this website: www.myfloridacfo.com/dishelpdesk/filelayouts ¾ Agency Addressed Memorandum No. 13, 2009-2010, Florida Accounting Information Resource (FLAIR) Fiscal Year 2009-10 Closing and Agency Addressed #15 – Undisbursed Appropriations at Fiscal Year Ended June 30, 2010. - Rita Smith and Cheri Greene This year the certified information and the year end information are split into two separate memos, with no major changes. Agencies are reminded that MFMP transactions need to be in the Bureau of Auditing’s queue by June 21 to allow for the transactions to be processed by June 29. Paper vouchers must be received by the Bureau by 5 p.m. on 6/30 to be processed as 09-10 transactions. Voucher sites outside of Tallahassee must adjust their last day of voucher input to allow for ample mailing time. ¾ FLAIR Education Update – Ella Hinson This fiscal year the FLAIR Education provided training to more than 500 agency staff from 31 agencies. Classes will begin again in September after agencies year end closings and all courses will be held in Tallahassee. There was an agency request for a survey to determine agencies need for courses during the summer months. A survey will be provided, but explained in the past we have not had enough participants to hold classes and that the training staff uses this time to revise materials, develop classes, etc. FLAIR User Group Page 5 of 6 6/22/2010 DEPARTMENT OF FINANCIAL SERVICES FLAIR Meeting Minutes ¾ Nominations and Election of FY 2010/2011 Officers – Ella Hinson Nominations & Election of FY 2009-2010 Officers – Ella Hinson: a. Nominations: i. President – Mike Wolfe 1. Closed, voted and elected ii. Vice President – Jim Oakley 1. Closed, voted and elected iii. Secretary – Ella Hinson ¾ Other Business – Mike Wolfe Christina Smith provided additional information concerning the Division’s plan to develop a policy regarding confidential FLAIR information. Confidential information will be limited to specific FLAIR fields. Agencies with concerns should contact Christina Smith. Jim Oakley questioned how often the FLAIR User Group should meet. Mike Wolfe responded to the question of how often the FLAIR User Group should meet with a minimum of once a year or more often if required. ¾ Adjournment Motion made to adjourn, seconded, and approved FLAIR User Group Page 6 of 6 6/22/2010