Quarterly Purchasing Card Administrators’ Meeting AGENDA Introductions

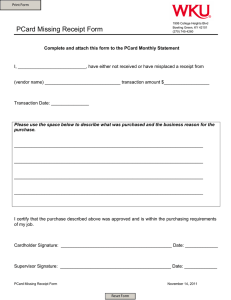

advertisement

Quarterly Purchasing Card Administrators’ Meeting Wednesday, February 9, 2011 – 8:30-12:30 HSMV Auditorium, Neil Kirkman Building AGENDA Introductions Outstanding Items ITN Update National Association of Purchasing Card Professionals Membership Update Tolls and Fees Update (includes presentation by Lisa Wilkerson, DOT) PCard Copies by Hotels Need for Both Monthly and Cycle Limits MRE Training Financial Disclosure New Items Bureau of Accounting Issues o Statewide Vendor File o 1099s o 3% o Third Party Billing “Zero Balance” Invoices and Other Receipt Requirements (Included with Charge Reviews) Charge Reviews o Statutory Authority/Justification o Allowable Expenses o Documentation Requirements Reports for Agency PCard Administrators’ Management Status of Plan Reviews o Rep Letters Tax-Exemption Renewal Travel Insurance Benefits Disapproval Code for Disputes Decline Reports Vendor Issues o Office Depot/Staples requesting card numbers o Best Buy Best Practices Clips Quarterly Purchasing Card Administrators’ Meeting Minutes Wednesday, February 9, 2011 – 8:30-11:30 HSMV Auditorium, Neil Kirkman Building Facilitator: Marie Walker Introductions Marie Walker introduced: Bureau of Auditing staff, including Mark Merry, Cheri Greene, Lee Rayner, and Michelle Oliver. Bank of America (BOA) staff, Kristen Harrison and Evan Tullos. Note: All BOA concerns and issues still need to go through Marie. This meeting was an opportunity to enhance communication among all parties. Outstanding Issues 1. Invitation To Negotiate (ITN) Update – The current agreement with BOA has been extended until 2013 (Amendment 10); however, the extension can be terminated earlier. The ITN team is still negotiating with the finalists. 2. National Association of Purchasing Card Professionals Membership Update – DMS is taking the lead on this issue. If DMS joins the Association as the primary member, other state agencies and local governments may join as associates at a reduced rate. Marie will follow up with DMS. 3. Tolls and Fees Update (presentation by Lisa Wilkerson, DOT) Lisa Wilkerson provided slides to Agency Administrators. The slides will be posted to the PCard website in the near future. Open road tolling video (click on tv screen appearing at the right of the screen on the following link): http://www.floridasturnpike.com/all-electronictolling/about.html Receipt system for Highway Tolls Administration video. http://www.htallc.com/Receipt_Request.aspx?rental=208 Additional discussion regarding Tolls and Fees: a. Transponders supplied by each agency are recommended in order to avoid paying the convenience/administrative fees and higher toll charges. b. When replenishing a transponder‘s balance, the agency should print out where the tolls were charged for that transponder and attach to the PCard receipt. Quarterly PCard Administrators’ Meeting February 9, 2011 Page 2 4. PCard Copies by Hotels – DFS and DOR are at an impasse. DOR continues to require hotels to make copies of the PCard to support the tax exemption. This item is off the agenda unless something changes. 5. Need for both Monthly and Cycle Limits – According to the FLAIR personnel in DFS‘ Division of Information Systems, both ―monthly and cycle maximum amounts are required.‖ Only the ―monthly and cycle transactions can be left at zero, which equates to unlimited.‖ 6. MRE Training – The FLAIR Enterprise Education staff are still developing the introductory class for PCard. Financial Disclosure – Agency Addressed Memo is working its way through the approval process. (Note: Agency Addressed Memo #21, (2010-2011), Purchasing Card Financial Disclosure Requirements was issued February 9, 2011.) The form can be accessed at the following website: http://www.ethics.state.fl.us/ 7. Third Party Vendors – Agencies should use the Third Party Vendor‘s FEID in the Vendor ID field and capture the vendor‘s name the agency is doing business with in the description and/or commodity description fields. The use of PayPal is discouraged; however, it is acceptable if no other options are available. New Items 1. DFS, Bureau of Accounting Issues - Debbie Evans a. The Feds have postponed the 3% withholding requirement on payments of $10,000 or more for commodities or services for PCard purchases for at least 18 months. (The PCard portion has been postponed - not the 3% withholding requirement for other purchases.) b. Beginning January 1, 2011, Bank of America (the PCard provider) will be responsible for preparing 1099s for the purchases the State of Florida makes using a PCard. i. Agencies do not need to collect Form W-9 from PCard vendors anymore as an electronic methodology is being implemented ii. Agencies still need to obtain the correct Tax Identification Number (TIN) to: o maintain the integrity of the Statewide Vendor File o be consistent when there are other purchases from the vendor that are not PCard o report correctly on the Sunshine Spending Website (transparency) iii. DFS receives many requests to help find a TIN for a vendor. Here are some helpful tips: Quarterly PCard Administrators’ Meeting c. i. ii. iii. iv. v. vi. d. i. ii. iii. iv. v. vi. vii. February 9, 2011 Page 3 o Contact the source that provided the service and ask for the vendor‘s payroll or tax section o Ask for the Tax Identification Number used to report payroll taxes and income tax to the IRS o If their corporate office pays the taxes, ask for the phone number to the corporate office DFS is developing an electronic Substitute Form W-9 Has additional business designations than on our current Substitute Form W-9 needed for the 3% withholding requirement Will require vendors to complete this new form before creating purchase orders or payments for commodities or services. Will encourage the PCard vendors to register electronically The K-vouchers will be exempt from this requirement. The current Substitute Form W-9 will be obsolete An Agency Addressed Memorandum will be sent out the day the website goes live (towards the end of February) New vendor file enhancements Agency Addressed Memorandum #20 dated 02/07/2011 concerning the Client Vendor conversion and Statewide Vendor File enhancements. (Includes contact information) http://www.myfloridacfo.com/aadir/aam/aam2011.pdf Removed PCard (PC) indicator Added a ―Payee‖ designation for entities not providing services or commodities Allows agencies to add vendors that have not provided an FEIN or SSN with a prefix ‗N‘ (After due diligence trying to obtain the correct TIN) The nine digit vendor id following the ‗N‘ prefix will be systematically assigned DFS will still assign the vendor ID for foreign vendors Agency Addressed (No. 19, 2010-2011) dated 01/21/2011 indicates the training workshop schedule. Additional discussion regarding Statewide Vendor File: a. The PF1 key for Vendor # in the PCM does not populate the ―dba‖ name. For example, Highway Toll Administration should have a dba Avis Rentacar Tolls. Debbie suggested adding a seq. 02 for the vendor including Avis Rentacar Tolls to Line 1. b. The confidential indicator is automatically included for vendors added through MFMP. Agencies can request DFS to remove the indicator. c. Agencies should not use BOA‘s FEID when vendor‘s FEID is not available, especially for object codes listed in green on the State Standard Expenditure Object Codes list. Quarterly PCard Administrators’ Meeting February 9, 2011 Page 4 d. The Vendor File Group will assist agencies in finding the correct FEID. If the FEID cannot be determined, an agency should add the vendor to the statewide vendor file using the ―N‖ prefix. (The Statewide Vendor File Group will monitor the use of ―N‖ numbers.) e. Kristen Harrison (BOA) will ask the bank‘s developers how/what the bank can do to help with determining vendor FEIDs. 2. Charge Reviews – DFS will be performing more charge reviews. If the requested information (policies, procedures, statutes, etc.) apply to many purchases, DFS will file the copy provided to prevent from asking for it again. During the reviews, DFS has noticed a need for further explanation of the following subjects: o Statutory Authority/Justification – When DFS request authority or statutory authority, it must be State of Florida statute. An agency must have express or implied authority for a purchase. o Allowable Expenses – Reference Guide for State Expenditures is an excellent source to determine allowable expenses. The Reference Guide and CFO Memos carry the authority of rule. o Documentation Requirements The slides related to this discussion were provided separately and will be posted to the PCard website. Additional discussion regarding Charge Reviews: a. Some agencies do not allow last 4 digits of card number to be included on documentation. An indication the purchase was paid by a credit card is sufficient. b. Receipt and Invoice requirements were discussed. For the most current guidance, see the Reference Guide for State Expenditures being released March 2011. c. PCard is a method of payment, not an exception to purchasing rules. d. Advance payments must comply with requirements contained in the Reference Guide for State Expenditures. e. DFS will continue to perform post audits, from time to time. 3. Reports for Agency PCard Administrators’ Management – These reports are needed to ensure internal controls are being met. DFS is working to determine what information needs to be included on the reports, who needs access to them, and how the reports will be distributed. 4. Status of Plan Reviews – DFS is working on reviewing the agency plans received with last years‘ Representation (Rep) Letters. o Rep Letters - DFS plans to request the Rep letters annually; however, this year‘s request will be postponed due to new agency heads and the delay in Quarterly PCard Administrators’ Meeting February 9, 2011 Page 5 reviewing the agency plans included with last year‘s Rep letters. Agencies requested a workshop prior to receiving the next Rep Letter, and DFS agreed. 5. Tax-Exemption Renewal – DFS has contacted DMS regarding the expiration of the current Tax Exempt Certificate (May 2011), as it is DMS‘ program. DFS will post the new certificate (full-size and wallet-size versions) on the PCard website. The same tax-exempt number will be issued. (NOTE: The certificate has been issued and will be posted on the PCard website early in May.) 6. Travel Insurance Benefits – There is no ―death while traveling‖ coverage included with the PCard. 7. Disapproval Code for Disputes – DFS received a suggestion for a new disapproval code to be created strictly for PCard charges being disputed, in order to differentiate those disapprovals from others coded as 081. At this time, FLAIR changes cannot be made due to other projects. 8. Decline Reports – Zeros and dashes are appearing in the amount fields of the Decline Reports. According to BOA, these values depict address verification by the merchant, not valuable data, such as: restricted blocked MCC, over credit limit, or other reasons to monitor a cardholder‘s usage. The agency administrators were asked how they felt about DFS not including these entries on the weekly Decline Reports. To meet the various needs of agency administrators, records with zeros and dashes will be included at the end of each report. Agency administrators have noticed recently that charges are being declined, but later appearing in FLAIR as a valid charge. Marie asked the administrators to submit specific details of these occurrences and she will follow-up with BOA. (NOTE: Based on research after the meeting, some issues are being caused by merchant bank issues—not BOA. In those cases, the merchant must take action to resolve the issue.) 9. Vendor Issues– Office Depot and Staples have recently requested lists of cardholders and account numbers from agency administrators. The state contract does not require the vendors to maintain a list of cardholders and account numbers. o Office Depot – To receive the state contract prices, cardholders can either register the card on Office Depot‘s website or request an Office Depot Store Purchasing Card which can be used for identification purposes. o Staples – DEP noted that Staples was not able to manage all of the agency cards under one account, so the agency could capture the costs of the agency. Quarterly PCard Administrators’ Meeting February 9, 2011 Page 6 o Best Buy – Company account manager stated that in order for a state agency to receive contract prices related to Contract Number 880-000-091, the cardholder should order items via the Best Buy website or the dedicated toll-free number (866-214-2754) prior to picking up the items at the store. 10. Clips – DFS has boxes of binder clips and paper clips, which were received from the agencies on vouchers, etc. Marie offered to share the clips with the agencies. 11. Questions o Records Retention requirements – five years (original documents or scanned images) NOTE: Some topics were discussed in a different order than presented here for the convenience of the guests. CHARGE REVIEW CONCEPTS Allowable? – State Laws – State Rules – Reference Guide for State Expenditures – Federal Laws, Rules, and Regulations Ask – Can the funds be used in this manner? Allowable? Attorney General Opinion #078-101 - states an agency must have expressed or implied statutory authority to expend state funds. An agency cannot delegate to a provider an authority the agency does not possess. If an expenditure is unallowable for an agency, it is generally unallowable for the provider. (If the law does not say that you can, then you cannot.) Allowable? Questionable Expenditures: • • • • • • • • • • • • • Candy Alcohol Banquets Decorations Greeting Cards Gift Cards Lobbying Personal Cellular Telephones Flowers Office Parties Coffee Pots Microwave Ovens Refrigerators • • • • • • • Fund Raising Promotional Items Entertainment Refreshments Fans Portable Heaters Meals not in accordance with Section 112.061, F.S. Note: some of these items may be allowable with statutory authority. Justifiable? • Necessary--Required to provide services. • Reasonable--Sufficient for intended purpose. •A prudent person would come to the same decision under similar circumstances. Requires professional judgment. Justification should be documented. Ask - Can I defend this purchase? Allowable? Reasonable? Justification for Purchase of the following products and associated Florida Statute: Digital SLR Camera Canon 60D ($999.00) Canon EF 70-300mm f/4-5.6 IS USM Lens for Canon EOS SLR Camera ($547.11) BEAR MANAGEMENT One of my chief responsibilities is management of human-bear conflicts. Florida’s Endangered and Threatened Species Act (s. 379.2291, F.S.) states that the Legislature recognizes the wide diversity of fish and wildlife within Florida and that it is the policy of the State to conserve and wisely manage these resources, with particular attention on species defined as endangered or threatened. State-listed as threatened, Florida Black Bears are carefully monitored and conflicts with humans are taken very seriously. My staff and I trap and relocate approximately 30 bears and converse with more than 500 citizens, more than most in the NW Region. Our goal is use the camera to document each aspect of our management duties (trapping, relocating, hazing, site visits) so that we might impart the knowledge we have gained to new and current employees. The Canon 60D is the least expensive camera that still provides the desired video and photo quality necessary for tutorial production. Documentation Requirements • Preferred: Receipt • Optional: Document or Combination that Provides: – Same information as a receipt (detailed information about goods or services received) – Clear evidence goods or services were received – Payment date – Indication paid by PCard & last 4 digits Example 1 Example 2 Example 3 Example 4 Rental Car Toll Charges Quarterly Purchasing Card Administrators’ Meeting Wednesday, February 9, 2011 8:30-12:30 1 Rental Car Toll Charges •Rental car companies have been using toll by plate (formerly referred to as PlatePass) for over two years •In 2011, Florida's Turnpike Enterprise is moving forward with implementing all-electronic open road tolling •First conversion to all-electronic open road tolling happens on February 19, 2011 in South Florida http://www.floridasturnpike.com/all-electronictolling/about.html 2 Rental Car Toll Charges •Most rental car companies participate in a toll by plate program, but we are going to talk specifically about Avis •Avis program is automatic •There is no “opt out” provision •The only way to not participate is to use a transponder or pay cash (IF AVAILABLE FOR THE ENTIRE ROUTE) 3 Rental Car Toll Charges •Cameras take a photo of the rental car's license plate as it goes through the high speed toll lane •The system filters out transponders •The system sends a bill for the tolls to the rental company's tolling program vendor •Avis’ tolling program vendor was PlatePass, but their new company is called Highway Toll Administration (HTA). They do business as AVIS RENTACAR TOLLS. 4 Rental Car Toll Charges • HTA collects the toll plus applicable service fees from the customer's credit card, and pays the toll to the road agency. • The service fees are retained by HTA, not the toll road. 5 Rental Car Toll Charges • $2.50 per day up to $10.00 even if you only use one toll booth the entire trip • Cash is a way to opt out, but ONLY if cash is an option for the entire trip • If you are traveling from Orlando to Miami and you hit the all electronic toll road, you will be charged the administrative fee for the entire trip 6 Rental Car Toll Charges • Charges post approximately two weeks after rental car is returned •The charges post using the vendor name AVIS RENTACAR TOLLS http://www.htallc.com/Receipt_Request.aspx?rental=208 7 Rental Car Toll Charges 8 Rental Car Toll Charges 9 Rental Car Toll Charges 10 Rental Car Toll Charges •If you are billed by the rental car company, because you did not have the transponder mounted properly….. 11 Rental Car Toll Charges • Don’t hold it in your hand • Make sure the batteries are fully charged • Transponders don’t last forever, if it is over 10 years old…you may need a new one. • If all that fails and your transponder does not work, please contact SunPass Customer Service Center: 1-888-TOLL-FLA (1-888-865-5352). 12 Rental Car Toll Charges •If you are billed, because you did not have a transponder or pay cash….. DRAFT LANGUAGE FOR DFS REFERENCE GUIDE Convenience fees – Tolls The agency may pay the convenience fee related to a rental car transponder only if the following conditions are met: 1. an agency supplied transponder was not available to the traveler 2. the toll was paid at a toll plaza that did not accept cash Documentation must be maintained in the agency’s file to support the payment of the convenience fee. 13