Quarterly Purchasing Card Administrators’ Meeting AGENDA Wednesday, November 14, 2012 – 9:00-12:00

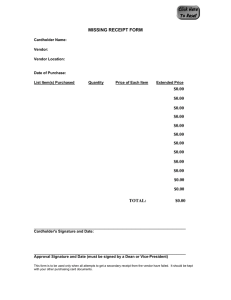

advertisement

Quarterly Purchasing Card Administrators’ Meeting Wednesday, November 14, 2012 – 9:00-12:00 Winewood Office Center, Building 4 AGENDA Introductions Special Presentation: Handling Confidential Information—Danielle Alvarez, DFS, Information Security Manager (or designee) Ongoing Items Rep Letter/Plan Reviews Statewide Vendor File Update Service Fees Large Card Files Reminder PCard Website Reminder New Items Bank of America Contract Amendment Discipline Policies NAPCP Membership Overrides for Limits MCC/MCCG Update Project Questions/Other Discussion PCard Basics Lost Receipts Monitoring—Mary Quinsey, DEP Third Party Payers/Vendors—Michelle Oliver, DFS Ordering Replacement Cards—Erica Catledge, DFS Discussion about Replacement Card BOA Issues Quarterly Purchasing Card Administrators’ Meeting Minutes Wednesday, November 14, 2012 – 9:00-11:30 Winewood Office Center, Building 4 Facilitator: Marie Walker Introductions Special Presentation: Handling Confidential Information – Warren Braswell, DFS Information Security Management Office o Warren’s contact information: Warren.Braswell@MyFloridaCFO.com (850) 413-2209 (Presentation posted on the Purchasing Card Quarterly Meetings website.) Ongoing Items Rep Letter/Plan Reviews – The Statewide Administrator’s Office has reviewed all of the Rep Letters, noted possible issues, and will be contacting the agency administrators with questions and concerns. The initial review of the amended plans submitted with the Rep Letters has also been completed. The Statewide Office will contact the administrators of the agencies that submitted amended plans regarding the results of the reviews. Statewide Vendor File Update – The Statewide Administrator’s Office is participating on a Statewide Vendor File work group with a number of agencies who were invited to participate. Service Fees – Marie has researched the topic of service fees and convenience fees. Florida Statute 501.0117 prohibits a seller from imposing a surcharge, except under certain circumstances. F.S. 215.322 allows “an agency or officer” to charge a convenience fee subject to some limitations. The legal office at the Public Service Commission has been contacted regarding the authority for utilities to charge a service charge. Marie plans to make a recommendation to management. Large Card Files Reminder – Contact the Statewide Administrator’s Office a couple of days before making changes to 100+ card records. The Statewide Office will notify the technical representative at the bank of the large file, as the bank will need to ensure staff is available for processing the file. PCard Website Reminder – Remember to utilize the Purchasing Card website (https://flair.dbf.state.fl.us/iwpapps/pchome.shtml) and the Purchasing Card Meetings website (http://www.myfloridacfo.com/aadir/PurchasingCard/PCardMeetings.htm). Both websites are good resources for the agency administrators. New Items Bank of America Purchasing Card Contract Amendment No. 12 – The amendment went into effect on November 1, 2012. The amendment included Bank of America’s merger with FIA Card Services, N.A and modified the rebate structure. Discipline Policies – Bob Notman requested that we include this topic in the agenda; however, no discussion was made. NAPCP Membership – The Statewide Administrator’s Office has a primary membership that allows for the agencies to join as associates for $99. Marie provided NAPCP with the email addresses of the agency administrators and invitations were sent to the agencies. Overrides for Limits – There has been confusion regarding this issue. Marie discussed it with Mark and a decision was made that the Agency Administrators can work with Jane Ritter at BOA directly to override limits. An email was sent to Jane to authorize the policy change. MCC/MCCG Update Project – Michelle Oliver, DFS The Statewide Administrator’s Office has received an updated MCC list from the bank and it includes new MCCs - some of which need to be prohibited from use. In the near future, the Statewide Office will be emailing the updated list to the Agency Administrators. The Agency Administrators will need to modify their MCCGs in the PCM and with the bank. As always, the Statewide Office will need to approve the changes before the change request is sent to the bank. PCard Basics – Presentations (Presentations are posted on the Purchasing Card Quarterly Meetings website.) Lost Receipts Monitoring – Mary Quinsey, DEP Third Party Payers/Vendors – Michelle Oliver, DFS Ordering Replacement Cards – Erica Catledge, DFS Final Item Marie Walker announced that she will be taking a position at the Department of Revenue, as the Director of Auditing in the Inspector General’s Office. Her last day at DFS will be November 21, 2012. PCard Quarterly Meeting November 14, 2012 CONFERENCE CALL INSTRUCTIONS The conference number will be available beginning at 8:45am. Conference Number: (850) 413-5947 NOTE: For this meeting, we are limited to 8 lines for calling in. If multiple people from your agency are calling in, please place one call for the group. If you have any difficulties with dialing in, we can be reached at the PCard cell phone number: (850) 528-5995. OIG completed a Purchasing Card Audit August 2012 Audit timeframe was July 5, 2011 through June 4, 2012 Audit was intended to improve the P-Card Program, compared expenditures with limits and reviewed the reconciliation process OIG examined 110 purchasing card transactions 5 out of the 110 were documented using the Replacement Receipt Form The scope was then extended to take a look at the 5 cardholders 1 out of the 5 cardholders used the Replacement Receipt Form 18 times One month the cardholder used 5 Replacement Receipt Forms and another month the cardholder used 4 Replacement Receipt Forms Vendors included Wal-Mart, Office Depot and Advanced Auto Parts, etc. Based on those findings, the office received their own internal audit by the OIG’s office Updated the Replacement Receipt Form to include a supervisor’s signature Updated P-Card Plan Send memo out to all Cardholders changing policy Provide monthly reports to F&A and Procurement for audit purposes Provide quarterly reports to upper management LOST RECEIPTS If a receipt is lost or misplaced, the Cardholder will contact the vendor for a duplicate receipt. A faxed copy of the receipt is acceptable. If the vendor is unable to provide another copy, a Replacement Receipt Form (DEP 55-307) may be used. The Replacement Receipt Form should be kept just as an original receipt/invoice would be with the Purchasing Card records and must be signed and dated by the Cardholder. Supervisor’s signature is required on each replacement receipt form. The Department will be using the short “Description” field on the first page in FLAIR to document lost receipts. The Reviewers are required to enter “Lost Receipt” when the Cardholder is not able to obtain the required receipt for the purchase. The PCPA will provide both Bureaus with a Monthly P-Card Lost Receipt Report which will be used to perform quality assurance checks on all to verify compliance with State procurement regulations. The PCPA will be providing Management with a Quarterly P-Card Lost Receipt Report. PCDETAIL PCDSTB table table Welcome Division of Information Systems Information Security Office November 2012 Information Security • Information Security Rule: 71A-1 • Information Security Managers (ISMs): – DFS ISM is: Danielle Alvarez danielle.alvarez@myfloridacfo.com 850-413-2244 – Every Agency must appoint one • How does this help the Agency? • How does this impact me? 2 How does this help the Agency? • • • • • • SPOC for IT Security Questions ISMs work together Incident Response Disaster Recovery Risk Management Security of data 3 How does this impact me? • • • • Safe handling of confidential, exempt data Inter-Agency data sharing procedures SPOC for guidance Assistance with tools: – IronPort (Registered Envelope Service) – ATTACH or sFTP or HTTPs – Rights Management – Data redaction 4 Welcome Questions? 5 Welcome Thank You! 6 Purchasing Card Administration When to Order a Replacement Card Cardholder Name A cardholder may request a replacement card to: Correct a misspelled name Change a name due to marriage, divorce or legal name change As only the name is changed, the replacement card will have the same account number as the original card. Issuance of the replacement card should be documented as the original card was. Replace a cracked card or magnetic strip issue How to Order a Replacement Card: Change Cardholder Name Steps Type CM in the code field. Press <Enter> to view a card mini menu screen. How to Order a Replacement Card: Change Cardholder Name Steps (continued) Type CB in the code field. Press <Enter> to view a card file browse screen. How to Order a Replacement Card: Change Cardholder Name Steps (continued) Type M under ACT column next to the cardholder’s name. Press <Enter> to view a card file maintenance screen. How to Order a Replacement Card: Change Cardholder Name Steps (continued) Type over the existing name with the new name and insert X in the replacement card field. Press <Enter>. “Card record modified successfully” appears in the upper left corner of the screen. How to Order a Replacement Card: Replace a cracked card or magnetic strip issue Follow slides 3-5 and simply insert X in the replacement card field. Press <Enter>. “Card record modified successfully” appears in the upper left corner of the screen. Lost or Stolen Cards The Replacement Card field should not be used for a Lost or Stolen Card Cardholders who lose cards or have cards stolen are responsible for expediently reporting the card’s loss, both to Bank of America and to you. You should immediately cancel the card in the Purchasing Card Module. Questions? Please contact the Purchasing Card Administration: Marie Walker 850-413-5679 Michelle Oliver 850-413-5451 Lee Rayner 850-413-5733 Tyesin Payne 850-413-5359 Erica Catledge 850-413-5539 THIRD PARTY PAYERS Quarterly PCard Administrators’ Meeting November 14, 2012 What are Third Party Payers? Third party payers, also known as third party processors, are companies that process credit card transactions on behalf of another company. Similar to an escrow account, third party payers act as the middleman holder of money. The buyer (cardholder) does not receive merchandise from a third party payer. The seller pays for the service of processing the transaction. Third Party Payers PayPal Google Wallet (GOOGLE Square (SQ *) Amazon Marketplace *) (AMAZON MKTPLACE PMTS or AMZ*) Barnes & Noble Marketplace (BARNES&NOBLE*MRKTPLACE) Best Buy Marketplace (BESTBUYMKTPLACE) Active Network (ACT*) Event Brite (EB *) Amazon vs. Amazon Marketplace Amazon Direct online merchant Goods are shipped from Amazon.com Customer service handled by Amazon Amazon Marketplace Independent sellers (third party payers) who use the Amazon.com platform to sell goods Goods are shipped from independent seller Customer service handled by seller (not Amazon) Why does DFS discourage the use of Third Party Payers? DFS discourages the use of third party payers, but understands that another option may not be available. The cardholder should note if no other option is available. Third party payers are discouraged due to: Greater risk of abuse Issues involving disputed transactions Difficulty indentifying and reconciling transactions. Examples of Third Party Vendors - as shown in FLAIR PAYPAL *ASSOCIATION PAYPAL *GOLD PAYPAL *PROFESSIONA PAYPAL *TALLAHASSEE ACT*DEFAULT COMPANY ACT*FLORIDA DEPARTMENT ACT*268529 SQ *GEORGE TWIGGS SQ *IAN TUTTLE Square (SQ *) Transaction The vendor appears in FLAIR as SQ *CHAD WHERRELL. Square (SQ *) Transaction The vendor appears in FLAIR as SQ *KARHLEEN APPLEBY. Questions?