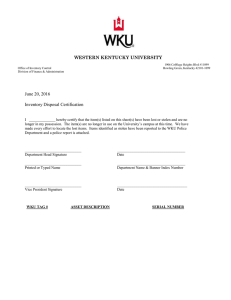

Western Kentucky University Gordon Ford College of Business Department of Accounting

advertisement