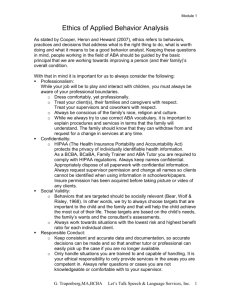

Maurice A. Deane School of Law at Hofstra University (516) 463-5895

advertisement

LINDA GALLER Maurice A. Deane School of Law at Hofstra University Hempstead, New York 11549 linda.galler@hofstra.edu (516) 463-5895 ACADEMIC APPOINTMENTS MAURICE A. DEANE SCHOOL OF LAW AT HOFSTRA UNIVERSITY Professor of Law 1996 – present; Associate Professor 1993-1996; Assistant Professor 1987-1993 Courses taught: Federal Income Taxation of Corporations, Federal Income Taxation of Individuals, Ethical Problems in Federal Tax Practice, Federal Tax Clinic Practicum, Federal Tax Policy Seminar, International Taxation, Business Organizations BENJAMIN N. CARDOZO SCHOOL OF LAW, YESHIVA UNIVERSITY Adjunct Professor of Law Fall 1996, Fall 1997 Course taught: Income Taxation I LAW PRACTICE CURTIS, MALLET-PREVOST, COLT & MOSLE Senior Tax Counsel; Tax Associate 2000-present. Taxpayer counsel, Dover Corp. v. Commissioner, 122 T.C. 324 (2004). SHEARMAN & STERLING Tax Associate 1984-1987 MILBANK, TWEED, HADLEY & McCLOY Tax Associate 1982 - 1984 EDUCATION NEW YORK UNIVERSITY SCHOOL OF LAW LL.M. (Taxation), 1986 BOSTON UNIVERSITY SCHOOL OF LAW J.D., cum laude, 1982 Edward F. Hennesey Scholar Editor, American Journal of Law & Medicine WELLESLEY COLLEGE B.A., with honors, 1979 Wellesley College Scholar Natalie Bolton Faculty Prize in Economics NEWCOMB COLLEGE OF TULANE UNIVERSITY Dean's List Phi Eta Sigma freshman honor society Linda Galler, page 2 PUBLICATIONS Book REGULATION OF TAX PRACTICE (2d ed.) (with Michael B. Lang) (LexisNexis, 2015) (manuscript submitted). REGULATION OF TAX PRACTICE (with Michael B. Lang) (LexisNexis, 2010), reviewed at 131 Tax Notes 201 (Apr. 11, 2011) & 132 Tax Notes 87 (July 4, 2011). Articles and Book Chapters Why Do Law Students Want to Become Tax Lawyers?, 68 TAX LAW. 305 (2015). Special Rules for the Professionals: Return Preparer Penalties and Ethical Standards, chapter eight in NUTS AND BOLTS OF TAX PENALTIES 2015: A PRIMER ON THE STANDARDS, PROCEDURES AND DEFENSES TO CIVIL AND CRIMINAL TAX PENALTIES (Bryan C. Skarlatos, ed. 2015) (Practising Law Institute). Special Rules for the Professionals: Return Preparer Penalties and Ethical Standards, chapter eight in NUTS AND BOLTS OF TAX PENALTIES 2014: A PRIMER ON THE STANDARDS, PROCEDURES AND DEFENSES TO CIVIL AND CRIMINAL TAX PENALTIES (Bryan C. Skarlatos, ed. 2014) (Practising Law Institute). Special Rules for the Professionals: Return Preparer Penalties and Ethical Standards, chapter eight in NUTS AND BOLTS OF TAX PENALTIES 2013: A PRIMER ON THE STANDARDS, PROCEDURES AND DEFENSES TO CIVIL AND CRIMINAL TAX PENALTIES (Bryan C. Skarlatos, ed. 2013) (Practising Law Institute). Everything You Always Wanted to Know About Farid But Were Afraid to Ask, 13 FLA. TAX REV. 461 (2013). Ladder Safety: Disclosure of Corporate Client Confidences, 6 BROOKLYN JOURNAL OF CORPORATE, FINANCIAL & COMMERCIAL LAW 553 (2012). ABA Section of Taxation Report of the Task Force on Judicial Deference, 57 TAX LAW. 717 (2004) (with Irving Salem and Ellen P. Aprill), reprinted in 104 TAX NOTES 1231 (Sept. 13, 2004). Mead and Tax Law, ADMIN. & REG. NEWS (Summer 2004) (with Irving Salem and Ellen P. Aprill). Deciphering the Code: Major Legislation in 2003 Cuts Taxes and Increases Complexity, 89 A.B.A.J. 58 (Nov. 2003) (with Carol F. Burger). Controlling the Unauthorized Practice of Law: A Misguided Approach to Restraining MDPs, 44 ARIZ. L. REV. 773 (2002). Ethical Considerations Upon the Discovery of Client Fraud, N.Y. PROF. RESP. REP., June 2002. Practicing Law in the New Millennium: New Roles, New Rules, But No Definitions, 72 TEMPLE L. REV. 1001 (2000). Advising Clients in International Transactions: Selected Ethical Issues, PRAC. U.S. INT’L TAX STRATEGIES, Jan. 31, 2000, at 11. Using the Internet to Teach Tax Ethics, 3 COMMUNITY TAX L. REP. 8 (1999). Linda Galler, page 3 Choice of Business Organization, chapter one of TAXATION FOR THE GENERAL PRACTITIONER (Richard V. D’Alessandro, ed. 1999) (New York State Bar Association publication). The MDP Pot Boils -- But No Action in ‘99, N.Y. PROF. RESP. REP., Sept. 1999, at 3. The Future of the Legal Profession, A.B.A. TAX SEC. NEWSL., Spring 1999, at 14. When Lawyers Work for Accounting Firms, N.Y. PROF. RESP. REP., Feb. 1999, at 4. The Tax Lawyer’s Duty to the System, 16 VA. TAX REV. 681 (1997). Scaled-Down Advice in Pro Bono Tax Practice, 2 COMMUNITY TAX L. REP. 10 (1997). Judicial Deference to Revenue Rulings: What It's All About, 72 TAX NOTES 769 (1996). Judicial Deference to Revenue Rulings: Reconciling Divergent Standards, 56 OHIO ST. L.J. 1037 (1995). Emerging Standards for Judicial Review of IRS Revenue Rulings, 72 B.U. L. REV. 501 (1992). Chevron and the Administrative Regulation of Indexation: Challenging the Cooper Memorandum, 56 TAX NOTES 1791 (1992). An Historical and Policy Analysis of the Title Passage Rule in International Sales of Personal Property, 52 U. PITT. L. REV. 521 (1991). Risk of Loss in Sourcing Profits from Sales of Personal Property, 17 INT'L TAX J. 77 (Spring 1991). Annual Reports on Developments in Standards of Tax Practice (A.B.A. Committee Report), 49 TAX LAW. 1201 (1996); 48 TAX LAW. 1317 (1995); 47 TAX LAW. 1309 (1994), 46 TAX LAW. 1209 (1993), 45 TAX LAW. 1355 (1992). Tax Reform Act of 1986 Changes Affecting Real Estate Investment Trusts, 18 TAX ADVISER 178 (1987). Subjecting Hospitals to Truth in Lending Disclosure Requirements: Bright v. Ball Memorial Hospital, 8 AM. J.L. MED. 69 (1982). Selected Commentary More on Tax Opinion Letter Sanctions, Shop Talk, 111 J. TAX’N 191 (2009). Does Judge Sotomayor Have a Tax Problem, TaxProf Blog, July 2009. PAPERS AND PRESENTATIONS Voluntary Offshore Disclosure – Where Do We Turn Next? and Do You Know Where Your Ethics Are? Keeping up with the Changing Environment and Recent Developments, 2015 Private Wealth & Taxation Institute sponsored by Maurice A. Deane School of Law at Hofstra University and Meltzer, Lippe, Goldstein & Breitstone, LLP, May 2015. Special Rules for Tax Professionals: Return Preparer Penalties and Ethical Standards, program sponsored by Practising Law Institute, entitled “Nuts and Bolts of Tax Penalties 2014: A Primer on the Standards, Linda Galler, page 4 Procedures and Defenses Relating to Civil and Criminal Tax Penalties,” March 2015. Ethical Issues in International Tax Practice, 27th Annual Institute on Current Issues in International Taxation sponsored by the Internal Revenue Service and The George Washington University, December 2014. Ethical Issues in Modern Global Tax Practice, 26th Annual Philadelphia Tax Conference, November 2014. Special Rules for Tax Professionals: Return Preparer Penalties and Ethical Standards, program sponsored by Practising Law Institute, entitled “Nuts and Bolts of Tax Penalties 2014: A Primer on the Standards, Procedures and Defenses Relating to Civil and Criminal Tax Penalties,” March 2014. Teaching Ethics: Incorporating Ethical Issues from Basic Tax to LLM Course, ABA Section of Taxation Committees on Standards of Tax Practice and Teaching Taxation, January 2014. Ethical Issues in International Tax Practice, 26th Annual Institute on Current Issues in International Taxation sponsored by the Internal Revenue Service and The George Washington University, December 2013. Ethics: Disclosing the Protecting Information, Responding to Requests for Information, Reporting Mistakes and Related Practice Issue, 12th Biennial Parker C. Fielder Oil and Gas Tax Conference sponsored by The University of Texas Law School and the IRS Office of the Chief Counsel, November 2013. Ethical Dilemmas in Tax Controversy Matters, program sponsored by the Tax Executives Institute, entitled “IRS Audits & Appeals Seminar: Managing Tax Controversies at Home and Abroad,” April 2013. Special Rules for Tax Professionals: Return Preparer Penalties and Ethical Standards, program sponsored by Practising Law Institute, entitled “Nuts and Bolts of Tax Penalties 2013: A Primer on the Standards, Procedures and Defenses Relating to Civil and Criminal Tax Penalties,” February 2013. Ethical Issues in a Global Tax Practice, 41st Annual Conference of the USA Branch of the International Fiscal Association, February 2013. Practical and Ethical Strategies in Representing Couples, Ethical Issues in International Tax Practice, 25th Annual Institute on Current Issues in International Taxation sponsored by the Internal Revenue Service and The George Washington University, December 2012. Tax Planning for the Fiscal Cliff, Curtis, Mallet-Prevost, Colt & Mosle, November 2012. Amendments and Penalties to Circular 230: What You Need to Know, webinar sponsored by Knowledge Congress, May 2012. Tax Ethics for Real Estate Lawyers: An Introduction to Circular 230, program sponsored by the New York State Bar Association, entitled “Tax Aspects of Real Estate Transactions,” November 2011. FBAR Amnesty II: The Good, The Bad and The Ugly, Curtis, Mallet-Prevost, Colt & Mosle, June 2011. What Is Substantial Authority in Light of Mayo and Current Trends in Treasury Guidance, Annual Tax Lawyering Workshop sponsored by New York Law School Graduate Tax Program, May 2011. Ethics and the Codification of Economic Substance, ABA Section of Taxation Committee on Standards of Tax Practice, September 2010. Linda Galler, page 5 The Work Product Privilege After Textron, Annual Tax Lawyering Workshop sponsored by New York Law School Graduate Tax Program, April 2010. Implications and Consequences of Foreign Bank Account Reporting, Holtz Rubenstein Reminick LLP, September 2009. Ethics and FBAR, ABA Section of Taxation Committee on Standards of Tax Practice, May 2009. Privileges and Client Confidentiality in Tax Practice, ABA Section of Taxation Young Lawyers Forum and Committee on Standards of Tax Practice, May 2009. Monetary Penalties for Violations of Circular 230, New York Tax Study Group, June 2007. Monetary Penalties and the Firm: Ethical Considerations, ABA Section of Taxation Committee on Standards of Tax Practice, May 2007. The Ethics of Witness Preparation, ABA Section of Taxation Committee on Standards of Tax Practice, January 2007. The Ethics of Witness Preparation, Internal Revenue Service Office of Chief Counsel Continuing Legal Education Seminar, July 2006. Ethical Standards for Providing Advice to Taxpayers, program sponsored by the Association of the City of New York Center for CLE, entitled “Hot Topics in Taxation: Recent Statutes, Regulations & Court Decisions that Affect Your Practice,” October 2005. Introduction to Circular 230: Context and Development of Revised Circular 230, Annual Tax Lawyering Workshop sponsored by New York Law School Graduate Tax Program, April 2005. A Primer on Circular 230 and the IRS Office of Professional Responsibility, teleconference jointly sponsored by ABA Section of Taxation and ABA Center for Continuing Legal Education, December 2004. In Pursuit of Tax Shelter Promoters: How Many Arrows Does OPR Have in Its Circular 230 Quiver?, ABA Section of Taxation Committee on Standards of Tax Practice, October 2004. Ethics in Tax Practice, New York Tax Study Group, June 2004. Ethical Problems in Federal Tax Practice, Internal Revenue Service Estate & Gift Tax Continuing Legal Education Seminar, June 2004. Conflicts of Interest and Other Ethical Concerns in Representing Tax Shelter Clients, ABA Section of Taxation Committee on Standards of Tax Practice, May 2004. Rethinking Corporate Tax Planning and Teaching in the New World of Partial Integration, ABA Section of Taxation Committee on Teaching Taxation, May 2004 (panel moderator). Ethics & Advocacy: Standards for Representing Taxpayers Before the IRS, program sponsored by the Association of the City of New York Center for CLE, entitled “Tax Controversies: Negotiating & Resolving Disputes with the IRS,” April 2004. Practice Problems: Ethics and Rules, Plenary Session, ABA Section of Taxation Midyear Meeting, January 2004. Linda Galler, page 6 Current Developments in Tax Law, teleconference jointly sponsored by ABA Section of Taxation, ABA Center for Continuing Legal Education, and Center for Continuing Legal Education, November 2003. Tax Planning, Preparation and Privilege, First Annual Capital University Law School Tax Institute, entitled "Tax Planning: What Can Tax Practitioners Do Today,” October 2003. The Noisy Withdrawal, ABA Tax Section Committee on Standards of Tax Practice, May 2003 (panel chair). Ethical Problems in Federal Tax Practice, Internal Revenue Service Estate & Gift Tax Continuing Legal Education Seminar, November 2002. Problems in Defining and Controlling the Unauthorized Practice of Law, conference on The Future Structure and Regulation of Law Practice sponsored by the University of Arizona James E. Rogers College of Law, February 2002. The Independence of Certified Public Accountants in the Post-Enron Era, invited testimony before the New York State Senate Higher Education Committee, February 2002. Should Tax Lawyers be Permitted (Required) to Disclose Client Misconduct?, teleconference jointly sponsored by ABA Section of Taxation, ABA Center for Continuing Legal Education, and Center for Continuing Legal Education, December 2001. Judicial Deference to Subregulatory Guidance, Federalist Society First Annual National Tax Conference, June 2001. Ethical Considerations in the Delivery of Legal Services Through Multidisciplinary Practices, Erasmus University Law School, Rotterdam, The Netherlands, December 2000. Advising Clients in International Transactions: Selected Ethical Issues, ABA Tax Section Committee on Standards of Tax Practice, October 2000 (panel chair). Corporate Tax Shelters: Privilege, and Confidentiality Issues, Office of Chief Counsel, Internal Revenue Service, District Counsel, Brooklyn District, July 2000. Ethics: MDPs, Confidentiality, Privilege, and Opinion Standards, 22nd Annual Conference on Federal Taxation of Real Estate Transactions sponsored by New York University, May 2000. Advising Clients in International Transactions: Selected Ethical Issues, The 12th Annual Institute on Current Issues in International Taxation sponsored by the Internal Revenue Service and The George Washington University, December 1999 (panel chair). Multidisciplinary Practice, Faculty Workshop, Hofstra University School of Law, April 1999. Counseling the Desperate Taxpayer, 21st Annual Conference on Federal Taxation of Real Estate Transactions sponsored by New York University, April 1999. Accounting Firms in the Legal Market: Professional, Pedagogical and Policy Implications, Association of American Law Schools Section on Taxation, January 1999. Linda Galler, page 7 Controversial Cross Border Transactions: Selected Ethical Issues, The 11th Annual Institute on Current Issues in International Taxation sponsored by the Internal Revenue Service and The George Washington University, December 1998. Professional Responsibilities of Lawyers Employed by Accounting Firms, testimony before the American Bar Association (ABA) Commission on Multidisciplinary Practice, November 1998 (published by the ABA at http://www.abanet.org/cpr/galler.html). Teaching Tax Ethics to Law Students, ABA Tax Section Committee on Standards of Tax Practice, January 1998. Check-the-Box and Beyond: The Future of Limited Liability Entities, faculty member in on-line symposium sponsored by THE BUSINESS LAWYER and the ABA Real Property, Probate, and Trust Law Section, September 1997 (published at 52 BUS. LAW. 605 (1997)). Evolving Standards of Judicial Deference to IRS Guidance, Coopers & Lybrand, April 1997. Evolving Standards of Judicial Deference to IRS Guidance, ABA Tax Section Committee on Teaching Taxation, January 1997. Recent Developments in Tax Ethics and Practice Standards, ABA Tax Section Committee on Standards of Tax Practice, January 1996. Recent Developments in Tax Ethics and Practice Standards, ABA Tax Section Committee on Standards of Tax Practice, January 1995. Recent Developments in Tax Ethics and Practice Standards, ABA Tax Section Committee on Standards of Tax Practice, January 1994. PROFESSIONAL ACTIVITIES LAW 360 Member, Tax Advisory Board. AMERICAN BAR ASSOCIATION SECTION OF TAXATION Committee on Standards of Tax Practice. Chair, 1999-2001; Vice Chair for Law Development, 2004-present; Vice Chair, 1997-1999; Chair, Task Force on Notice 2007-39 (2007); Member, Standards of Tax Practice Statements Subcommittee, 1995-1999; Subcommittee Chair for Membership, 1996-1997; Representative to Continuing Legal Education Committee, 1996-1997; Subcommittee Chair for Important Developments, 1994-1996; Subcommittee Chair for Continuing Legal Education and Annual Report 1992-1994; author of 1991, 1992, 1993, 1994 and 1995 annual reports; Reporter for first Statement of Standards of Tax Practice (which considers whether an attorney may limit the scope of representation of a client who requests "scaled down" tax advice due to time or budget constraints). Committee on Teaching Taxation. Chair, 2002-2004; Vice Chair, 2000-2002; Planning Chair, 1998-2000; Important Developments Editor (The Tax Lawyer), 1994-1995. Committee on Nominating. 1999-2003. Linda Galler, page 8 Committee on Appointments to the Tax Court. 1999-2006. Committee on Professional Services. Vice Chair, 2002-2005. Special Task Force on Judicial Deference. 2001-2004; featured speaker, 2001 ABA Annual Meeting (Judicial Deference to Revenue Rulings). THE THEODORE TANNENWALD, JR. FOUNDATION FOR EXCELLENCE IN TAX SCHOLARSHIP Member, Academic Advisory Board. AMERICAN TAX POLICY INSTITUTE Life Sponsor.