Federal Tax Procedure Spring 2015 Professor Mandel ASSIGNMENT SCHEDULE

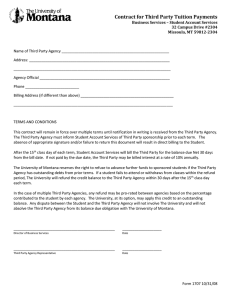

advertisement

Federal Tax Procedure Spring 2015 Professor Mandel ASSIGNMENT SCHEDULE Class Date 1/14 1 2 1/21 3 4 1/28 2/4 5 2/11 6 2/18 7 2/25 8 3/4 9 10 11 12 3/11 3/18 3/25 4/1 13 4/15 14 4/22 Topic Introduction to Federal Tax Controversies & IRS Rulemaking Tax Returns & Examinations; Summonses & Privileges IRS Appeals Restrictions on Assessment of Tax The Notice of Deficiency & the US Tax Court The Notice of Deficiency & the US Tax Court (cont’d) Overpayments, Refund Claims & Refund Litigation Overpayments, Refund Claims & Refund Litigation (cont’d) Tax Litigation & Settlement Civil Tax Penalties Interest Liens, Levies, and other Collection Procedures Collection Due Process Procedures Offers in Compromise, Installment Agreements Assignment Text*-Chapters 1&2** Text-Chapters 3&4 Text-Chapter 5 Text-Chapter 7 Text-Chapters 8&9 Text-Chapters 8&9 Text-Chapter 10 Text-Chapter 10 Text-Chapter 11 Text-Chapter 12 Text-Chapter 13 Text-Chapter 14 Text-Chapter 16 Text-Chapter 15 * Lederman & Mazza, Tax Controversies: Practice & Procedure (3rd ed. 2009). The authors have issued a free 2014 online supplement that can be found and uploaded from the following link: http://www.lexisnexis.com/store/images/Supplements/11602014S.pdf. The text is available in hardcover and a less expensive loose leaf edition, both of which are in the bookstore. ** Please be familiar with the problems at the end of each chapter which will be incorporated into the class discussion.