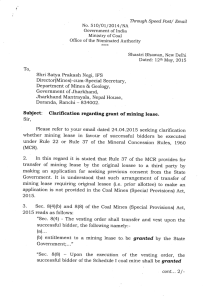

MINERAL CONCESSION RULES, 1960 Government of India Ministry of Mines

advertisement