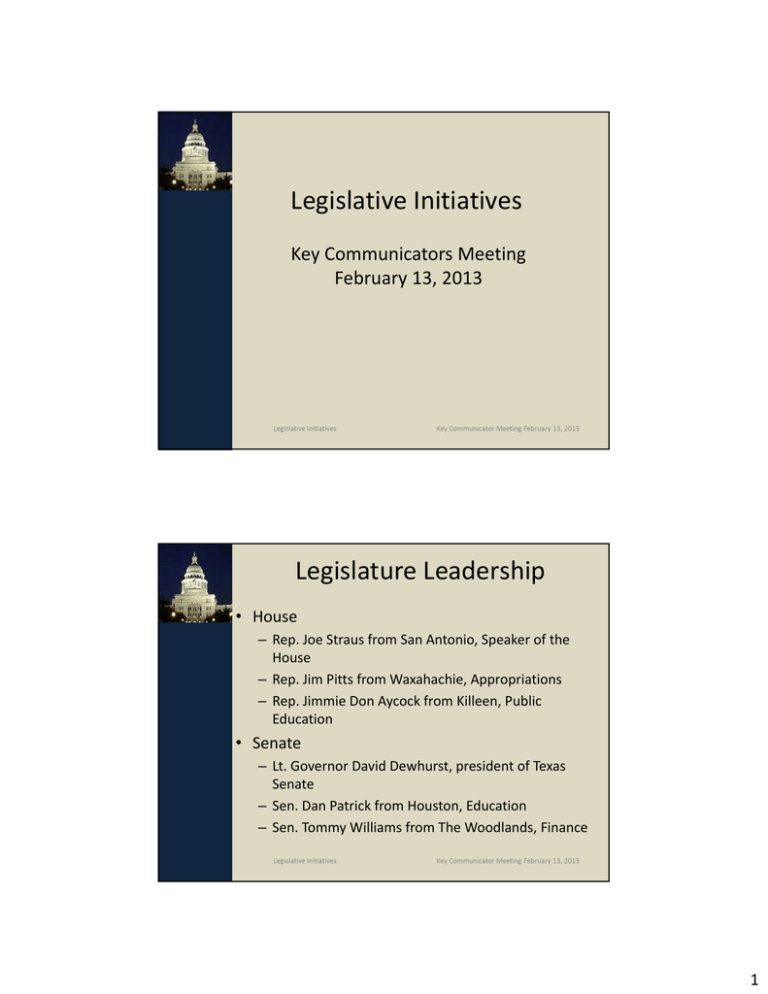

Legislative Initiatives Legislature Leadership Key Communicators Meeting February 13, 2013

advertisement

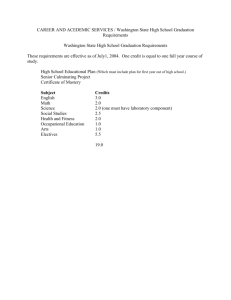

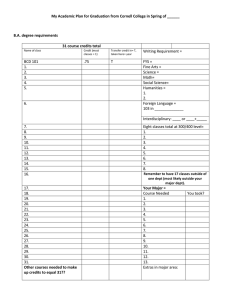

Legislative Initiatives Key Communicators Meeting February 13, 2013 Legislature Leadership • House – Rep. Joe Straus from San Antonio, Speaker of the House – Rep. Jim Pitts from Waxahachie, Appropriations – Rep. Jimmie Don Aycock from Killeen, Public Education • Senate – Lt. Governor David Dewhurst, president of Texas Senate – Sen. Dan Patrick from Houston, Education – Sen. Tommy Williams from The Woodlands, Finance 1 Legislature Leadership • Rep. Jodi Laubenberg – Investments & Financial Services – Public Health • Rep. Jeff Leach – Criminal Jurisprudence – Rules & Regulations – Urban Affairs • Rep. Van Taylor – Government Efficiency – Insurance Legislature Leadership • Sen. Ken Paxton – – – – – – Committee of the whole Senate Education Government Organization Intergovernmental Relations Jurisprudence Transportation (Vice Chair) 2 2013 Legislative Board Priorities • School Start Date • Finance • End of Course Exams • Paths to Graduation • Vouchers School Start Date Legislation has been proposed by Representative Bennett Ratliff that districts may not begin instruction before the week in which August 21 falls. (HB 669) 3 Finance Restore funding in the manner in which it was reduced. A LOOK BACK AT THE 2011‐13 BIENNIUM General fund only ($ In Millions) 2011‐12 Actual Revenues (Net of Recapture) $ 409.1 Expenditures (396.7) Other Sources/Uses 1.0 Excess/Deficiency 13.4 Beginning Fund 152.2 Balance Ending Fund Balance $ 165.6 2012‐13 Budget Biennium Total $ 393.6 $ 802.7 (415.9) (812.6) 1.1 2.1 (21.2) (7.8) 165.6 152.2 $ 144.4 $ 144.4 4 SUMMARY OF BUDGETARY ACCOMPLISHMENTS FOR 2011‐13 BIENNIUM • Averaged over 250 more students than 2009‐2011 • Lost $59.0M in State formula funding • Gave 3% employee pay raise in 2012‐13 • Minimized Fund Balance drawdown ($7.8 million) Operating Expenditures Per Student 2010‐11 Plano ISD State $5,768 $6,000 $5,364 $5,000 $4,000 $3,000 $2,000 $1,000 $1,367 $1,123 $496 $621 $1,093 $903 $170 $272 $0 Instruction & Instructional & Support Support General Instructional School Services ‐ Services ‐ Non‐ Administration Related Leadership Student Based Student Based 5 STATE FUNDING DISCUSSION Comptroller’s Revenue Estimate Impact • Based on Comptroller’s revenue estimate in 2011 Legislative Session, State cut PK‐12 funding by $5.4 billion. • Comptroller now projects $9.4 billion more general revenue‐ related revenue in 2011‐13 than projected in December 2011.* • Previous projection was $2.5 billion more than the Legislature had stated, when it was in session.* • 2013 growth rate for all taxes is 22.0%.* • Significant share of additional revenue will automatically go the Rainy Day Fund.* • State will likely need to use a portion to fully fund Medicaid and reinstate the August Education Payment. • State still has enough remaining to discuss reducing taxes. *Source: Moak & Casey presentation at TASA Midwinter Conference, January 2013 STATE FUNDING LAWSUIT UPDATE • • • • Lawsuit filed late 2011. Trial began in October 2012. Forty‐Four days of Testimony. Judge Dietz issued oral ruling on February 4, 2013. System violates constitution based on: – Inadequacy – Inequity – De facto State Property Tax • Judge further ruled that Charter School and TREEE arguments do not violate constitution. • State will undoubtedly appeal initial ruling. • Final outcome likely in late 2013, if not 2014. • Legislative leadership recommends waiting on final outcome, before reinstating any funding. 6 2013‐15 PROFORMA BUDGET‐ WITH 1.5% VARIANCE ($ In Millions) 2013‐14 Revenues Expenditures (With 1.5% Variance) Fund Balance Drawdown Beginning Fund Balance $ 390.8 2014‐15 $ 391.3 Total $ 782.1 (408.5) (412.6) (821.1) (17.7) (21.3) (39.0) 146.2 128.5 146.2 Ending Fund Balance $ 128.5 $ 107.2 Fund Balance as a % of Following Years Appropriations 27.6% 22.3% $ 107.2 22.3% Myth Busters Myth – Funding for public education in Texas has seen phenomenal growth during the past decade. Reality – Although the State has provided nominal increases for foundation funding over the past decade, the increases have been more than offset by inflation, enrollment growth, and mandated property tax relief. 7 STATE FUNDING CHANGES 2003 TO PRESENT Biennium • 2003‐05: $110 per WADA • 2005‐07: $2,500 teacher pay raise (PISD‐$154 per WADA) Implemented target revenue system Mandated 33.33% property tax rate reduction • 2007‐09: $23.63 per WADA pay raises • 2009‐11: $120 per WADA (Funded with Federal Stimulus Funds) required 50% be spent on pay raises • 2011‐13 : Reduced foundation funding, cost to PISD ‐ $400 per WADA in 2011‐12, additional $155 per WADA in 2012‐13. Total reduction $555 per WADA. TOTAL PREK‐12 FUNDING IN TEXAS 2003 vs. 2012 ($ in Billions) $50.0 Unadjusted $44.2 $45.0 Adjusted $44.2 Enrollment Growth $6.6 $40.0 $35.0 $30.0 Inflation $10.3 $29.6 $29.6 $25.0 $20.0 Adjusted Balance $27.4 $15.0 $10.0 7.5% decrease $5.0 $0.0 2002‐03 2011‐12 2002‐03 2011‐12 8 STATE SHARE OF PREK‐12 FUNDING IN TEXAS Increase $ % 2002‐03 2011‐12* $ 11.0 B $ 18.9 B $ 7.9 B 72.5% N/A ($ 7.1 B) ($ 7.1 B) N/A Balance for Education $ 11.0 B $ 11.8 B $ 0.8 B 7.7% Adjusted for Enrollment $ 11.0 B $ 10.1 B ($ 0.9 B) (8.3%) Adjusted for Enrollment and Inflation $ 11.0 B $ 7.3 B ($ 3.7B) (33.3%) Inflation Adjusted Amount Per Pupil $ 2,577 $ 1,719 ($ 858) (33.3%) Total State Aid Tax Swap Sources: Legislative Budget Board (LBB), Texas Education Agency * 2011‐12 revenue and inflation projected by LBB STATE SHARE OF PREK‐12 FUNDING IN TEXAS 2003 vs. 2012 $20.0 Unadjusted ($ in Billions) Adjusted $18.9 $18.9 $18.0 $16.0 Tax Swap $7.1 $14.0 $12.0 $11.0 $11.0 $10.0 Enrollment Growth $1.8 $8.0 Inflation $2.7 $6.0 Adjusted Balance $7.3 $4.0 $2.0 33.3% decrease $0.0 2002‐03 2011‐12 2002‐03 2011‐12 9 NET GENERAL FUND REVENUE PER PUPIL Plano ISD 9,000 8,000 7,000 7,143 7,335 6,467 6,678 7,703 7,593 7,673 7,947 8,079 $934/Student 6,847 $51.5 Million 7,145 7,345 7,693 7,589 7,409 7,361 7,393 6,743 4,000 6,680 5,000 6,497 6,000 Actual $ 3,000 2,000 Inflation Adjusted 1,000 0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 (B) Path to Graduation • Graduation‐ 96% • Post‐Secondary‐ 94% ACT SAT Plano Texas US 25.6 1665 20.8 1422 21.1 1477 10 Path to Graduation • Distinguished • Recommended • Minimum Path to Graduation Current SBOE Recommended Graduation Requirement (4x4) • • • • • • • • • • English 4 credits Math 4 credits Science 4 credits Social Studies 4 credits Fine Arts 1 credit Foreign Language 2 credits Health .5 credit (or 1 credit of Principals of Health Science) Physical Education 1 credit Speech .5 credit Electives 5 credits 11 Path to Graduation Proposed Foundation Graduation Plan • English 4 credits • Math 3 credits • Science 2 credits • Social Studies 3 credits Endorsements • STEM • Arts/Humanities • Business and Industry • Human Services • General Studies Path to Graduation Current Legislation Concerns: • We prefer 3 sciences instead of 2 • We prefer 4 social studies instead of 3 • A ‐ F accountability rating provision 12 End of Course Exams Current Law • 15 exams • 15% of final grade and cumulative and minimum scores End of Course Exams Algebra Geometry Biology Reading Writing World Geography 97% 98.8% 98% 94% 89% 97% *65% 8th Graders 13 End of Course Exams Proposed Legislation • Eliminate 15% requirement • Seliger‐ reduces EOC exams to four: Algebra I English III Biology US History Vouchers/School Choice Tax credit scholarship program • Businesses donate monies to nonprofit scholarship organizations and receive a franchise or insurance tax credit • Scholarships would be given to eligible students 14