IN THE CIRCUIT COURT OF THE SEVENTEENTH JUDICIAL CIRCUIT MINOUCHE NOEL,

advertisement

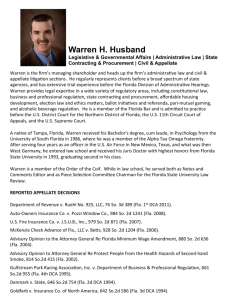

IN THE CIRCUIT COURT OF THE SEVENTEENTH JUDICIAL CIRCUIT IN AND FOR BROWARD COUNTY, FLORIDA MINOUCHE NOEL, etc., et al, Plaintiffs v. Case No. 90-31966 (13) NORTH BROWARD HOSPITAL DISTRICT, etc., et al Defendants ____________________/ MOTION FOR LEAVE OF COURT TO APPEAR AS AMICUS CURIAE COMES NOW Alex Sink, Chief Financial Officer of the State of Florida, by and through undersigned counsel, and moves this Court for leave to appear herein as amicus curiae, and files the accompanying memorandum of law with the Court. In support of this motion it is shown: 1) Every attorney in this state may be called upon by the courts thereof to serve as an amicus curiae [Section 454.11, Fla. Stat.], and an amicus curiae may appear before a trial court as well as before an appellate court. Revell v. Dishong, 175 So. 905 (Fla. 1937); State ex rel Revell v. City of Wachula, 189 So. 247 (Fla. 1939). 2) Pursuant to a Claims Bill enacted by the 2007 Florida Legislature, codified as Ch. 2007-261, Laws of Florida, (an enrolled copy thereof is attached hereto), the Chief Financial Officer has been legislatively directed to deliver certain specified sums of money to Minouche Noel, and to her parents Jean and Flora Noel. Further, the Florida Legislature expressly specified in said Claims Bill that attorneys’ fees and costs and lobbyists’ fees and costs were to be capped at $1,074,667 and $85,000 respectively. 3) However, the attorneys for the Noels have now filed motions to re- open this case and file a charging lien that would result in counsel being paid fees and costs substantially in excess of those specified by the Claims Bill. Additionally, counsel seeks compensation for lobbying services it purportedly performed, which services were not addressed in the Claims Bill; the Claims Bill award of lobbyist fees was directed to another lobbyist, not to the attorneys acting as lobbyists. Moreover, it appears that counsel is seeking this additional compensation based on an “agreement” they purportedly entered into with the Noels on July 9, 2007, a date that occurred after the passage of the Claims Bill. 4) The Chief Financial Officer believes that said motions are not well- taken, and are a transparent attempt to evade the clear intent of the Florida Legislature to limit the award of attorneys’ fees and costs and lobbyists’ fees and costs to that figure specified in the Claims Bill for those services and expenses. The Florida Legislature apparently agrees. See the attached letter from Senate President Ken Pruitt and House Speaker Marco Rubio. 5) The Chief Financial Officer has a legal obligation to obey the commands of the Florida Legislature, which in this instance forbade the payment of attorneys’ fees and costs and lobbyists’ fees and costs above the specified amounts. As demonstrated in the following memorandum of law, the Chief Financial Officer believes that she and her attorneys may be of substantial assistance to this Court relative to the proper disposition of the pending motions. 2 MEMORANDUM OF LAW A. The Court lacks jurisdiction to re-open this case. On March 25, 1999, a jury awarded damages to the Noels. That award was thereafter reduced to a Final Judgment that contained no relevant reservation of jurisdiction, and the award specified therein, as authorized and delimited by section 768.28(5), Fla. Stat., was paid in 2000. Upon the expiration of the period within which to file a motion to alter, modify, or vacate the final judgment, which period has long since passed, this Court was permanently divested of jurisdiction over this cause. Pruitt v. Brock, 437 So.2d 768 (Fla. 1st DCA 1983); General Capital Corp. v. Tel Service Co., 212 So.2d 369 (Fla. 2nd DCA 1968); Patin v. Popino, 459 So.2d 435 (Fla. 3rd DCA 1984); Port Everglades Authority v. International Longshoreman’s Ass’n, Local 1922-1, 652 So.2d 1169 (Fla. 4th DCA 1995) Seddon v. Harpster, 438 So.2d 165 (Fla. 5th DCA 1983). Thus, this Court is now without jurisdiction to entertain any substantive motion whatsoever, including the pending motions. B. The claims bill is a matter of legislative grace, the terms and conditions of which cannot be altered by private contract. In 1980 the Florida Legislature enacted Ch. 80-448, Laws of Florida, a Claims Bill for the relief of Cynthia Leigh Gamble, a minor child who had suffered disfiguring injuries while in the state’s custody. (A copy of that Claims Bill is attached.) That Claims Bill specifically limited her attorneys’ fee to $10,000. Her attorney proceeded to court, arguing that the Claims Bill’s limitation on his fee unconstitutionally impaired the obligation of his contingency fee contract with his 3 client, which called for a 33 and 1/3% share of the recovery. The Second District Court of Appeal agreed and held the limitation unconstitutional. Gamble v. Wells, 436 So.2d 173 (Fla. 2nd DCA 1983) On review, the Florida Supreme Court unanimously reversed, stating, in pertinent part: “Parties cannot enter into a contract to bind the state in the exercise of its sovereign power. The legislature had the power to place the attorney’s fee limitation in chapter 80-448. Wells, by the terms of his contingent fee contract with Gamble, could not deprive the legislature of this power.” Gamble v. Wells, 450 So.2d 850, 853 (Fla. 1984) Here, by virtue of a purported, written “agreement”, purportedly entered into on July 9, 2007, well after the passage of the instant claims bill, the attorneys seek to alter the terms and conditions of the claims bill as to their fees and costs. Under the teaching of Gamble v. Wells, supra, that is impermissible, even had the contract arisen before the claims bill passed; it is even more patently impermissible when the purported contract arose only after the claims bill had passed. Further, from the available case law, a charging lien will attach only to a judgment or to a settlement; no case law shows its applicability to a Claims Bill. See, e.g., Litman v. Fine, Jacobsen, Schwartz, Nash, Block & England , 517 So.2d 88 (Fla. 3rd DCA 1987); Nichols v. Kroelinger, 46 So.2d 722 (Fla. 1950). The Florida Supreme Court’s holding in Gamble v. Wells is materially on all fours with the instant case, and controls. The private contract cannot trump the sovereign power of the state. 4 C. The charging lien motion is fatally defective. To establish a valid charging lien, four conditions must be met: 1) an express or implied contract between the attorney and the 2) an express or implied understanding for the payment of the client; attorneys fees out of the proceeds of the client’s recovery; 3) either an avoidance of payment by the client, or a dispute between the client and the attorney as to the amount of the fee, and 4) timely notice of the charging lien claim. Law Offices of David H. Zoberg, P.A. v. Rosen, 684 So.2d 828, 829 (Fla. 3rd DCA 1996); Daniel Moines, P.A. v. Jeffrey Smith and First Impression Industries, Inc., 486 So.2d 559 (Fla. 1986). An examination of the instant charging lien motion shows no allegation that the there was an express or implied understanding between the attorneys and the clients that attorneys fees and costs would be paid out of the proceeds of the claims bill rather than out of the court litigation, and more importantly, no allegation of any avoidance of payment by the client or any dispute as to the amount of the fees. The absence of either allegation renders the motion patently defective. Moreover, the 2007 written “agreement” states that the client agrees to pay the fees and costs sought by the motion. Thus, the purported “agreement” apparently relied on by the attorneys to establish a charging lien negatives the third element necessary to establish such a lien. The motion is thus fatally defective. 5 Additionally, the purported 1990 contract which, according to paragraph one of the “Attorney’s Charging Lien”, serves as the basis for the charging lien motion, does not appear to be attached to the motion. Pursuant to Fla. R. Civ. P. 1.130, it is necessary to attach to the operative pleading any written contract on which the pleading relies. The penalty for failure to do so is dismissal. Samuels v. King Motor Co. of Ft. Lauderdale, 782 So.2d 489 (Fla. 4th DCA 2001); Eigen v. Federal Deposit Ins. Co., 492 So.2d 826 (Fla. 2nd DCA 1986); Safeco Ins. Co. of America v. Ware, 401 So.2d 1129 (Fla. 4th DCA 1981). In summation, the Chief Financial Officer respectfully suggests that the Court is presently without jurisdiction to entertain the motions in question, cannot grant the relief sought by the motion inasmuch as that relief is in direct contravention of the express will of the Florida Legislature, and that the motions themselves are fatally defective. Therefore, the motions should be denied. A Declaratory Judgment/Interpleader action addressing these issues is being filed in the Second Judicial Circuit as of even date herewith. A true copy of the same will shortly be delivered to this court as a courtesy. Respectfully submitted, __________________________ Michael H. Davidson 200 E. Gaines Street 612 Larson Building Tallahassee, Fl. 32399 (850) 413-4178 Fla. Bar No. 191637 Counsel for the Department 6 CERTIFICATE OF SERVICE I hereby certify that a true and correct copy of the foregoing was sent by regular U.S. mail to Bruce S. Rogow and Cynthia E. Gunter, Bruce S. Rogow, P.A., Broward Financial Center, Suite 1930 500 East Broward Blvd. Ft. Lauderdale, Fl. 33394 and Sheldon J. Schlesinger and Scott P. Schlesinger, 1212 Southeast Third Avenue Ft. Lauderdale, Fl. 33316, and to Minouche Noel and Jean and Flora Noel, 506 Balcon Terrace, S.E., Palm Bay, Fl. 32909 this _______ day of July, 2007. _______________________________ 7