Virginia Journal Volume 5 2002

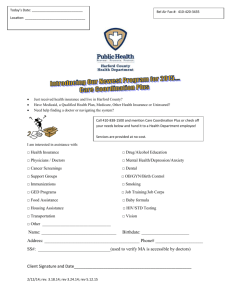

advertisement