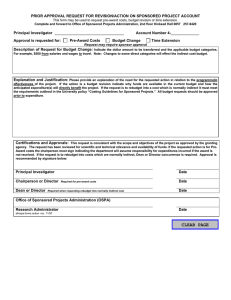

UNIVERSITY OF HOUSTON COST ACCOUNTING STANDARDS BOARD

advertisement