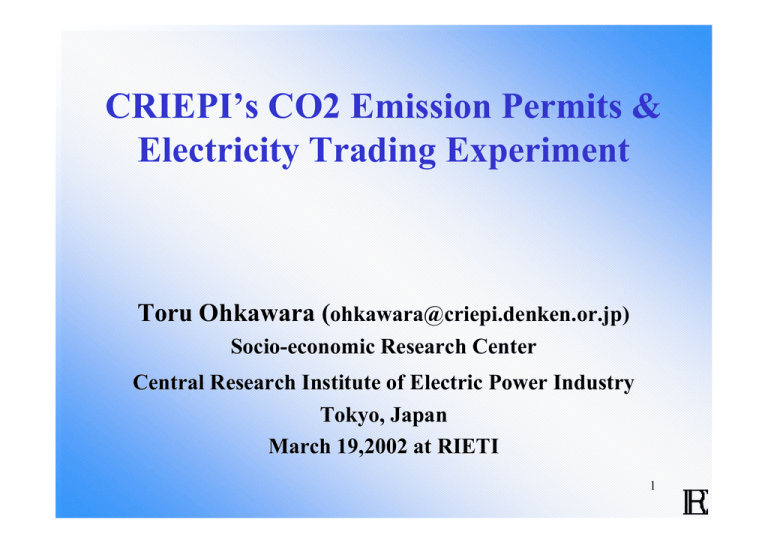

CRIEPI’s CO2 Emission Permits & Electricity Trading Experiment Toru Ohkawara (

advertisement

CRIEPI’s CO2 Emission Permits & Electricity Trading Experiment Toru Ohkawara (ohkawara@criepi.denken.or.jp) Socio-economic Research Center Central Research Institute of Electric Power Industry Tokyo, Japan March 19,2002 at RIETI 1 Main Characteristics of Trade Experiment • Participants to the market Virtual generation companies similar to Japanese electricity companies. CRIEPI’s researchers played the roles of nine companies in the experiment • Commodities traded in the market Virtual company trades both CO2 emission rights and electricity. Generators produce both electricity and CO2 simultaneously.Virtual company tries to maximize its profit by deciding operation and investment of power plants which are also means of reduction of CO2. • Uncertainty The ex-ante demands are reported by game-master but the ex-post demands are determined probablisitically • Market clearance mechanism Order Driven Method; Orders to buy or sell were collected within a set amount of time, and then the trade volume and price were determined by demand balancing. Electrical trade through the Internet 2 Behavior of Virtual Electricity Company Given Conditions T otal electricity demand CO2 emissions objective Exiting generation capacity Price of fuels for genaration Capital cost and CO2 emission rate of generation Retail electricity price strategy Operation and investment of different types of generation e.g. nuclear, coal, gas and renewable energy. Trade of CO2 emission permits and electricity among companies. Object Profit maximization 3 1st 1st Experiment: Ends in 2012 CO2 Emission Trade (¥/tCe) Ce) Price and Quantity ¥29,007 Clearance 30000 ¥29,009 Trade Penalty ×1.5 1500 1400 ¥25,030 Highest 1300 1200 1100 ¥19,339 Average Price in 2008~ 2008~2012 20000 (10,000 tCe) tCe) 1000 900 ¥16,667 Price of Emission (Left Axis) Axis) 580万t 580万t万t-C |14,000;First |14,000;First Price 800 Equilibrium Price Based on Allied Behavior 700 600 500 10000 400 Quantity Traded (Right Axis) Axis) 300 200 100 0 0 123456123456123456123456123456123456123456123 2006 2007 2008 2009 2010 2011 2012 Clearance 4 2nd 2nd Experiment: Ends in 2013 CO2 Emission Trade (¥/tCe) Ce) (10,000 tCe) tCe) Price and Quantity Traded in the CO2 Emission Market 30000 1500 1400 1300 ¥19,000 1200 Penalty ¥21,137 ¥20,000 20000 1100 1000 Price of Emission (Left Axis) Axis) 900 800 ¥14,091 Average Price in 2008~ 2008~2012 700 ¥12,250 10000 ¥9,141 Equilibrium Price Based on Allied Behavior 600 500 ¥8,500 ¥10,000 400 ¥7,500 300 Quantity Traded (Right Axis) Axis) 200 100 0 0 1 2 3 4 5 6 1 2 34 5 6 1 2 3 4 5 6 1 2 3 4 5 6 1 23 4 5 6 1 2 3 4 5 6 1 2 3 4 5 6 12 3 1 2 3 4 5 6 2006 2007 2008 2009 2010 2011 2012 C.P. 2013 5 Summary In the 1st simulation, insufficient investment of power plant and unexpected growth of power demand created rise in the prices of emissions permits and power. In the 2nd simulation, since several large companies invested excessively in power plant despite of relatively lower demand for power, the price of emissions permits fell gradually, so did price of power. These confirmed that the price of emissions permits was greatly affected by the uncertainty in the demand for power and by investment of power plants. The price of emissions permits was affected by their demand throughout the entire periods of the simulation, not just by the current year. 6 Summary The rules of fine system may explain the price fluctuations in the later half of two simulations (when the demand and supply condition of market was gradually getting known). In case of non-comliance of CO2 emission reduction, the company should pay fine. The fine is set at 150% level compared to the average market price. During the first simulation, this fine system affected the increase of emissions price. Since the fine is varied according to the market price, the rule of fine itself might affect the market price. Some of the participants tries to hold emission permit because they can sell it in the grace period at the high price which is nearly equal to fine level.Thus, the market power to rise the price is observed. If an emissions permits trading system is to be established in Japan in future, it will need to be investigated along the lines of the Danish system, in which the fine is a fixed amount. 7