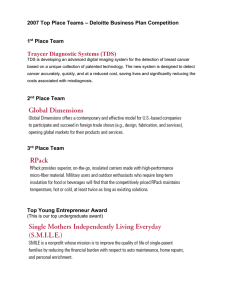

Updates on TDS :

advertisement

Updates on TDS : - Section 194-IA - Filing of 26QB Statement & Payment against TDS Defaults - Section 194C – TDS on Payment to Transport Services - Form 15CA and 15CB - Form 15G and Form 15H - Section 194A - TDS on Interest - Misc -Refund of TDS - Password 24/04/2016 CA PINKI KEDIA CA PINKI KEDIA 1 1 Filing of 26QB Statement & Payment against TDS Defaults • Deposit of Tax deducted with respect to Purchase of Immovable Property (26QB Statement-cum-challan) 26QB Statement-cum-challan can be filed (along with payment of tax), under “Form 26QB” in “TDS on Sale of Property” on the payment portal of NSDL. URL- https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp • Demand for TDS Defaults with respect to Purchase of Immovable Property (26QB Statement-cum-challan) LETTER F.NO.DIT(S)-2/FORM 26QB/100/2015, DATED 22-3-2016 - WITHDRAWAL OF STANDARD OPERATING PROCEDURE (SOP) dated 20-4-2015 • password to open intimation letter and justification report sent by CPC – TDS - enter password as ‘ABCD_30092012’ – First 4 character of PAN and Date of payment/Credit as regular statement 23-04-2016 24/04/2016 CA PINKI KEDIA CA PINKI KEDIA 2 2 TDS Defaults • various types of defaults on 26QB processing - Short Deduction Computation u/s 200A when the rate at which TDS Deducted is less than 1% - Late Payment Interest Computation u/s 200A read with Sec. 201(1A) Late payment interest will be charged @ 1.5% per month from the date of tax deduction to date of tax deposition Due date of TDS deposit will be by 7th of the next month of the month for which transaction is reported - Late Deduction Interest Computation u/s 200A read with Sec. 201(1A) Late deduction interest is charged @ 1% per month from date of transaction to date of tax deduction. Due date of deduction will be date of payment/credit whichever is earlier - Short Deduction Interest Computation u/s 200A read with Sec. 201(1 A) provisional in nature Short deduction interest is calculated @ 1% per month on Part of the month from the date on which tax was deductible to the date of the processing of statement 23-04-2016 24/04/2016 CA PINKI KEDIA CA PINKI KEDIA 3 3 TDS Defaults • • - Late filing fee Computation u/s 234E a sum of Rs.200 for each day during which the failure continues Fee amount will not exceed TDS deductible as per 26QB filed Due date of filing will be by 7th of the next month of the month for which transaction is reported “demand payment” link on the TIN portal through URLhttps://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp Requirements for Online Corrections Corrections related to email address; Mobile Number and Address of the Property will not require DSC or Assessing Officer’s approval. - Registration at TRACES is mandatory - Can make correction using Digital Signature Certificate (DSC) - DSC not used then in some case approval of TDS AO is required 24/04/2016 CA PINKI KEDIA 4 Correction in 26QB statements - Following fields of 26QB statements can be corrected using the Online Correction facility: a. PAN of Buyer Details - Approval needed b. PAN of Seller Details - Approval needed c. Buyer’s Address – Auto approval d. Seller’s Address – Auto approval e. Property Details including property value – Auto approval f. Amount Paid/Credited - Auto approval in case of using DSC g. Date of Payment/Credit - Auto approval in case of using DSC h. Date of Tax Deduction - Auto approval in case of using DSC TDS AO may like to ask for the Identity Proof and PAN Card of buyer along with the documents related to Transfer of Properly and the proofs of payment made to verify the Amount of Property, Date of Payment, Property Details etc. 24/04/2016 CA PINKI KEDIA CA PINKI KEDIA 5 5 TDS on Payment to Transport • CIRCULAR NO. - 19 /2015, DATED 27th NOVEMBER, 2015 • The new provision of Section 194C effective from June 1, 2015 • Non Deduction of tax – only for small transport operators who are eligible for 44AE • owing not more than 10 goods carriage at any time during the previous year • on the date on which the amount is credited or paid, whichever is earlier. • Not applicable for transportation vehicle for passengers • a declaration to this effect along with his PAN, to the person paying such sum. 24/04/2016 CA PINKI KEDIA 6 Form 15CA and Form 15CB • Notification No. G.S.R. 978(E) dated 16th December, 2015 • come into effect from 01st April’2016 • Both forms 15CA and 15CB are to be filed online • Form 15CA and 15CB not required to file: a. an individual for remittance which does not require RBI approval under Liberalised Remittance Scheme. b. Specified list of 33 Payments including 5 new payments: - Advance payment against Imports - Payment towards imports-settlement of invoice - Import by diplomatic missions - Intermediary trade - Import below INR 5 lacs (for use by ECD offices) 24/04/2016 CA PINKI KEDIA 7 Form 15CA and Form 15CB • Revised Form Nos.15CA and 15CB divided in 4 parts: Part A – Remittance is chargeable to tax but does not exceed INR 5 lacs during the financial year Part B – Sum chargeable to tax, remittances does not exceed five lakh rupees during the financial year and lower WHT certificate obtained under Section 197/195(2)/195(3) Part C – CA Certificate under Form 15CB if payments exceed INR 5 lacs and are chargeable to tax Part D – Sum not chargeable to tax under the provisions of the Act • Penalty for non-furnishing or inaccurate filing of information –INR 100,000 for each default • filing of quarterly information on remittance by the AD in Form 15CC electronically under digital signature within fifteen days from the end of the quarter of the financial year to the Principal Director General of Income-tax (Systems) 24/04/2016 CA PINKI KEDIA 8 Form 15CA and Form 15CB Procedure : • Generate signature of Remitter for the zip file using DSC Management Utility (available under Downloads) and upload the generated signature file. • Upload of Form 15CB is mandatory prior to filling Part C of Form 15CA. To prefill the details in Part C of Form 15CA, the Acknowledgment number of eFiled Form 15CB (sent on email of remitter and CA by efiling website) should be provided • ‘ADD CA’ in Income Tax website for Form 15CB by Remitter • Login as Chartered Accountant on incometaxefiling.gov.in 15CB • Download FORM 15CB utility from Downloads page and prepare the XML File • Login to e-Filing, Go to e-File ⇒ Upload Form, Enter PAN/TAN of assesse, PAN of CA, Select Form Name as 15CB, Select Filing Type as Original. 24/04/2016 CA PINKI KEDIA 9 Form 15CA and Form 15CB • Upload the XML generated from the downloaded utility. Upload the signature file generated using DSC Management Utility for the XML. • Login by Remitter to e-Filing, Go to Worklist ⇒ For Your Information • Click on “View Form” link to view the Uploaded Form details. The status of the form on submission shall appear as “Submitted”. • On successful filing of Form 15CA-Part C against the particular Form 15CB, the status of Form 15CB shall update as “Consumed”. • In case of withdrawal of Form 15CA against which Form 15CB was consumed, then the status of Form 15CB will change from “Consumed” to “Withdrawn”. • Click on “Withdraw Form 15CA” link against the Form uploaded to withdraw the uploaded FORM 15CA. One Form 15CB can be consumed for filing one Form 15CA only. 24/04/2016 CA PINKI KEDIA 10 Form 15G and Form 15H • Notification No.76/2015/F.No.133/50/2015-dated 29th September 2015 Form 15G and Form 15H can be furnished - Paper Form - Electronically • CBDT Notification No.4/2015 Dt: December 01, 2015 F.No.: DGIT(S) /CPC(TDS)/DCIT/15GH/2015-16/14425-556, • Tax payer need to submit form 15G/15H (paper/ electronic) and deductor on receiving the same will assign Unique Identification Number (UIN) to all self-declaration in accordance with a procedure by CBDT. • The tax payer can generate and submit Form 15G/Form 15H online provided the banker has created a link on their individual banks Internet Banking. 24/04/2016 CA PINKI KEDIA 11 Form 15G and Form 15H • Deductor shall digitize the paper declaration and upload all declaration received during a particular quarter to website www.incometaxindiaefiling.gov.in on quarterly basis • Both the UIN and self-declaration details will have to be furnished by the deductor in the quarterly TDS statements. • In addition, deductor will be required to retain Form 15G and 15H for seven years. • To fill form 15G or 15H online, you must have access to internet banking • Any individual or HUF, making a false statement in the form 15G/H shall be liable to prosecution u/s 277 of the IT Act, 1961 and on conviction be punishable • • evaded exceeds one lakh rupees - rigorous imprisonment – 6 months to 7 yrs with fine • In other case - rigorous imprisonment – 3 months to 3 yrs with fine Form 15G/15H should be submitted to each and every branch where you hold your deposits 24/04/2016 CA PINKI KEDIA 12 Section – 194A -TDS on Interest • Untill 31st May, 2015, the threshold limit -income credited/paid by a branch of the banking company or co-operative society, as applicable. • W.e.f. 1 st June 2015 - the income credited/paid by the banking company or the co-operative society or the public company (i.e. all branches) which has adopted core banking solutions. • Tax u/s 194A not applicable: - does not exceed the specified threshold limit - to any banking company, co-operative bank, public financial institutions, LIC, UTI, an insurance company, co-operative society carrying the business of insurance or notified institutions. - by the firm to its partner(s) - by co-operative society to its members (Interest on deposit excluding time deposit) 24/04/2016 CA PINKI KEDIA 13 Section – 194A -TDS on Interest - In respect of deposit under Post office Scheme i.e. RD, NSC, KVP, IVP and Monthly Income - deposits (other than time deposit made on/after July 1, 1995) with a banking company or interest paid/credited to non-members on deposit with a cooperative bank. - deposits (by non-members) with a primary agricultural credit society or primary credit society or co-operative land mortgage bank or co-operative land development bank. - on compensation awarded by the Motor Accidents Claim Tribunal if the aggregate amount does not exceed Rs.50,000 - by an infrastructure capital company/fund or public sector company in relation to zero coupon bonds - by an Offshore Banking Unit on deposits made (or borrowings) on/after Apr 1, 2005, by a person who is resident but not ordinarily resident in India 24/04/2016 CA PINKI KEDIA 14 Section – 194A -TDS on Interest • Time Deposit as amended by Finance Act 2015 w.e.f 1 st June 2015: - include recurring deposits - the existing threshold limit of Rs.10,000 - applicable in case of interest payment on recurring deposits • Interest on FDR’s, made in the name of the Registrar General of Court or the depositor of the fund on the directions of the court, “Circular No.23/2015 in F.no. 279/Misc./140/2015-ITJ dt.28.12.2015” • Interest component on Decree Madhusudan Shrikrishna Vs. Emkay Exports 188 Taxman 195(Bom) Akbar Abdul Ali Vs. Additional CIT (2012) 146 TTJ 57 (Mum) (UO) 24/04/2016 CA PINKI KEDIA 15 Misc Section 40(a)(i)/(ia) Expenditure paid during the Financial Year on which tax is not deducted, whetherdisallowance of expenditure is called for? _ W.e.f 01/04/2015 Proviso to Section 40(a)(ia) has been inserted which states: Provided that where tax has been deducted in any subsequent year or has been deducted during the previous year but paid after the due date specified in section 139(1), thirty percent of such sum shall be allowed as a deduction in computing the income of the previous year in which tax has been paid. _ W.e.f 01/04/2015, no disallowance shall be made under Section 40 (a)(i) if tax is deducted and deposited by the due date of filing the Return of Income . 24/04/2016 CA PINKI KEDIA 16 Updates on TCS In this Budget, from 1st June 2016 • sale of a motor vehicle(include high-end two wheeler) of value exceeding Rs.10 lakh • receipt of money for sale of goods or provision of services exceeding Rs.2 lakh • Applicable to all i.e. salaried employee, Vehicle Manufacturer, Vehicle Dealer • government departments, public sector undertakings, clubs, and some others are excluded • purchasing goods for personal consumption also excluded • for the purchase of goods or services exceeding Rs.2 lakh in cash, these exclusions would not apply 24/04/2016 CA PINKI KEDIA 17 Refund of TDS Refund for Excess Claim to be made in Form 26B • Provided there is no outstanding demand or credit is not claimed by the Assessee • Mandatory to register DSC • Contain max of 5 challans. For more challans, submit new request • Max refund amount will be the min chllan bal amount in challan history • Available amount per challan > Rs.100/- • Statements should be processed before claiming refund • Refund chq will be issued in the Name and Address of the Deductor as per TRACES profile Google Chrome does not support Java Platform which is required for Digital Signature Utility Functionality 24/04/2016 CA PINKI KEDIA 18 PASSWORD 24/04/2016 CA PINKI KEDIA 19 CA PINKI KEDIA B1, GANDHI SADAN NR PINKY TALKIES ANDHERI EAST Mumbai – 400 069 Contact – 98690 30652 Email – pinkikediaca@gmail.com 24/04/2016 CA PINKI KEDIA 20