• Ste & %

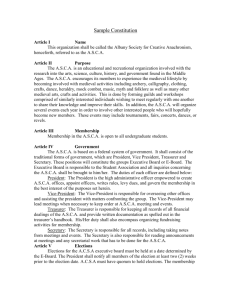

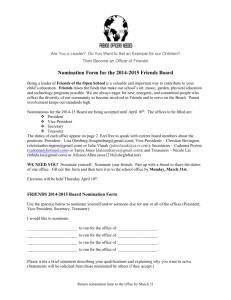

advertisement