SOLOW’S HARROD: TRANSFORMING CYCLICAL DYNAMICS INTO A MODEL OF LONG-RUN GROWTH

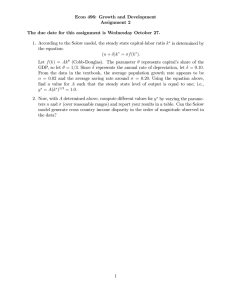

advertisement