INTERCOM THE -

advertisement

THE

INTERCOM

VOL5, N0.2

JUL OCT 1995

-

PUBLICATION FOR AGENTS AM0 ADJUSTERS FROM

THE STATE OF FLORIDA DEPARTMENT OF INSURANCE

E W l ~

Treasurer/lnsuraneeCommissioner/Fire Marshal

1

(CE)

GUN I INUINU EUULAI IUN

COMPLIANCE

December 1, 1995, the

information

should call

(904) 922-3134,

Ext. 1 If0 Please

remain on the line;

order in which it

h x l In the Rule,

FUNDS-%~!+

ment entered into a Seltkmnt Stipulation for Conswit Older with ti^

agent. The settlrrmmt rendered a $1,000 fine, a one-year

A Property and Casualty agent wes served wkh a n i ~ n t and won

of $528 to

inswed.

in

Administrative Complaint alleging that the agent engaged in sliding

DECEPTlVE ACTSmotor club memberships, required consumerstopurchasemotor dubs

In order to obtain premium financing, and allowed unlbmed employAn agent under imrsstigalion by the h p t m m l of Insurance fw

ees to transact Insurance. The agent's requestfor afwmat hearingwas

-lble

,,,lsapproprialion of m ~ u mfunds

found to

granted and the case concludedwith m t l o nd the agenfs Iloensas.

arm -.

humem

frwn lllhil mtehlb

thtd that the name, Social Sear* number and date of birth being

DECEPTIVE PRACTICES-used by the w n t wewe those of a deceased person. An Emergency

A licensed Health agent communicated falsa hformath to other

isrwed immedhbb

amow

agents wncerning-the screening of small employer groups for health

Ingthis

puan mnlstrative writ on me -mpriaproblems before offering to write the coverage. Benefit plans must be

tlon charge.

Issued to small employer groups on a guarantee-hue basls. ScreenFAILURE TO DISCLOSEIng for pm-exkt!ng conditions or elalms hismy h not allowed by taw.

Such a c t h s by the agent demo~trated

a lack of M e s s or trustwoMlAn a m falsified his appllmtion for Insumnee license by

and a one-ycrarpwas - I

On the

ness. A fine Of

stating that he had not %een arrested or Indicted by any state or

agent.

.

federal authorities anywhere in the United States in the last 12

MISAPPROPRIATIONOF

m t h a . mThe llwnsinp p m n s rmqulru m FBllFDLE repod on

each appllmnt, but issuance of the Ilaanae Isr not delayed while

The D e p d m n t of Insumme issued an Administmth Complaint

waltlng Por the report. Accordindy. the applhnt was llcensed

agaimt an agent

that he mlaa~roprlatedmd~fundrrend

bawd lrpon

Imrmat)on contalmd [n

mm

made matterla1misstatamenti3for the purposeof ilcduclngmeurnem lo

th.

bklwy report was receld

by

it

e-te

l ~ ~ a Ilfelnsumnw

~ ~ l ~ ~ A f~t e rl w nr g

a m far a g g m m t d ba~aryand m s l a l n ~an -r

want

the scent aurmndered Ibnsefor

t h m a~

w ~ hvio~mce.

t

TII~m r t r n e n t entarad lntoa~ettlment~ t i p u Settlement Stipukth for mwnl Order.

latlon lor Consent Order which r m u M In a Ilne olW and n

FALSE AND MATERIAL MISREPRESENTATION%

one-year probation for a materlal mimrspmsenhtlon on an applC

'Or

license'

life and Healthagent wasE3legedto haw madefah a n d material

mlsreprewntatlonsto a consumer eoncerntng the replacement of a life

Insurance policy and execdon of a ,Sectlan1085 Exchange Form.

+ 9 9 4 + 9

These misrepresentations and f

a

H

m to execute the proper forms

resulted In four poncles lapslng and being amelled, which a t t m d the

If you en nol sure about the intent of ths law or have q#stha

consumer to lose the cash surrender velum of the polldes. Afbr an

about Um FlaWa Insurams Code, plea- mU (a)

922-9138 for

. Investigation, an Admlnletrath Complaint wae I#wdand the DeparthfamWa~

SLIDIIYG/MISREPRESENTAfION-

-...-- -- .-

-----. .

.

- - -

-

- -

--

ENTITIES

UNLICENSED

.. .

.--.

donorable William Gary, Judge of the leon County Circult Court, has entered

rmanent injunction a @ m

Insurance Company of Great Britain, Professional Indemnity Corporation, American Institute of Chiropractic, Jean

Busch, Dr. Richard Busch, and Chiropmcth Associationfor Research and Education, permanentlyand forever enjoining

them from transacting Insurance in Florida or relative to rhks or insureds locsted in Florida, unless and until they o h i n

a Certificate of Authority from the Department of Inwrance. The court also entered a final judgment w i n s t the

defendants ordering them to pay a substantial fine and delinquent premium taxes.The defendants had organized an

unauthorized purchasing group and were soliciting insurance through a magazine maled to Chiropracton. The group

was purportedly insured by two unauthorized &horn compani*

lnsuranoe Company of Great Britain and Profes::. -.:s-*. - .

*.

- . ..--- .- - . ,

.: .,LA- - ,.<: .!-,.slonal Indemnity Corporation. .,*..;

;;,-;< ?*&<?+.,7

...+:-- -.

- - , .L

:?

- 7 -3

,<:;-?.

>

A

:

-

L-r-.----.----...-..-.

,

\

\

,

,

-,+---

I"

, ,-

h , , v ,

- -

*

, -

.

,

- < -

,

.

.

. ..

;,y,:;Ls

; .,

,

CHANGE IN UNAUTHORIZED ENTITIES COORDINATOR

The Division of Insurance Fraud, Unauthorized Entities Section, recently announced the appointment of Denise

Prather to the position of Unauthorized Entities Coordinator. Denise replaces Gail Connell who hers transferred to the

Ortando Fraud Field Office as a Crime lntelllgenca Analyst.

Persons suspecting any unauthorized insurance activity are urged to contact Me. Prather Immediately by calling

(904) 413-4036or addressing your correspondence to 200 East Gaines SL, Tallahassee, FL 32399-0324; Fax eomrnunk

cations should be directed to (904) 488-2632. Unauthorized aethrlty may invohre unlicenseddome& entities, unlicensed

oflrhordforeign companies, unapprove(l union plans, unapprwd employee leasing plans, unapprovedinsurance benefit

plans and lndlviduats !hat are marketing andlor solkltlng unauthorized insurance plans within the State of Rorlda.

To determine whether or not an insurer is authorized in Florlda, please call the Departmenfs Consumer Sewices

Hotline at 1-800-342-2762in Florida or (904) 922-3131 outside of ~lorida.

rn

WARNING: RESIDENT AND NON-RESIDENT AGENTS RISK LOSING THEIR LICENSE

WHENEVER THEY SOLICIT FOR AN UNAUTHORIZED INSURER

-

I

.......o u r r murrw rrLrwnaiwa art: r t m r r g r y esrrvuurugw ru u u r r r p ~ y

W I L rr II re: UUIR

w r r u ~urrr;rrurrurr

laws and regulations and to ensure the proper discipline of violators by filing formal

written comdaints wlth the De~artmen

t of Insurance

..,....

ILLEGAL BAlL BOND SOLICITATION

The Department has stepped up its efforts statewide to

curtail illegal bail bond solicitation activities. Section

648.44(1)(b), Florida Statutes, provides that bail bondsmen and runners may not directly or indirectly solicit business in or on the property or grounds of a jail, prison, or

other place where prisoners are confined or in or on the

propertyor grounds of any court. Section4-221 -095,Florida

Administrative Code, further specifies that prohibitedsolicitation includes displaying, wearing, or distributing any item

which directly or indirectly advertises bail bond services, or

approaching anyone or urging, enticing, luring, or inviting

anyone to approach a bandsmen to use his senrices, and

parking a motor vehicle, which displays the name of a

bondsman, a bail bond agency, or any other information

advertising bail bond senrices, when not conducting bail

bond business or for a longer perid of time than necessary

when conducting bail bond business. The property or

grounds of a court, jail, prison, or other place where

prisoners are confined includes all parking lots and

p r k i n g spaces adjacent to such places or adjacent to

-9blic walkways adjacent to such places.

The Department recognizesthat, while the solicitation of

bail bond business is constrained at designated locations,

the approach of licensees whlle at these locations by

otherwise unsolicited clientele. does not necessarily constitute a violation of the law; therefore, it is necessary to

distinguish between direct and indirect solicitation. It is the

Departrnenfs position that a bail bond licensee's presence

inasolicitatianprohibitedarea,when said licenseeis not on

court or bail bond related business, may constitute indirect

solicitation. Licensees should exercise caution to ensure

that neitherthey nor their agents violate these provisionsof

the law.The Departmentfurther cautions that it is improper

to monitor first appearance court hearings for the purpose

of prequalification of candidates for follow-up solicitation,

make unrequestedjail visitations with detainees to solicit

aeir business, or take any other unrequested actions at

prohibited Imtions which facilitate bringing together bail

bondsmen and potential clients.

Prohibitedsolicitation is a crime punishableas a misde

m n o r of the first degree, as well as a regulatory violation

punishable by administrative sanctions against an agent's

limnsure status. Clear distinctions between legal and illegal bail bond solicitation balances the recognized legiti

mate activity of attracting business clientele while prohibiting activity which would foster unfair methods of competition within the bail bond industry.

BAlL BOND AGENTS MAY NOT EMPLOY

PERSONS WITH A FELONY HISTORY

The Department is presently investigatingseveralcaseswhere lt h r s

that llcensed bait bond agents have

employed persons who have pleaded

gull@or no contest to a felony or crime

punishable by impdsonrnentof one (1)

year or more. AH bail bond licensees

are remindedthat pursuantto Chapter

648.44(7)(&),ES., personswithafelony

background may not m i p a t e as a

director, offlwr, manager, or employem

of any bail bond agency or office, m

gardtemof whether or not adjudication

of gulh was withheld. Such mstrlctians

apply even ifthe felony case is under

appeal. W u s e of the dose relationip between the ball bond business

epartment v i m thls as a very serious matter and urges all ticensees to

conduct a thorough, due-diligence

background w i e w before &ending

an &r of employment to any p e m i

Bail bond agents ate subject to licensure suspension, revocation, or other

administrative penatdes for violating

this statutory prohibition. Further, any

person who knowingly permits a person who has been convicted of or who

has pleaded guilty or no oontesl to a

felony to engage in the bail bond buiness commits a felony of the third degree. A felony charge of thls nature

against a llcensed bail bondsman will

muR Intheimmediateemergency swpension of the bondsman's license;

and, depenciing upon the autcome of

the case, could muttinthe permanent

revacation of the Ilcense. Bail bond

agents are strongly encouraged to

closely adhere to this law.

1

BAlL BONDSMEN

CHARGED

WORKERS' COMPENSATION

INSURANCE PURCHASING ALLIANCE

ASSISTS SMALL EMPLOYERS

The 1993 Special Session of the

Legislature passedthe Workers' Compensation Insurance PurchasingAllian# (WCIPA) bill. The prwisions of

this law assist small employers (50 or

fewer employees) in obtaining workers' compensation coverage in the

voluntary market. The Alliance was

created within the,Departmentof Insurance, yet its seven-member Board

of Directors is comprised of representatives from insurancecompanies

and small employers.

The WClPA

r CHPA

Although the WClPA may sound

simllar to a Community Health Care

Purchasing Alliance, it is not. The

CHPAs (pronounced %hippas") enable small businesses to group together to purchase health insurance

for their employees in greatervolume

at reduced rates. With worken' compensation insurance, this 'grouping"

of small businesses is not possible

for small employers given the wide

variety of classlfications involved.

Conseque't'~~the WClPA merely

assists individual risb in obtaining

workem' camp co''eraW in the voluntary mark* by contading interested

insurem. The Alliance staff neither

underwrites nor earns a commission

for this service, and contacts only

those insurerswho have expressed a

willingness to review Alliance risks.

Free Sewlce, but no

Guaranteed Results

0

Section 626.9541(l)(m), Florida

Statutes, provides a limited exceptionto the statutory prohibitionagainst

rebating. This exception permits the

giving of sadvertisinggifts* limited to

'articles of merchandise having a

value of not more than $25.' Under

this provision, insurers and agent3

may giveclients advertising gifts such

as pens, pencils, calendars, etc.,with

the company or agency name and

telephone number or clocks with company trademarks. Merchandisa is

defined as anything movableand customarily bought and sold for prom.

The Department of Insurance previously has Issued opinions which

specifically provide that cash and gif!

certificates are not articles of merchandise. Further, no court has connoted merchandise as a plan or ser-

While thk senrice is free to the

small employer, the WClPA staff does

not guarantee that it can find every

riskawillingvoluntary marketinsurer.

However, in its first few months of

operation, the WClPA staff has been

successful in finding voluntary coverage for over 50 percent of those requesting assistance. Small employers who cannot find coverage in the

voluntary market either go bare or

usuallyhaveto settlefor paying higher

pollcy premiumsinthe Workers' Cornpensatlon Joint Undennriting Aweciatian (WCJUA).

In an effort to attract more inwrers, the Purchasing Alliance encour- such things as auto club

ages employers to lrnpkment drugfree workplace programs, workplace

safety standards, and managed care

arranaements

for their employees.

. ifa limnsee encounters amall emeyers for whom worksmi mmpen-tion ins" ranee in the wluntary

market cannot be found, please ento **&

the WCIPA

counge

staff at -800-342-2782,

a

0

.;

,

New Phone Process Aids Callers

In the midst of this technological age, Commissioner Bill

Nelson has called for a little more human touch to the handling

of telephone calls .rec-merit's main tele-

calls received by th

Ize the system b c

posslble to those needlng the services of the Department of

Insurance.

4

ADVERTISING

GIFTS

PERMITTED

EEma

Reminder

Each penon operating an insurance agency

or adjusting firm and each location of a multiplm

agency or firm must complete a Primary Agent/

Primary Adjuster Form (014-WM) on or Wore

January 1 of each year. No Insurance agency

location or adjusting firm lacation shall conduct

t

hbusinessof insuranceu n ha pdmmy W n t

or primary adjuster is designated at aH times.

Failure to designate a primary ~

nor primary

t

adjusteras muired undar W o r t s $28.592 and

626.8895, F.S., shall oonstktle gmunds far rt+

qulfing that the agency or

Please refer to pati4 1 ~ 8 ~ 8 8

copy of the form. If you havequestionsw

Guest the form, &tact me Bureau of I n W -

]

1

I

I NEW COMPANIES

4:

, ,

k

Statewide of Florida Ins. Co. was

uthorized on 8/11/95, Lines of

siness: Fire, Allled Lines.

omeowners Multi Peril, Inland

Marine, Private Passenger Auto

Clablfity, PPA Physical Damage,

Mobile Home Multl Peril, Mobile Home

Physlcal Damage; Re-Insurance on

all lines listed. Address: 2500 N.W.

79th Avenue, Miami, FL 33122;

telephone (305) 715-0000.

Paramount Dental Plan, Inc., was

authorized on 7120195. Lines of

burlness: Dental Service Plan

(Prepaid). Address: 10627 Rivercrest

Drive, Rlvervlew, FL 33569;

telephone (813) 667-4955.

Frontier Pacific lnsurance Go.

was authorized on 4/6/95. Address:

6404 WHshire Boulevard #850, Los

Angeles, CA 90048; telephone

(2 I3) 653-4058.

HIP lnsurance Company d Florida

was authorized on 4/6/85, Lbrs of

business: Re-insurance-Life, Rainsurance-Accldent and Health, Life,

Accldent and Health. Address: 200 S

Park Road, Suite f 00, Hollywood, FL

021 ; telephone (305) 962-3008.

1

Spedrslty I n s w a m Go.

1wasLeadw

authorized on 5111/95. Llnea of

business: Re-insurance on Private

PassengerAuto Liability, Commercial

Auto Llablllty, PPA Physlcal Damage,

Commerclal Auto Physical Damage;

Prlvater Passenger Auto Liability,

Commerclal Auto Liability, PPA

Physlcal Damage. Address: 4807

Ftockslde Road, Independence, OH

44131; telephone (218) 447-1660.

Plnnacle Assurance Corp. an

Assessable Mutual was authorized

on 4/7/05 to convert Irom a WC Self

Insurance Fund under the name of

Self lnsurance Fund. Address: P. 0.

Box 14846, North Palm Beach, FL

33408; telephone (407) 840-7171.

Voyager lndemnlty Insurance was

authorized on 4/6/95. Address: P. 0.

Box 901045, Ft. Wofih, TX 76101;

telephone (404) 41 1-2389.

PHL Varlablcr Insurance Co. was

purchased by Phoenix Home Life and

re-admitted t o Florida on 7/20/05.

Former company names were:

rtford Llfe and Annuity, Dreyfus

nsumer Life. Address: 100 Brlght

adow Boulevard, Enfield, CT

-

-

Sunrise Healthcare Plan, Inc., was

authorized on 7/13/95. tines of

business: Health Maintenance

Organizations. Address: 500 West

Cypress Creek Road. Suite 640, Ft.

Lauderdale, FL 33309; telephone

(305) 492-4243.

Crum and Forster Indemnity Co. was

authorized on 5/11/95. Lines of

business: Fire, Allied Lines,

Commercial Multi Peril, Inland Marine,

Workers' Comp. Other Llabibity,

Commercial

Auto

Liability,

Commercial Auto Physical Damage.

Address: 6 Sylvan Way. Parsippany,

NJ 07054; telephone (2f2) 416-51 00.

Federal Emergency Management Agency

Washington, D.C. 20472

National Flood Imurance Program (NRP)

Subject: Rebating of Agents' Commissions

Background: The Federal Insurance Administmtlon (FIA) has reoehfed

inquiries from producers and Write Your Own Companies concerning the

tmbatlng of q#mtsLmrnmjSSjOne wlth respect to the NationJ Flood tnswam

Program (NNP). The three committees that advise the FIA regardingthe MNP

have provided input on this h u e : the Flood Insurance Producers National

Commitlee, the Insurance Institute for Property Loss Reduction flood Insurance Committeeand the Write Your Own MarketingCommittee. The Insurance

Institute for Propetty Loss Reduction Flood Insurance Committee did not

comment as a committee because of concerns about potential anti-trust

issues. Howewer, two member companies of that committee responded as

lndlvldual companies.

The comments pointed out the need for the NFIP, as a Federal program

operatingon a natlonalscale, to havea uniform pricingsystem countrywide, so

that insuredswould always pay the mme price for the same risk, regardless of

geographic location. This Is the only insurance program for the general public

that is nationally available with Federal programmatic oversight.

After reviewing all the comments received, the FIA has concluded that the

purposes of the NFlP are better served by maintaining the uniform pricing

system countrywide.

Polley Statement: In order to preserve the uniform pricing system of thls

national program, producen writing policies directly with the Federal Government as well as with Write b u r Own Companies shall not engage in rebatinq

agents' mmlssion8 on NFlP policies.

B+f/9r

Date

Eldne A. McReynolds

Federal Insurance Administretor

W o n 624.438, F.S., G e m l Eligibility for Multiple

Employer Welfare Arrangements (MEWA's)

-

MEWA's were designed to afford businessesthe opportunity to join together in insurancepurchasingpoolsfor thr -beneM of themselves and their employees. The

revisions provide that MEWA's licensed by the Depad

ment of Insurance are required to be employers who are

of the same profession, trade or industry as recognizedby

the appropriate licendng agency. The new requirement

does not apply to an arrangement licensed prior to 4/1/95

regardless of the nature of its business.

nee

FRPCJUA House Bill

2619 (Chapter 95-276

Laws of

Florida). Relates t o property insurance; became

law on J u n e 14, 1995.

Included in this bH1 were increased coverage limits for

the Florida Windstorm Undenvriting Association, the redefinition of residentla1coverage to include both personal

lines residential coverage and commercial Lines residential coverage, and a depopulation mechanism for the

Florida Residential Properly and Casualty Joint Underwriting Association (FRPCJUA). The depopulation plan

affects insureds, Insurers and agents.

The new law provides for a take-out bonus which

requires the JUA to pay up to $100 to insurers for each risk

the Insurer removes from the FRPCJUA, if the insurer

takes out a minimum of 25,000 policies. The bill also

allows an exemption from a deficit assessment if the

insurer removes at least 50,000 policies, subject to a

three-year decreasing percentage.

House Sill 2619 also addresses the affect the take-out

plan has on the FRPCJUA agent of record. When a policy

is removed from the JUA, either by buance of a policy

upon exptratlon of the JUA pollcy or by assumption, the

agent of record is entitledto retain any unearnedcommission on the policy. In addition, the insurer must either pay

this agent an amount equal to the JUA commission tha

agent would have earned If the policy had been renewed,

or the insurer shall offer to retain the agent to continue

servicing the policy for at least one yea<~heagent shall

receive the insurer's usual commission according to the

policy type. The agent has the option to accept or reject

this offer. If the offer is rejected by the agent, the insurer

is under no further obligation to the agent.

The Department of Insurance is committed to the

stabilization of the insurance market in the State of

Florida. This tegislatlon takes the first step toward that

goal. The Department encourages anyone who may be

affected by this bHI to read it thoroughly, as t h b article

deals with only a very smell part. If you have questions

concerning these matters, you may call the Oivisbn of

insurer Services at (904) 822-3142 or the Depanment

Hotline at 1-800-342-2762.

Section 628.561, F.S., Reporting and Accounting for

Funds

-

This section was amended to provide that any agent,

solicitor or adjuster who either temporarily or permanently diverts or approptiates

premiums, return premiums, or

other funds, or any portion thereof,

belonging to insurers or others, to

his own use or deprives the other

person of such a benefit therefrom

commits an offense. The offense

can be deemed a misdemeanor of

the first degree, a felony of

the third degree, a felony of

the second degree, or a

felony of the first degree,

depending upon the amount

of funds diverted.

4

h

Sectlon 626.902, F.S. Penalty tor ~ e ~ r e k o n t ~nauthorlzed

ln~

Insurers

-

This section was amended to make it a third degree

felony for an unlicensed person to represent or aid an

unauthorized insurer.

Saclion 626.989, F.S., Dlvlslon of Inuuranw Fraud;

Dellnition; Invertlgallve, Subpottna Powers; Proteotton from Clvl Llablllty; Reportsto Dlvlslon; Oivislon

Inveutigator's Power to Exacute Warrants and Make

Armst8

-

This section was amended to provide immunity to

members of insurers' Speclal Investigative Units (SIU's)

and like entities which share information &out fraudulent insurance acts with other SlUP and like entities.

, Fraud 6IllCSIHB 1745 (Chapter95-340Laws of Florida).

Effective July 1, 1995.

This bill makes it easier for the Division of Insurance

Fraud within the Department of Insurance and insurers to

pursue and prosecute cases of insurance fraud.

Followingare summaries of the eight amendedor newly

created statutory sections included In this bill:

Sectlon 826.9091, F.S., Insurer Antl-Fraud lmerti-

-

Unitm

e

This newly createdsection requiresinsurerswhich have

$10 million or more in written premiums to establish an

-

internal SIU or contract with others for investigative services. An insurer subject to this suClsection shall file a

detailed description of their unit with the Division of Insurance Fraud on or before July 1, 1996. Insurers with less

han $10 million written premiums must adopt and submit

anti-fraud plan tothe Divisionof Insurance Fraudby July

*l996,

or they may, in lieu of adopting and filing an antifraud plan, comply with the same provisions as the larger

insurers.

---

Section 772.102, F.S., Civll Remedies for Criminal

Practices. Definltlons.

-

Under this section of the statutes, new language provides that acting as or representing an unauthorized

insurer, acting as an unauthorized MEWA, or transacting

insurance without a CertZficate of Authority is subject to

civil liability.

-

Sectlon 817.234, F.S., Falser and Fnrudulmnt Insurance

Clalms

-

A new provision was added to this section stipulating

that any person who knowingly presents a false, incomplete, or misleading insurance application to an insurer

can be charged with s third degree felony. A statement

_I

will be addedto applications clearly definL

ingthis obj&h.The deadtian

line for

changes

applicais

e

-

.-

-

March I,1996.

Section 895.02, F.S., Offenses Concerning R a c b t w Ing and Ilkgal Pebts. Deftnltlons.

-

A new dsfinltion was added to this section whlch states

that transacting insurance without a Certifkate of Authority, operating an illegal MEWA, or representing an unauthorized Insurer, are prosecutable acts under the Racketeer Influenced and Corrupt Organization Act (RICO).

who prepares or files a health insurance claim on

behalf of a patient was unchanged by the amendments.

The new measures exempt persons who file a health

insurance claim on behalf of another and does so

without compensation.

The revisions to the law specifically prohibit a Public

Adjusterfrom giving legal actvie and from acting on behalf

of or aiding any person in negotiating or settling a claim

relatingto bodily injury, death, or noneconomic damages.

For the purposes of this section, the Legislature has

M n e d the term 'insured" to indude only the policyhddr

and any beneficiaries named or similarly identmed in the

PQl~cy.

Section 626.8698, F.S., relating to disciplinary guide

lines for PuMic Adjusters was created by the new legislation. These disciplinary guidelines are supplementary to

those found in Chapters 626.561,828.011,626.621, and

elsewhere in the Florida InsuranceCode. The new guide

llnes specify that the Department may dsny, suspend, or

revoke the license ofa Public Adjuster, and administer a

fine not to exceed $5,000 per act for any of the following:

violating any provision of this Chapter or a Ruk or Order

of the Department; receiving payment or anything of value

as a result of an unfair or deceptive practice; receiving or

accepting any fee, kickback, or other thing of value pursuant to any agreement or understan-,

mlor otherwise;

entering into a spllt-fee arrangement with another person

who is not a PuMlc Adjuster; or being otherwise paid or

accepting payment for senrims that have not been performed; violating s. 817.234, or s.316.006, F.S.; soliciting

or othemise taking advantage d a prson who is vulnerable, emotional, or othemise upselasthe mutt of trauma,

accident, or other similar occurrence; or violattry any

ethical Rule of the Department.

The Deparhnentsupportedthe implementation of tnew disciplinary provisions since Publlc Adjusters are

independent practitioners and are solely responsible for

their conduct when transacting the business of insurance.

Churning Senate Bill 906 (Chapter 95-219 Laws

Public Adjusters CS/SBs 2030 and 2144 (Chapter

95-238 Laws of Florida). Amends Section 626.854, F. S.

Effective June 9, 1995.

The new language states that *the Legislature finds it Is

necessary for the protection of the publk to regulate

Public Insurance Adjusten and to prevent the unauthorlred practice of law." A Publc Adjuster is defined as any

person, except a duly licensed attorney, who for money,

commission, or any other thing of value, prepares, completes, or files an insurance claim form for an insured or

third-party clalmant or who, for money, wmmisslon, or any

other thlng of value, acts or aids in any manner on behalf

of an Insured or third-party claimant in negotiating for or

effecting the settlement of a daim or daims for loss or

amage covered by an insurance contract, or who adverses for employment as an adjuster of such claims.

The exemption from licensure end appointment for

a licensed health care provider or employee thereof

-a

of Florida). Amends Section 626.9541, F. S. Effective July 1, 1995.

Section 626.9541, F.S., relating to unfair methods of

competition and unfair or deceptive acts or practiceswas

amendedto prohibit the practke of churning. Churning is

the practke whereby policy values in an existing life

insurance policy or annuity contract, including, but not

limitedto cash, loan values, or dividend values, and in any

riders to that policy or contract, are utilized to purcha8e

another insurancepdicy or annulty contract with the same

insurer for the purpose of earning additional premiums,

fees, commissions, or other compensation.

The new language requires insuren to a&pt wrttten

procedures whlch will provide notice of Intended replacement of life insurance policies or annutty tycontraets. Chuming d-n from the unfair method of competition known as

CONTINUED ON PAGE 8

CONTiNUED FROM PAGE 7

twisting only in that twisting involves the replacement of a

policy by another insurer. Problems created by these sales

practices became more obvious to the Department during

the pastyear when consumersfiled complaintsallegingthat

they had been ha&

as a result of such replacements.

The replacementof policies, per se, is not a violation of

the Florida Insurance Code; the violation mcurs when

misrepresentation or deceptive practices are used to

convince the policyowner to surrender one policy in favor

of another.

The written procedures for contract replaoement defined in the new statute requires insurersto provide notice

to the policyowner which compares the benefits of the

existing policy wlth what is being offered in the replacement policy. Advantages of the replacement policy must

be clearly described so that the pollcyowner can determine if the surrender or use of cash values in existing

contracts to purchase a different contract is in their best

interest. The statute also requires that this notice be

providedto all named partieswho may have an interest in

the continuation of the policy. Additlonatly, the new law

mandates an unconditional

refund period of 60 days

which begins the date the policy is delivered.

Most churning and twisting complaints received by the

I

i

I

Section 1. Paragraph (aa) is added to subsection

(1) of Section 626.9541. F.S., to read:

628.941 Unfair m a h i i s of competition and unfair

or deceptive acts or practices defined.(I)UNFAIR METHODS OF COMPETITION AND

UNFAIR OR DECEPTIVE ACTS.-The following are

defined as unfair methods of competition and unfair or

deceptive acts or practices:

(aa) Churning.1. Churning is the practice whereby policy values in an existing life insurance poiicy or annuity

contract, including, but not limited to cash, loan values,

or divldend values, and In any riders to that policy or

contract, are utilized to purchase another insurance

policy or annuity contract with that same insurer tor the

purpose of earning additional premiums, fees, commissions, or other compensation:

a. Without an objectively reasonable basis for

believing that the replacement or extraction wilt

result in an actual and demonstrable benefit to the

policyholder;

b. In n fashion that is fraudulent, deceptive, or

otherwise mlsleadlng or that involves a deceptive

omission;

c. Effective October I,1995, when the applicant

is not informed that the policy values including cash

values, dividends, and other assets of the existing

polcy or contract will be reduced, forfeited, or utilized

Department have been as a result of consumers being

convinced to ustrip' cash value out of existing policies to

provide substantial roll-in funds or replace policies with

higher death benefits. Projections made by agents re-' garding future values of the replacement polides we*

apparently bawd upon the interest rates andlor dividends

effectiveat he time of replacement. Many consumerswere

notmadeawareofhrturev~luesbaseduponthemrstcase

scenario or what is known as the muarantees.' Further,

some consumers were advised that no future premiums

would ever be due over the Me of the new p d i when, in

fact, prendums may very possibly become due later in life

when the policyholder may be less able to afford it

Consumers have a right to information which will enable them to make an informed decision when conternplating the replacementof an existing insurancecontract.

It is the responslbitity of agents in the insurance profession to provide as much pertinent information as is available, even if it means losing the sale.

Following is a re-print of the text of the new statute,

which ml8tes to the replacementof life insurance policies

or annuity contracts. The Department hopes this new Act

will assist the Industry in providing crucial information to

consumers who are contemplating a replacement policy.

in the purchase of the replacing or additional policy or

contract, ifthis is the case; or

d. Effgctive Octaber 1,1995, without informing

the applicant that the replacing or additional policy or

contract will not be a paid-up policy or that additional

premiums will be due, if this is the case.

Churning by an insurer or an agent is an unfair methad

of mnptkionand an unfair or deoeptive act or practice.

2. Effective October 1, 1995, each insurer

shall comply with sub-subparagraph 1.c. and subsubparagraph 1.d. by disclosing to the applicant at

the time of the offer on a form designed and adopted

by rule by the department if,how, and the extent to

which the policy or contract values (including cash

value, dividends, and other assets) of a previously

issued policy or contract will be used to purchase a

replacing or additional policy or contract with the

same insurer. The form shall include disclosure of

the premium, the death benefit of the proposed

replacing or additional policy, and the date when the

policy values of the existing policy or contract will be

insufficient to pay the premiums of the replacing or

additional polby or contract.

3. Effective October I , 1995, each insurer shdl

adopt written procedures to reasonably avoid churning

of policies or contractsthat it has issued, and failure to

adopt written procedures sufficient to reasonablyavoid

churning shall be an unfair method of competition and

an unfar or deceptive act or practice.

-

PREMIUM FINANCING

DISCLOSURE FORM

REQUIRED

L

Effective August 16, 1995, when motor vehicle insurance premiums are financed, agents

are required to disclose certain types of coverages financed with personal injury protection.

The disclosure is to be made at the time of sale

using e completed disclosure form (see page

lo), signed by the insured, with copies provided to the insured and the premlum finance

company. A copy must also be retained by the

agent.

If insurance coverages other than property

damage liability, bodily injury, collision, uninsured motorist, or comprehensive coverage for

damage of or loss to the vehicle are not financed with personal injury protection, then no

disclosure form is required.

The form i s adopted by reference in Rule

4-196.02 1, Florida Administrative Code. (A reprint of the Rule is shown in the column to the

right.) The Rule, along with a slightly different

format of the form, was initially effective on

February 1, 1995.

Licensees should ensure that the disclosure

requirements are followed and that copies of

completed disclosure statements are included

in the file maintained by the agency.

Failure to comply wlth the disclosure requirements constitutes grounds for disciplinary action under Ssctlon 628.621 (12), Florida Statutes. Depending upon the circumstances, a

three- month suspension may result from a single

transaction where the disclosure requirements

are not followed.

A photocopyof the new form 'Insurance Premium

Financing Disclosure Formm-DI4-1 182 (3/95), may

be used as long as there are no alterations in

text and type size and the copies are clearly

legible.

Rule 4-1 96.021

Disclosure Requirements for

Insurance Coverages Financed

With Personal Injury

Protection

(1) Whenever motor vehicle insurance is

financed, the agent shall disclose at the time

of sale any cwemges financed with personal injury protection other than property

damage liabiti, bodily injury, collision, uninsured motorist, or comprehensive coverage for damage of or loss to the vehicle.

(2) The disclosure shall be on Form

014-1 182 (3195), which is incorporated

herein by reference. A blank form can be

obtalW from the Bureauof Specially Insurers, 200 East Qaines Street, Tallahasree,

Florida 32399-0331, fm which you may

make as many copies as needed. Photocopies of Form Dl41162 (3/95)are acceptable, provided that the copits are dearly

legible and contain no alterations intext and

type she.

l

(3) The disclosure shall be signed by the

insured.

(4) Copies of the signed d ~ l o r u n shall

r

be given to the agent, insured, and fhe

premium finance company.

Specfflc Authority 627.8405 FS.

Law Implemented 828.9541 (I)@),

627.734,627.8405 FS.

History-New 3-1-95, Amended 8-16-95.

FYI

Consumers in Florida may call the Department's HelpLine for assistance with insurance-related questions.

The Toll-Free number is 1-800-342-2762

INSURANCE PREMf UM FINANCING

DISCLOSURE FORM

Florida law requires the owner of a motor vehicle to maintain personal injury protection and

property damage liability insurance. Under certain circumstances as provided in Chapter 324,

Florida Statutes, additional liability insurance may be required for bodily injury liability. Also,

additional insurance is usually required by a lienholder of a financed vehicle. Florida law

does not require other insurance. The direct or indirect premium financing of auto club

memberships and other non-insurance products is prohibited by state law.

i

I

Insurance you are REQUIRED by law to have:

Personal Injury Protection {PIP) .....................................................................

$

Property Damage Uability (PD) .......................

.......................................

.

.

.

Other insurance which you MAY be required by law to have:

Bodily Injury (If an SR-22 has been issued) ..................................................

OPTIONAL insurance coverage:

Bodily Injury (If an sR-22 has NOT been issued) ............................... 1.....

Uninsured Motorist ............................................................................................

Comprehensive ..................................................................................................

Collision ............................................................................................................

........................................................

........................................................

@

Policy Fee, i f applicable ...........................................................................................

..........................................................................

..........................................................

TOTAL INSURANCE PREMIUMS

$

Less Down Payment Applied ..................................................................................

(

AMOUNT FINANCED (LOANED TO YOU)

$

I

!I

1

I

t

1

t

i

!

,have read the above and understand the coverages I am buyingand

1,

{Pdm Namm ol tnrursd)

how much they cost.

I

?

!

Department of Insurance

BULK RAT€

Division of Agent and Agency Services

U.S. Poetage

I

200 East Gaines Street

TaikhamM, R

Permit No. 101

Tallahassee, Florida 32399-0318

NAMEIADI)RESS

CHANGE?

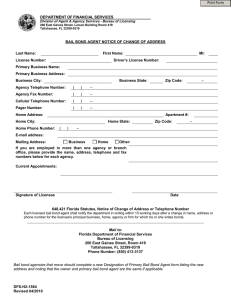

If your name, residence addms, principal business street

address, or mailing address

changes, you mud notify h e Department within 30 days of the

change. Lkensees who fall to

comply are In vlolatlon of Chspter

826.551, ES., and are subject to

investlgatlon and possible discipllnary action.

'

Please mall your notice of

change to:

Bureau of Wnslng

Department ol In8umm

200 East Gaines Street

T a l h h ~ @ eFL, 32308-0919

A name change necessitates

the re-iss~anceof your insurance license. Please remember to enclose the $5 fee and a

copy of your marrlage certiflcate, divorce decree, or other

documentation at the time you

request re-lrsuance.

i

t

Bill Nelson

r

john

DIYEBUmOPAGRNTlAGBNCYSXVlCW

H,h, Dklllon

mv ~ l kwmw,

,

AWWM

~~~~,~~

c

D-

OMM

~

,

~

-(w)

'"-"

-(eoc)

-(w)mats

mu-

of I-##*

( w ~ 1 8 8

@a-sliwEH. M

mMma

01 "-ng

ed-

--B#Hon-

-

kotlon

sr

onn-a1

~ x t 110s

.

(804)922.8187 Ext. 1101

~

The Intercom ispulz

~

m

-

partment of Insurance, Division of

~ ~ and

& Agency

t

Services, 200 East

Gaines Street, Tallahassee, FL

32399-0318.

Lucy Walker

Editor /Publisher

1

i

-i

I

-!:

~~

--

m2sz!lx

BallMm-AQmm

fmwwwu

-Rlpmsntlltlv#

Uon#.~0000-I904)~4197EKt.1100

-iCI#nnrrmwu

Fwrm

-Rrwwrrll

Contributors:

GerrySmith

Phil Fountain

ShirleyKerrIs

Dale Gliare

Vinw Mount

DonPowem

JoanC a b g e

Sally Burt

Eugenia Tyua

Barry Lanier

D a ~ F l u m m e r DickKealw

K e n y Edgil

Tom Zutell

Denisr Prather

onpny-&~Orp

Wewthmmemgeestlomsand~eolreamlag

The bt*rrom. Written suggestions rbould k

mailed to Lucy Walker, Florida Department of

Inrurance, 2M1 E. Gain- Street, ~nllahmsaa,

Plodda 32399-0318

t

8