INTERCOM THE

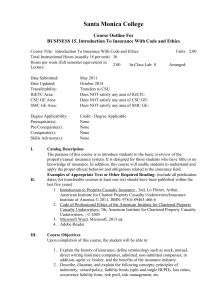

advertisement