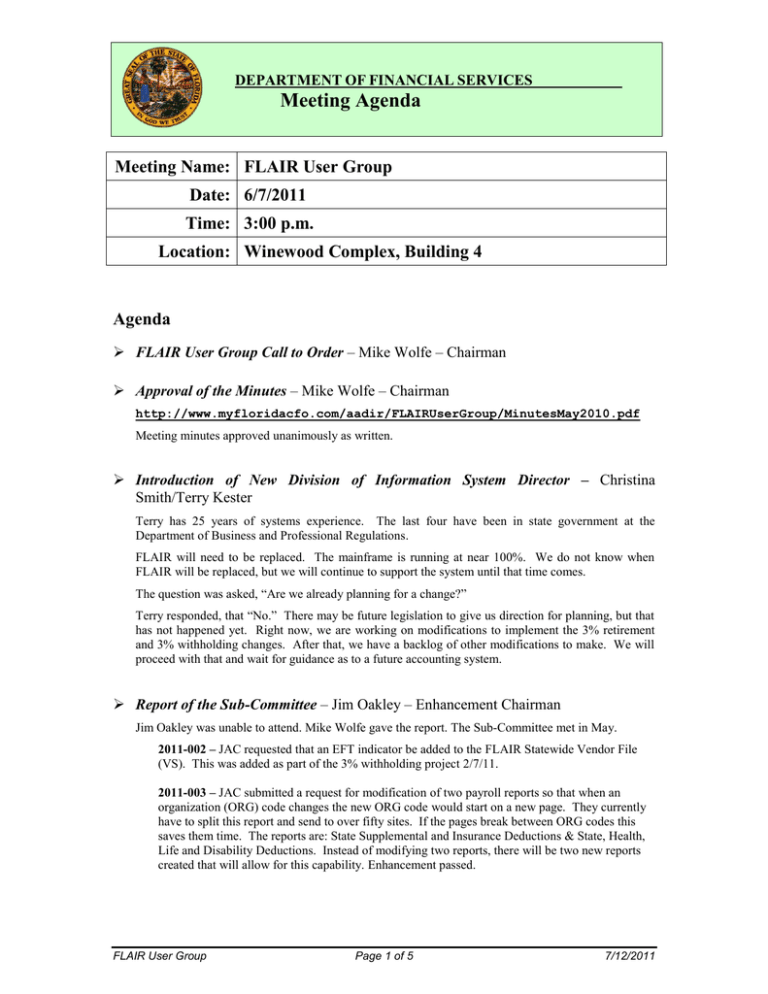

Meeting Agenda

advertisement

DEPARTMENT OF FINANCIAL SERVICES Meeting Agenda Meeting Name: FLAIR User Group Date: 6/7/2011 Time: 3:00 p.m. Location: Winewood Complex, Building 4 Agenda FLAIR User Group Call to Order – Mike Wolfe – Chairman Approval of the Minutes – Mike Wolfe – Chairman http://www.myfloridacfo.com/aadir/FLAIRUserGroup/MinutesMay2010.pdf Meeting minutes approved unanimously as written. Introduction of New Division of Information System Director – Christina Smith/Terry Kester Terry has 25 years of systems experience. The last four have been in state government at the Department of Business and Professional Regulations. FLAIR will need to be replaced. The mainframe is running at near 100%. We do not know when FLAIR will be replaced, but we will continue to support the system until that time comes. The question was asked, “Are we already planning for a change?” Terry responded, that “No.” There may be future legislation to give us direction for planning, but that has not happened yet. Right now, we are working on modifications to implement the 3% retirement and 3% withholding changes. After that, we have a backlog of other modifications to make. We will proceed with that and wait for guidance as to a future accounting system. Report of the Sub-Committee – Jim Oakley – Enhancement Chairman Jim Oakley was unable to attend. Mike Wolfe gave the report. The Sub-Committee met in May. 2011-002 – JAC requested that an EFT indicator be added to the FLAIR Statewide Vendor File (VS). This was added as part of the 3% withholding project 2/7/11. 2011-003 – JAC submitted a request for modification of two payroll reports so that when an organization (ORG) code changes the new ORG code would start on a new page. They currently have to split this report and send to over fifty sites. If the pages break between ORG codes this saves them time. The reports are: State Supplemental and Insurance Deductions & State, Health, Life and Disability Deductions. Instead of modifying two reports, there will be two new reports created that will allow for this capability. Enhancement passed. FLAIR User Group Page 1 of 5 7/12/2011 DEPARTMENT OF FINANCIAL SERVICES Meeting Agenda 2011-004 – DCF has requested that a reconciliation process for transfers between state agencies be created. The Sub-committee would like to form a workgroup to determine if a Transfer Function could be created for Agency-to-Agency transfers from expenditure accounts. AWI suggested that agencies document current procedures. The workgroup will be formed and begin meeting at the end of August 2011. Enhancement passed. 2011-005 – FWC submitted request to increase invoice field on TR51 and TR70. While the SubCommittee agreed they like the idea, the impact on FLAIR is too great. There are too many different screens and reports in FLAIR that would hav to be modified. MFMP has a 32-character invoice field. It would be good to match that if we do get a new accounting system, but we cannot at this time. Enhancement tabled. 2011-006 – DOT has requested greater control over the PPI field by giving specific Access Control authority to those who can use a “Y” during dual year processing. The Sub-Committee liked that idea and decided to specify even further by having three levels of control. Those with “blank” in the PPI field will only be able to input transactions for the current period. Those with “M” in the PPI field will be able to input transactions for the current period and the prior month, and those with a “Y” in the PPI field will be able to input transactions for the current period, prior month, and prior year. Enhancement passed. 2011-007 – DOC requested to add Site to the search criteria on the Voucher Summary Screen. This modification will be combined with other 3% Withholding modifications. Enhancement passed. Legislative Update – Christina Smith Rick Sweet was introduced as the new Assitant Director of Accounting & Auditing. Christina thanked all the agencies for their help with the Vendor File updates. The Vendor Client file has been disabled and re-purposed. She has had feedback that the agencies appreciated having workshops and communication ahead of time. This is how she plans to handle future projects, and will help to set the foundation for the next accounting system when the time comes. There has been a lot of movement in the agencies in part or whole. There are two types of transfers. Type 1 is when an entity moves to another agency and is shifted, divided, or otherwise changed. A Type 2 transfer is when the entity moves to another agency but still maintains its identity. There is a new agency being created October 1, 2011. This will impact several agencies. Christina plans to hold workshops for the impacted agencies and MyFlorida MarketPlace in late July or early August. This will be an opportunity to wallk through a checklist of what must be done. There will also be A&A Memos regarding the changes. The Chart of Accounts Bill passed (SB1292). This is a reporting bill for transparency on the web and standardized reporting. There are three sets of chart of accounts to review: State, Local Governments, and School Distracts/Universities. For 6months, we will look at all three charts and find the commonalities. We will have workshops to determine reporting needs beginning in October. The final list is due in January 2014. We also expect new reporting requirements by 2014. Transparency Bills. SB1738 (would have created the Agency for Enterprise Business Services) was vetoed, but SB2096 passed. SB2096 requires the CFO to provide Contract Reporting. The goal is to build one place to report information for contracts, grants, and revenue contracts. The current plan is build a web-based repository, where procurement staff would enter the data just before execution. This is planned in three phases. 1) Develop the repository and start reporting the data. 2) Link the repository to FLAIR so that expenditures are captured and payment information is available. 3) FLAIR User Group Page 2 of 5 7/12/2011 DEPARTMENT OF FINANCIAL SERVICES Meeting Agenda Develop a means to capture images of the contracts. Workshops will be held regarding the process changes. FLAIR Natural Security – Joanne Krieberg-Wolin We have many people who have not signed on for a long period of time. In an effort to clean-up unnecessary access, we will send out quarterly reports of User IDs not used in the past six months. The date of the last sign-on will be on the report. If someone hasn’t signed on for greater than six months the record will be purged. The question was asked, “Some budget personnel may only sign on once a year. Are they going to be deleted?” Joanne answered, “We will work with you. When the report is reviewed and a name on the list that should not be deleted, please contact the Help Desk. We will not delete without your input.” 3% State Employee Retirement Contribution – Becky Rosier The Biweekly payroll warrant date has been changed to June 30th, instead of July 1st. File 13s will be available June 24th. This will be the third biweekly for June, so there will be no insurance dedudctions. That also means there will only be two biweekly payrolls in July. Every payment on July 1st or later, which has retirement applied, will be subject to the 3% withholding, except those in DROP and retired re-hires. The 3% will be a pre-tax deduction. There will be three new Miscellaneous Deduction codes: 80, 81, and 83. Any retirement adjustments must be sent to Bureau of State Payrolls for manual processing. The salary process, and EFT and Warrant cancellation processes will be in place by July 1 st. Other processes will be handled manually until an automate process is created. Any warrants dated before July 1, 2011, or sick leave payouts, will not be affected. Retirement adjustements will be the last system changed. Please send any requests to BOSP. The question was asked, “Has the Payroll Manual been updated?” Becky replied, “No, but we are working on it. There will be an A&A Memo released to provide guidance.” The question was asked, “Will you be deducting 3% from on-demands issued during the first week of July?” She replied, “Yes. The requirement to deduct 3% is based on the pay date, not the time worked.” Another attendee asked, “What about any overpayments in December? Will these be reported on W-2s?” Becky answered, “We will have a cut-off date in December to ensure reporting is correct.” 3% Federal Withholding from Vendor Payments – Molly Merry Final Regulations were release by the Feds May 6th. The implementation date has been pushed back to January 1, 2013. We have emailed surveys to the agencies regarding object codes, and revolving funds and payment administrators. If you have not responded, please do so. Please pay attention to the November 1, 2011 date. Vendors must have a valid W-9 on file to receive payment for most goods or services. It is a good policy to begin requiring the W-9, even though deductions will not start until November 1. This information is in A&A Memo #23. The new W-9 Website was launched in March. The Business Designations were changed due to the 3% withholding implementation; old forms are no longer valid. We are currently using the IRS TIN matching process to validate the W-9s submitted. The vendor will get an e-mail letting them know if their tax ID was validated or not. The W-9 Status will be updated in the Statewide Vendor File, “Y” is matched, all other codes are non- matches. Vendors without internet access can send in a hardcopy FLAIR User Group Page 3 of 5 7/12/2011 DEPARTMENT OF FINANCIAL SERVICES Meeting Agenda form. The question was asked, “What is the turnaround time on the TIN matching?” Molly answered, “Most results are returned within three hours, but it has been as long as two days.” It is the object code that indicates what is being paid and determines if it is a vendor type payment or not. The Final Regs have been added to the website, www.myfloridacfo.com, using the search tool enter “IRS 3%” and it will pull up the right page. Another participant asked, “How do the vendors know about the 3% withholding requirements?” Molly responded, “We have communicated through the DMS newsletter, during the last week of May, a message was also added to all EFT and Warrant remittances. MFMP has modified its pages so that vendors who are registering are directed to the W-9 website and MFMP is sending e-mails to approximately 30,000 MFMP vendors. We plan to contact agencies to help contact their vendors. The question was raised, “Will there be any modifications to the Prompt Payment Statute?” Molly replied that 215.422 F.S. allows us to withhold payment for vendors not providing taxpayer information which applies to the W-9. If a payment is delayed bacause the vendor has not submitted a W-9 form, then the transaction date would be changed to the date that all documentation had been submitted. The 3% withholding will not apply to PCard for at least 18 months after the January 2013 implementation. The November 1st edits will not apply to PCard vendors, however the policy is to collect a valid W-9 for all vendors. You may reach the Vendor Management Section at (850)413-5519 or 3percent@myfloridacfo.com with any questions. Vendor File Cleanup (Employee, Statewide) – John Nicholson Statistics on the Vendor Files: Total Vendors 318,000 Active Vendors 305,000 Unique 10 character # 254,000 Unique FID 176,000 Unique N# 4,882 Unique SSN 73,000 Valid W-9 on file 5,000 Confidential vendors 30,000 MFMP vendors 143,000 We still have some records on the system with a “C” number. Beginning November 1 st, there will be edits in place preventing any “C” numbers from being used. The Contract Information File has over 350 “C” vendors on it and encumbrances have over 250, these will need to be changed to a valid Vendor number. The Revolving fund subsidiary file still has 9,000 records with “C” numbers. If you have “C” numbers on your 7S records (appears to be where most records are located), contact Rita Smith to discuss. In addition, any agencies that are piloting the RC file did not have their “C” records cleaned and purged; this will need to be done. Cleaning the Vendor Employee (VE) file will be next. FLAIR Education Update – Ella Hinson Thank you for sending your employees to FLAIR training. We are extending the hours for our Bascis and Revenue classes to make them two full days. Parking has been limited by DMS. Please let us know if you are aware of parking issues for attendees. We recommend that you arrive early or carpool if possible. FLAIR User Group Page 4 of 5 7/12/2011 DEPARTMENT OF FINANCIAL SERVICES Meeting Agenda Nominations and Election of FY 2011/2012 Officers – Ella Hinson Nominations for President: Mike Wolfe Closed, voted, and elected. Nominations for Vice-President: Tommy Lemacks Closed, voted, and elected. Other Business – Mike Wolfe Rita Smith: During the budget load process last year, there were 175 budget errors due to non-operating budget accounts not being established on the AD file before the new year budget load process. The average time to work with agencies to resolve these errors was 4:25. Agencies were asked to work with their budget offices to identify non-operating account codes that needed to be added to the AD file and to enter those accounts in FLAIR when the Agency Add (AA) function is reopened in FLAIR. . The New Account (NA) function for adding operating accounts is scheduled to be turned off next week, and the AA function will be reopened. Questions: “How long will the NA function be open?” Answer: “One week.” The NA function and the AA function cannot be operational simultaneously. The question was asked if they could be. DFS staff responded that it was possible since both functions load to the same nightly file. However; the two functions each serve a purpose and should continue to be used as designed. Adjournment Motion made to adjourn, seconded and approved. FLAIR User Group Page 5 of 5 7/12/2011