FLAIR Financial Reporting Overview 1

advertisement

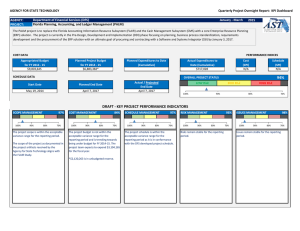

FLAIR Financial Reporting Overview 1 Month-end and Year-end Closing Central and Departmental FLAIR 2 Closing • Closing allows for a snapshot of account balances at a point in time which reflects the results of financial activities recorded during the period covered. • Central FLAIR and Departmental FLAIR process month-end closing and fiscal year-end closing separately. • The State’s fiscal year runs from July 1 to June 30. 3 Month-end Closing – Central FLAIR • Month-end closing for Central FLAIR occurs on the last workday of the month and is performed by FLAIR systematically. • The Master Balance File (State’s checkbook) is updated with results of financial activities occurred during the preceding month. • FLAIR reports are generated as a result of month-end closing and made available to agencies primarily for reconciliation purposes. 4 Month-end Closing – Departmental FLAIR • All agencies must close the previous month in Departmental FLAIR by the 15th of the following month. • Agencies can schedule their month-end closing anytime between the last day of the month and the 15th of the following month. Otherwise, the CFO will schedule it for the 15th of the following month. • Agencies can update/adjust records for the month until month-end closing. 5 Year-end Closing - Central FLAIR • Central FLAIR goes through 2 year-end closings: ▫ Preliminary closing – 2 workdays after the end of the fiscal year ▫ Final closing – generally 2 weeks after preliminary closing 6 Year-end Closing – Central FLAIR • Central FLAIR continues processing as of June 30th for 2-4 workdays after year-end to primarily allow for: ▫ Processing vouchers for the old fiscal year. ▫ Resolving atypical account balances for cash, appropriated budget, and unexpended released appropriations. • During the 2-4 workdays, records generated in Departmental FLAIR for the new fiscal year are held from processing in Central FLAIR. • After the 2-4 workdays, the month-end closing for June is run. This closing is referred to as the preliminary closing of the old fiscal year. 7 Year-end Closing – Central FLAIR • Subsequent to preliminary closing, Central FLAIR locks access to the system and runs opening entries and first nightly processing the following day. Upon completion, the system is opened up to receive daily input. Then Central FLAIR begins running dual year processing. • Opening entries primarily include loading of appropriation files from the Executive Office of the Governor (EOG) into FLAIR. • First nightly processing primarily includes the catching up of processing records generated in Departmental FLAIR for the first 2-4 workdays of the new fiscal year that were put on hold. 8 Year-end Closing – Central FLAIR • Dual year processing continues until final closing primarily to allow for the completion of the supplemental receipts process. Supplemental receipts are tax revenues postmarked by June 30 but received by the State after June 30. • Final closing of the fiscal year for Central FLAIR is generally scheduled for mid-July. 9 Year-end Closing – Departmental FLAIR • Year-end closing for Departmental FLAIR generally takes place in August. Each agency is closed separately over the course of 2 weeks. • Between June 30 and an agency’s closing date (dual-year processing), the agency has the ability to adjust and update records for the old fiscal year using a prior period indicator. That ability ceases after closing. 10 Year-end Closing – Departmental FLAIR • During closing for Departmental FLAIR, agencies’ general ledger nominal accounts are closed into fund equity and real accounts are rolled to the next fiscal year. • As the system closes each agency, a copy of the general ledger account balances is transmitted to the Statewide Financial Statements subsystem within FLAIR for CAFR preparation. 11 CAFR Preparation 12 Reference and Authority • Section 216.102, Florida Statutes, requires the CFO to prepare the State’s Comprehensive Annual Financial Report (CAFR) and requires agencies to file financial information with the CFO in accordance with generally accepted accounting principles (GAAP). • To comply with GAAP, the CFO follows standards established by the Governmental Accounting Standards Board (GASB). • The State Auditor General’s Office audits the CAFR. • Statutes require the CFO to prepare and furnish to the Auditor General annual financial statements of the State by December 31 and to publish the CAFR by February 28. 13 Overall Process • All state agencies go through Departmental FLAIR year-end closing in August. The closing process includes transmitting the agencies’ general ledger account balances to the Statewide Financial Statements (SWFS) subsystem in FLAIR. • Post-closing adjustments to update or correct data are processed by CAFR staff in the SWFS subsystem. • Data is downloaded from the SWFS subsystem and used to prepare financial statements. • Other information is gathered from external sources to compile the CAFR. 14 SWFS Subsystem • The SWFS Subsystems houses 3 files: ▫ Statewide Master File – contains general ledger balances at the fund level (OLO-GAAFR Fund-SF-FID) ▫ Statewide Funds File – contains all valid funds (OLO-GAAFR Fund-SF-FID) for the CAFR and their corresponding accounting fund types and reporting classifications ▫ Adjustment File – contains all post-closing adjustments processed by CAFR staff 15 SWFS Subsystem • The SWFS subsystem in FLAIR is separate from Departmental and Central FLAIR and can only be accessed by CAFR staff. • Post-closing adjustments are manually input by CAFR staff and only affect balances retained in the SWFS subsystem. • Data in the SWFS subsystem is transmitted routinely to the Auditor General’s Office during CAFR preparation process. • Audited data is provided to agencies via reports subsequent to the completion of CAFR for agencies to manually adjust agency records as applicable. 16 Post-closing Adjustment Statistics Number of post-closing adjustments 3000 2500 2650 2522 2211 2197 2000 1731 1500 1000 All Post-closing Adjustments Auditor General Adjustments 500 0 50 74 45 46 26 FY 08 FY 09 FY 10 FY 11 FY 12 17 CAFR Compilation • The primary source of data for financial statements in the CAFR is the Statewide Master File from the SWFS subsystem. • The general ledger account balances by fund (OLO-GAAFR Fund-SF-FID) are rolled-up and classified by the following accounting fund types for presentation: ▫ Governmental Funds ▫ Proprietary Funds ▫ Fiduciary Funds 18 CAFR Compilation • General ledger account balances for each accounting fund type are further classified by the State’s major functions and programs. For example, governmental funds include: ▫ ▫ ▫ ▫ ▫ General Fund Environment, Recreation and Conservation Public Education Health and Family Services Transportation 19 CAFR Compilation • General ledger account balances in the Statewide Master File are downloaded from FLAIR to Microsoft Access for roll-up and classification. • Summarized data is then exported to Microsoft Excel in which financial statements are prepared. • Microsoft Word is used to prepare notes to the financial statements along with other written documents required for the CAFR. 20 CAFR Compilation • Information for note disclosure is primarily gathered through Microsoft Access and Excel forms completed by agencies outside of FLAIR. • Forms are also used for reconciliation purposes such as the reconciliation of interfund balances and transfers (between agencies or between funds within an agency). • Some external reports (e.g. actuarial reports) are used for recording and verification purposes. 21 CAFR Tasks Performed by Agencies • Reconcile, update, and support general ledger balances to ensure accuracy and completeness. • Record accruals (receivables and payables). • Ensure depreciation is calculated correctly. ▫ FLAIR property subsystem calculates and records depreciation after agency initiates depreciation run. • Complete forms for note disclosure and interfund balances and transfers. • Obtain and review external reports and additional information needed for the CAFR. 22 Tasks Performed by CAFR Staff • Reconcile certain general ledger accounts (e.g. cash, investments). • Reconcile interfund balances and transfers. • Record statewide entries (e.g. fair market value adjustments for investments, General Revenue transactions). • Review and summarize forms and other information submitted by agencies. • Prepare financial statements, required schedules, and note disclosures. • Assemble and publish CAFR. 23 Component Units • Component units are legally separate organizations for which the elected officials of the State are financially accountable. These organizations are required by accounting standards to be reported in the CAFR. • State has over 90 component units including state universities, colleges, and water management districts. • Each component unit is required to submit its financial statements to the CFO by September 30. • Component unit data is manually input into FLAIR by agencies or CAFR staff. Note disclosure information is obtained via Excel forms. 24 Year-end/CAFR Timeline June 30 July • Fiscal Year-end • Central FLAIR Year-end Closing • Carried Forward/Certified Forward Process August • Departmental FLAIR Year-end Closing September December • Major CAFR Tasks Performed • Draft Financial Statements Due to Auditor General by 12/31 per Statutes January February • CAFR Publication by 2/28 per Statutes 25 Challenges • CAFR compilation process is generally manual and performed outside of FLAIR. • Interfund balances and transfers between agencies are reconciled outside of FLAIR and generally only at year-end for CAFR purposes. • Post-closing adjustments are prepared on paper and do not automatically update agency FLAIR records thus requiring agencies to record adjusting entries as applicable in the subsequent fiscal year. • Information obtained from external sources (e.g. component unit financial statements, actuarial reports) is not always available in a timely manner and often presents reconciliation issues. 26