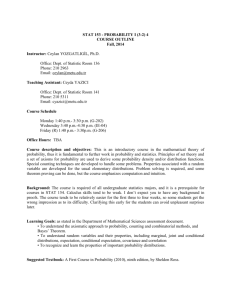

Random sets in economics, finance and insurance Ilya Molchanov

advertisement

Random sets in economics, finance

and insurance

Ilya Molchanov

University of Bern, Switzerland

based on joint works with

I.Cascos (Madrid, Statistics), E.Lepinette (Paris, Finance),

F.Molinari (Cornell, Economics), M.Schmutz (Bern, Probability and Finance),

A.Haier (Swiss Financial Market Supervision)

University Austin TX, May 2015

1

Early years

I

I

Why do people make particular choices?

How to allocate assets optimally between agents?

2

50 years and 3 Nobel Prizes

I

Gerard Debreau (1983)

(Debreau expectation of random sets)

I

3

50 years and 3 Nobel Prizes

I

Robert Aumann and Thomas Schelling (2005)

(Aumann expectation of random sets)

I

4

50 years and 3 Nobel Prizes

I

Alvin Roth and Llloyd Shapley (2012)

(allocations: choice of an element of a random set)

I

5

Overview

Developments over the last 10 years

Lecture 1

I

I

Random sets and selections in economics.

Market imperfections and transaction costs.

Lecture 2

I

I

Sublinearity and risk.

Financial networks.

6

I

I

I

I

A. Beresteanu, I. Molchanov, and F. Molinari. Sharp

identification regions in models with convex moment

predictions. Econometrica, 79:1785–1821, 2011.

I. Molchanov and I. Cascos. Multivariate risk

measures: a constructive approach based on

selections. Math. Finance, 2015.

I. Molchanov and M. Schmutz. Multivariate

extensions of put-call symmetry. SIAM J. Financial

Math., 1:396–426, 2010.

Works in progress ...

7

Basics of random sets

Definition

A map X : Ω 7→ F from a probability space (Ω, F, P) to the

family of closed subsets of a Polish space X is said to be

a random closed set if

{ω : X(ω) ∩ G 6= ∅} ∈ F

for all open sets G.

I

In X = Rd one can take compact sets K instead of

open G.

8

Examples

So far most of examples involve “simple” sets

scattered in space.

I

I

I

I

Point process.

Random geometric graphs.

Collection of lines/balls, etc.

Random polytopes.

9

Examples: Economics

I

I

I

Consider a game of d players with random

parameters. Then the set of equilibria (pure or mixed)

is a subset of the unit cube in Rd .

Measurements are often represented as intervals

rather than points. The reason may be not only the

lack of precision or censoring, but also intentional

reporting of intervals.

If the underlying probability measure P is uncertain,

this uncertainty can be described as a family of

random elements.

10

Examples: Finance

I

I

Each asset has two prices Sb ≤ Sa : bid and ask

prices.

Adding cash as one axis, this leads to a random

cone.

asset

Sb−1

X

Sa−1

1

I

cash

Multiasset setting leads to more complicated random

cones. Example: currency exchanges with

transaction costs (Kabanov’s model).

11

Examples: Finance (link-save)

I

Buying carrots and potatoes together brings a

reduction.

Potatoes

Carrots

12

Example: Financial networks

Here is a picture

of a large network

connecting major financial

institutions in the world

13

Example: Financial network

Holding

Subsidiary I

Subsidiary II

Reinsurance

Life Non−life

Junk

Investment

I

Objective: IntraGroup Transfers (in order to help

distressed members of the group)

14

Example: Financial network, two agents

I

I

I

I

Two agents A and B are assessed by a regulator.

The regulator evaluates their individual exposure to

risks and requests that they set aside (and freeze)

necessary capital reserves.

The agents want to minimise these reserves and

conclude an agreement that at the terminal time (and

under certain conditions) one of them would help to

offset the deficit of another one.

The family of allowed transactions is a random closed

set in the plane.

15

Examples: financial network, two agents

I

I

I

The terminal capital is (C1 , C2 ).

Transfers from a solvent company to another one are

allowed up to the available positive capital.

Disposal of assets is allowed.

(C1 , C2 )

X

(C1 , C2 )

X

16

Selections

I

I

A random vector ξ is called a selection of X if both ξ

and X can be realised on the same probability space,

so that ξ ∈ X a.s.

From now on we tacitly assume that all random

elements are realised on the same probability space.

Theorem (Zvi Artstein, 1983)

A probability measure µ is the distribution of a selection of

a random closed set X in Rd if and only if

µ(K ) ≤ P{X ∩ K 6= ∅}

for all compact sets K ⊂ Rd .

17

Games and payoffs

I

I

I

I

Set K is a coalition of players.

ϕ(K ) is the payoff that K receives.

Payoff functional is not additive, but subadditive.

Allocation is a measure µ such that

µ(K ) ≤ ϕ(K )

I

∀ K.

Bondareva–Shapley theorem: existence of an

allocation under some conditions on ϕ (convexity).

18

Example: market entry game

(non-coalitional)

I

Payoff for the jth player, j = 1, 2,

πj = aj (a−j θj + εj ) ,

where

I

I

I

I

aj ∈ {0, 1} is the action (enter or not) of the jth player;

a−j is the action of other player(s),

θj are unknown parameters

εj are random profit shifters with known distribution

19

Example: market entry game — equilibria

πj = aj (a−j θj + εj ) ,

I

j = 1, 2.

Set Sθ (ε) of (Nash) equilibria is random and depends

on ε.

ε2

{11}

{01}

−θ2

{10, (− θε22 , − θε11 ), 01}

{00}

−θ1

ε1

{10}

Note that θ1 , θ2 < 0.

20

Example: market entry game - inference

I

I

I

Assume pure strategies only

(the method works also for mixed strategies).

The econometrician observes empirical variant of the

distribution

µ = (p00 , p10 , p01 , p11 ) .

These frequencies are sampled from the set of

possible equilibria, i.e.

µ is the distribution of a selection of Sθ (ε) .

Inference

Estimate θ = (θ1 , θ2 ) based on this, i.e. estimate

parameters of a random set by observing its selection:

n

o

θ : µ(K ) ≤ P{Sθ ∩ K 6= ∅} ∀K ⊂ {00, 01, 10, 11} .

21

The most serious difficulty

I

I

The family of selections is too rich.

It is numerically difficult to verify inequalities

µ(K ) ≤ P{X ∩ K 6= ∅} for all K .

22

Course exercise

I

I

I

ξ has normal distribution N(µ, σ 2 ).

Observe numbers x1 , . . . , xn chosen (using an

unknown mechanism) such that xi ≥ ξi for i.i.d.

realisations ξ1 , . . . , ξn of ξ.

Estimate µ and σ 2 and utilise the available

information in full!

23

Castaing representation

Theorem (Charles Castaing, 1977)

X is a random closed set if and only if

X = cl({ξn , n ≥ 1})

meaning that X is the closure of a countable family of its

selections.

Definition

Lp (X) denotes the family of p-integrable selections of X.

Expectations of selections

I

I

Assume that X has at least one integrable selection,

i.e. L1 (X) 6= ∅.

The (Aumann) expectation of X

EX = cl{Eξ : ξ ∈ L1 (X)}.

I

I

The expectation is always a convex set if the

probability space is non-atomic (follows from

Lyapunov’s theorem on range of a vector-valued

measure).

Higher moments are not well defined!

25

Example: interval least squares I

I

I

Explanatory variable x

Response y ∈ Y = [yL , yU ].

y

yiU

yiL

x

xi

26

Example: interval least squares II

I

Regression model (for mean values). If y ∈ Y a.s.,

then

E(y) = θ1 + θ2 E(x) .

I

Then

(θ1 , θ2 ) = Σ(x)

I

−1

E(y)

,

E(xy )

1 Ex

Σ(x) =

.

Ex Ex 2

The expectations E(y) and E(xy) may take various

values depending on the choice of selection

y ∈ Y = [yL , yU ].

27

Example: interval least squares III

I

I

y is a selection of Y and xy is a selection of xY

Thus, (y , xy) is a selection of

y

G=

: yL ≤ y ≤ yU ⊂ R2

xy

segment with end-points (yL , xyL ) and (yU , xyU ).

xyU

xy

G

xyL

yL

I

y

yU

Identification region θ ∈ Σ(x)−1 EG .

28

Course exercises

1. How to amend the setting for the polynomial

regression?

2. How to handle the case of interval-valued

explanatory variable x?

29

Options (main idea)

I

Call price

EQ (F η − k )+

and put price

EQ (k − F η)+

can be expressed in terms of the expectation of the

random set X.

(1, η)

EX

Eη = 1

X

(0, 0)

1

1

30

Option prices I

I

Let η be a non-negative random variable (relative

price change).

(1, η)

X

(0, 0)

I

1

The support function of X in direction u is

hX (u) = sup{hu, xi : x ∈ X} = (u1 + u2 η)+

31

Option prices II

hX (u) = (u1 + u2 η)+

I

I

If u = (−k, F ), then hX (u) = (F η − k)+ is the payoff

from the call option.

In this case:

I

I

I

I

F is the forward price (deterministic carrying costs);

S = F η is the terminal price;

k is the strike price (buying price at the terminal time).

If u = (k, −F ), then hX (u) = (k − F η)+ is the payoff

from the put option.

32

Option prices III

I

I

The expected support function EhX (u) is the support

function of the expectation hEX (u).

Then hEX (−k, F ) = EQ (F η − k)+ is the call price if the

expectation is taken with respect to the martingale

measure.

(1, η)

EX

Eη = 1

X

(0, 0)

1

1

33

Symmetries

I

Point symmetry with respect to ( 12 , 21 ) is equivalent to

European put-call parity

I

Line symmetry is equivalent to put-call symmetry.

34

Multi-asset symmetry

Asset prices ST 1 = F1 η1 , . . . , STd = Fd ηd

Prices of basket options

EQ (u0 + u1 η1 + · · · + ud ηd )+

(forward prices are included in the weights).

I

I

I

I

When is the price invariant for all permutations of the

weights (self-duality)?

If this is the case, then η is exchangeable.

However, the exchangeability property does not

suffice, e.g. η with i.i.d. coordinates.

When is the price invariant for u0 = 0 and

permutations of other weights (swap-invariance)?

35

Convex models of transaction costs

I

I

I

I

Let (Ω, Ft , t = 0, . . . , T , P) be a stochastic basis.

Let Kt , t = 0, . . . , T , be a sequence of random convex

sets so that Kt is Ft -measurable.

Sets Kt contain the origin and are lower sets.

Assume that they do not contain any line.

Set Kt describes the positions available at price zero

at time t.

36

Kabanov’s exchange cone model

I

I

I

Kt is a random exchange cone (e.g. generated by

bid-ask exchange rates for currencies at time t).

Kt is the family of portfolios available at price zero.

Reflected set −Kt is the family of solvent positions at

time t.

EUR

1

1

USD

Kt

37

Self-financing

I

A self-financing portfolio process satisfies

Vt − Vt−1 ∈ L0 (Kt , Ft )

I

so the increment is available at price zero.

The set

t

X

At =

L0 (Ki , Fi ) ⊂ L0 (Rd )

i=0

is the family of attainable claims at time t.

38

No arbitrage

Definition

(NAS) (strict no-arbitrage) condition holds if

At ∩ L0 (−Kt , Ft ) = {0}

for all t = 0, . . . , T .

Interpretation

Starting from zero it is not possible to achieve non-zero

solvent position at any time t.

39

No arbitrage and martingales (cone models)

I

Define the dual cone

K∗t = {u : hu, xi ≤ 0 ∀ x ∈ Kt }

I

It describes the family of consistent price systems, if

u are prices, then each portfolio available at price

zero indeed has negative price.

Theorem (Kabanov et al.)

(NAS) condition is equivalent to the existence of an

equivalent probability measure Q and a Q-martingale Mt

such that

Mt ∈ relative interior K∗t ,

t = 0, . . . , T .

40

Conditional expectation and martingales

I

A sequence of random sets Xt , t = 0, . . . , T , is a

martingale if

E(Xt |Fs ) = Xs

I

a.s. ∀ s ≤ t.

The conditional expectation is defined as the family of

conditional expectations of all selections.

41

Cores and conditional cores

Definition

If X is F-measurable random closed set and A is a

sub-σ-algebra, then the conditional core

Y = m(X|A)

is the largest A-measurable random set Y such that Y ⊂ X

a.s.

I

I

The conditional core exists.

If X = (−∞, ξ], then the conditinal core is the set

Y = (−∞, η], where η is the largest A-measurable

random variable such that η ≤ ξ.

Single asset case

I

I

Recall the sequence of exchange sets Kt and price

intervals Xt = [Sbt , Sat ], t = 0, . . . , T .

(NAS) (no arbitrage) condition.

asset

price −1

Sbt

Kt

−1

Sat

1

cash

43

No arbitrage and conditional cores

Theorem

In case of a single asset with bid-ask spread

Xt = [Sbt , Sat ], the (NAS) condition holds if and only if

Xt ⊆ m(Xt+1 |Ft ),

t = 0, . . . , T − 1.

44