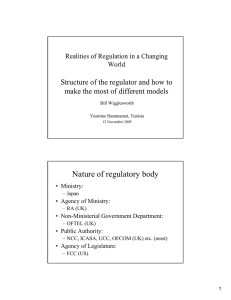

Business review

advertisement