Focus University of Wisconsin–Madison Institute for Research on Poverty

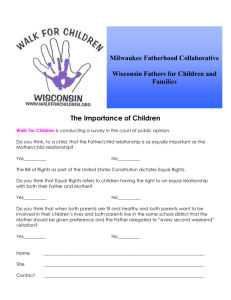

advertisement